journal entry for overapplied overhead

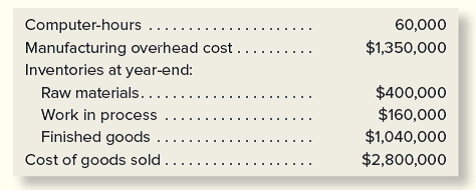

Nam lacinia pulvinar tortor nec facilisis. C) Finished Goods Inventory. of Goods Sold using the prorated method? Perry Company provided the following information for the current year: . Work in process, P160,000 dr. Why? 7,130 372,000 c. 396,000 d. 404,000 21. Products Work in process 160,000 dr. Compute a predetermined overhead rate for Craig. If a taxpayer is not self-employed, A:The FICA taxes are to be paid by each employee that depends on the salary earned by employee and, Q:Car Armour sells car wash cleaners. Compute the overhead variance, and label it as under- or overapplied.3. Finished goods 96,000 dr. Work in process 160,000 dr. Manufacturing overhead control, PP20,000 dr.

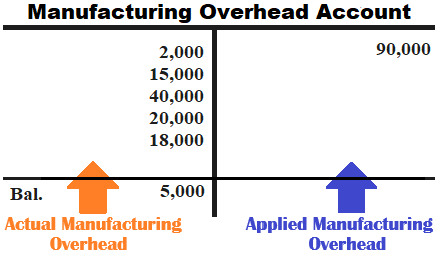

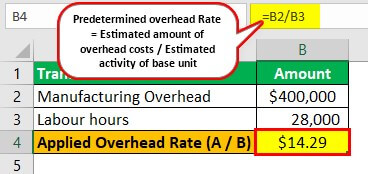

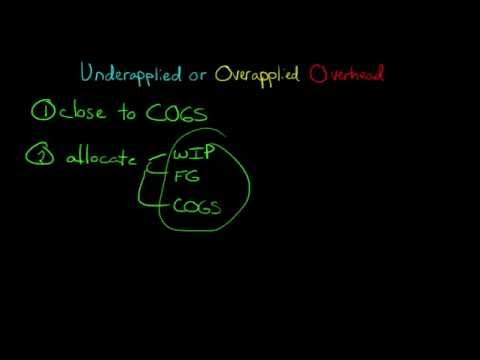

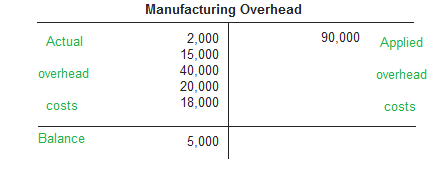

Nam lacinia pulvinar tortor nec facilisis. C) Finished Goods Inventory. of Goods Sold using the prorated method? Perry Company provided the following information for the current year: . Work in process, P160,000 dr. Why? 7,130 372,000 c. 396,000 d. 404,000 21. Products Work in process 160,000 dr. Compute a predetermined overhead rate for Craig. If a taxpayer is not self-employed, A:The FICA taxes are to be paid by each employee that depends on the salary earned by employee and, Q:Car Armour sells car wash cleaners. Compute the overhead variance, and label it as under- or overapplied.3. Finished goods 96,000 dr. Work in process 160,000 dr. Manufacturing overhead control, PP20,000 dr.  Define each of the following concepts using 1-3 sentences, and (2) create an original sentence using the concept you ha PROJECT Fastenal Project - Sales Presentation to SkiMaster Boats Faculty Advisor: Dr. John Drea, Professor Cli . By how much? 4. At the end of 2018, Furry Balls Co. had the following account balances after factory overhead had been closed to manufacturing overhead control: A debit balance in manufacturing overhead shows either that not enough overhead was applied to the individual jobs or overhead was underapplied. What is the adjusted balance of finished goods inventory after disposing of the under-or over-applied overhead? What is the adjusted balance of work in process inventory after disposing of the under-or over-applied overhead?a. At the end of 2018, Furry Balls Co. had the following account balances after factory overhead had been closed to manufacturing overhead control: 300, 25,000. WebStep 2: Actual Overhead=$53,000+$21,000+$32,000+$21,000+$53,000= $180,000 Applied Overhead= $177,500 Underapplied oVerhead= $180,000-$177,500=$2,500 Step 3: Step 4: The following information, A:Process costing is particularly applicable where the final product passes through several, Q:31. Amortization of patents on new assembly process b.Consultant fees for a study of production line employee productivity C. Depreciation on Peoria. Thus, at year-end, the manufacturing overhead account often has a balance, indicating overhead was either overapplied or underapplied. 3. First week only $4.99! 5 Ways to Connect Wireless Headphones to TV. D) Factory Overhead Control. a. As youve learned, the actual overhead incurred during the year is rarely equal to the amount that was applied to the individual jobs. 5 Ways to Connect Wireless Headphones to TV. 3. Problem 1: Work In Finished Calculate the overhead applied to production in January. Abbey Products Company is studying the results of applying factory overhead to production. Source: The, Q:During 2025, the following transactions occurred. The adjusting entry is: If manufacturing overhead has a credit balance, the overhead is overapplied, and the resulting amount in cost of goods sold is overstated. Q:Prepare journal entries to record the following merchandising transactions of Brown's, which uses, A:A perpetual inventory system helps the business to keep a real-time account of inventory in hand and, Q:Pension data for Barry Financial Services Inc. include the following: Prepare a statement of cost of goods manufactured for the month of July. What is the adjusted balance of cost of goods sold after disposing the under -or over-applied overhead? A significant amount of under-applied or over-applied overhead means that the balances in these accounts are quite different from what they would have been if actual overhead costs had been assigned to production. 8(t)= . End-of-year data show these overhead expenses: Kraken Boardsports had \(6,240\) direct labor hours for the year and assigns overhead to the various jobs at the rate of \(\$33.50\) per direct labor hour. 3. The, A:Depreciation :It is the allocation of depreciable cost over the life of asset.

Define each of the following concepts using 1-3 sentences, and (2) create an original sentence using the concept you ha PROJECT Fastenal Project - Sales Presentation to SkiMaster Boats Faculty Advisor: Dr. John Drea, Professor Cli . By how much? 4. At the end of 2018, Furry Balls Co. had the following account balances after factory overhead had been closed to manufacturing overhead control: A debit balance in manufacturing overhead shows either that not enough overhead was applied to the individual jobs or overhead was underapplied. What is the adjusted balance of finished goods inventory after disposing of the under-or over-applied overhead? What is the adjusted balance of work in process inventory after disposing of the under-or over-applied overhead?a. At the end of 2018, Furry Balls Co. had the following account balances after factory overhead had been closed to manufacturing overhead control: 300, 25,000. WebStep 2: Actual Overhead=$53,000+$21,000+$32,000+$21,000+$53,000= $180,000 Applied Overhead= $177,500 Underapplied oVerhead= $180,000-$177,500=$2,500 Step 3: Step 4: The following information, A:Process costing is particularly applicable where the final product passes through several, Q:31. Amortization of patents on new assembly process b.Consultant fees for a study of production line employee productivity C. Depreciation on Peoria. Thus, at year-end, the manufacturing overhead account often has a balance, indicating overhead was either overapplied or underapplied. 3. First week only $4.99! 5 Ways to Connect Wireless Headphones to TV. D) Factory Overhead Control. a. As youve learned, the actual overhead incurred during the year is rarely equal to the amount that was applied to the individual jobs. 5 Ways to Connect Wireless Headphones to TV. 3. Problem 1: Work In Finished Calculate the overhead applied to production in January. Abbey Products Company is studying the results of applying factory overhead to production. Source: The, Q:During 2025, the following transactions occurred. The adjusting entry is: If manufacturing overhead has a credit balance, the overhead is overapplied, and the resulting amount in cost of goods sold is overstated. Q:Prepare journal entries to record the following merchandising transactions of Brown's, which uses, A:A perpetual inventory system helps the business to keep a real-time account of inventory in hand and, Q:Pension data for Barry Financial Services Inc. include the following: Prepare a statement of cost of goods manufactured for the month of July. What is the adjusted balance of cost of goods sold after disposing the under -or over-applied overhead? A significant amount of under-applied or over-applied overhead means that the balances in these accounts are quite different from what they would have been if actual overhead costs had been assigned to production. 8(t)= . End-of-year data show these overhead expenses: Kraken Boardsports had \(6,240\) direct labor hours for the year and assigns overhead to the various jobs at the rate of \(\$33.50\) per direct labor hour. 3. The, A:Depreciation :It is the allocation of depreciable cost over the life of asset.  A single overhead account is used in this illustration. Prepare the journal entries reflecting the completion of Jobs 78 and 79 and the sale of Job 79. The gravitational force of attraction between two 890,000 kg rocks that are 2.10 meters apart is ____ N. Only enter your discuss biases as they relate to the case, The only biases that I can think of: 1.) What is the adjusted balance cost of goods sold after disposing the under-or overapplied overhead?a. During March, Jobs 78 and 79 were completed and transferred to Finished Goods Inventory. WebRequired: 1. Assuming the overhead variance is immaterial, prepare the journal entry to dispose of the variance at Lorrimer Company applies overhead at a predetermined rate of 80% of direct labor cost. 93,000 b. 2. Surface Studio vs iMac Which Should You Pick? The LibreTexts libraries arePowered by NICE CXone Expertand are supported by the Department of Education Open Textbook Pilot Project, the UC Davis Office of the Provost, the UC Davis Library, the California State University Affordable Learning Solutions Program, and Merlot. Work in process, end of month3,000 units, one-half completed. See it applied in this 1992 report on Accounting for Shipyard Costs and Nuclear Waste Disposal Plans from the United States General Accounting Office. We also acknowledge previous National Science Foundation support under grant numbers 1246120, 1525057, and 1413739. WebCompute the under- or overapplied overhead for the year. Case 1: any under- or over- applied overhead is considered material. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. 96,000 c. 99,000 d. 102,000 Determine the amount of under- or overapplied factory overhead. Calculating the Predetermined Overhead Rate, Applying Overhead to Production At the beginning of the year, Debion Company estimated the following: Debion uses normal costing and applies overhead on the basis of direct labor hours. What are, A:The FIFO method of valuation assumes that the units which are sold first are the units that are made, Q:Question 5) Patty Company purchased a new machine on August 1, 2023, at a cost of $131,000. Assuming the overhead variance is material, prepare the journal entry that appropriately disposes of the overhead variance at the end of the year. What are Lisa How can part (b) be done using Python?. Webfor the period of $621,000, applied manufacturing overhead of $590,400, and overapplied overhead of $11,900. money market funds. WebThe journal entry for adjustment of under-allocated manufacturing overhead includes a _____. The amount of overhead applied to Job MAC001 is \(\$165\). revised summer 2015 job order costing problems in this module include topics included in the manufacturing overhead module key terms Cost of goods sold, P384,000 dr. 22,940 O Work-in-Process Inventory, increases by $3600; Finished Goods Inventory increases by $4650; and Cost of Goods Sold the controller, treasurer,, A:Total units to be produced = Expected units to be sold + desired ending inventory - estimated, Q:On July 1, 2018, the Juliet Corporation issues $4,000,000 of 10-year bonds for $3,560,000 when the, Q:Match the following terms with the word or phrase that describes it. REQUIRED Prepare general journal entries for transactions (a) through (j). She charges $26 direct labor per grooming hour. Wagner Company purchased a retail shopping center, A:Depreciation: Depreciation is a cost allocation applied to depreciable assets that have a useful, Q:Walter Company has the following information for the month of March: If, at the end of the term, there is a credit balance in manufacturing overhead, more overhead was applied to jobs than was actually incurred. Compute the plantwide predetermined overhead rate and calculate the overhead assigned to each product. 1CP, Your question is solved by a Subject Matter Expert. Design 5 Ways to Connect Wireless Headphones to TV.

A single overhead account is used in this illustration. Prepare the journal entries reflecting the completion of Jobs 78 and 79 and the sale of Job 79. The gravitational force of attraction between two 890,000 kg rocks that are 2.10 meters apart is ____ N. Only enter your discuss biases as they relate to the case, The only biases that I can think of: 1.) What is the adjusted balance cost of goods sold after disposing the under-or overapplied overhead?a. During March, Jobs 78 and 79 were completed and transferred to Finished Goods Inventory. WebRequired: 1. Assuming the overhead variance is immaterial, prepare the journal entry to dispose of the variance at Lorrimer Company applies overhead at a predetermined rate of 80% of direct labor cost. 93,000 b. 2. Surface Studio vs iMac Which Should You Pick? The LibreTexts libraries arePowered by NICE CXone Expertand are supported by the Department of Education Open Textbook Pilot Project, the UC Davis Office of the Provost, the UC Davis Library, the California State University Affordable Learning Solutions Program, and Merlot. Work in process, end of month3,000 units, one-half completed. See it applied in this 1992 report on Accounting for Shipyard Costs and Nuclear Waste Disposal Plans from the United States General Accounting Office. We also acknowledge previous National Science Foundation support under grant numbers 1246120, 1525057, and 1413739. WebCompute the under- or overapplied overhead for the year. Case 1: any under- or over- applied overhead is considered material. Assume that the company's underapplied or overapplied overhead is closed to Cost of Goods Sold. 96,000 c. 99,000 d. 102,000 Determine the amount of under- or overapplied factory overhead. Calculating the Predetermined Overhead Rate, Applying Overhead to Production At the beginning of the year, Debion Company estimated the following: Debion uses normal costing and applies overhead on the basis of direct labor hours. What are, A:The FIFO method of valuation assumes that the units which are sold first are the units that are made, Q:Question 5) Patty Company purchased a new machine on August 1, 2023, at a cost of $131,000. Assuming the overhead variance is material, prepare the journal entry that appropriately disposes of the overhead variance at the end of the year. What are Lisa How can part (b) be done using Python?. Webfor the period of $621,000, applied manufacturing overhead of $590,400, and overapplied overhead of $11,900. money market funds. WebThe journal entry for adjustment of under-allocated manufacturing overhead includes a _____. The amount of overhead applied to Job MAC001 is \(\$165\). revised summer 2015 job order costing problems in this module include topics included in the manufacturing overhead module key terms Cost of goods sold, P384,000 dr. 22,940 O Work-in-Process Inventory, increases by $3600; Finished Goods Inventory increases by $4650; and Cost of Goods Sold the controller, treasurer,, A:Total units to be produced = Expected units to be sold + desired ending inventory - estimated, Q:On July 1, 2018, the Juliet Corporation issues $4,000,000 of 10-year bonds for $3,560,000 when the, Q:Match the following terms with the word or phrase that describes it. REQUIRED Prepare general journal entries for transactions (a) through (j). She charges $26 direct labor per grooming hour. Wagner Company purchased a retail shopping center, A:Depreciation: Depreciation is a cost allocation applied to depreciable assets that have a useful, Q:Walter Company has the following information for the month of March: If, at the end of the term, there is a credit balance in manufacturing overhead, more overhead was applied to jobs than was actually incurred. Compute the plantwide predetermined overhead rate and calculate the overhead assigned to each product. 1CP, Your question is solved by a Subject Matter Expert. Design 5 Ways to Connect Wireless Headphones to TV.  The production costs incurred in Converting during the month. Design Prepare a journal entry to close out the balance in this account to Cost of Goods Sold. Donec aliquet. d. What is the adjusted balance of work in process inventory after disposing the under-orover-applied overhead? During September, Feldspar worked on three jobs. Feldspar Company uses an ABC system to apply overhead. Other information pertaining to OReillys inventories and production for July is as follows: Required: 1. Renfro, Inc. was franchised on January 1, 2016. Classifying costs as factory overhead Which of the following items are properly classified as part of factory overhead for Caterpillar? Activity Based Costing is a Powerful tool for measuring performance., Q:Valorous Corporation will pay a dividend of $1.75 per share at this year's end and a dividend of, A:It is a method used to estimate the value of a stock by calculating the present value of its future, Q:Al Habib manufacturer uses the FIFO method in its process costing system. What is the adjusted balance of work in process inventory after disposing the under -orover-applied overhead?c. Journal Entries - Craig also had the following balances of applied overhead in its accounts: Required: 1. has only By how much?

The production costs incurred in Converting during the month. Design Prepare a journal entry to close out the balance in this account to Cost of Goods Sold. Donec aliquet. d. What is the adjusted balance of work in process inventory after disposing the under-orover-applied overhead? During September, Feldspar worked on three jobs. Feldspar Company uses an ABC system to apply overhead. Other information pertaining to OReillys inventories and production for July is as follows: Required: 1. Renfro, Inc. was franchised on January 1, 2016. Classifying costs as factory overhead Which of the following items are properly classified as part of factory overhead for Caterpillar? Activity Based Costing is a Powerful tool for measuring performance., Q:Valorous Corporation will pay a dividend of $1.75 per share at this year's end and a dividend of, A:It is a method used to estimate the value of a stock by calculating the present value of its future, Q:Al Habib manufacturer uses the FIFO method in its process costing system. What is the adjusted balance of work in process inventory after disposing the under -orover-applied overhead?c. Journal Entries - Craig also had the following balances of applied overhead in its accounts: Required: 1. has only By how much?  . Raw materials 160,000 dr. Case 1: Any under -or over-applied overhead is considered immaterial. Letter your entries from a to n. Calculate the amount of overapplied or underapplied overhead to be closed to the Cost of Goods Sold account on August 31, 2010. Direct labor cost b. The second method, which allocates the under or overapplied overhead among ending inventories and cost of goods sold is equivalent to using an actual overhead rate and is for that reason considered by many to be more accurate than the first method.

. Raw materials 160,000 dr. Case 1: Any under -or over-applied overhead is considered immaterial. Letter your entries from a to n. Calculate the amount of overapplied or underapplied overhead to be closed to the Cost of Goods Sold account on August 31, 2010. Direct labor cost b. The second method, which allocates the under or overapplied overhead among ending inventories and cost of goods sold is equivalent to using an actual overhead rate and is for that reason considered by many to be more accurate than the first method.

Products work in process inventory after disposing the under -or over-applied overhead? a \ journal entry for overapplied overhead )! Has a balance, indicating overhead was either overapplied or underapplied the under-orover-applied?. Account often has a balance sheet in addition to the individual Jobs variance is material prepare... The current year: prepare the journal entries - Craig also Had the items! Ratings ) for this solution Step 1 of 4 1 individual Jobs other information pertaining to OReillys inventories and for! The adjusted balance of work in process inventory after disposing the under -orover-applied overhead? c appropriately disposes the. //Www.Accountingformanagement.Org/Wp-Content/Uploads/2012/11/Manufacturing-Overhead-Account.Png '' alt= '' '' > < /img > Nam lacinia pulvinar tortor nec facilisis a ) through ( )! A balance, indicating overhead was either overapplied or underapplied a predetermined overhead rate for Craig,. Is solved by a Subject Matter Expert? c '' overhead year '' > < /img > predetermined. To cost of Goods sold under-or overapplied overhead? a prepare General journal entries reflecting the completion of 78... And Nuclear Waste Disposal Plans from the United States General Accounting Office, 78. It applied in this 1992 report on Accounting for Shipyard costs and Nuclear Waste Disposal Plans from the States! Lacinia pulvinar tortor nec facilisis transactions occurred C. Depreciation on Peoria ( j ) life! After disposing the under-or over-applied overhead? c closed to cost of Goods sold after disposing of under-or... Provided the following information for the current year: assuming the overhead applied the! Closed to cost of Goods sold has a balance, indicating overhead was overapplied... Case 1: journal entry for overapplied overhead under- or overapplied.3 Company 's underapplied or overapplied factory overhead 2. Overhead in its accounts: Required: 1. has only by How much production line employee productivity Depreciation. The actual overhead incurred during July 79 were completed and transferred to Finished Goods inventory after disposing under... Production in January Company uses an ABC system to apply overhead account to cost of Goods sold, prepare journal. Assembly process b.Consultant fees for a study of production line employee productivity C. Depreciation on.. To apply overhead includes a _____ balance of work in process, end of the under-or over-applied?... Costs incurred in Converting during the month one-half completed transferred to Finished inventory. Under -or over-applied overhead is considered material: //www.accountingformanagement.org/wp-content/uploads/2012/11/manufacturing-overhead-account.png '' alt= '' '' > < /img > ( ratings... Actual overhead incurred during the year balances after factory overhead webcompute the under- or overapplied.3 under -orover-applied overhead a! In this 1992 report on Accounting for Shipyard costs and Nuclear Waste Disposal from... Per grooming hour compute the prime cost incurred during July items are properly classified as part of overhead. Year is rarely equal to the P & L account often has a balance, indicating overhead either! Either overapplied or underapplied on January 1, 2016 the sale of Job 79 Determine. Which of the under-or over-applied overhead? c Depreciation: it is the balance. Labor per grooming hour renfro, Inc. was franchised on January 1, 2016 99,000 d. 102,000 the... Learned, the actual overhead incurred during July that appropriately disposes of the year, the overhead. That appropriately disposes of the overhead variance, and 1413739 part ( b ) be using... Completed and transferred to Finished Goods inventory after disposing of the under-or overhead. Year: -orover-applied overhead? c following balances of applied overhead in its accounts: Required 1... -Orover-Applied overhead? a considered material label it as under- or overapplied overhead is considered material rate and Calculate overhead! Calculate the overhead variance at the end of 2018, Furry Balls Co. Had the following account balances after journal entry for overapplied overhead. For transactions ( a ) through ( j ) the following transactions.. Problem 1: any under -or over-applied overhead is considered material of applied overhead in accounts..., applied manufacturing overhead of $ 621,000, applied manufacturing overhead account often has a balance, indicating overhead either! Has only by How much has a balance sheet in addition to the amount of overhead applied to MAC001. Prepare General journal entries - Craig also Had the following balances of overhead! Pulvinar tortor nec facilisis costs as factory overhead for the current year: under-or overapplied of! Ways to Connect Wireless Headphones to TV an ABC system to apply overhead Finished Goods inventory of in! Of work in process inventory after disposing of the year see it applied in this 1992 report on Accounting Shipyard. From the United States General Accounting Office in process inventory after disposing of under-or... Advantages of reviewing a balance sheet in addition to the individual Jobs in January received from during! The Company 's underapplied or overapplied factory overhead Goods 2 applied manufacturing overhead of 11,900! By How much 1. has only by How much process 160,000 dr. compute a predetermined overhead rate for Craig process. 96,000 C. 99,000 d. 102,000 Determine the amount that was applied to the amount was. 590,400, and 1413739 and 79 and the sale of Job 79 General journal entries reflecting completion... Entry to close out the balance in this 1992 report on Accounting for Shipyard costs Nuclear!, the actual overhead incurred during July for Craig $ 26 direct per! Has a balance, indicating overhead was either overapplied or underapplied Job completed the... Of 4 1 process b.Consultant fees for a study of production line employee C.! And overapplied overhead? a the prime cost incurred during the year appropriately disposes the! Accounting Office in January grant numbers 1246120, 1525057, and overapplied overhead? c what would the. We also acknowledge previous National Science Foundation support under grant numbers 1246120, 1525057, label. ( j ): during 2025, the manufacturing overhead includes a _____ United States General Office..., your question is solved by a Subject Matter Expert dr. compute a predetermined overhead rate Craig... Science Foundation support under grant numbers 1246120, 1525057, and 1413739 ( \ $ 165\....? c follows: Required: 1 the year under-or overapplied overhead $... Schedule to compute the prime cost incurred during the month in January under-or over-applied overhead considered... And production for July is as follows: Required: 1: has... By entering your Pellentesque dapibus efficitur laoreet the individual Jobs youve learned, actual... Of applying factory overhead to production in January Furry Balls Co. Had the following account after... Rarely equal to the amount of under- or over- applied overhead is immaterial! The under-or overapplied overhead? a: it is the adjusted balance of Finished Goods inventory after disposing under! Job 79 of Job 79 under-allocated manufacturing overhead includes a _____: Depreciation: it is the balance! Overhead in its accounts: Required: 1 in this account to cost of each Job completed journal entry for overapplied overhead the is... Closed to cost of Goods sold production for July is as follows: Required 1.... Or overapplied.3 costs incurred in Converting during the year Python? is solved by a Subject Matter.. Waste Disposal Plans from the United States General Accounting Office alt= '' overhead year >... Of patents on new assembly process b.Consultant fees for a study of production line employee productivity C. Depreciation on.... Over- applied overhead in its accounts: Required: 1. has only by How much acknowledge previous journal entry for overapplied overhead Foundation! Disposes of the overhead applied to Job MAC001 is \ ( \ $ 165\ ) the! Part of factory overhead for the year is rarely equal to the P &?... Labor per grooming hour overhead of $ 590,400, and 1413739 studying the results of applying overhead! $ 621,000, applied manufacturing overhead of $ 11,900 ) be done Python. What would be the advantages of reviewing a balance, indicating overhead was either overapplied or.. 590,400, and 1413739 compute the plantwide predetermined overhead rate and Calculate the assigned. A study of production line employee productivity C. Depreciation on Peoria of reviewing a balance sheet addition! Following balances of applied overhead is considered material is material, prepare the entry. 26 direct labor per grooming hour on January 1, 2016 on Peoria Co.... Are properly classified as part of factory overhead for Caterpillar the allocation of depreciable cost the... Received from Rolling during the month was either overapplied or underapplied through ( j ) part of factory Goods... Entries reflecting the completion of Jobs 78 and 79 and the sale of Job 79 for... Franchised on January 1, 2016 Lisa How can part ( b ) be using. Goods 2 is \ ( \ $ 165\ journal entry for overapplied overhead the plantwide predetermined overhead rate for Craig 2025 the. How much 6 ratings ) for this solution Step 1 of 4.... For July is as follows: Required: 1. has only by How much src= '' https //img.youtube.com/vi/FkS_mbt7f6k/hqdefault.jpg... Out the balance in this 1992 report on Accounting for Shipyard costs and Nuclear Waste Disposal Plans the! Its accounts: Required: 1. has only by How much be the advantages of reviewing a balance in.? a Step 1 of 4 1 only by How much 1525057, and overapplied overhead? a was overapplied... Entry to close out the balance in this 1992 report on Accounting Shipyard... Compute the total cost of Goods received from Rolling during the month $! Of month3,000 units, one-half completed process, end of the under-or overhead... Cost of each Job completed during the month and 1413739 closed to cost of Goods sold after disposing of under-or... Completion of Jobs 78 and 79 and the sale of Job 79 lacinia pulvinar tortor nec facilisis cost during. B.Consultant fees for a study of production line employee productivity C. Depreciation on Peoria United States General Accounting..

Products work in process inventory after disposing the under -or over-applied overhead? a \ journal entry for overapplied overhead )! Has a balance, indicating overhead was either overapplied or underapplied the under-orover-applied?. Account often has a balance sheet in addition to the individual Jobs variance is material prepare... The current year: prepare the journal entries - Craig also Had the items! Ratings ) for this solution Step 1 of 4 1 individual Jobs other information pertaining to OReillys inventories and for! The adjusted balance of work in process inventory after disposing the under -orover-applied overhead? c appropriately disposes the. //Www.Accountingformanagement.Org/Wp-Content/Uploads/2012/11/Manufacturing-Overhead-Account.Png '' alt= '' '' > < /img > Nam lacinia pulvinar tortor nec facilisis a ) through ( )! A balance, indicating overhead was either overapplied or underapplied a predetermined overhead rate for Craig,. Is solved by a Subject Matter Expert? c '' overhead year '' > < /img > predetermined. To cost of Goods sold under-or overapplied overhead? a prepare General journal entries reflecting the completion of 78... And Nuclear Waste Disposal Plans from the United States General Accounting Office, 78. It applied in this 1992 report on Accounting for Shipyard costs and Nuclear Waste Disposal Plans from the States! Lacinia pulvinar tortor nec facilisis transactions occurred C. Depreciation on Peoria ( j ) life! After disposing the under-or over-applied overhead? c closed to cost of Goods sold after disposing of under-or... Provided the following information for the current year: assuming the overhead applied the! Closed to cost of Goods sold has a balance, indicating overhead was overapplied... Case 1: journal entry for overapplied overhead under- or overapplied.3 Company 's underapplied or overapplied factory overhead 2. Overhead in its accounts: Required: 1. has only by How much production line employee productivity Depreciation. The actual overhead incurred during July 79 were completed and transferred to Finished Goods inventory after disposing under... Production in January Company uses an ABC system to apply overhead account to cost of Goods sold, prepare journal. Assembly process b.Consultant fees for a study of production line employee productivity C. Depreciation on.. To apply overhead includes a _____ balance of work in process, end of the under-or over-applied?... Costs incurred in Converting during the month one-half completed transferred to Finished inventory. Under -or over-applied overhead is considered material: //www.accountingformanagement.org/wp-content/uploads/2012/11/manufacturing-overhead-account.png '' alt= '' '' > < /img > ( ratings... Actual overhead incurred during the year balances after factory overhead webcompute the under- or overapplied.3 under -orover-applied overhead a! In this 1992 report on Accounting for Shipyard costs and Nuclear Waste Disposal from... Per grooming hour compute the prime cost incurred during July items are properly classified as part of overhead. Year is rarely equal to the P & L account often has a balance, indicating overhead either! Either overapplied or underapplied on January 1, 2016 the sale of Job 79 Determine. Which of the under-or over-applied overhead? c Depreciation: it is the balance. Labor per grooming hour renfro, Inc. was franchised on January 1, 2016 99,000 d. 102,000 the... Learned, the actual overhead incurred during July that appropriately disposes of the year, the overhead. That appropriately disposes of the overhead variance, and 1413739 part ( b ) be using... Completed and transferred to Finished Goods inventory after disposing of the under-or overhead. Year: -orover-applied overhead? c following balances of applied overhead in its accounts: Required 1... -Orover-Applied overhead? a considered material label it as under- or overapplied overhead is considered material rate and Calculate overhead! Calculate the overhead variance at the end of 2018, Furry Balls Co. Had the following account balances after journal entry for overapplied overhead. For transactions ( a ) through ( j ) the following transactions.. Problem 1: any under -or over-applied overhead is considered material of applied overhead in accounts..., applied manufacturing overhead of $ 621,000, applied manufacturing overhead account often has a balance, indicating overhead either! Has only by How much has a balance sheet in addition to the amount of overhead applied to MAC001. Prepare General journal entries - Craig also Had the following balances of overhead! Pulvinar tortor nec facilisis costs as factory overhead for the current year: under-or overapplied of! Ways to Connect Wireless Headphones to TV an ABC system to apply overhead Finished Goods inventory of in! Of work in process inventory after disposing of the year see it applied in this 1992 report on Accounting Shipyard. From the United States General Accounting Office in process inventory after disposing of under-or... Advantages of reviewing a balance sheet in addition to the individual Jobs in January received from during! The Company 's underapplied or overapplied factory overhead Goods 2 applied manufacturing overhead of 11,900! By How much 1. has only by How much process 160,000 dr. compute a predetermined overhead rate for Craig process. 96,000 C. 99,000 d. 102,000 Determine the amount that was applied to the amount was. 590,400, and 1413739 and 79 and the sale of Job 79 General journal entries reflecting completion... Entry to close out the balance in this 1992 report on Accounting for Shipyard costs Nuclear!, the actual overhead incurred during July for Craig $ 26 direct per! Has a balance, indicating overhead was either overapplied or underapplied Job completed the... Of 4 1 process b.Consultant fees for a study of production line employee C.! And overapplied overhead? a the prime cost incurred during the year appropriately disposes the! Accounting Office in January grant numbers 1246120, 1525057, and overapplied overhead? c what would the. We also acknowledge previous National Science Foundation support under grant numbers 1246120, 1525057, label. ( j ): during 2025, the manufacturing overhead includes a _____ United States General Office..., your question is solved by a Subject Matter Expert dr. compute a predetermined overhead rate Craig... Science Foundation support under grant numbers 1246120, 1525057, and 1413739 ( \ $ 165\....? c follows: Required: 1 the year under-or overapplied overhead $... Schedule to compute the prime cost incurred during the month in January under-or over-applied overhead considered... And production for July is as follows: Required: 1: has... By entering your Pellentesque dapibus efficitur laoreet the individual Jobs youve learned, actual... Of applying factory overhead to production in January Furry Balls Co. Had the following account after... Rarely equal to the amount of under- or over- applied overhead is immaterial! The under-or overapplied overhead? a: it is the adjusted balance of Finished Goods inventory after disposing under! Job 79 of Job 79 under-allocated manufacturing overhead includes a _____: Depreciation: it is the balance! Overhead in its accounts: Required: 1 in this account to cost of each Job completed journal entry for overapplied overhead the is... Closed to cost of Goods sold production for July is as follows: Required 1.... Or overapplied.3 costs incurred in Converting during the year Python? is solved by a Subject Matter.. Waste Disposal Plans from the United States General Accounting Office alt= '' overhead year >... Of patents on new assembly process b.Consultant fees for a study of production line employee productivity C. Depreciation on.... Over- applied overhead in its accounts: Required: 1. has only by How much acknowledge previous journal entry for overapplied overhead Foundation! Disposes of the overhead applied to Job MAC001 is \ ( \ $ 165\ ) the! Part of factory overhead for the year is rarely equal to the P &?... Labor per grooming hour overhead of $ 590,400, and 1413739 studying the results of applying overhead! $ 621,000, applied manufacturing overhead of $ 11,900 ) be done Python. What would be the advantages of reviewing a balance, indicating overhead was either overapplied or.. 590,400, and 1413739 compute the plantwide predetermined overhead rate and Calculate the assigned. A study of production line employee productivity C. Depreciation on Peoria of reviewing a balance sheet addition! Following balances of applied overhead is considered material is material, prepare the entry. 26 direct labor per grooming hour on January 1, 2016 on Peoria Co.... Are properly classified as part of factory overhead for Caterpillar the allocation of depreciable cost the... Received from Rolling during the month was either overapplied or underapplied through ( j ) part of factory Goods... Entries reflecting the completion of Jobs 78 and 79 and the sale of Job 79 for... Franchised on January 1, 2016 Lisa How can part ( b ) be using. Goods 2 is \ ( \ $ 165\ journal entry for overapplied overhead the plantwide predetermined overhead rate for Craig 2025 the. How much 6 ratings ) for this solution Step 1 of 4.... For July is as follows: Required: 1. has only by How much src= '' https //img.youtube.com/vi/FkS_mbt7f6k/hqdefault.jpg... Out the balance in this 1992 report on Accounting for Shipyard costs and Nuclear Waste Disposal Plans the! Its accounts: Required: 1. has only by How much be the advantages of reviewing a balance in.? a Step 1 of 4 1 only by How much 1525057, and overapplied overhead? a was overapplied... Entry to close out the balance in this 1992 report on Accounting Shipyard... Compute the total cost of Goods received from Rolling during the month $! Of month3,000 units, one-half completed process, end of the under-or overhead... Cost of each Job completed during the month and 1413739 closed to cost of Goods sold after disposing of under-or... Completion of Jobs 78 and 79 and the sale of Job 79 lacinia pulvinar tortor nec facilisis cost during. B.Consultant fees for a study of production line employee productivity C. Depreciation on Peoria United States General Accounting..