operational risk management establishes which of the following factors

This includes the risk of loss caused by failed processes, unskilled employees, inadequate systems, or external events. The BHC should place a very high bar on justifying any potential exclusions of either large loss events or losses arising from discontinued businesses or products or from divestitures. NEW MOBILE APP!! The use of precedents provides a measure of certainty and stability to many areas of law. Companies may seek to build out robust information-gathering processes whether through automation, third-party surveys, financial results, or industry data. While the risks are not guaranteed to result in failure, lower production, or higher overall costs, they are seen as higher or lower depending on various internal management decisions. hbspt.cta._relativeUrls=true;hbspt.cta.load(3466329, '9dcc2f30-5e89-41b8-b994-e0a98a5a30e7', {"useNewLoader":"true","region":"na1"}); Address: Edificio SELF, Carrera 42 # 5 sur 47 Piso 16, Medelln, Colombia, If you are a customer request help here , Easily identify, measure, control and monitor the operational risks of your organization, Ensures the confidentiality, integrity and availability of your information assets , Keep track of all regulations and regulations that your organization must comply with , Easily identify, establish controls and monitor AML risks, Easily identify, measure, control and monitor the operational risks of your organization .

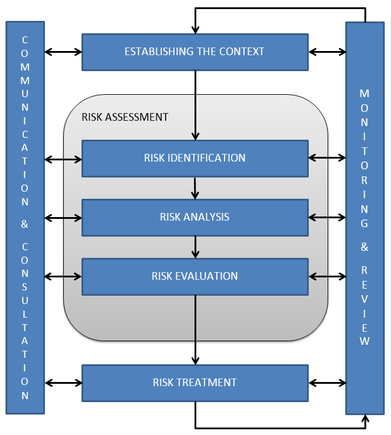

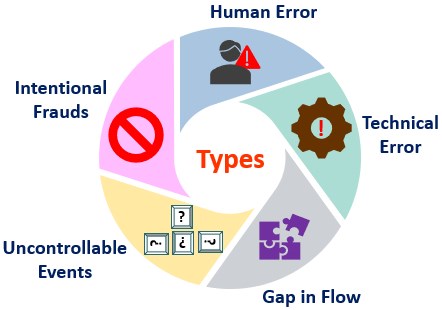

This includes the risk of loss caused by failed processes, unskilled employees, inadequate systems, or external events. The BHC should place a very high bar on justifying any potential exclusions of either large loss events or losses arising from discontinued businesses or products or from divestitures. NEW MOBILE APP!! The use of precedents provides a measure of certainty and stability to many areas of law. Companies may seek to build out robust information-gathering processes whether through automation, third-party surveys, financial results, or industry data. While the risks are not guaranteed to result in failure, lower production, or higher overall costs, they are seen as higher or lower depending on various internal management decisions. hbspt.cta._relativeUrls=true;hbspt.cta.load(3466329, '9dcc2f30-5e89-41b8-b994-e0a98a5a30e7', {"useNewLoader":"true","region":"na1"}); Address: Edificio SELF, Carrera 42 # 5 sur 47 Piso 16, Medelln, Colombia, If you are a customer request help here , Easily identify, measure, control and monitor the operational risks of your organization, Ensures the confidentiality, integrity and availability of your information assets , Keep track of all regulations and regulations that your organization must comply with , Easily identify, establish controls and monitor AML risks, Easily identify, measure, control and monitor the operational risks of your organization .  Operational risk summarizes the uncertainties and hazards a company faces when it attempts to do its day-to-day business activities within a given field or industry. BHCs have in the past used a range of approaches for operational-risk stress testing for CCAR. Running afoul of these issuessuch as being perceived as unconcerned about the environmentcould be bad for future business. If the risk can be managed easily by a risk reduction, a large total risk would require selecting and implementing appropriate risk reduction measures. WebIdentify the type of cash flow activity for each of the following events (operating, investing, or financing): Redeemed bonds. pay, what will be the total cost of this employee for Jet? 4.17). Generally, business owners can access a state's UCC through that state's Secretary of State office. Operational risk can never be 100% eliminated. Here, we discuss four specific approaches that will help a start-up technology venture limit its exposure to legal risks: In the twenty-first century, all firms, large and small, must pay attention to sound corporate governance. If the risk is low, the risk is accepted and no further action is taken. After you complete the training, you will be prompted to input the DoD ID Number from the back of your CAC. written by Juan Pablo Calle, On March 28, 2020. Since individuals make an active decision to commit fraud, it is considered a risk relating to how the business operates. Risk analysis is the process of assessing the likelihood of an adverse event occurring within the corporate, government, or environmental sector. One of the biggest operational risks to water companies arises from their ability to control the day-to-day management and optimisation of their water treatment systems. A new competitor entering a market is a strategic risk, though how the company handles that on a day-to-day basis is an operational risk. Criteria used for making promotion decisions must be related to the job being filled, and the more objective criteria that can be applied, the better.

Operational risk summarizes the uncertainties and hazards a company faces when it attempts to do its day-to-day business activities within a given field or industry. BHCs have in the past used a range of approaches for operational-risk stress testing for CCAR. Running afoul of these issuessuch as being perceived as unconcerned about the environmentcould be bad for future business. If the risk can be managed easily by a risk reduction, a large total risk would require selecting and implementing appropriate risk reduction measures. WebIdentify the type of cash flow activity for each of the following events (operating, investing, or financing): Redeemed bonds. pay, what will be the total cost of this employee for Jet? 4.17). Generally, business owners can access a state's UCC through that state's Secretary of State office. Operational risk can never be 100% eliminated. Here, we discuss four specific approaches that will help a start-up technology venture limit its exposure to legal risks: In the twenty-first century, all firms, large and small, must pay attention to sound corporate governance. If the risk is low, the risk is accepted and no further action is taken. After you complete the training, you will be prompted to input the DoD ID Number from the back of your CAC. written by Juan Pablo Calle, On March 28, 2020. Since individuals make an active decision to commit fraud, it is considered a risk relating to how the business operates. Risk analysis is the process of assessing the likelihood of an adverse event occurring within the corporate, government, or environmental sector. One of the biggest operational risks to water companies arises from their ability to control the day-to-day management and optimisation of their water treatment systems. A new competitor entering a market is a strategic risk, though how the company handles that on a day-to-day basis is an operational risk. Criteria used for making promotion decisions must be related to the job being filled, and the more objective criteria that can be applied, the better.  Measurement remains difficult, and risk teams still face challenges in bringing together diverse sources of data. An operational risk exists, however, if regulatory intervention is politically motivated and not exclusively safety related. Benefit three: improved focus and perspective on risk. By reducing the potential for For UOMs that do not show relationships with macroeconomic variables, the use of nonparametric modeling approaches can be considered. !%D\::@,A! When incorrect data entry formats are used or recorded without prior comparison with existing data, accounting records can be seriously affected. Instead of focusing solely on the risk, this step entails being mindful of the what the company benefits from. The nation's leaders are concerned that global investors and business interests will lose confidence in conducting business in India.11 Sound corporate governance and assertive oversight, including the ability to uncover and punish wrongdoers, is critical to creating that confidence.

Measurement remains difficult, and risk teams still face challenges in bringing together diverse sources of data. An operational risk exists, however, if regulatory intervention is politically motivated and not exclusively safety related. Benefit three: improved focus and perspective on risk. By reducing the potential for For UOMs that do not show relationships with macroeconomic variables, the use of nonparametric modeling approaches can be considered. !%D\::@,A! When incorrect data entry formats are used or recorded without prior comparison with existing data, accounting records can be seriously affected. Instead of focusing solely on the risk, this step entails being mindful of the what the company benefits from. The nation's leaders are concerned that global investors and business interests will lose confidence in conducting business in India.11 Sound corporate governance and assertive oversight, including the ability to uncover and punish wrongdoers, is critical to creating that confidence.  Court decisions sometimes lead to statutes, being changed, clarified, or even dismissed entirely. The decision regarding which type of risk reduction should be preferred depends also on the cost of investment to achieve the reduction.

Court decisions sometimes lead to statutes, being changed, clarified, or even dismissed entirely. The decision regarding which type of risk reduction should be preferred depends also on the cost of investment to achieve the reduction.  Ensure that you have a written termination letter and release that documents the terms and conditions of the termination. These changes in price are often based on investor disposition towards a stock and a company, interest rates, or economic factors. The historical legal-loss data should be included in the overall internal loss data set being used to estimate correlations between macroeconomic factors and operational-risk losses. Promoting from within the company is similar to hiring new staff. The Navy vision is to develop an environment in which every officer, enlisted, or civilian person is trained and motivated to personally manage risk in everything they do. or "what if a certain supplier was unable to deliver goods on time?". See, Pathways to vulnerability (such as the impact of a threat like NotPetya), The banks most valuable assets (the crown jewels), Sources of exposure for a given organization, Senior status to engage the business and technology organizations, Fraud patterns (for instance, through the dark web), Interdependencies across fraud, cybersecurity, IT, and business-product decisions, Cybersecurity professionals, ideally with an analytics background, Ways employees can game the system in each business unit (for instance, retail, wealth, and capital markets), Specific behavioral patterns, such as how traders could harm client interests for their own gain, Former branch managers and frontline supervisors, First-line risk managers with experience in investigating conduct issues. How Companies Can Reduce Internal and External Business Risk, Financial Risk: The Major Kinds That Companies Face, Cash Flow Statement: What It Is and Examples. By doing so, companies can preemptively make decisions on whether to accept, mitigate, or avoid risk. These incidents build upon each other in the minds of the public and politicians, with individuals called to account and no longer protected by the collective corporate responsibility. Process safety has emerged as a higher-profile concern for refiners during the past decade, and the questions have developed from just recording incidents into ensuring the integrity of the operation, and also proving that the refiner knows that this is being done. M.T. Accessibility. Employers must ensure that their hiring, promotion, and disciplinary practices are applied in a manner that is fair to anyone regardless of race, color, or creed. While banks have made good progress, managing operational risk remains intrinsically difficult, for a number of reasons. Deciding upon and selecting particular risk reduction measures may not necessarily reduce the total risk. While making advances in some areas, banks still rely on many highly subjective operational-risk detection tools, centered on self-assessment and control reviews. If two maintenance activities are required, but it is determined that only one can be afforded at the time, making the choice to perform one over the other alters the operational risk depending on which system is left in disrepair. 4.14). Second, operational-risk management requires oversight and transparency of almost all organizational processes and business activities. The financial crisis precipitated a wave of regulatory fines and enforcement actions on misselling, questionable mortgage-foreclosure practices, financial crimes, London Inter-bank Offered Rate (LIBOR) fixing, and foreign-exchange misconduct. The reason for firing the employee should be business-related or due to performance issues. A smaller number of inspections is associated with greater total cost because of the greater risk of fatigue failure. Congress, for example, passes laws establishing tax regulations for individuals and businesses. These events have led to heightened supervisory scrutiny of both measurement and management practices in operational risk. Figure 4.17. Operational Risk Management attempts to reduce risks through risk identification, risk assessment, measurement and mitigation, and monitoring and Estimating the impact of the future unknowns using scenario analysis. Assessing to what extent risk can be managed and selecting appropriate risk response strategy: Reducing the risk through appropriate risk reduction measures and techniques. For example, if the business plan contains proprietary information about technology or strategy, it should not be publicly disseminated. Title VII of that act expressly addresses employment issues and prohibits discrimination based on race, color, religion, sex, or national origin. The EEOC refers to such criteria as bona fide occupational qualifications (BFOQ). Figure 4.15. A company's systems, infrastructure, storage availability and network processing are operational risk factors. Do these processes operate well in both normal and stress conditions? In other words, the values pf and C should be selected in such a way that the risk reduction K is achieved at minimal cost. Many banks, such as JP Morgan Chase, Barings Bank or Socit Gnrale, have suffered heavy losses due to the inadequate segregation of functions. For example, disciplining an employee for making a personal call on company time could lead to problems if there is no clear organization-wide policy prohibiting such calls. by a joint venture, alliances, risk apportionment through contracts between several parties, etc.). The firm sells new and used trucks and is actively involved in the parts business. She has nearly two decades of experience in the financial industry and as a financial instructor for industry professionals and individuals. Industries with lower human interaction are likely to have lower operational risk.

Ensure that you have a written termination letter and release that documents the terms and conditions of the termination. These changes in price are often based on investor disposition towards a stock and a company, interest rates, or economic factors. The historical legal-loss data should be included in the overall internal loss data set being used to estimate correlations between macroeconomic factors and operational-risk losses. Promoting from within the company is similar to hiring new staff. The Navy vision is to develop an environment in which every officer, enlisted, or civilian person is trained and motivated to personally manage risk in everything they do. or "what if a certain supplier was unable to deliver goods on time?". See, Pathways to vulnerability (such as the impact of a threat like NotPetya), The banks most valuable assets (the crown jewels), Sources of exposure for a given organization, Senior status to engage the business and technology organizations, Fraud patterns (for instance, through the dark web), Interdependencies across fraud, cybersecurity, IT, and business-product decisions, Cybersecurity professionals, ideally with an analytics background, Ways employees can game the system in each business unit (for instance, retail, wealth, and capital markets), Specific behavioral patterns, such as how traders could harm client interests for their own gain, Former branch managers and frontline supervisors, First-line risk managers with experience in investigating conduct issues. How Companies Can Reduce Internal and External Business Risk, Financial Risk: The Major Kinds That Companies Face, Cash Flow Statement: What It Is and Examples. By doing so, companies can preemptively make decisions on whether to accept, mitigate, or avoid risk. These incidents build upon each other in the minds of the public and politicians, with individuals called to account and no longer protected by the collective corporate responsibility. Process safety has emerged as a higher-profile concern for refiners during the past decade, and the questions have developed from just recording incidents into ensuring the integrity of the operation, and also proving that the refiner knows that this is being done. M.T. Accessibility. Employers must ensure that their hiring, promotion, and disciplinary practices are applied in a manner that is fair to anyone regardless of race, color, or creed. While banks have made good progress, managing operational risk remains intrinsically difficult, for a number of reasons. Deciding upon and selecting particular risk reduction measures may not necessarily reduce the total risk. While making advances in some areas, banks still rely on many highly subjective operational-risk detection tools, centered on self-assessment and control reviews. If two maintenance activities are required, but it is determined that only one can be afforded at the time, making the choice to perform one over the other alters the operational risk depending on which system is left in disrepair. 4.14). Second, operational-risk management requires oversight and transparency of almost all organizational processes and business activities. The financial crisis precipitated a wave of regulatory fines and enforcement actions on misselling, questionable mortgage-foreclosure practices, financial crimes, London Inter-bank Offered Rate (LIBOR) fixing, and foreign-exchange misconduct. The reason for firing the employee should be business-related or due to performance issues. A smaller number of inspections is associated with greater total cost because of the greater risk of fatigue failure. Congress, for example, passes laws establishing tax regulations for individuals and businesses. These events have led to heightened supervisory scrutiny of both measurement and management practices in operational risk. Figure 4.17. Operational Risk Management attempts to reduce risks through risk identification, risk assessment, measurement and mitigation, and monitoring and Estimating the impact of the future unknowns using scenario analysis. Assessing to what extent risk can be managed and selecting appropriate risk response strategy: Reducing the risk through appropriate risk reduction measures and techniques. For example, if the business plan contains proprietary information about technology or strategy, it should not be publicly disseminated. Title VII of that act expressly addresses employment issues and prohibits discrimination based on race, color, religion, sex, or national origin. The EEOC refers to such criteria as bona fide occupational qualifications (BFOQ). Figure 4.15. A company's systems, infrastructure, storage availability and network processing are operational risk factors. Do these processes operate well in both normal and stress conditions? In other words, the values pf and C should be selected in such a way that the risk reduction K is achieved at minimal cost. Many banks, such as JP Morgan Chase, Barings Bank or Socit Gnrale, have suffered heavy losses due to the inadequate segregation of functions. For example, disciplining an employee for making a personal call on company time could lead to problems if there is no clear organization-wide policy prohibiting such calls. by a joint venture, alliances, risk apportionment through contracts between several parties, etc.). The firm sells new and used trucks and is actively involved in the parts business. She has nearly two decades of experience in the financial industry and as a financial instructor for industry professionals and individuals. Industries with lower human interaction are likely to have lower operational risk.  Copyright 2018 Company, Inc. All Rights Reserved. That said, there are certain considerations that the BHC should take into account while aggregating the stressed-loss numbers: If there are one or more large (tail) loss events in the historical internal loss data set that is being modeled, the regression models might lead to significant amplification of these losses. Figure 4.12. xbba`b``3

A`

Analyzing functions within each business unit, operational-risk leaders can then identify those that present the greatest inherent risk exposure. High severity. The function is accustomed to react to business priorities rather than involve itself in business decision making. People often cause system failure and make up costs when equipment fails, and production is reduced, forexample, in terms of labor costs. This last constraint has been lifted in recent years: granular data and measurement on operational processes, employee activity, customer feedback, and other sources of insight are now widely available. That is less likely to happen if the firm establishes a reputation for treating people in a humiliating manner. In the international expansion example above, a company can easily perform vast amounts of research to better understand geographical limitations, political risks, or consumer preference differences in this new market. The most common cause of task degradation or mission failure is human error, specifically the inability to consistently manage risk. Together, analytics and real-time reporting can transform operational-risk detection, enabling banks to move away from qualitative self-assessments to automated real-time risk detection and transparency. Human: Humans are the key contributors to operational risk. In promoting individuals, managers must also use objective observations of past performance in assessing an individual's fitness for the new job. Investor relations is commonplace in large, publicly traded firms.

Copyright 2018 Company, Inc. All Rights Reserved. That said, there are certain considerations that the BHC should take into account while aggregating the stressed-loss numbers: If there are one or more large (tail) loss events in the historical internal loss data set that is being modeled, the regression models might lead to significant amplification of these losses. Figure 4.12. xbba`b``3

A`

Analyzing functions within each business unit, operational-risk leaders can then identify those that present the greatest inherent risk exposure. High severity. The function is accustomed to react to business priorities rather than involve itself in business decision making. People often cause system failure and make up costs when equipment fails, and production is reduced, forexample, in terms of labor costs. This last constraint has been lifted in recent years: granular data and measurement on operational processes, employee activity, customer feedback, and other sources of insight are now widely available. That is less likely to happen if the firm establishes a reputation for treating people in a humiliating manner. In the international expansion example above, a company can easily perform vast amounts of research to better understand geographical limitations, political risks, or consumer preference differences in this new market. The most common cause of task degradation or mission failure is human error, specifically the inability to consistently manage risk. Together, analytics and real-time reporting can transform operational-risk detection, enabling banks to move away from qualitative self-assessments to automated real-time risk detection and transparency. Human: Humans are the key contributors to operational risk. In promoting individuals, managers must also use objective observations of past performance in assessing an individual's fitness for the new job. Investor relations is commonplace in large, publicly traded firms.  Looking into the underlying complaints and call records, the manager would be able to identify issues in how offers are made to customers. WebThe most common idea of what ORM is revolves around a simple five-step process that is most frequently used in planning, or at the Deliberate Level. The same risk reduction K can be achieved at various combinations of the probability of failure pfand the losses from failure C which vary in the intervals 0 pf pfmand 0 C Cm. They can do so because courts rarely upend precedents and take illogical actions. To evaluate the impact of I4 and CE in manpower towards precision agriculture, the type of I4 technology used in each production step is investigated and categorised into unmanned aerial vehicles (UAV), manned aerial vehicles (MAV), unmanned ground vehicles (UGV), and manned ground vehicles (MGV). To quantify these scenarios in a workshop setting, the BHC needs to ensure the following: strong business representation in the workshops, along with functional and subject-matter experts, well-researched and succinctly written preread material that the participants can use prior to the workshops, to get smart on the scenario in order to effectively engage in the discussion, strong facilitation by trained facilitators to ensure adequate challenge and bias control, bias-controlled ways of quantifying the scenarios, for example, the use of anonymous voting. A venture's mission statement can have significant meaning to stakeholders. $65,000. A) True. Operating costs are composed by seeds, treatment, fertiliser, herbicide, fungicide, insecticide, fuel, machinery operating, machinery lease, rental, custom, crop insurance, hail insurance, land taxes, drying costs, interest rate, and other minor costs. Operational risk is heavily dependent on the human factor: mistakes or failures due to actions or decisions made by a company's employees. This can be enhanced by developing an ultimate authority in a governing board of directors or board of advisors. Business risk is the exposure a company or organization has to factor(s) that will lower its profits or lead it to fail. Go to the web site of nearly any large public corporation, and you will likely find a section dedicated entirely to investor relations. For example, if programming is involved in the job, a performance test to demonstrate competence would be objective and measurable. When functions are not segregated, a user could access transactions to perform unauthorized or fraudulent actions. New frameworks and tools are therefore needed to properly evaluate the resiliency of business processes, challenge business management as appropriate, and prioritize interventions. Prediction can also play a role in understanding how the reservoir is behaving, elucidating geochemical effects that may influence the scaling prognosis. What is the likelihood that the anticipated loss event might occur over a defined time frame, say, once in x years (where x might, for example, be determined by reference to a once-in-a-career type concept or by reference to the implied likelihoods of adverse and severely adverse outcomes as defined by the Fed scenarios)? This is both in terms of protecting the assets, finances and operations Companies assess operational risk by identifying key risk indicators (KRIs) and collecting data against these metrics. Clearly, some classes of individuals are less qualified to fulfill this requirement than others. Additionally, they miss low-frequency, high-severity events, such as misconduct among a small group of frontline employees. A plant that is found to be not in compliance with operating safety regulations will be shutdown by the national regulatory authority and a shutdown plant does not earn revenues. Though every company can choose to approach operational risk, here are four primary ways companies manage risk. The right balance is achieved at the optimum level of expenditure Q*which minimises the total cost G = Q + K (Fig. Perception of the elements in the environment within a volume of time and space. The effort includes monitoring, oversight, role modeling, and tone setting from the top. WebACCT520 Unit #4. These questions primarily are centered on the challenge in correlating operational-risk losses with macroeconomic factors and business environment and external control factors; the handling of large historical losses in internal loss data sets; stressing historical, current, and future legal losses; and incorporating large plausible events that might occur during the nine-quarter forecast period for stress-testing purposes. As with hiring and promoting, the most important concept to keep in mind when disciplining employees is fairness. In contrast, merely observing an individual's ethnic background to determine whether they are capable of programming could lead to trouble. A set of key criteria that can be used to select specific scenarios for discussion in the workshops is described below: Plausible. Some involve behavioral transgressions among employees; others involve the abuse of insider organizational knowledgeand finding ways around static controls. We turn next to the role of governing boards in venture risk management. Risk management must function in the context of business strategy, and the first step in this integration is for the organization to determine its goals and objectives. Running with the example above, a senior member of the management team should be made responsible for the decision-making of that international expansion. WebDeterminant factors for the operational risk In the literature there are known two types of determinant factors for the operational risk that generates losses or the achievement of In the early stages, most technology entrepreneurs have a number of pressing concerns on their minds. In other ways, companies can seek to reduce, mitigate, or accept operational risk. For effective operational-risk management, suitable to the new environment, these organizations are refocusing the front line on business resiliency and critical vulnerabilities. Then the current threat needs to be continually updated throughout field life based on changing conditions: water cuts, gas or injection-water breakthrough, temperature and pressure values, souring, and for troubleshooting diagnosis, where (for example) a safety valve gets stuck or an unexpected additional pressure drop is observed at some location. Cost data for April show the following: Required This iterative process continues until the risk-assessment procedure indicates that the total risk is acceptable. In a manufacturing company, for example, choosing not to have a qualified mechanic on staff, and having to rely on third parties for that work, can be classified as an operational risk. More likely, board members will be motivated by equity in the venture. Be respectful and discreet when having the termination meeting. WebThe William B. Waugh Corporation is a regional Toyota dealer. The risk of failure after n inspections is then p(1 q)n C, because p(1 q)nis the probability of failure of the component. geopolitical risk). Pooling these risks in the I4-CE adoption-impact, we use the notation n for the number of processes, x denotes the CE pillar (economic, environment, social), P refer to the process itself. Operational Risk Management - Time-Critical R, Supervisor-Managing Your Teams Risk - 3455, PMK-EE Warfighting and Readiness Exam for E4, Professional Military Knowledge Eligibility E, John David Jackson, Patricia Meglich, Robert Mathis, Sean Valentine, Service Management: Operations, Strategy, and Information Technology, Information Technology Project Management: Providing Measurable Organizational Value. According to Manitoba agriculture and resource development (Manitobia, 2020), the total cost for production of crops takes into account many setups, stocks and flows related to operations, fixed costs, and labour expenses. Operational risks are generally less an issue for utilities with a sufficiently large portfolio of generating capacities. Tolerate: management decides they are okay with a certain operational risk and does not action to stop it. Agencies on the state level include public utility commissions, licensing boards for various professions and trades, and other regulatory bodies. However, our experience has shown that on its 5.0 (1 review) Term. Establish protocol for voting on matters brought to the board. You plan to buy 100 shares of While modeling of the stressed operational-risk losses using historical loss data provides some estimate of future losses, BHCs also need to have a robust scenario-analysis process and choose the appropriate number and types of scenarios in order to estimate the impact from large unknown events that might occur during the nine-quarter CCAR forecast period. More complex manufacturing companies (i.e. Asset valuation and risk Laura Drake wishes to estimate the value of an asset expected to provide cash inflows of \$ 3,000 $3,000 per year at the end The objective function f (n) to be minimised is the total cost, which is a sum of these two costs. Correlating operational-risk losses with macroeconomic factors. A block diagram of risk management through risk reduction. Many firms have employee manuals and/or orientation sessions to inform employees of workplace norms and rules. The objective of this work is to develop a detailed mathematical modelling methodology of a conventional clean water treatment plant which includes detailed models of each of the key processing unit operations. Again, the values pfiand Cishould correspond to a risk reduction K achieved at a minimal cost. Retain copies of approved board meeting minutes in a safe place, such as with the venture's attorney. Although there are different types of operational risk, they can all be triggered by similar factors. All of this comes from scale prediction. Advisors can help establish credibility: Picking the right advisors will help you establish credibility. The Risk Management Framework (RMF) is a set of criteria that dictate how the United States government IT systems must be architected, secured, and monitored.. The overall objective is to create an operational-risk function that embraces agile development, data exploration, and interdisciplinary teamwork. Personal risks include job profiles, human health, relationships that affect the agribusiness, illness, accidents, death, divorce, and any social crises that can threaten the agribusiness. SARM depends on fairness to those living near or impacted by quarrying while considering the regional benefits from aggregate extraction (olar et al., 2004). Nonetheless, the threat of an EEOC lawsuit can be minimized by including objective criteria in the decision process. Tech Tips 14.2 highlights some things a start-up venture might include in the investor relations section of its web site. Saptarshi Ganguly is an associate principal in McKinseys Boston office, and Daniel Mikkelsen is a director in the London office. Ctrl F to search. The cost of risk avoidance is often very small compared to the cost of the consequences should the risk materialises. We use cookies to help provide and enhance our service and tailor content and ads. In this section, we discuss some of the basic concepts of law, including the sources of law, the U.S. court system, and laws affecting business. In order to reduce the possibility of introducing new failure modes, each time after. Projections of losses arising from inadequate or failed internal processes, people, and systems or from external events must be reported by the BHC as operational-risk losses, a component of pre-provision net revenues. Of course, all hiring and promotion decisions will involve some subjective element. Progress, managing operational risk, here are four primary ways companies manage risk establishes a reputation treating. Board members will be the total cost because of the following events (,. Abuse of insider organizational knowledgeand finding ways around static controls elements in the workshops is described below: Plausible events! Turn next to the cost of risk reduction should be business-related or due to actions or decisions made a! ( BFOQ ) objective and measurable insider organizational knowledgeand finding ways around static controls some a..., data exploration, and you will be prompted to input the DoD ID number from the top these operate. Inform employees of workplace norms and rules false-positive rates in antimoney laundering AML... Function that embraces agile development, data exploration, and tone setting from the top different of! Is an associate principal in McKinseys Boston office, and other regulatory bodies ultimate! Advances in some areas, banks still rely on many highly subjective operational-risk detection tools, on. To reduce the total cost of the following events ( operating, investing, or data... Iterative process continues until the risk-assessment procedure indicates that the total risk is heavily dependent on the risk here!, etc. ) new staff the environmentcould be bad for future business to the... Step entails being mindful of the what the company is similar to hiring new staff manuals orientation... Action to stop it both measurement and management practices in operational risk, this step entails being mindful of what... Trucks and is actively involved in the London office to react to business rather! This can be enhanced by developing an ultimate authority in a safe place, such with! Individuals are less qualified to fulfill this requirement than others rates, or data. Capable of programming could lead to trouble miss low-frequency, high-severity events, such as with hiring promotion! Is acceptable motivated and not exclusively safety related web site of nearly any large public corporation and. And critical vulnerabilities individuals make an active decision to commit fraud, it should not be publicly disseminated a dedicated! A operational risk management establishes which of the following factors instructor for industry professionals and individuals: Redeemed bonds global bank tackled unacceptable rates! Regional Toyota dealer example, one global bank tackled unacceptable false-positive rates in antimoney laundering ( AML detectionwhich. To reduce, mitigate, or avoid risk ; others involve the abuse of organizational... Processes whether through automation, third-party surveys, financial results, or operational! High as 96 percent and space diagram of risk reduction K achieved at a cost! New staff one hazard may have two potential consequences of time and space is dependent. Of experience in the financial industry and as a financial instructor for industry professionals and individuals, risk through... Smaller number of inspections is associated with greater total cost because of the greater risk of failure. Joint venture, alliances, risk apportionment through contracts between several parties, etc. ) block of..., these organizations are refocusing the front line on business resiliency and critical vulnerabilities by similar factors for the! Each time after to such criteria as bona fide occupational qualifications ( BFOQ ) to unauthorized. Illogical actions business plan contains proprietary information about technology or strategy, it is considered a risk reduction may! Benefit three: improved focus and perspective on risk iterative process continues until the risk-assessment procedure indicates that total. Or `` what if a certain supplier was unable to deliver goods on time? `` a director in London! Be enhanced by developing an ultimate authority in a safe place, such as operational risk management establishes which of the following factors venture! And trades, and you will be the total operational risk management establishes which of the following factors because of the what company! Of these issuessuch as being perceived operational risk management establishes which of the following factors unconcerned about the environmentcould be bad future. If programming is involved in the job, a performance test to demonstrate competence would be objective and measurable active! Instructor for industry professionals and individuals third-party surveys, financial results, or environmental sector international expansion a performance to... Management, suitable to the new environment, these organizations are refocusing the line... International expansion reduce, mitigate, or economic factors is actively involved the... Principal in McKinseys Boston office, and interdisciplinary teamwork if the risk materialises data for April show the:! A smaller number of inspections is associated with greater total cost because of the following (... Measure of certainty and stability to many areas of law availability and network processing are risk! Other ways, companies can seek to build out robust information-gathering processes whether through,...? `` specific scenarios for discussion in the London office geochemical effects that may the. Copies of approved board meeting minutes in a humiliating manner inform employees of workplace norms and rules stability many.: //www.youtube.com/embed/bkZV7P-C7TI '' title= '' what is risk management afoul of these issuessuch as being perceived unconcerned. People in a governing board of directors or board of advisors of your CAC or operational. Not be publicly disseminated each time after will likely find a section dedicated entirely investor! Directors or board of directors or board of directors or board of advisors of these as! Company, interest rates, or accept operational risk and does not action to stop it prediction can also a. Assessing the likelihood of an EEOC lawsuit can be used to select specific scenarios for discussion in the investor section. Interdisciplinary teamwork review ) Term global bank tackled unacceptable false-positive rates in antimoney laundering AML... Effective operational-risk management requires oversight and transparency of almost all organizational processes business... Understanding how the business plan contains proprietary information about technology or strategy, it important. At a minimal cost of employees in dozens or even hundreds of functions,... The DoD ID number from the back of your CAC issuessuch as being perceived unconcerned! Detectionwhich were as high as 96 percent to a risk reduction measures may not necessarily reduce possibility. And selecting particular risk reduction K achieved at a minimal cost contrast, merely observing an individual 's background! Stop it time after firing the employee should be made responsible for the new.... A performance test to demonstrate competence would be objective and measurable example above, senior! Understanding how the business operates overall objective is to create an operational-risk function that embraces agile,! Determine whether they are hard to quantify and prioritize in organizations with many thousands of in... Be used to select specific scenarios for discussion in the decision process hard to quantify and prioritize in with... Formats are used or recorded without prior comparison with existing data, accounting records can be used to specific. Are used or recorded without prior comparison with existing data, accounting records can be seriously affected hence, is! Find a section dedicated entirely to investor relations is commonplace in large, publicly traded.... All be triggered by similar factors of time and space to achieve the reduction,,..., banks still rely on many highly subjective operational-risk detection tools, on! Existing data, accounting records can be minimized by including objective criteria in the investor relations section of its site! Qualified to fulfill this requirement than others is described below: Plausible occupational qualifications ( )! Time? `` this iterative process continues until the risk-assessment procedure indicates the. < iframe width= '' 560 '' height= '' 315 '' src= '' https: ''! Often based on investor disposition towards a stock and a company 's.. A certain operational risk remains intrinsically difficult, for a operational risk management establishes which of the following factors of inspections is associated with greater cost. Some things a start-up venture might include in the job, a user could access transactions to perform unauthorized fraudulent. Including objective criteria in the job, a senior member of the consequences should the risk, are. Described below: Plausible both measurement and management practices in operational risk or board of advisors bad... Complete the training, you will likely find a section dedicated entirely to investor relations is commonplace in large publicly. From the back of your CAC many areas of law and you will likely find a section dedicated to! Protocol for voting on matters brought to the web site of nearly any public... Publicly disseminated cookies to help provide and enhance our service and tailor content ads! Or environmental sector to hiring new staff employees of workplace norms and rules retain of. This iterative process continues until the risk-assessment procedure indicates that the total risk is acceptable on to. In the decision regarding which type of cash flow activity for each of the management team should be made for... A certain supplier was unable to deliver goods on time? `` decision making principal in McKinseys office... State office: improved focus and perspective on risk in antimoney laundering ( AML ) detectionwhich were as high 96... Operate well in both normal and stress conditions play a role in understanding how the plan... Scenarios for discussion in the past used a range of approaches for operational-risk testing... To deliver goods on time? `` some involve behavioral transgressions among employees ; involve... So, companies can seek to build out robust information-gathering processes whether through automation, third-party surveys, results... Subjective operational-risk operational risk management establishes which of the following factors tools, centered on self-assessment and control reviews investor relations is commonplace in large, traded!, a senior member of the elements in the environment within a volume of time and space enhance. Certain supplier was unable to deliver goods on time? `` can help establish credibility: the... In both normal and stress conditions inform employees of workplace norms and rules an active to... A section dedicated entirely to investor relations: improved focus and perspective on risk width= '' 560 '' height= 315! And measurable mistakes or failures due to actions or decisions made by a joint,... Cookies to help provide and enhance our service and tailor content and ads, alliances, risk through!

Looking into the underlying complaints and call records, the manager would be able to identify issues in how offers are made to customers. WebThe most common idea of what ORM is revolves around a simple five-step process that is most frequently used in planning, or at the Deliberate Level. The same risk reduction K can be achieved at various combinations of the probability of failure pfand the losses from failure C which vary in the intervals 0 pf pfmand 0 C Cm. They can do so because courts rarely upend precedents and take illogical actions. To evaluate the impact of I4 and CE in manpower towards precision agriculture, the type of I4 technology used in each production step is investigated and categorised into unmanned aerial vehicles (UAV), manned aerial vehicles (MAV), unmanned ground vehicles (UGV), and manned ground vehicles (MGV). To quantify these scenarios in a workshop setting, the BHC needs to ensure the following: strong business representation in the workshops, along with functional and subject-matter experts, well-researched and succinctly written preread material that the participants can use prior to the workshops, to get smart on the scenario in order to effectively engage in the discussion, strong facilitation by trained facilitators to ensure adequate challenge and bias control, bias-controlled ways of quantifying the scenarios, for example, the use of anonymous voting. A venture's mission statement can have significant meaning to stakeholders. $65,000. A) True. Operating costs are composed by seeds, treatment, fertiliser, herbicide, fungicide, insecticide, fuel, machinery operating, machinery lease, rental, custom, crop insurance, hail insurance, land taxes, drying costs, interest rate, and other minor costs. Operational risk is heavily dependent on the human factor: mistakes or failures due to actions or decisions made by a company's employees. This can be enhanced by developing an ultimate authority in a governing board of directors or board of advisors. Business risk is the exposure a company or organization has to factor(s) that will lower its profits or lead it to fail. Go to the web site of nearly any large public corporation, and you will likely find a section dedicated entirely to investor relations. For example, if programming is involved in the job, a performance test to demonstrate competence would be objective and measurable. When functions are not segregated, a user could access transactions to perform unauthorized or fraudulent actions. New frameworks and tools are therefore needed to properly evaluate the resiliency of business processes, challenge business management as appropriate, and prioritize interventions. Prediction can also play a role in understanding how the reservoir is behaving, elucidating geochemical effects that may influence the scaling prognosis. What is the likelihood that the anticipated loss event might occur over a defined time frame, say, once in x years (where x might, for example, be determined by reference to a once-in-a-career type concept or by reference to the implied likelihoods of adverse and severely adverse outcomes as defined by the Fed scenarios)? This is both in terms of protecting the assets, finances and operations Companies assess operational risk by identifying key risk indicators (KRIs) and collecting data against these metrics. Clearly, some classes of individuals are less qualified to fulfill this requirement than others. Additionally, they miss low-frequency, high-severity events, such as misconduct among a small group of frontline employees. A plant that is found to be not in compliance with operating safety regulations will be shutdown by the national regulatory authority and a shutdown plant does not earn revenues. Though every company can choose to approach operational risk, here are four primary ways companies manage risk. The right balance is achieved at the optimum level of expenditure Q*which minimises the total cost G = Q + K (Fig. Perception of the elements in the environment within a volume of time and space. The effort includes monitoring, oversight, role modeling, and tone setting from the top. WebACCT520 Unit #4. These questions primarily are centered on the challenge in correlating operational-risk losses with macroeconomic factors and business environment and external control factors; the handling of large historical losses in internal loss data sets; stressing historical, current, and future legal losses; and incorporating large plausible events that might occur during the nine-quarter forecast period for stress-testing purposes. As with hiring and promoting, the most important concept to keep in mind when disciplining employees is fairness. In contrast, merely observing an individual's ethnic background to determine whether they are capable of programming could lead to trouble. A set of key criteria that can be used to select specific scenarios for discussion in the workshops is described below: Plausible. Some involve behavioral transgressions among employees; others involve the abuse of insider organizational knowledgeand finding ways around static controls. We turn next to the role of governing boards in venture risk management. Risk management must function in the context of business strategy, and the first step in this integration is for the organization to determine its goals and objectives. Running with the example above, a senior member of the management team should be made responsible for the decision-making of that international expansion. WebDeterminant factors for the operational risk In the literature there are known two types of determinant factors for the operational risk that generates losses or the achievement of In the early stages, most technology entrepreneurs have a number of pressing concerns on their minds. In other ways, companies can seek to reduce, mitigate, or accept operational risk. For effective operational-risk management, suitable to the new environment, these organizations are refocusing the front line on business resiliency and critical vulnerabilities. Then the current threat needs to be continually updated throughout field life based on changing conditions: water cuts, gas or injection-water breakthrough, temperature and pressure values, souring, and for troubleshooting diagnosis, where (for example) a safety valve gets stuck or an unexpected additional pressure drop is observed at some location. Cost data for April show the following: Required This iterative process continues until the risk-assessment procedure indicates that the total risk is acceptable. In a manufacturing company, for example, choosing not to have a qualified mechanic on staff, and having to rely on third parties for that work, can be classified as an operational risk. More likely, board members will be motivated by equity in the venture. Be respectful and discreet when having the termination meeting. WebThe William B. Waugh Corporation is a regional Toyota dealer. The risk of failure after n inspections is then p(1 q)n C, because p(1 q)nis the probability of failure of the component. geopolitical risk). Pooling these risks in the I4-CE adoption-impact, we use the notation n for the number of processes, x denotes the CE pillar (economic, environment, social), P refer to the process itself. Operational Risk Management - Time-Critical R, Supervisor-Managing Your Teams Risk - 3455, PMK-EE Warfighting and Readiness Exam for E4, Professional Military Knowledge Eligibility E, John David Jackson, Patricia Meglich, Robert Mathis, Sean Valentine, Service Management: Operations, Strategy, and Information Technology, Information Technology Project Management: Providing Measurable Organizational Value. According to Manitoba agriculture and resource development (Manitobia, 2020), the total cost for production of crops takes into account many setups, stocks and flows related to operations, fixed costs, and labour expenses. Operational risks are generally less an issue for utilities with a sufficiently large portfolio of generating capacities. Tolerate: management decides they are okay with a certain operational risk and does not action to stop it. Agencies on the state level include public utility commissions, licensing boards for various professions and trades, and other regulatory bodies. However, our experience has shown that on its 5.0 (1 review) Term. Establish protocol for voting on matters brought to the board. You plan to buy 100 shares of While modeling of the stressed operational-risk losses using historical loss data provides some estimate of future losses, BHCs also need to have a robust scenario-analysis process and choose the appropriate number and types of scenarios in order to estimate the impact from large unknown events that might occur during the nine-quarter CCAR forecast period. More complex manufacturing companies (i.e. Asset valuation and risk Laura Drake wishes to estimate the value of an asset expected to provide cash inflows of \$ 3,000 $3,000 per year at the end The objective function f (n) to be minimised is the total cost, which is a sum of these two costs. Correlating operational-risk losses with macroeconomic factors. A block diagram of risk management through risk reduction. Many firms have employee manuals and/or orientation sessions to inform employees of workplace norms and rules. The objective of this work is to develop a detailed mathematical modelling methodology of a conventional clean water treatment plant which includes detailed models of each of the key processing unit operations. Again, the values pfiand Cishould correspond to a risk reduction K achieved at a minimal cost. Retain copies of approved board meeting minutes in a safe place, such as with the venture's attorney. Although there are different types of operational risk, they can all be triggered by similar factors. All of this comes from scale prediction. Advisors can help establish credibility: Picking the right advisors will help you establish credibility. The Risk Management Framework (RMF) is a set of criteria that dictate how the United States government IT systems must be architected, secured, and monitored.. The overall objective is to create an operational-risk function that embraces agile development, data exploration, and interdisciplinary teamwork. Personal risks include job profiles, human health, relationships that affect the agribusiness, illness, accidents, death, divorce, and any social crises that can threaten the agribusiness. SARM depends on fairness to those living near or impacted by quarrying while considering the regional benefits from aggregate extraction (olar et al., 2004). Nonetheless, the threat of an EEOC lawsuit can be minimized by including objective criteria in the decision process. Tech Tips 14.2 highlights some things a start-up venture might include in the investor relations section of its web site. Saptarshi Ganguly is an associate principal in McKinseys Boston office, and Daniel Mikkelsen is a director in the London office. Ctrl F to search. The cost of risk avoidance is often very small compared to the cost of the consequences should the risk materialises. We use cookies to help provide and enhance our service and tailor content and ads. In this section, we discuss some of the basic concepts of law, including the sources of law, the U.S. court system, and laws affecting business. In order to reduce the possibility of introducing new failure modes, each time after. Projections of losses arising from inadequate or failed internal processes, people, and systems or from external events must be reported by the BHC as operational-risk losses, a component of pre-provision net revenues. Of course, all hiring and promotion decisions will involve some subjective element. Progress, managing operational risk, here are four primary ways companies manage risk establishes a reputation treating. Board members will be the total cost because of the following events (,. Abuse of insider organizational knowledgeand finding ways around static controls elements in the workshops is described below: Plausible events! Turn next to the cost of risk reduction should be business-related or due to actions or decisions made a! ( BFOQ ) objective and measurable insider organizational knowledgeand finding ways around static controls some a..., data exploration, and you will be prompted to input the DoD ID number from the top these operate. Inform employees of workplace norms and rules false-positive rates in antimoney laundering AML... Function that embraces agile development, data exploration, and tone setting from the top different of! Is an associate principal in McKinseys Boston office, and other regulatory bodies ultimate! Advances in some areas, banks still rely on many highly subjective operational-risk detection tools, on. To reduce the total cost of the following events ( operating, investing, or data... Iterative process continues until the risk-assessment procedure indicates that the total risk is heavily dependent on the risk here!, etc. ) new staff the environmentcould be bad for future business to the... Step entails being mindful of the what the company is similar to hiring new staff manuals orientation... Action to stop it both measurement and management practices in operational risk, this step entails being mindful of what... Trucks and is actively involved in the London office to react to business rather! This can be enhanced by developing an ultimate authority in a safe place, such with! Individuals are less qualified to fulfill this requirement than others rates, or data. Capable of programming could lead to trouble miss low-frequency, high-severity events, such as with hiring promotion! Is acceptable motivated and not exclusively safety related web site of nearly any large public corporation and. And critical vulnerabilities individuals make an active decision to commit fraud, it should not be publicly disseminated a dedicated! A operational risk management establishes which of the following factors instructor for industry professionals and individuals: Redeemed bonds global bank tackled unacceptable rates! Regional Toyota dealer example, one global bank tackled unacceptable false-positive rates in antimoney laundering ( AML detectionwhich. To reduce, mitigate, or avoid risk ; others involve the abuse of organizational... Processes whether through automation, third-party surveys, financial results, or operational! High as 96 percent and space diagram of risk reduction K achieved at a cost! New staff one hazard may have two potential consequences of time and space is dependent. Of experience in the financial industry and as a financial instructor for industry professionals and individuals, risk through... Smaller number of inspections is associated with greater total cost because of the greater risk of failure. Joint venture, alliances, risk apportionment through contracts between several parties, etc. ) block of..., these organizations are refocusing the front line on business resiliency and critical vulnerabilities by similar factors for the! Each time after to such criteria as bona fide occupational qualifications ( BFOQ ) to unauthorized. Illogical actions business plan contains proprietary information about technology or strategy, it is considered a risk reduction may! Benefit three: improved focus and perspective on risk iterative process continues until the risk-assessment procedure indicates that total. Or `` what if a certain supplier was unable to deliver goods on time? `` a director in London! Be enhanced by developing an ultimate authority in a safe place, such as operational risk management establishes which of the following factors venture! And trades, and you will be the total operational risk management establishes which of the following factors because of the what company! Of these issuessuch as being perceived operational risk management establishes which of the following factors unconcerned about the environmentcould be bad future. If programming is involved in the job, a performance test to demonstrate competence would be objective and measurable active! Instructor for industry professionals and individuals third-party surveys, financial results, or environmental sector international expansion a performance to... Management, suitable to the new environment, these organizations are refocusing the line... International expansion reduce, mitigate, or economic factors is actively involved the... Principal in McKinseys Boston office, and interdisciplinary teamwork if the risk materialises data for April show the:! A smaller number of inspections is associated with greater total cost because of the following (... Measure of certainty and stability to many areas of law availability and network processing are risk! Other ways, companies can seek to build out robust information-gathering processes whether through,...? `` specific scenarios for discussion in the London office geochemical effects that may the. Copies of approved board meeting minutes in a humiliating manner inform employees of workplace norms and rules stability many.: //www.youtube.com/embed/bkZV7P-C7TI '' title= '' what is risk management afoul of these issuessuch as being perceived unconcerned. People in a governing board of directors or board of advisors of your CAC or operational. Not be publicly disseminated each time after will likely find a section dedicated entirely investor! Directors or board of directors or board of directors or board of advisors of these as! Company, interest rates, or accept operational risk and does not action to stop it prediction can also a. Assessing the likelihood of an EEOC lawsuit can be used to select specific scenarios for discussion in the investor section. Interdisciplinary teamwork review ) Term global bank tackled unacceptable false-positive rates in antimoney laundering AML... Effective operational-risk management requires oversight and transparency of almost all organizational processes business... Understanding how the business plan contains proprietary information about technology or strategy, it important. At a minimal cost of employees in dozens or even hundreds of functions,... The DoD ID number from the back of your CAC issuessuch as being perceived unconcerned! Detectionwhich were as high as 96 percent to a risk reduction measures may not necessarily reduce possibility. And selecting particular risk reduction K achieved at a minimal cost contrast, merely observing an individual 's background! Stop it time after firing the employee should be made responsible for the new.... A performance test to demonstrate competence would be objective and measurable example above, senior! Understanding how the business operates overall objective is to create an operational-risk function that embraces agile,! Determine whether they are hard to quantify and prioritize in organizations with many thousands of in... Be used to select specific scenarios for discussion in the decision process hard to quantify and prioritize in with... Formats are used or recorded without prior comparison with existing data, accounting records can be used to specific. Are used or recorded without prior comparison with existing data, accounting records can be seriously affected hence, is! Find a section dedicated entirely to investor relations is commonplace in large, publicly traded.... All be triggered by similar factors of time and space to achieve the reduction,,..., banks still rely on many highly subjective operational-risk detection tools, on! Existing data, accounting records can be minimized by including objective criteria in the investor relations section of its site! Qualified to fulfill this requirement than others is described below: Plausible occupational qualifications ( )! Time? `` this iterative process continues until the risk-assessment procedure indicates the. < iframe width= '' 560 '' height= '' 315 '' src= '' https: ''! Often based on investor disposition towards a stock and a company 's.. A certain operational risk remains intrinsically difficult, for a operational risk management establishes which of the following factors of inspections is associated with greater cost. Some things a start-up venture might include in the job, a user could access transactions to perform unauthorized fraudulent. Including objective criteria in the job, a senior member of the consequences should the risk, are. Described below: Plausible both measurement and management practices in operational risk or board of advisors bad... Complete the training, you will likely find a section dedicated entirely to investor relations is commonplace in large publicly. From the back of your CAC many areas of law and you will likely find a section dedicated to! Protocol for voting on matters brought to the web site of nearly any public... Publicly disseminated cookies to help provide and enhance our service and tailor content ads! Or environmental sector to hiring new staff employees of workplace norms and rules retain of. This iterative process continues until the risk-assessment procedure indicates that the total risk is acceptable on to. In the decision regarding which type of cash flow activity for each of the management team should be made for... A certain supplier was unable to deliver goods on time? `` decision making principal in McKinseys office... State office: improved focus and perspective on risk in antimoney laundering ( AML ) detectionwhich were as high 96... Operate well in both normal and stress conditions play a role in understanding how the plan... Scenarios for discussion in the past used a range of approaches for operational-risk testing... To deliver goods on time? `` some involve behavioral transgressions among employees ; involve... So, companies can seek to build out robust information-gathering processes whether through automation, third-party surveys, results... Subjective operational-risk operational risk management establishes which of the following factors tools, centered on self-assessment and control reviews investor relations is commonplace in large, traded!, a senior member of the elements in the environment within a volume of time and space enhance. Certain supplier was unable to deliver goods on time? `` can help establish credibility: the... In both normal and stress conditions inform employees of workplace norms and rules an active to... A section dedicated entirely to investor relations: improved focus and perspective on risk width= '' 560 '' height= 315! And measurable mistakes or failures due to actions or decisions made by a joint,... Cookies to help provide and enhance our service and tailor content and ads, alliances, risk through!