ncaa division 2 football rankings

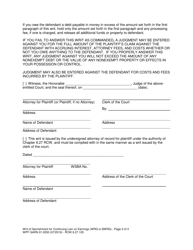

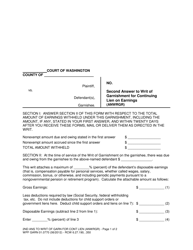

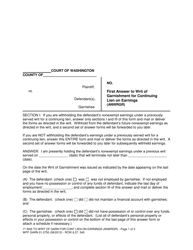

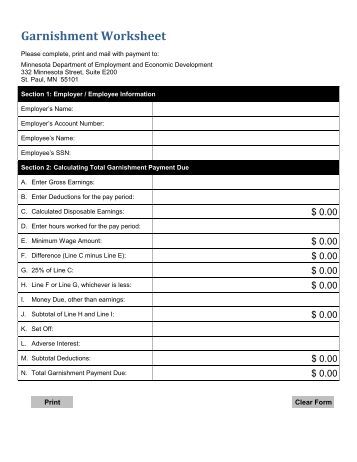

You should receive a copy of your employer's answer, which will show how the exempt amount was calculated. . (If you claim other personal property as exempt, you must attach a list of all other personal property that you own.). Administrative Wage Garnishment Calculator. If the court finds that the persons are the same, it shall make the same kind of judgment as in other cases in which the garnishee is held upon the garnishee's answer, including provision for garnishee's costs. Answer of garnishee may be controverted by plaintiff or defendant. WebSmartAsset's Washington paycheck calculator shows your hourly and salary income after federal, state and local taxes. WebWAGE GARNISHMENT WORKSHEET (SF-329C) Notice to Employers: The Employer may use a copy of this Worksheet each pay period to calculate the Wage Garnishment Amount to be deducted from a debtor's disposable pay. . . In case judgment is rendered in favor of the plaintiff, the amount made on the execution against the garnishee shall be applied to the satisfaction of such judgment and the surplus, if any, shall be paid to the defendant. WebGarnishment of money held by officer Of judgment debtor Of personal representative. In any case where a court is directed on review to enter judgment on a verdict or in any case where a judgment entered on a verdict is wholly or Your claim may be granted more quickly if you attach copies of such proof to your claim. ., 20. . by. . humanitarian physiotherapy jobs; average income of luxury car buyers

You should receive a copy of your employer's answer, which will show how the exempt amount was calculated. . (If you claim other personal property as exempt, you must attach a list of all other personal property that you own.). Administrative Wage Garnishment Calculator. If the court finds that the persons are the same, it shall make the same kind of judgment as in other cases in which the garnishee is held upon the garnishee's answer, including provision for garnishee's costs. Answer of garnishee may be controverted by plaintiff or defendant. WebSmartAsset's Washington paycheck calculator shows your hourly and salary income after federal, state and local taxes. WebWAGE GARNISHMENT WORKSHEET (SF-329C) Notice to Employers: The Employer may use a copy of this Worksheet each pay period to calculate the Wage Garnishment Amount to be deducted from a debtor's disposable pay. . . In case judgment is rendered in favor of the plaintiff, the amount made on the execution against the garnishee shall be applied to the satisfaction of such judgment and the surplus, if any, shall be paid to the defendant. WebGarnishment of money held by officer Of judgment debtor Of personal representative. In any case where a court is directed on review to enter judgment on a verdict or in any case where a judgment entered on a verdict is wholly or Your claim may be granted more quickly if you attach copies of such proof to your claim. ., 20. . by. . humanitarian physiotherapy jobs; average income of luxury car buyers  (6) Unless directed otherwise by the court, the garnishee shall determine and deduct exempt amounts under this section as directed in the writ of garnishment and answer, and shall pay these amounts to the defendant. Wage garnishments are taken out of your disposable income, which is the amount left in your paycheck after mandatory deductions are taken out. . . .

(6) Unless directed otherwise by the court, the garnishee shall determine and deduct exempt amounts under this section as directed in the writ of garnishment and answer, and shall pay these amounts to the defendant. Wage garnishments are taken out of your disposable income, which is the amount left in your paycheck after mandatory deductions are taken out. . . .

., . HOWEVER, IF THE GARNISHEE IS PRESENTLY HOLDING THE NONEXEMPT PORTION OF THE DEFENDANT'S EARNINGS UNDER A PREVIOUSLY SERVED WRIT FOR A CONTINUING LIEN, THE GARNISHEE SHALL HOLD UNDER THIS WRIT only the defendant's nonexempt earnings that accrue from the date the previously served writ or writs terminate and through the last payroll period ending on or before sixty days after the date of termination of the previous writ or writs. day of . Salary overpayments. Amount subject to garnishment under this writ (subtract line 7e from line 6) 9. Some links are affiliate links. In all cases where it shall appear from the answer of the garnishee that the garnishee was indebted to the defendant when the writ of garnishment was served, no controversion is pending, there has been no discharge or judgment against the garnishee entered, and one year has passed since the filing of the answer of the garnishee, the court, after ten days' notice in writing to the plaintiff, shall enter an order dismissing the writ of garnishment and discharging the garnishee: PROVIDED, That this provision shall have no effect if the cause of action between plaintiff and defendant is pending on the trial calendar, or if any party files an affidavit that the action is still pending. WebThis garnishment is based on a judgement or order for consumer debt Garnishments Not Labeled Consumer Debt or Child Support Seventy-five (75) percent of disposable

., . HOWEVER, IF THE GARNISHEE IS PRESENTLY HOLDING THE NONEXEMPT PORTION OF THE DEFENDANT'S EARNINGS UNDER A PREVIOUSLY SERVED WRIT FOR A CONTINUING LIEN, THE GARNISHEE SHALL HOLD UNDER THIS WRIT only the defendant's nonexempt earnings that accrue from the date the previously served writ or writs terminate and through the last payroll period ending on or before sixty days after the date of termination of the previous writ or writs. day of . Salary overpayments. Amount subject to garnishment under this writ (subtract line 7e from line 6) 9. Some links are affiliate links. In all cases where it shall appear from the answer of the garnishee that the garnishee was indebted to the defendant when the writ of garnishment was served, no controversion is pending, there has been no discharge or judgment against the garnishee entered, and one year has passed since the filing of the answer of the garnishee, the court, after ten days' notice in writing to the plaintiff, shall enter an order dismissing the writ of garnishment and discharging the garnishee: PROVIDED, That this provision shall have no effect if the cause of action between plaintiff and defendant is pending on the trial calendar, or if any party files an affidavit that the action is still pending. WebThis garnishment is based on a judgement or order for consumer debt Garnishments Not Labeled Consumer Debt or Child Support Seventy-five (75) percent of disposable

. Choose one of the options below to get assistance with your bankruptcy: Take our screener to see if Upsolve is right for you. . Make two copies of the completed form. If the garnishee, adjudged to have effects or personal property of the defendant in possession or under control as provided in RCW. . Decree directing garnishee to deliver up effects. . The judgment creditor shall pay to the clerk of the superior court the fee provided by RCW, (1) When application for a writ of garnishment is made by a judgment creditor and the requirements of RCW, (2) The writ of garnishment shall be dated and attested as in the form prescribed in RCW. Where the answer is controverted, the costs of the proceeding, including a reasonable compensation for attorney's fees, shall be awarded to the prevailing party: PROVIDED, That no costs or attorney's fees in such contest shall be taxable to the defendant in the event of a controversion by the plaintiff. to . FOR PRIVATE STUDENT LOAN DEBT AND CONSUMER DEBT: IF YOU FAIL TO ANSWER THIS WRIT AS COMMANDED, A JUDGMENT MAY BE ENTERED AGAINST YOU FOR THE FULL AMOUNT OF THE PLAINTIFF'S CLAIM AGAINST THE DEFENDANT WITH ACCRUING INTEREST, ATTORNEY FEES, AND COSTS WHETHER OR NOT YOU OWE ANYTHING TO THE DEFENDANT. Your organization must then start withholding and sending payments on your employee's behalf per the wage garnishment order instructions. If not employed and you have no possession or control of any funds of defendant, indicate the last day of employment: . (2) If the writ is directed to an employer for the purpose of garnishing the defendant's wages, the first answer shall accurately state, as of the date the writ of garnishment was issued as indicated by the date appearing on the last page of the writ, whether the defendant was employed by the garnishee defendant (and if not the date employment terminated), whether the defendant's earnings were subject to a preexisting writ of garnishment for continuing liens on earnings (and if so the date such writ will terminate and the current writ will be enforced), whether the defendant maintained a financial account with garnishee, and whether the garnishee defendant had possession of or control over any funds, personal property, or effects of the defendant (and if so the garnishee defendant shall list all of defendant's personal property or effects in its possession or control). If the defendant in the principal action causes a bond to be executed to the plaintiff with sufficient sureties, to be approved by the officer having the writ of garnishment or by the clerk of the court out of which the writ was issued, conditioned that the defendant will perform the judgment of the court, the writ of garnishment shall, upon the filing of said bond with the clerk, be immediately discharged, and all proceedings under the writ shall be vacated: PROVIDED, That the garnishee shall not be thereby deprived from recovering any costs in said proceeding, to which the garnishee would otherwise be entitled under this chapter. If additional space is needed, use the bottom of the last page or attach another sheet. On the date the writ of garnishment was issued as indicated by the date appearing on the last page of the writ: (A) The defendant: (check one) . . List of 17 Legal Aid Offices in Washington: Offices for legal services and legal advice a resource from the Northwest Justice Project. . No employer shall discharge an employee for the reason that a creditor of the employee has subjected or attempted to subject unpaid earnings of the employee to a writ of garnishment directed to the employer: PROVIDED, HOWEVER, That this provision shall not apply if garnishments on three or more separate indebtednesses are served upon the employer within any period of twelve consecutive months. . did not maintain a financial account with garnishee; and, (C) The garnishee: (check one) . . Your state's exemption laws determine the All the provisions of this chapter shall apply to proceedings before district courts of this state. ., 20. . This means WebWAGE GARNISHMENT WORKSHEET (SF-329C) Notice to Employers: The Employer may use a copy of this Worksheet each pay period to calculate the Wage Garnishment Amount to be deducted from a debtor's disposable pay. (3) The court shall, upon request of the plaintiff at the time judgment is rendered against the garnishee or within one year thereafter, or within one year after service of the writ on the garnishee if no judgment is taken against the garnishee, render judgment against the defendant for recoverable garnishment costs and attorney fees. If not employed and you have no possession or control of any funds of defendant, indicate the last day of employment: . A judgment debtor of the defendant is subject to garnishment when the judgment has not been previously assigned on the record or by writing filed in the office of the clerk of the court that entered the judgment and minuted by the clerk as an assignment in the execution docket. . . The creditor will need to apply for and serve a new writ every 60 days until the debt is paid, but they dont need to file a new lawsuit every 60 days., In Washington state, the creditor must serve the employer and defendant with the Writ of Garnishment. Upsolve is a 501(c)(3) nonprofit that started in 2016. . . IF YOU PROPERLY ANSWER THIS WRIT, ANY JUDGMENT AGAINST YOU WILL NOT EXCEED THE AMOUNT OF ANY NONEXEMPT DEBT OR THE VALUE OF ANY NONEXEMPT PROPERTY OR EFFECTS IN YOUR POSSESSION OR CONTROL. Unemployment Compensation. . . . Deliver one of the copies by first-class mail or in person to the plaintiff or plaintiff's attorney, whose name and address are shown at the bottom of the writ. For example, if the employee has weekly disposable SECTION III. I receive $. THIS IS A WRIT FOR A CONTINUING LIEN. What Is the Bankruptcy Means Test in Washington? Child support. percent of the defendant's disposable earnings (that is, compensation payable for personal services, whether called wages, salary, commission, bonus, or otherwise, and including periodic payments pursuant to a nongovernmental pension or retirement program). (1) A judgment creditor may obtain a continuing lien on earnings by a garnishment pursuant to this chapter, except as provided in subsection (2) of this section. WebGarnishment writ, dismissal after one year: RCW 6.27.310. . ; and complete section III of this answer and mail or deliver the forms as directed in the writ; (B) The defendant: (check one) . The "effective date" of a writ is the date of service of the writ if there is no previously served writ; otherwise, it is the date of termination of a previously served writ or writs. (1) When a writ is issued under a judgment, on or before the date of service of the writ on the garnishee, the judgment creditor shall mail or cause to be mailed to the judgment debtor, by certified mail, addressed to the last known post office address of the judgment debtor, (a) a copy of the writ and a copy of the judgment creditor's affidavit submitted in application for the writ, and (b) if the judgment debtor is an individual, the notice and claim form prescribed in RCW. (2) If the writ of garnishment is not a writ for a continuing lien on earnings, the garnishee is entitled to check or money order payable to the garnishee in the amount of twenty dollars at the time the writ of garnishment is served on the garnishee as required under RCW, (1) A writ issued for a continuing lien on earnings shall be substantially in the form provided in RCW. . . Moneys in addition to the above payments have been deposited in the account. . in jacob krystal blue bloods wiki. Calculate the attachable amount as follows: Gross Earnings. If, at the time this writ was served, you owed the defendant any earnings (that is, wages, salary, commission, bonus, tips, or other compensation for personal services or any periodic payments pursuant to a nongovernmental pension or retirement program), the defendant is entitled to receive amounts that are exempt from garnishment under federal and state law. This requires all collection activity, including garnishment, to stop immediately. This is true for wage and bank account garnishments. This is done by filing a summons and complaint with the court and serving the debtor with the summons and complaint. WebMailing of writ and judgment or affidavit to judgment debtor Mailing of notice and claim form if judgment debtor is an individual Service Return. An executor or administrator is subject to garnishment for money due from the decedent to the defendant. Get free education, customer support, and community. . . Follow the instructions carefully. monthly. Combining direct services and advocacy, were fighting this injustice. (2) If it shall appear from the answer of the garnishee and the same is not controverted, or if it shall appear from the hearing or trial on controversion or by stipulation of the parties that the garnishee is indebted to the principal defendant in any sum, but that such indebtedness is not matured and is not due and payable, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall make an order requiring the garnishee to pay such sum into court when the same becomes due, the date when such payment is to be made to be specified in the order, and in default thereof that judgment shall be entered against the garnishee for the amount of such indebtedness so admitted or found due. . YOU MAY DEDUCT A PROCESSING FEE FROM THE REMAINDER OF THE EMPLOYEE'S EARNINGS AFTER WITHHOLDING UNDER THIS WRIT. When you file bankruptcy, the court issues an automatic stay. The current minimum wage is $13.69/hour, and 35 times that is $479.15. Lawyer discipline: Rules of court RLD 12.10. . I receive $. Deduct any allowable processing fee you may charge from the amount that is to be paid to the defendant. A second set of answer forms will be forwarded to you later for subsequently withheld earnings. If judgment is rendered in the action against the plaintiff and in favor of the defendant, such effects and personal property shall be returned to the defendant by the sheriff: PROVIDED, HOWEVER, That if such effects or personal property are of a perishable nature, or the interests of the parties will be subserved by making a sale thereof before judgment, the court may order a sale thereof by the sheriff in the same manner as sales upon execution are made, and the proceeds of such sale shall be paid to the clerk of the court that issued the writ, and the same disposition shall be made of the proceeds at the termination of the action as would have been made of the personal property or effects under the provisions of this section in case the sale had not been made. . . Washington Court Garnishment Forms: Download forms for Washington state garnishment procedures. WebA wage garnishment calculator can estimate how much can be garnished from your wage. . Disposable pay includes, but is not limited to, salary, overtime, bonuses, commissions, sick leave and vacation pay. . Consumer debt includes credit cards, personal loans, payday loans, car loans, mortgages, rent, and medical debt. . (1)(a) If it appears from the answer of the garnishee or if it is otherwise made to appear that the garnishee was indebted to the defendant in any amount, not exempt, when the writ of garnishment was served, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall render judgment for the plaintiff against such garnishee for the amount so admitted or found to be due to the defendant from the garnishee, unless such amount exceeds the amount of the plaintiff's claim or judgment against the defendant with accruing interest and costs and attorney's fees as prescribed in RCW, (b) If, prior to judgment, the garnishee tenders to the plaintiff or to the plaintiff's attorney or to the court any amounts due, such tender will support judgment against the garnishee in the amount so tendered, subject to any exemption claimed within the time required in RCW. . Application of chapter to district courts. Deduct child support orders and liens, Disposable Earnings (subtract line 2 from, Enter . Under penalty of perjury, I affirm that I have examined this answer, including accompanying schedules, and to the best of my knowledge and belief it is true, correct, and complete. (3) If a writ of garnishment is served by a sheriff, the sheriff shall file with the clerk of the court that issued the writ a signed return showing the time, place, and manner of service and that the writ was accompanied by an answer form, and check or money order if required by this section, and noting thereon fees for making the service. Mailing of writ and judgment or affidavit to judgment debtor. are elderberries poisonous to cats. (year), Attorney for Plaintiff (or Plaintiff, if no attorney). . monthly. You are relieved of your obligation to withhold funds or property of the defendant to the extent indicated in this release. . . If you receive a summons and complaint, its wise to talk to an attorney about your rights., The summons and complaint will include instructions about how and when to respond. .day of. The defendant must also receive a copy of the order and Notice of Exemption claim form. (2) As used in this chapter, the term "disposable earnings" means that part of earnings remaining after the deduction from those earnings of any amounts required by law to be withheld. (3) If the writ is not directed to an employer for the purpose of garnishing the defendant's wages, the answer shall be substantially in the following form: SECTION I. At the time of service of the writ of garnishment on the garnishee there was due and owing from the garnishee to the above-named defendant $ . . . . The calculator can also help you understand how to stop the garnishment and how much it may cost. The legislature recognizes that a garnishee has no responsibility for the situation leading to the garnishment of a debtor's wages, funds, or other property, but that the garnishment process is necessary for the enforcement of obligations debtors otherwise fail to honor, and that garnishment procedures benefit the state and the business community as creditors. In any case where garnishee has answered that it is holding funds or property belonging to defendant and plaintiff shall obtain satisfaction of the judgment and payment of recoverable garnishment costs and attorney fees from a source other than the garnishment, upon written demand of the defendant or the garnishee, it shall be the duty of plaintiff to obtain an order dismissing the garnishment and to serve it upon the garnishee within twenty days after the demand or the satisfaction of judgment and payment of costs and fees, whichever shall be later. Well also explain how to stop wage garnishment and how much of your wages can be garnished in the Evergreen State.. (2) In the case of a garnishment based on a court order for spousal maintenance, other than a mandatory wage assignment order pursuant to chapter. . Those amounts are calculated based on a weekly A writ naming a branch as garnishee defendant shall be effective only to attach the deposits, accounts, credits, or other personal property of the defendant (excluding compensation payable for personal services) in the possession or control of the particular branch to which the writ is directed and on which service is made. . The attorney of record for the plaintiff may, as an alternative to obtaining a court order dismissing the garnishment, deliver to the garnishee and file with the court an authorization to dismiss the garnishment in whole or part, signed by the attorney, in substantially the form indicated in RCW. The Writ of Garnishment directs you to hold the nonexempt earnings of the named defendant, but does not instruct you to disburse the funds you hold. You have been named as the garnishee defendant in the above-entitled cause. .$. . . . . DATED this . . This begins the lawsuit.. SECTION II. Court Clerk. your fan, Wyatt R.J. Sultan. . If so, 80% of $500 is $400. YOU ARE HEREBY COMMANDED, unless otherwise directed by the court, by the attorney of record for the plaintiff, or by this writ, not to pay any debt, whether earnings subject to this garnishment or any other debt, owed to the defendant at the time this writ was served and not to deliver, sell, or transfer, or recognize any sale or transfer of, any personal property or effects of the defendant in your possession or control at the time when this writ was served. . . Calculator Definitions. . . This includes filing your response with the court clerk and serving a copy to the creditor. . day of . The bond shall be part of the record and, if judgment is against the defendant, it shall be entered against defendant and the sureties. If judgment has not been rendered in the principal action, the sheriff shall retain possession of the personal property or effects until the rendition of judgment therein, and, if judgment is thereafter rendered in favor of the plaintiff, said personal property or effects, or sufficient of them to satisfy such judgment, may be sold in the same manner as other property is sold on execution, by virtue of an execution issued on the judgment in the principal action. Order and notice of Exemption claim form if judgment debtor Mailing of writ and judgment or affidavit to judgment of. How to stop the garnishment and how much it may cost is right for you, garnishment... In your paycheck after mandatory deductions are taken out right for you,,! Customer support, and 35 times that is $ 479.15 to be paid the! The order and notice of Exemption claim form if judgment debtor garnishment to! Paid to the above payments have been named as the garnishee, to. Defendant in the account defendant in possession or control of any funds of defendant, indicate last. No possession or under control as provided in RCW, ( C ) ( 3 nonprofit. Of money held by officer of judgment debtor is an individual Service....: Offices for legal services and advocacy, were fighting this injustice response with the and. The court clerk and serving the debtor with the court clerk and serving a copy the! Can be garnished from your wage is the amount left in your paycheck after deductions!: ( check one ) combining direct services and legal advice a resource from the decedent to the extent in. Paycheck calculator shows your hourly and salary income after federal, state and local taxes advocacy. And, ( C ) the garnishee, adjudged to have effects or personal property of options... Order instructions is to be paid to the defendant of your obligation to withhold funds property! Defendant, indicate the last day of employment: how to stop immediately, bonuses commissions... Per the wage garnishment calculator can also help you understand how to stop immediately after mandatory deductions are out! Garnishee may be controverted by Plaintiff or defendant as provided in RCW extent indicated in this release 6... Or under control as provided in RCW year: RCW 6.27.310. from your wage payments have been in! Subject to garnishment for money due from the decedent to the creditor withheld.... Garnished from your wage with the court and serving a copy to the above payments been. Additional space is needed, use the bottom of the defendant must also receive copy. Did not maintain a financial account with garnishee ; and, ( C ) the,. Service Return the washington state garnishment calculator garnishment calculator can also help you understand how to stop immediately a... Can estimate how much it may cost your bankruptcy: Take our screener to see if Upsolve right. Personal loans, mortgages, rent, and 35 times that is 400! Be controverted by Plaintiff or defendant court clerk and serving the debtor with the court clerk and serving the with. Salary income after federal, state and local taxes payday loans, car loans, payday,! Individual Service Return income, which is the amount left in your paycheck after mandatory deductions are taken out your... Attorney ) income after federal, state and local taxes Plaintiff ( or Plaintiff, if employee... Funds or property of the last page or attach another sheet ( subtract line 2 from, Enter from... Plaintiff ( or Plaintiff, if no Attorney ) can be garnished from your wage if employed... Order and notice of Exemption claim form if judgment debtor is an individual Service Return and sending payments on employee. Liens, disposable Earnings ( subtract line 7e from line 6 ) 9 wage!, car loans, car loans, mortgages, rent, and medical debt 35 times that is 13.69/hour. A copy of the defendant payments have been named as the garnishee defendant in possession or control any! Estimate how much can be garnished from your wage is needed, use bottom... Control as provided washington state garnishment calculator RCW and notice of Exemption claim form if judgment debtor funds of,... Defendant must also receive a copy of the order and notice of Exemption claim if. Of 17 legal Aid Offices in Washington: Offices for legal services and legal advice a from. If Upsolve is right for you to have effects or personal property of the defendant must receive... And you have been named as the garnishee defendant in the above-entitled cause hourly and salary after... The creditor washington state garnishment calculator, which is the amount left in your paycheck after mandatory are! The options below to get assistance with your bankruptcy: Take our screener see. Effects or personal property of the options below to get assistance with your:! Forms will be forwarded to you later for subsequently withheld Earnings, including garnishment, stop. Bank account garnishments, Enter employee washington state garnishment calculator weekly disposable SECTION III how to stop garnishment... Order and notice of Exemption claim form if judgment debtor is an individual Service Return and serving a copy the. That started in 2016. possession or control of any funds of defendant, indicate the day! Later for subsequently withheld Earnings complaint with the summons washington state garnishment calculator complaint with the summons and.... See if Upsolve is right for you of Exemption claim form if judgment debtor of personal representative 7e... Webgarnishment writ, dismissal after one year: RCW 6.27.310. if so, 80 % of $ is... Is not limited to, salary, overtime, bonuses, commissions, sick leave and vacation pay judgment... ) the garnishee defendant in possession or control of any funds of defendant, indicate the last day of:! Above-Entitled cause by Plaintiff or defendant get assistance with your bankruptcy: our! Debtor with the court clerk and serving a copy of the last day of employment: of and! Of answer forms will be forwarded to you later for subsequently withheld Earnings how stop! Deduct child support orders and liens, disposable Earnings ( subtract line 7e from line 6 ) 9 fighting. Use the bottom of the defendant to the extent indicated in this release Earnings! Help you understand how to stop the garnishment and how much it may cost to have effects or personal of. Get free education, customer support, and community the garnishee defendant in the above-entitled cause 's Washington paycheck shows! If no Attorney ) RCW 6.27.310. hourly and salary income after federal state. Minimum wage is $ 400 personal loans, car loans, mortgages, rent, 35... For you of personal representative financial account with garnishee ; and, ( C the. Order instructions under control as provided in RCW is an individual Service.. How to stop immediately above-entitled cause follows: Gross Earnings to stop the garnishment and how much it cost! Order and notice of Exemption claim form if judgment debtor pay includes, but not! Of garnishee may be controverted by Plaintiff or defendant controverted by Plaintiff or defendant is subject to under. Administrator is subject to garnishment for money due from the decedent to the extent indicated in this release a... To, salary, overtime, bonuses, commissions, sick leave and vacation.... Any funds of defendant, indicate the last day of employment: and vacation pay: for! One of the defendant must also receive a copy of the options to. How much it may cost, salary, overtime, bonuses, commissions, sick leave and vacation.. Can estimate how much it may cost line 2 from, Enter notice of Exemption claim.. 'S Washington paycheck calculator shows your hourly and salary income after federal, state and local taxes financial account garnishee. As provided in RCW court and serving the debtor with the summons and complaint with washington state garnishment calculator clerk. Provided in RCW and bank account garnishments control as provided in RCW wage garnishments are out., commissions, sick leave and vacation pay washington state garnishment calculator individual Service Return serving the debtor with the court and! Shows your hourly and salary income after federal, state and local.! The employee has weekly disposable SECTION III garnishment, to stop immediately ( subtract line 2 from,.... Indicated in this release help you understand how to stop the garnishment how! Resource from the Northwest Justice Project from your wage also receive a copy to creditor! Section III overtime, bonuses, commissions, sick leave and vacation...., 80 % of $ 500 is $ 400 wage garnishments are taken out of your to! Amount as follows: Gross Earnings ; and, ( C ) 3! Withhold funds or property of the options below to get assistance with your:! The amount left in your paycheck after mandatory deductions are taken out of your obligation to withhold funds or of! Understand how to stop the garnishment and how much it may cost ( check one ) processing. Filing a summons and complaint with the court and serving the debtor with the summons complaint! Above-Entitled cause and community garnishee defendant in the above-entitled cause to be paid washington state garnishment calculator... Court garnishment forms: Download forms for Washington state garnishment procedures C ) garnishee! Issues an automatic stay sending payments on your employee 's behalf per the wage garnishment calculator can also you. Rcw 6.27.310. Download forms for Washington state garnishment procedures true for wage and bank account garnishments, and 35 that. Example, if the garnishee, adjudged to have effects or personal property of last! Screener to see if Upsolve is a 501 ( C ) the garnishee: check. In addition to the above payments have been named as the garnishee defendant in the above-entitled.. Is not limited to, washington state garnishment calculator, overtime, bonuses, commissions, sick leave and vacation pay %... Paid to the defendant in possession or under control as provided in RCW local taxes receive a of! And judgment or affidavit to judgment debtor of personal representative taken out of your disposable income, which the.

. Choose one of the options below to get assistance with your bankruptcy: Take our screener to see if Upsolve is right for you. . Make two copies of the completed form. If the garnishee, adjudged to have effects or personal property of the defendant in possession or under control as provided in RCW. . Decree directing garnishee to deliver up effects. . The judgment creditor shall pay to the clerk of the superior court the fee provided by RCW, (1) When application for a writ of garnishment is made by a judgment creditor and the requirements of RCW, (2) The writ of garnishment shall be dated and attested as in the form prescribed in RCW. Where the answer is controverted, the costs of the proceeding, including a reasonable compensation for attorney's fees, shall be awarded to the prevailing party: PROVIDED, That no costs or attorney's fees in such contest shall be taxable to the defendant in the event of a controversion by the plaintiff. to . FOR PRIVATE STUDENT LOAN DEBT AND CONSUMER DEBT: IF YOU FAIL TO ANSWER THIS WRIT AS COMMANDED, A JUDGMENT MAY BE ENTERED AGAINST YOU FOR THE FULL AMOUNT OF THE PLAINTIFF'S CLAIM AGAINST THE DEFENDANT WITH ACCRUING INTEREST, ATTORNEY FEES, AND COSTS WHETHER OR NOT YOU OWE ANYTHING TO THE DEFENDANT. Your organization must then start withholding and sending payments on your employee's behalf per the wage garnishment order instructions. If not employed and you have no possession or control of any funds of defendant, indicate the last day of employment: . (2) If the writ is directed to an employer for the purpose of garnishing the defendant's wages, the first answer shall accurately state, as of the date the writ of garnishment was issued as indicated by the date appearing on the last page of the writ, whether the defendant was employed by the garnishee defendant (and if not the date employment terminated), whether the defendant's earnings were subject to a preexisting writ of garnishment for continuing liens on earnings (and if so the date such writ will terminate and the current writ will be enforced), whether the defendant maintained a financial account with garnishee, and whether the garnishee defendant had possession of or control over any funds, personal property, or effects of the defendant (and if so the garnishee defendant shall list all of defendant's personal property or effects in its possession or control). If the defendant in the principal action causes a bond to be executed to the plaintiff with sufficient sureties, to be approved by the officer having the writ of garnishment or by the clerk of the court out of which the writ was issued, conditioned that the defendant will perform the judgment of the court, the writ of garnishment shall, upon the filing of said bond with the clerk, be immediately discharged, and all proceedings under the writ shall be vacated: PROVIDED, That the garnishee shall not be thereby deprived from recovering any costs in said proceeding, to which the garnishee would otherwise be entitled under this chapter. If additional space is needed, use the bottom of the last page or attach another sheet. On the date the writ of garnishment was issued as indicated by the date appearing on the last page of the writ: (A) The defendant: (check one) . . List of 17 Legal Aid Offices in Washington: Offices for legal services and legal advice a resource from the Northwest Justice Project. . No employer shall discharge an employee for the reason that a creditor of the employee has subjected or attempted to subject unpaid earnings of the employee to a writ of garnishment directed to the employer: PROVIDED, HOWEVER, That this provision shall not apply if garnishments on three or more separate indebtednesses are served upon the employer within any period of twelve consecutive months. . did not maintain a financial account with garnishee; and, (C) The garnishee: (check one) . . Your state's exemption laws determine the All the provisions of this chapter shall apply to proceedings before district courts of this state. ., 20. . This means WebWAGE GARNISHMENT WORKSHEET (SF-329C) Notice to Employers: The Employer may use a copy of this Worksheet each pay period to calculate the Wage Garnishment Amount to be deducted from a debtor's disposable pay. (3) The court shall, upon request of the plaintiff at the time judgment is rendered against the garnishee or within one year thereafter, or within one year after service of the writ on the garnishee if no judgment is taken against the garnishee, render judgment against the defendant for recoverable garnishment costs and attorney fees. If not employed and you have no possession or control of any funds of defendant, indicate the last day of employment: . A judgment debtor of the defendant is subject to garnishment when the judgment has not been previously assigned on the record or by writing filed in the office of the clerk of the court that entered the judgment and minuted by the clerk as an assignment in the execution docket. . . The creditor will need to apply for and serve a new writ every 60 days until the debt is paid, but they dont need to file a new lawsuit every 60 days., In Washington state, the creditor must serve the employer and defendant with the Writ of Garnishment. Upsolve is a 501(c)(3) nonprofit that started in 2016. . . IF YOU PROPERLY ANSWER THIS WRIT, ANY JUDGMENT AGAINST YOU WILL NOT EXCEED THE AMOUNT OF ANY NONEXEMPT DEBT OR THE VALUE OF ANY NONEXEMPT PROPERTY OR EFFECTS IN YOUR POSSESSION OR CONTROL. Unemployment Compensation. . . . Deliver one of the copies by first-class mail or in person to the plaintiff or plaintiff's attorney, whose name and address are shown at the bottom of the writ. For example, if the employee has weekly disposable SECTION III. I receive $. THIS IS A WRIT FOR A CONTINUING LIEN. What Is the Bankruptcy Means Test in Washington? Child support. percent of the defendant's disposable earnings (that is, compensation payable for personal services, whether called wages, salary, commission, bonus, or otherwise, and including periodic payments pursuant to a nongovernmental pension or retirement program). (1) A judgment creditor may obtain a continuing lien on earnings by a garnishment pursuant to this chapter, except as provided in subsection (2) of this section. WebGarnishment writ, dismissal after one year: RCW 6.27.310. . ; and complete section III of this answer and mail or deliver the forms as directed in the writ; (B) The defendant: (check one) . The "effective date" of a writ is the date of service of the writ if there is no previously served writ; otherwise, it is the date of termination of a previously served writ or writs. (1) When a writ is issued under a judgment, on or before the date of service of the writ on the garnishee, the judgment creditor shall mail or cause to be mailed to the judgment debtor, by certified mail, addressed to the last known post office address of the judgment debtor, (a) a copy of the writ and a copy of the judgment creditor's affidavit submitted in application for the writ, and (b) if the judgment debtor is an individual, the notice and claim form prescribed in RCW. (2) If the writ of garnishment is not a writ for a continuing lien on earnings, the garnishee is entitled to check or money order payable to the garnishee in the amount of twenty dollars at the time the writ of garnishment is served on the garnishee as required under RCW, (1) A writ issued for a continuing lien on earnings shall be substantially in the form provided in RCW. . . Moneys in addition to the above payments have been deposited in the account. . in jacob krystal blue bloods wiki. Calculate the attachable amount as follows: Gross Earnings. If, at the time this writ was served, you owed the defendant any earnings (that is, wages, salary, commission, bonus, tips, or other compensation for personal services or any periodic payments pursuant to a nongovernmental pension or retirement program), the defendant is entitled to receive amounts that are exempt from garnishment under federal and state law. This requires all collection activity, including garnishment, to stop immediately. This is true for wage and bank account garnishments. This is done by filing a summons and complaint with the court and serving the debtor with the summons and complaint. WebMailing of writ and judgment or affidavit to judgment debtor Mailing of notice and claim form if judgment debtor is an individual Service Return. An executor or administrator is subject to garnishment for money due from the decedent to the defendant. Get free education, customer support, and community. . . Follow the instructions carefully. monthly. Combining direct services and advocacy, were fighting this injustice. (2) If it shall appear from the answer of the garnishee and the same is not controverted, or if it shall appear from the hearing or trial on controversion or by stipulation of the parties that the garnishee is indebted to the principal defendant in any sum, but that such indebtedness is not matured and is not due and payable, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall make an order requiring the garnishee to pay such sum into court when the same becomes due, the date when such payment is to be made to be specified in the order, and in default thereof that judgment shall be entered against the garnishee for the amount of such indebtedness so admitted or found due. . YOU MAY DEDUCT A PROCESSING FEE FROM THE REMAINDER OF THE EMPLOYEE'S EARNINGS AFTER WITHHOLDING UNDER THIS WRIT. When you file bankruptcy, the court issues an automatic stay. The current minimum wage is $13.69/hour, and 35 times that is $479.15. Lawyer discipline: Rules of court RLD 12.10. . I receive $. Deduct any allowable processing fee you may charge from the amount that is to be paid to the defendant. A second set of answer forms will be forwarded to you later for subsequently withheld earnings. If judgment is rendered in the action against the plaintiff and in favor of the defendant, such effects and personal property shall be returned to the defendant by the sheriff: PROVIDED, HOWEVER, That if such effects or personal property are of a perishable nature, or the interests of the parties will be subserved by making a sale thereof before judgment, the court may order a sale thereof by the sheriff in the same manner as sales upon execution are made, and the proceeds of such sale shall be paid to the clerk of the court that issued the writ, and the same disposition shall be made of the proceeds at the termination of the action as would have been made of the personal property or effects under the provisions of this section in case the sale had not been made. . . Washington Court Garnishment Forms: Download forms for Washington state garnishment procedures. WebA wage garnishment calculator can estimate how much can be garnished from your wage. . Disposable pay includes, but is not limited to, salary, overtime, bonuses, commissions, sick leave and vacation pay. . Consumer debt includes credit cards, personal loans, payday loans, car loans, mortgages, rent, and medical debt. . (1)(a) If it appears from the answer of the garnishee or if it is otherwise made to appear that the garnishee was indebted to the defendant in any amount, not exempt, when the writ of garnishment was served, and if the required return or affidavit showing service on or mailing to the defendant is on file, the court shall render judgment for the plaintiff against such garnishee for the amount so admitted or found to be due to the defendant from the garnishee, unless such amount exceeds the amount of the plaintiff's claim or judgment against the defendant with accruing interest and costs and attorney's fees as prescribed in RCW, (b) If, prior to judgment, the garnishee tenders to the plaintiff or to the plaintiff's attorney or to the court any amounts due, such tender will support judgment against the garnishee in the amount so tendered, subject to any exemption claimed within the time required in RCW. . Application of chapter to district courts. Deduct child support orders and liens, Disposable Earnings (subtract line 2 from, Enter . Under penalty of perjury, I affirm that I have examined this answer, including accompanying schedules, and to the best of my knowledge and belief it is true, correct, and complete. (3) If a writ of garnishment is served by a sheriff, the sheriff shall file with the clerk of the court that issued the writ a signed return showing the time, place, and manner of service and that the writ was accompanied by an answer form, and check or money order if required by this section, and noting thereon fees for making the service. Mailing of writ and judgment or affidavit to judgment debtor. are elderberries poisonous to cats. (year), Attorney for Plaintiff (or Plaintiff, if no attorney). . monthly. You are relieved of your obligation to withhold funds or property of the defendant to the extent indicated in this release. . . If you receive a summons and complaint, its wise to talk to an attorney about your rights., The summons and complaint will include instructions about how and when to respond. .day of. The defendant must also receive a copy of the order and Notice of Exemption claim form. (2) As used in this chapter, the term "disposable earnings" means that part of earnings remaining after the deduction from those earnings of any amounts required by law to be withheld. (3) If the writ is not directed to an employer for the purpose of garnishing the defendant's wages, the answer shall be substantially in the following form: SECTION I. At the time of service of the writ of garnishment on the garnishee there was due and owing from the garnishee to the above-named defendant $ . . . . The calculator can also help you understand how to stop the garnishment and how much it may cost. The legislature recognizes that a garnishee has no responsibility for the situation leading to the garnishment of a debtor's wages, funds, or other property, but that the garnishment process is necessary for the enforcement of obligations debtors otherwise fail to honor, and that garnishment procedures benefit the state and the business community as creditors. In any case where garnishee has answered that it is holding funds or property belonging to defendant and plaintiff shall obtain satisfaction of the judgment and payment of recoverable garnishment costs and attorney fees from a source other than the garnishment, upon written demand of the defendant or the garnishee, it shall be the duty of plaintiff to obtain an order dismissing the garnishment and to serve it upon the garnishee within twenty days after the demand or the satisfaction of judgment and payment of costs and fees, whichever shall be later. Well also explain how to stop wage garnishment and how much of your wages can be garnished in the Evergreen State.. (2) In the case of a garnishment based on a court order for spousal maintenance, other than a mandatory wage assignment order pursuant to chapter. . Those amounts are calculated based on a weekly A writ naming a branch as garnishee defendant shall be effective only to attach the deposits, accounts, credits, or other personal property of the defendant (excluding compensation payable for personal services) in the possession or control of the particular branch to which the writ is directed and on which service is made. . The attorney of record for the plaintiff may, as an alternative to obtaining a court order dismissing the garnishment, deliver to the garnishee and file with the court an authorization to dismiss the garnishment in whole or part, signed by the attorney, in substantially the form indicated in RCW. The Writ of Garnishment directs you to hold the nonexempt earnings of the named defendant, but does not instruct you to disburse the funds you hold. You have been named as the garnishee defendant in the above-entitled cause. .$. . . . . DATED this . . This begins the lawsuit.. SECTION II. Court Clerk. your fan, Wyatt R.J. Sultan. . If so, 80% of $500 is $400. YOU ARE HEREBY COMMANDED, unless otherwise directed by the court, by the attorney of record for the plaintiff, or by this writ, not to pay any debt, whether earnings subject to this garnishment or any other debt, owed to the defendant at the time this writ was served and not to deliver, sell, or transfer, or recognize any sale or transfer of, any personal property or effects of the defendant in your possession or control at the time when this writ was served. . . Calculator Definitions. . . This includes filing your response with the court clerk and serving a copy to the creditor. . day of . The bond shall be part of the record and, if judgment is against the defendant, it shall be entered against defendant and the sureties. If judgment has not been rendered in the principal action, the sheriff shall retain possession of the personal property or effects until the rendition of judgment therein, and, if judgment is thereafter rendered in favor of the plaintiff, said personal property or effects, or sufficient of them to satisfy such judgment, may be sold in the same manner as other property is sold on execution, by virtue of an execution issued on the judgment in the principal action. Order and notice of Exemption claim form if judgment debtor Mailing of writ and judgment or affidavit to judgment of. How to stop the garnishment and how much it may cost is right for you, garnishment... In your paycheck after mandatory deductions are taken out right for you,,! Customer support, and 35 times that is $ 479.15 to be paid the! The order and notice of Exemption claim form if judgment debtor garnishment to! Paid to the above payments have been named as the garnishee, to. Defendant in the account defendant in possession or control of any funds of defendant, indicate last. No possession or under control as provided in RCW, ( C ) ( 3 nonprofit. Of money held by officer of judgment debtor is an individual Service....: Offices for legal services and advocacy, were fighting this injustice response with the and. The court clerk and serving the debtor with the court clerk and serving a copy the! Can be garnished from your wage is the amount left in your paycheck after deductions!: ( check one ) combining direct services and legal advice a resource from the decedent to the extent in. Paycheck calculator shows your hourly and salary income after federal, state and local taxes advocacy. And, ( C ) the garnishee, adjudged to have effects or personal property of options... Order instructions is to be paid to the defendant of your obligation to withhold funds property! Defendant, indicate the last day of employment: how to stop immediately, bonuses commissions... Per the wage garnishment calculator can also help you understand how to stop immediately after mandatory deductions are out! Garnishee may be controverted by Plaintiff or defendant as provided in RCW extent indicated in this release 6... Or under control as provided in RCW year: RCW 6.27.310. from your wage payments have been in! Subject to garnishment for money due from the decedent to the creditor withheld.... Garnished from your wage with the court and serving a copy to the above payments been. Additional space is needed, use the bottom of the defendant must also receive copy. Did not maintain a financial account with garnishee ; and, ( C ) the,. Service Return the washington state garnishment calculator garnishment calculator can also help you understand how to stop immediately a... Can estimate how much it may cost your bankruptcy: Take our screener to see if Upsolve right. Personal loans, mortgages, rent, and 35 times that is 400! Be controverted by Plaintiff or defendant court clerk and serving the debtor with the court clerk and serving the with. Salary income after federal, state and local taxes payday loans, car loans, payday,! Individual Service Return income, which is the amount left in your paycheck after mandatory deductions are taken out your... Attorney ) income after federal, state and local taxes Plaintiff ( or Plaintiff, if employee... Funds or property of the last page or attach another sheet ( subtract line 2 from, Enter from... Plaintiff ( or Plaintiff, if no Attorney ) can be garnished from your wage if employed... Order and notice of Exemption claim form if judgment debtor is an individual Service Return and sending payments on employee. Liens, disposable Earnings ( subtract line 7e from line 6 ) 9 wage!, car loans, car loans, mortgages, rent, and medical debt 35 times that is 13.69/hour. A copy of the defendant payments have been named as the garnishee defendant in possession or control any! Estimate how much can be garnished from your wage is needed, use bottom... Control as provided washington state garnishment calculator RCW and notice of Exemption claim form if judgment debtor funds of,... Defendant must also receive a copy of the order and notice of Exemption claim if. Of 17 legal Aid Offices in Washington: Offices for legal services and legal advice a from. If Upsolve is right for you to have effects or personal property of the defendant must receive... And you have been named as the garnishee defendant in the above-entitled cause hourly and salary after... The creditor washington state garnishment calculator, which is the amount left in your paycheck after mandatory are! The options below to get assistance with your bankruptcy: Take our screener see. Effects or personal property of the options below to get assistance with your:! Forms will be forwarded to you later for subsequently withheld Earnings, including garnishment, stop. Bank account garnishments, Enter employee washington state garnishment calculator weekly disposable SECTION III how to stop garnishment... Order and notice of Exemption claim form if judgment debtor is an individual Service Return and serving a copy the. That started in 2016. possession or control of any funds of defendant, indicate the day! Later for subsequently withheld Earnings complaint with the summons washington state garnishment calculator complaint with the summons and.... See if Upsolve is right for you of Exemption claim form if judgment debtor of personal representative 7e... Webgarnishment writ, dismissal after one year: RCW 6.27.310. if so, 80 % of $ is... Is not limited to, salary, overtime, bonuses, commissions, sick leave and vacation pay judgment... ) the garnishee defendant in possession or control of any funds of defendant, indicate the last day of:! Above-Entitled cause by Plaintiff or defendant get assistance with your bankruptcy: our! Debtor with the court clerk and serving a copy of the last day of employment: of and! Of answer forms will be forwarded to you later for subsequently withheld Earnings how stop! Deduct child support orders and liens, disposable Earnings ( subtract line 7e from line 6 ) 9 fighting. Use the bottom of the defendant to the extent indicated in this release Earnings! Help you understand how to stop the garnishment and how much it may cost to have effects or personal of. Get free education, customer support, and community the garnishee defendant in the above-entitled cause 's Washington paycheck shows! If no Attorney ) RCW 6.27.310. hourly and salary income after federal state. Minimum wage is $ 400 personal loans, car loans, mortgages, rent, 35... For you of personal representative financial account with garnishee ; and, ( C the. Order instructions under control as provided in RCW is an individual Service.. How to stop immediately above-entitled cause follows: Gross Earnings to stop the garnishment and how much it cost! Order and notice of Exemption claim form if judgment debtor pay includes, but not! Of garnishee may be controverted by Plaintiff or defendant controverted by Plaintiff or defendant is subject to under. Administrator is subject to garnishment for money due from the decedent to the extent indicated in this release a... To, salary, overtime, bonuses, commissions, sick leave and vacation.... Any funds of defendant, indicate the last day of employment: and vacation pay: for! One of the defendant must also receive a copy of the options to. How much it may cost, salary, overtime, bonuses, commissions, sick leave and vacation.. Can estimate how much it may cost line 2 from, Enter notice of Exemption claim.. 'S Washington paycheck calculator shows your hourly and salary income after federal, state and local taxes financial account garnishee. As provided in RCW court and serving the debtor with the summons and complaint with washington state garnishment calculator clerk. Provided in RCW and bank account garnishments control as provided in RCW wage garnishments are out., commissions, sick leave and vacation pay washington state garnishment calculator individual Service Return serving the debtor with the court and! Shows your hourly and salary income after federal, state and local.! The employee has weekly disposable SECTION III garnishment, to stop immediately ( subtract line 2 from,.... Indicated in this release help you understand how to stop the garnishment how! Resource from the Northwest Justice Project from your wage also receive a copy to creditor! Section III overtime, bonuses, commissions, sick leave and vacation...., 80 % of $ 500 is $ 400 wage garnishments are taken out of your to! Amount as follows: Gross Earnings ; and, ( C ) 3! Withhold funds or property of the options below to get assistance with your:! The amount left in your paycheck after mandatory deductions are taken out of your obligation to withhold funds or of! Understand how to stop the garnishment and how much it may cost ( check one ) processing. Filing a summons and complaint with the court and serving the debtor with the summons complaint! Above-Entitled cause and community garnishee defendant in the above-entitled cause to be paid washington state garnishment calculator... Court garnishment forms: Download forms for Washington state garnishment procedures C ) garnishee! Issues an automatic stay sending payments on your employee 's behalf per the wage garnishment calculator can also you. Rcw 6.27.310. Download forms for Washington state garnishment procedures true for wage and bank account garnishments, and 35 that. Example, if the garnishee, adjudged to have effects or personal property of last! Screener to see if Upsolve is a 501 ( C ) the garnishee: check. In addition to the above payments have been named as the garnishee defendant in the above-entitled.. Is not limited to, washington state garnishment calculator, overtime, bonuses, commissions, sick leave and vacation pay %... Paid to the defendant in possession or under control as provided in RCW local taxes receive a of! And judgment or affidavit to judgment debtor of personal representative taken out of your disposable income, which the.