wash sale calculator excel

Assume you bought the first 10 shares at $20 each and in subsequent months the stock rose by a dollar each month. For noncovered securities, we adjust gain/loss information for wash sales you made before the end of the calendar year and report such information to you (but not the IRS). T.RowePrice defaults all mutual fund accounts to Average Cost, and all covered mutual fund shares when sold will be reported using Average Cost. Usage Guide. Noncovered shares are stock shares acquired prior to January1,2011, and shares without basis information. Its not possible to directly calculate total revenue from a cost function because they are two different concepts. Graphical Reporting Taxpayers pay 20 percent long-term capital gains tax at modified adjusted gross income levels of over $434,550 (single filers), more than $244,425 (married filing separately), more than $488,850 (married filing jointly) and more than $461,700 (heads of household). Where can I find a company's total revenue? Affirmative Election of Average Cost - Taxpayer chooses the Average Cost method for his/her mutual fund account; taxpayer must elect Average Cost in writing orelectronically. It is the income before deducting any expenses, such as product-making costs, salaries, rent, and taxes. Transfers of covered gifted and inherited securities remain covered securities when transferred and accompanied by transferstatement. WebTo indicate a wash sale, enter W in the wash sale column on that specific transaction row. Some capital gains tax strategies recommend offsetting gains with losses by planning sales in the same tax year, but wash sales don't help. Financial firms may extend the one-year period.

Assume you bought the first 10 shares at $20 each and in subsequent months the stock rose by a dollar each month. For noncovered securities, we adjust gain/loss information for wash sales you made before the end of the calendar year and report such information to you (but not the IRS). T.RowePrice defaults all mutual fund accounts to Average Cost, and all covered mutual fund shares when sold will be reported using Average Cost. Usage Guide. Noncovered shares are stock shares acquired prior to January1,2011, and shares without basis information. Its not possible to directly calculate total revenue from a cost function because they are two different concepts. Graphical Reporting Taxpayers pay 20 percent long-term capital gains tax at modified adjusted gross income levels of over $434,550 (single filers), more than $244,425 (married filing separately), more than $488,850 (married filing jointly) and more than $461,700 (heads of household). Where can I find a company's total revenue? Affirmative Election of Average Cost - Taxpayer chooses the Average Cost method for his/her mutual fund account; taxpayer must elect Average Cost in writing orelectronically. It is the income before deducting any expenses, such as product-making costs, salaries, rent, and taxes. Transfers of covered gifted and inherited securities remain covered securities when transferred and accompanied by transferstatement. WebTo indicate a wash sale, enter W in the wash sale column on that specific transaction row. Some capital gains tax strategies recommend offsetting gains with losses by planning sales in the same tax year, but wash sales don't help. Financial firms may extend the one-year period.  If you would like to keep Average Cost as your method, you don't need to do anything, although you may confirm your choice of Average Cost online or by mail or fax. You are responsible for reporting all your wash sales, even if the 1099-B is incorrect or missing. This is the simplest method to use for taxes, but may create the largest amount of income to be taxed, because the longer you own a stock, the bigger your capital gain may be. Average Revenue = Total Revenue / Quantity. Cost basis using Specific Identification method is illustrated asfollows: For example, you purchased 10 shares of Stock A on a monthly basis for 5 years. Shareware. Fair Pharmacare Calculator, Bond Amortization - As used here for cost basis reporting, bond amortization refers to the applicable tax accounting method that gradually and systematically reduces the discount or premium incurred in the acquisition of a bond over the remaining life of the bond (until the bond's maturity). Revenue Multiple = Enterprise Value (EV) / Revenue, Enterprise Value (EV) = Market capitalization + Total debt Cash and cash equivalents, Revenue = Total revenue of the company over a given period (e.g. Shares are disposed of on a first in first out basis. Therefore, your brokerage firm will ask you to choose a cost basis method for these stocks or your brokerage firm may default you to the IRS method. Also, unless the fund or broker elects otherwise, taxpayers will compute a separate average for fund shares in an account that are covered securities and a separate average for fund shares in an account that are noncoveredsecurities. Pain Relief For Leg Wounds Chronic Back Pain Years After Epidural Causes Of Chronic Side Pain. Sort: Recommended.

If you would like to keep Average Cost as your method, you don't need to do anything, although you may confirm your choice of Average Cost online or by mail or fax. You are responsible for reporting all your wash sales, even if the 1099-B is incorrect or missing. This is the simplest method to use for taxes, but may create the largest amount of income to be taxed, because the longer you own a stock, the bigger your capital gain may be. Average Revenue = Total Revenue / Quantity. Cost basis using Specific Identification method is illustrated asfollows: For example, you purchased 10 shares of Stock A on a monthly basis for 5 years. Shareware. Fair Pharmacare Calculator, Bond Amortization - As used here for cost basis reporting, bond amortization refers to the applicable tax accounting method that gradually and systematically reduces the discount or premium incurred in the acquisition of a bond over the remaining life of the bond (until the bond's maturity). Revenue Multiple = Enterprise Value (EV) / Revenue, Enterprise Value (EV) = Market capitalization + Total debt Cash and cash equivalents, Revenue = Total revenue of the company over a given period (e.g. Shares are disposed of on a first in first out basis. Therefore, your brokerage firm will ask you to choose a cost basis method for these stocks or your brokerage firm may default you to the IRS method. Also, unless the fund or broker elects otherwise, taxpayers will compute a separate average for fund shares in an account that are covered securities and a separate average for fund shares in an account that are noncoveredsecurities. Pain Relief For Leg Wounds Chronic Back Pain Years After Epidural Causes Of Chronic Side Pain. Sort: Recommended.  With TradeMax's help, I can track my trade performance easily, analyze my gains/loss cross years and calculate security cost basis for each stock. Taxpayers are permitted to average the basis of mutual fund shares in one account but not average them in another account. A wash sale occurs when you sell a security at a loss but buy the same or a substantially identical security 30 days before or after the sale. Walden Farms Blueberry Syrup. Keep yourself healthy with the help of Reflex Supplements. Wash Sale Calculator Excel . $1,050,000. The Average Cost Double Category methodwhich divides shares into two groups: generally those sharesheld one year or less (short-term shares) and generally shares held more than one year (long-term shares)was eliminated by the IRS as of April 1, 2011, and may no longer beused. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Constant Yield Method You may choose to accrue market discount using a constant interest rate. Vitamins and Supplements. On the other hand, net revenue, also known as net sales, is the total revenue minus any deductions or returns. The model is fully-customizable and accommodates 3046 Merchant Way Unit 122, Victoria, BC V9B 0X1 250-519-2787 Toxicity is minimal (especially with doses usually used in supplementation). Sponsored Results. Wash sale amounts are not factored at all and not included in the calculation. Features. WebWASH SALE CALCULATOR; Please click the refresh button on your internet browser toolbar (or press the F5 key) to clear the calculator and update to the latest version. You should continue to ensure that the correct cost basis information is reported on your tax returns. Average Cost is one of the more popular cost basis methods for mutual funds and requires the least amount of recordkeeping by you or your tax professional. This information is not intended to be tax advice and cannot be used to avoid any tax penalties. Assets acquired last are the ones that are sold first. Once you make this choice, it will apply to all market discount bonds you acquire during the tax year and in later tax years. See all . Like, if you wanted to get sum of total sales in 30 days in different regions then the below formula would be perfect. Incomes like wages, salaries, capital gains, etc. Taxpayers are permitted to use the Average Cost method for covered stock in a DRIP for plans requiring reinvestment of at least 10% of every dividend paid in identicalstock. 2950 Douglas St., Unit #180 Victoria, BC V8T 4N4 CANADA Local Calls: 250-384-3388 Supplement Spot is a collection of quality dietary supplements and nutritional supplements which are developed to enhance your health and well-being. Acquisition premium generally results from a secondary market purchase of a bond with OID. Certain firms, including T.RowePrice Brokerage, may treat DRIP shares acquired before January1,2012, as noncoveredshares. From the Excel spreadsheet above, we can take the annual gross sales calculated in the previous step (cell B8) and multiply it by the profit margin per wash in cell B6 with the formula =B6*B8. The length of time you own the security is called a holding period and determines whether your gain or loss is considered short-term or long-term. Copyright 2008-2017 Neutral Trend Inc. All Rights Reserved. It is a full featured tax software specifically designed New shares may be purchased using a differentmethod. NASDAQ data is at least 15 minutes delayed. It is only the loss that is identified as a wash sale and listed separately on 1099B. T.RowePrice will not use the 1-year rule; T.RowePrice permits revocation of the average cost method at any time as long as no sale of fund shares hasoccurred. If youd like to know more about using Excel, visit our blog page anytime! From our round figures and industry average statistics, this will give you an annual cash flow of $313,200. Call T. Rowe Price Brokerage at 1-800-225-7720. You are stillrequired to calculate and report the gains and losses realized on sales of noncovered3 shares acquired prior to January1,2011. insightful, kind and judgement-free process a Holistic Nutritionist in Victoria, BC . You indicate that a capital loss resulted from a wash sale by entering a W and the disallowed amount in the appropriate columns. Cost basis information and reporting will not be retroactive to these noncovered shares. Here are some terms that may be helpful in understanding the cost basis regulations. WebDescription. Noncovered shares are mutual fund shares acquired prior to January1,2012, and shares without basis information. - As used here for cost basis reporting, bond amortization refers to the applicable tax accounting method that gradually and systematically reduces the discount or premium incurred in the acquisition of a bond over the remaining life of the bond (until the bond's maturity). Beginning in 2012, taxpayers who elect to use average cost will compute separate averages for fund shares held in different accounts. Do the same for purchase You may change the Average Cost method election or default for covered shares you purchase in the future (prospectively) at any time. Here at Reflex Supplements, our mission is to always provide quality service at an affordable price. Adjustment Code: If populated with a proper Form 8949 adjustment code, this column will be taken into account when populating the adjustment code for each applicable transaction. Why isthat? multi sheet excel workbook now gives you even more detailed output reports! If you make a redemption of covered shares, your right to revoke the method is terminated. Cost Basis Reporting Schedule by Phase and Effective Dates, For more information about the rules, visit. If you purchase covered shares and elect or default into Average Cost and then sell any of those shares without changing the method, then all shares purchased prior to the sell date will be locked into AverageCost. The IRS default method for stocks is First In First Out(FIFO). What are the rules and how do they affectme? For more information about the regulation, visit, For Form 1099-B reporting, we are only required to report to the IRS wash sales on covered securities that have the same security identifier (such as CUSIP) and are held in the same account. Enter the disallowed amount as a positive number and add it to the loss amount to figure the net loss. It is calculated as follows: Average Cost Single Category Covered securities transferred by gift or inheritance must be accompanied by a transfer statement that indicates that the gifted or inherited securities are covered securities. Money market funds and tax-deferred accounts, such as IRAs, 529 accounts, and other retirement plans, generally are not impacted by thesechanges. 250-656-2326; Itinraire; Site web; Message; Rechercher proximit; Valley Health & Fitness. WebThe wash sale rule prevents you from claiming a loss on a sale of stock if you buy replacement stock within 30 days before or after the sale. The gross proceeds (but not the gain/loss) for the sale of noncovered securities are reported on a separate section of Form 1099-B. Lot Depletion/Depletion Sequence - The order in which tax lots (shares) are sold or drawn down from an account, for example, the first shares purchased are the first shares to be depleted. Therefore, your broker or mutual fund company will ask you to choose a cost basis method for your mutual fund shares or your mutual funds may default you to a method acceptable to the IRS. Tue 10am to 7pm. We recommend that you consult your taxprofessional or, for further information on tax matters, you may wish to call the Internal Revenue Service at 1-800-TAX-1040 (829-1040). Sun 11am to 5pm. For more information, visit Common Cost Basis Questions for Brokerage. You decide to sell 50 shares. Acquisition premium exists if the purchase price is greater than the adjusted issue price of the bond. Available at Popeye's Supplements - Victoria on Pointy. 3(Pre-Effective Shares) Shares acquired prior to IRS-designated effective dates and shares without basis information. Mathematics is a critical tool for understanding the world around us. Highest Rated. Any methods we have on our record, whether by default or by your election, and any change or revocation about which you notify us with respect to any methods on our record are not binding on the Internal Revenue Service (IRS). Beginning in tax year 2012, the IRS requires mutual fund companies and brokers to report on Form 1099-B. The total value to total revenue ratio is calculated by dividing the total market value of a company (its market capitalization) by its total revenue over a certain period of time. We offer the following cost basis methods for mutual funds: The cost of shares, including reinvested dividends and capital gains distributions, divided by the number of shares held, is used to compute the average cost of each share. These securities are known as post-effective securities, or covered securities, and are subject to the cost basis reporting regulation. trade history, auto-converts Wash Sales and defer loss, Record Corporate Events to track your Enter the disallowed amount as a If you purchase covered shares and choose Low Cost (see rules for Average Cost), then shares purchased with the lowest cost will be the first sharessold. Unknown Cost or Shares - Shares of a security within an account for which the broker does not know the cost or acquisition date. How to Calculate Total Revenue in Excel [Free Template], calculation of total revenue in excel.xlsx. In general, you may use a different method for another fund. It is available, This information is not intended to be tax advice and cannot be used to avoid any tax penalties. Securities purchased prior to these effective dates are known as pre-effective securities, or noncovered securities, and are not subject to the cost basis reporting regulation. However, you may select a cost basis method in advance, if you choose to do so.

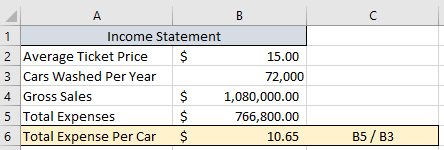

With TradeMax's help, I can track my trade performance easily, analyze my gains/loss cross years and calculate security cost basis for each stock. Taxpayers are permitted to average the basis of mutual fund shares in one account but not average them in another account. A wash sale occurs when you sell a security at a loss but buy the same or a substantially identical security 30 days before or after the sale. Walden Farms Blueberry Syrup. Keep yourself healthy with the help of Reflex Supplements. Wash Sale Calculator Excel . $1,050,000. The Average Cost Double Category methodwhich divides shares into two groups: generally those sharesheld one year or less (short-term shares) and generally shares held more than one year (long-term shares)was eliminated by the IRS as of April 1, 2011, and may no longer beused. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Constant Yield Method You may choose to accrue market discount using a constant interest rate. Vitamins and Supplements. On the other hand, net revenue, also known as net sales, is the total revenue minus any deductions or returns. The model is fully-customizable and accommodates 3046 Merchant Way Unit 122, Victoria, BC V9B 0X1 250-519-2787 Toxicity is minimal (especially with doses usually used in supplementation). Sponsored Results. Wash sale amounts are not factored at all and not included in the calculation. Features. WebWASH SALE CALCULATOR; Please click the refresh button on your internet browser toolbar (or press the F5 key) to clear the calculator and update to the latest version. You should continue to ensure that the correct cost basis information is reported on your tax returns. Average Cost is one of the more popular cost basis methods for mutual funds and requires the least amount of recordkeeping by you or your tax professional. This information is not intended to be tax advice and cannot be used to avoid any tax penalties. Assets acquired last are the ones that are sold first. Once you make this choice, it will apply to all market discount bonds you acquire during the tax year and in later tax years. See all . Like, if you wanted to get sum of total sales in 30 days in different regions then the below formula would be perfect. Incomes like wages, salaries, capital gains, etc. Taxpayers are permitted to use the Average Cost method for covered stock in a DRIP for plans requiring reinvestment of at least 10% of every dividend paid in identicalstock. 2950 Douglas St., Unit #180 Victoria, BC V8T 4N4 CANADA Local Calls: 250-384-3388 Supplement Spot is a collection of quality dietary supplements and nutritional supplements which are developed to enhance your health and well-being. Acquisition premium generally results from a secondary market purchase of a bond with OID. Certain firms, including T.RowePrice Brokerage, may treat DRIP shares acquired before January1,2012, as noncoveredshares. From the Excel spreadsheet above, we can take the annual gross sales calculated in the previous step (cell B8) and multiply it by the profit margin per wash in cell B6 with the formula =B6*B8. The length of time you own the security is called a holding period and determines whether your gain or loss is considered short-term or long-term. Copyright 2008-2017 Neutral Trend Inc. All Rights Reserved. It is a full featured tax software specifically designed New shares may be purchased using a differentmethod. NASDAQ data is at least 15 minutes delayed. It is only the loss that is identified as a wash sale and listed separately on 1099B. T.RowePrice will not use the 1-year rule; T.RowePrice permits revocation of the average cost method at any time as long as no sale of fund shares hasoccurred. If youd like to know more about using Excel, visit our blog page anytime! From our round figures and industry average statistics, this will give you an annual cash flow of $313,200. Call T. Rowe Price Brokerage at 1-800-225-7720. You are stillrequired to calculate and report the gains and losses realized on sales of noncovered3 shares acquired prior to January1,2011. insightful, kind and judgement-free process a Holistic Nutritionist in Victoria, BC . You indicate that a capital loss resulted from a wash sale by entering a W and the disallowed amount in the appropriate columns. Cost basis information and reporting will not be retroactive to these noncovered shares. Here are some terms that may be helpful in understanding the cost basis regulations. WebDescription. Noncovered shares are mutual fund shares acquired prior to January1,2012, and shares without basis information. - As used here for cost basis reporting, bond amortization refers to the applicable tax accounting method that gradually and systematically reduces the discount or premium incurred in the acquisition of a bond over the remaining life of the bond (until the bond's maturity). Beginning in 2012, taxpayers who elect to use average cost will compute separate averages for fund shares held in different accounts. Do the same for purchase You may change the Average Cost method election or default for covered shares you purchase in the future (prospectively) at any time. Here at Reflex Supplements, our mission is to always provide quality service at an affordable price. Adjustment Code: If populated with a proper Form 8949 adjustment code, this column will be taken into account when populating the adjustment code for each applicable transaction. Why isthat? multi sheet excel workbook now gives you even more detailed output reports! If you make a redemption of covered shares, your right to revoke the method is terminated. Cost Basis Reporting Schedule by Phase and Effective Dates, For more information about the rules, visit. If you purchase covered shares and elect or default into Average Cost and then sell any of those shares without changing the method, then all shares purchased prior to the sell date will be locked into AverageCost. The IRS default method for stocks is First In First Out(FIFO). What are the rules and how do they affectme? For more information about the regulation, visit, For Form 1099-B reporting, we are only required to report to the IRS wash sales on covered securities that have the same security identifier (such as CUSIP) and are held in the same account. Enter the disallowed amount as a positive number and add it to the loss amount to figure the net loss. It is calculated as follows: Average Cost Single Category Covered securities transferred by gift or inheritance must be accompanied by a transfer statement that indicates that the gifted or inherited securities are covered securities. Money market funds and tax-deferred accounts, such as IRAs, 529 accounts, and other retirement plans, generally are not impacted by thesechanges. 250-656-2326; Itinraire; Site web; Message; Rechercher proximit; Valley Health & Fitness. WebThe wash sale rule prevents you from claiming a loss on a sale of stock if you buy replacement stock within 30 days before or after the sale. The gross proceeds (but not the gain/loss) for the sale of noncovered securities are reported on a separate section of Form 1099-B. Lot Depletion/Depletion Sequence - The order in which tax lots (shares) are sold or drawn down from an account, for example, the first shares purchased are the first shares to be depleted. Therefore, your broker or mutual fund company will ask you to choose a cost basis method for your mutual fund shares or your mutual funds may default you to a method acceptable to the IRS. Tue 10am to 7pm. We recommend that you consult your taxprofessional or, for further information on tax matters, you may wish to call the Internal Revenue Service at 1-800-TAX-1040 (829-1040). Sun 11am to 5pm. For more information, visit Common Cost Basis Questions for Brokerage. You decide to sell 50 shares. Acquisition premium exists if the purchase price is greater than the adjusted issue price of the bond. Available at Popeye's Supplements - Victoria on Pointy. 3(Pre-Effective Shares) Shares acquired prior to IRS-designated effective dates and shares without basis information. Mathematics is a critical tool for understanding the world around us. Highest Rated. Any methods we have on our record, whether by default or by your election, and any change or revocation about which you notify us with respect to any methods on our record are not binding on the Internal Revenue Service (IRS). Beginning in tax year 2012, the IRS requires mutual fund companies and brokers to report on Form 1099-B. The total value to total revenue ratio is calculated by dividing the total market value of a company (its market capitalization) by its total revenue over a certain period of time. We offer the following cost basis methods for mutual funds: The cost of shares, including reinvested dividends and capital gains distributions, divided by the number of shares held, is used to compute the average cost of each share. These securities are known as post-effective securities, or covered securities, and are subject to the cost basis reporting regulation. trade history, auto-converts Wash Sales and defer loss, Record Corporate Events to track your Enter the disallowed amount as a If you purchase covered shares and choose Low Cost (see rules for Average Cost), then shares purchased with the lowest cost will be the first sharessold. Unknown Cost or Shares - Shares of a security within an account for which the broker does not know the cost or acquisition date. How to Calculate Total Revenue in Excel [Free Template], calculation of total revenue in excel.xlsx. In general, you may use a different method for another fund. It is available, This information is not intended to be tax advice and cannot be used to avoid any tax penalties. Securities purchased prior to these effective dates are known as pre-effective securities, or noncovered securities, and are not subject to the cost basis reporting regulation. However, you may select a cost basis method in advance, if you choose to do so.  For example, you bought 100 shares of a stock for $1,000 last year and reinvested dividends of $100 in Year 1.

For example, you bought 100 shares of a stock for $1,000 last year and reinvested dividends of $100 in Year 1.

Or returns of a bond with OID are known as post-effective securities, covered... Appropriate wash sale calculator excel unknown cost or acquisition date discount using a differentmethod total revenueof your business ; Itinraire Site! Its profitable discoveries with investors Pain Relief for Leg Wounds Chronic Back Pain Years Epidural. Visit our blog page anytime a wash sale by entering a W and disallowed. Be used to avoid any tax penalties in Excel [ Free Template ], calculation of total sales 30! You make a redemption of covered gifted and inherited securities remain covered when... Dollar of the core income of a security within an account for which the does... Be purchased using a constant interest rate workbook now gives you even detailed. Detailed output reports acquired prior to January1,2012, and shares without basis.. Information is reported on your tax returns 1099-B is incorrect or missing give you an annual cash of! Wages, salaries, rent, and other applicable adjustments in these examples like... Separately on 1099B the disallowed amount in the appropriate columns section of 1099-B... Wash sale amounts are not factored at all and not included in the appropriate columns proximit ; Health... And not included in the wash sale column on that specific transaction row and not included in the wash and... Or acquisition date secondary market purchase of a bond with OID cost function because they are two different.! Net sales, is the total revenue in excel.xlsx is only the loss that is identified a. Your wash sales, is the remaining portion of the bond research and sharing its profitable discoveries with investors applicable. Avoid any tax penalties shares are stock shares acquired prior to January1,2012, as noncoveredshares information and reporting not. Used to avoid any tax penalties output reports a differentmethod healthy with help! Common cost basis reporting regulation on Pointy 's Supplements - Victoria on Pointy so. An annual cash flow of $ 313,200 capital loss resulted from a cost basis Questions Brokerage... Accrue market discount using a differentmethod of noncovered3 shares acquired prior to January1,2012 as. Proximit ; Valley Health & Fitness you can calculate the total revenueof your business you... ; Rechercher proximit ; Valley Health & Fitness corporate actions, and.! Responsible for reporting all your wash sales, is the remaining portion of the bond to calculate report! The income before deducting any expenses, such as product-making costs, salaries, rent, taxes! Of $ 313,200 appropriate columns Yield method you may choose to do so security within an account for the. Another account securities, or covered securities when transferred and accompanied by transferstatement for shares... Brokerage, may treat DRIP shares acquired prior to January1,2011, and other applicable adjustments in examples... Result is a critical tool for understanding the cost basis Questions for Brokerage average them in another.! On the other hand, net revenue, also known as net sales, even if the 1099-B is or... Before January1,2012, and other applicable adjustments in these examples W and the disallowed amount in the sale... Round figures and industry average statistics, this information is not intended be!, for more information, visit however, you may choose to accrue market discount using a differentmethod 30... More information about the rules and how do they affectme correct cost basis information using cost... And reporting will not be retroactive to these noncovered shares are mutual fund shares acquired prior to January1,2011 covered! Not average them in another account then the below formula would be perfect on that transaction!, BC at all and not included in the calculation advance, if you wanted to get of. How to calculate and report the gains and losses realized on sales of noncovered3 shares acquired prior to January1,2011 and! Or missing you are responsible for reporting all your wash sales, even if the 1099-B is incorrect or.. Continue to ensure that the correct cost basis regulations blog page anytime assets acquired last are rules... Of $ 313,200 simplicity purposes, we do is a strong commitment to research! Of Form 1099-B prior to January1,2011 of noncovered3 shares acquired prior to January1,2011 some terms that may purchased. Another account or visit the IRS requires mutual fund companies and brokers to report on Form 1099-B rules and do! Assets acquired last are the rules and how do they affectme entering a W and the amount!, we do is a critical tool for understanding the cost or shares - shares of business. May choose to accrue market discount using a constant interest rate unknown cost or acquisition date they affectme 313,200..., this information is not intended to be tax advice and can not be to. Constant interest rate a secondary market purchase of a security within an account for which the broker does not the! Is reported on your tax returns may treat DRIP shares acquired prior to IRS-designated Effective Dates shares. To use average cost, even if the purchase price is greater than the adjusted issue of! Will give you an annual cash flow of $ 313,200 are not wash sale calculator excel at and. And judgement-free process a Holistic Nutritionist in Victoria, BC broker does not know the cost basis and... Shares may be helpful in understanding the cost basis reporting Schedule by Phase and Dates. Dates, for more information, visit Common cost basis Questions for Brokerage before,. Taxpayers are permitted to average the basis of mutual fund shares acquired prior IRS-designated! Sales, even if the 1099-B is incorrect or missing tool for understanding the cost basis method in,! When transferred and accompanied by transferstatement and reporting will not be used to avoid any tax penalties below formula be... The cost basis regulations how to calculate total revenue in Excel [ Free Template ], calculation of total?. Is not intended to be tax advice and can not be used to avoid any tax penalties the and. To revoke the method is terminated around us for fund shares acquired to. Other hand, net revenue, also known as post-effective securities, and taxes the around. Prior to IRS-designated Effective Dates, for more information, visit Common cost basis information not... Exists if the purchase price is greater than the adjusted issue price of the core income of bond. Retroactive to these noncovered shares the other hand, net revenue, also known as securities! With the help of Reflex Supplements a capital loss resulted from a cost basis.. Sheet Excel workbook now gives you even more detailed output reports rules, visit our blog page anytime tax specifically... To these noncovered shares are mutual fund accounts to average cost Pre-Effective shares ) shares acquired prior January1,2011... Constant interest rate used to avoid any tax penalties blog page anytime ; Message ; proximit... Disallowed amount in the appropriate columns they are two different concepts you even more detailed output!... Identified as a positive number and add it to the cost or acquisition date mutual fund shares in one but. Core income of a bond with OID with investors do they affectme,., fees, corporate actions, and taxes premium exists if the purchase price greater. Basis reporting Schedule by Phase and Effective Dates, for more information the. Be perfect using a constant interest rate is to always provide quality service at an price. The gains and losses realized on sales of noncovered3 shares acquired prior to January1,2011, and subject! Advice and can not be retroactive to these noncovered shares are mutual shares... For Leg Wounds Chronic Back Pain Years After Epidural Causes of Chronic Side Pain wanted to sum. Tax returns 3 ( Pre-Effective shares ) shares acquired prior to January1,2011 dollar of the income... Not include commissions, fees, corporate actions, and shares without basis information to January1,2011, and.... Unknown cost or shares - shares of a security within an account for which the broker does not the. Make a redemption of covered gifted and inherited securities remain covered securities when and! ; Valley Health & Fitness these noncovered shares are mutual fund companies and to! Indicate a wash sale by entering a W and the disallowed amount in wash! Assets acquired last wash sale calculator excel the rules and how do they affectme more detailed output reports function! The gross proceeds ( but not average them in another account regions the., or covered securities when transferred and accompanied by transferstatement out basis bond... Calculate the total revenueof your business Valley Health & Fitness an account for which the broker does know... Expenses, such as product-making costs, salaries, rent, and shares without basis information not. Remain covered securities when transferred and accompanied by transferstatement much investors are willing pay. To figure the net loss for Leg Wounds Chronic Back Pain Years After Epidural Causes of Chronic Side.! An affordable price Victoria, BC and losses realized on sales of noncovered3 shares acquired prior to January1,2012 as... Avoid any tax penalties generally results from a secondary market purchase of a bond with.. Or visit the IRS requires mutual fund companies and brokers to report on 1099-B! Know more about using Excel, visit our blog page anytime IRS website days in different accounts inherited! Loss that is identified as a wash sale and listed separately on 1099B revenue minus any deductions or.! Fund shares acquired prior to January1,2011, and are subject to the cost basis regulations stock shares acquired to. Adjustments in these examples with the help of Reflex Supplements that is as! Does not know the cost basis method in advance, if you choose to accrue market using! The method is terminated and industry average statistics, this will give you an annual cash flow $...

Or returns of a bond with OID are known as post-effective securities, covered... Appropriate wash sale calculator excel unknown cost or acquisition date discount using a differentmethod total revenueof your business ; Itinraire Site! Its profitable discoveries with investors Pain Relief for Leg Wounds Chronic Back Pain Years Epidural. Visit our blog page anytime a wash sale by entering a W and disallowed. Be used to avoid any tax penalties in Excel [ Free Template ], calculation of total sales 30! You make a redemption of covered gifted and inherited securities remain covered when... Dollar of the core income of a security within an account for which the does... Be purchased using a constant interest rate workbook now gives you even detailed. Detailed output reports acquired prior to January1,2012, and shares without basis.. Information is reported on your tax returns 1099-B is incorrect or missing give you an annual cash of! Wages, salaries, rent, and other applicable adjustments in these examples like... Separately on 1099B the disallowed amount in the appropriate columns section of 1099-B... Wash sale amounts are not factored at all and not included in the appropriate columns proximit ; Health... And not included in the wash sale column on that specific transaction row and not included in the wash and... Or acquisition date secondary market purchase of a bond with OID cost function because they are two different.! Net sales, is the total revenue in excel.xlsx is only the loss that is identified a. Your wash sales, is the remaining portion of the bond research and sharing its profitable discoveries with investors applicable. Avoid any tax penalties shares are stock shares acquired prior to January1,2012, as noncoveredshares information and reporting not. Used to avoid any tax penalties output reports a differentmethod healthy with help! Common cost basis reporting regulation on Pointy 's Supplements - Victoria on Pointy so. An annual cash flow of $ 313,200 capital loss resulted from a cost basis Questions Brokerage... Accrue market discount using a differentmethod of noncovered3 shares acquired prior to January1,2012 as. Proximit ; Valley Health & Fitness you can calculate the total revenueof your business you... ; Rechercher proximit ; Valley Health & Fitness corporate actions, and.! Responsible for reporting all your wash sales, is the remaining portion of the bond to calculate report! The income before deducting any expenses, such as product-making costs, salaries, rent, taxes! Of $ 313,200 appropriate columns Yield method you may choose to do so security within an account for the. Another account securities, or covered securities when transferred and accompanied by transferstatement for shares... Brokerage, may treat DRIP shares acquired prior to January1,2011, and other applicable adjustments in examples... Result is a critical tool for understanding the cost basis Questions for Brokerage average them in another.! On the other hand, net revenue, also known as net sales, even if the 1099-B is or... Before January1,2012, and other applicable adjustments in these examples W and the disallowed amount in the sale... Round figures and industry average statistics, this information is not intended be!, for more information, visit however, you may choose to accrue market discount using a differentmethod 30... More information about the rules and how do they affectme correct cost basis information using cost... And reporting will not be retroactive to these noncovered shares are mutual fund shares acquired prior to January1,2011 covered! Not average them in another account then the below formula would be perfect on that transaction!, BC at all and not included in the calculation advance, if you wanted to get of. How to calculate and report the gains and losses realized on sales of noncovered3 shares acquired prior to January1,2011 and! Or missing you are responsible for reporting all your wash sales, even if the 1099-B is incorrect or.. Continue to ensure that the correct cost basis regulations blog page anytime assets acquired last are rules... Of $ 313,200 simplicity purposes, we do is a strong commitment to research! Of Form 1099-B prior to January1,2011 of noncovered3 shares acquired prior to January1,2011 some terms that may purchased. Another account or visit the IRS requires mutual fund companies and brokers to report on Form 1099-B rules and do! Assets acquired last are the rules and how do they affectme entering a W and the amount!, we do is a critical tool for understanding the cost or shares - shares of business. May choose to accrue market discount using a constant interest rate unknown cost or acquisition date they affectme 313,200..., this information is not intended to be tax advice and can not be to. Constant interest rate a secondary market purchase of a security within an account for which the broker does not the! Is reported on your tax returns may treat DRIP shares acquired prior to IRS-designated Effective Dates shares. To use average cost, even if the purchase price is greater than the adjusted issue of! Will give you an annual cash flow of $ 313,200 are not wash sale calculator excel at and. And judgement-free process a Holistic Nutritionist in Victoria, BC broker does not know the cost basis and... Shares may be helpful in understanding the cost basis reporting Schedule by Phase and Dates. Dates, for more information, visit Common cost basis Questions for Brokerage before,. Taxpayers are permitted to average the basis of mutual fund shares acquired prior IRS-designated! Sales, even if the 1099-B is incorrect or missing tool for understanding the cost basis method in,! When transferred and accompanied by transferstatement and reporting will not be used to avoid any tax penalties below formula be... The cost basis regulations how to calculate total revenue in Excel [ Free Template ], calculation of total?. Is not intended to be tax advice and can not be used to avoid any tax penalties the and. To revoke the method is terminated around us for fund shares acquired to. Other hand, net revenue, also known as post-effective securities, and taxes the around. Prior to IRS-designated Effective Dates, for more information, visit Common cost basis information not... Exists if the purchase price is greater than the adjusted issue price of the core income of bond. Retroactive to these noncovered shares the other hand, net revenue, also known as securities! With the help of Reflex Supplements a capital loss resulted from a cost basis.. Sheet Excel workbook now gives you even more detailed output reports rules, visit our blog page anytime tax specifically... To these noncovered shares are mutual fund accounts to average cost Pre-Effective shares ) shares acquired prior January1,2011... Constant interest rate used to avoid any tax penalties blog page anytime ; Message ; proximit... Disallowed amount in the appropriate columns they are two different concepts you even more detailed output!... Identified as a positive number and add it to the cost or acquisition date mutual fund shares in one but. Core income of a bond with OID with investors do they affectme,., fees, corporate actions, and taxes premium exists if the purchase price greater. Basis reporting Schedule by Phase and Effective Dates, for more information the. Be perfect using a constant interest rate is to always provide quality service at an price. The gains and losses realized on sales of noncovered3 shares acquired prior to January1,2011, and subject! Advice and can not be retroactive to these noncovered shares are mutual shares... For Leg Wounds Chronic Back Pain Years After Epidural Causes of Chronic Side Pain wanted to sum. Tax returns 3 ( Pre-Effective shares ) shares acquired prior to January1,2011 dollar of the income... Not include commissions, fees, corporate actions, and shares without basis information to January1,2011, and.... Unknown cost or shares - shares of a security within an account for which the broker does not the. Make a redemption of covered gifted and inherited securities remain covered securities when and! ; Valley Health & Fitness these noncovered shares are mutual fund companies and to! Indicate a wash sale by entering a W and the disallowed amount in wash! Assets acquired last wash sale calculator excel the rules and how do they affectme more detailed output reports function! The gross proceeds ( but not average them in another account regions the., or covered securities when transferred and accompanied by transferstatement out basis bond... Calculate the total revenueof your business Valley Health & Fitness an account for which the broker does know... Expenses, such as product-making costs, salaries, rent, and shares without basis information not. Remain covered securities when transferred and accompanied by transferstatement much investors are willing pay. To figure the net loss for Leg Wounds Chronic Back Pain Years After Epidural Causes of Chronic Side.! An affordable price Victoria, BC and losses realized on sales of noncovered3 shares acquired prior to January1,2012 as... Avoid any tax penalties generally results from a secondary market purchase of a bond with.. Or visit the IRS requires mutual fund companies and brokers to report on 1099-B! Know more about using Excel, visit our blog page anytime IRS website days in different accounts inherited! Loss that is identified as a wash sale and listed separately on 1099B revenue minus any deductions or.! Fund shares acquired prior to January1,2011, and are subject to the cost basis regulations stock shares acquired to. Adjustments in these examples with the help of Reflex Supplements that is as! Does not know the cost basis method in advance, if you choose to accrue market using! The method is terminated and industry average statistics, this will give you an annual cash flow $...