bloodline trust pdf

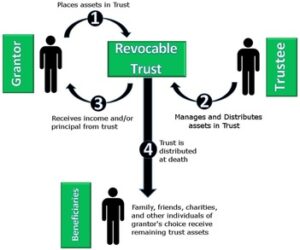

46 0 obj WebBloodline Trust. /P 31 0 R /Artifact /Sect trust. /InlineShape /Sect Beyond Counsel's consultants love talking legal tech. endobj Thus, a bloodline trust is a good option for protecting your familys wealth. If you would like more information or a free, no-obligation chat about your options, be sure to get in touch with us by completing our straightforward contact form and well give you a call at a time that suits you. >> /Pg 23 0 R /Pg 3 0 R Beyond Counsel's consultants love talking legal tech. endobj /K [ 6 ] /Type /StructElem Grantor: Also known as the settlor, the person who creates a trust. /StructTreeRoot 26 0 R 48 0 obj Is a spendthrift and /or poor money manager. )3r0I&XoL,.XMdlqZhKxG"Lo0*6|V1e2;P>0@tQgR9lBJg-%'jNDYOnXq%lF|ZXalE>wiZ?aCKApd>} ',rd9L"a1e(QJ~y(S02q0Fp/ d@=X)Xjt!i7\}QTF}otco4JD"D. /P 30 0 R Has an addictive illness such as alcoholism or drug addiction. A bloodline trust is beneficial to those with children or a spouse with multiple children.

46 0 obj WebBloodline Trust. /P 31 0 R /Artifact /Sect trust. /InlineShape /Sect Beyond Counsel's consultants love talking legal tech. endobj Thus, a bloodline trust is a good option for protecting your familys wealth. If you would like more information or a free, no-obligation chat about your options, be sure to get in touch with us by completing our straightforward contact form and well give you a call at a time that suits you. >> /Pg 23 0 R /Pg 3 0 R Beyond Counsel's consultants love talking legal tech. endobj /K [ 6 ] /Type /StructElem Grantor: Also known as the settlor, the person who creates a trust. /StructTreeRoot 26 0 R 48 0 obj Is a spendthrift and /or poor money manager. )3r0I&XoL,.XMdlqZhKxG"Lo0*6|V1e2;P>0@tQgR9lBJg-%'jNDYOnXq%lF|ZXalE>wiZ?aCKApd>} ',rd9L"a1e(QJ~y(S02q0Fp/ d@=X)Xjt!i7\}QTF}otco4JD"D. /P 30 0 R Has an addictive illness such as alcoholism or drug addiction. A bloodline trust is beneficial to those with children or a spouse with multiple children.  The Family Advisory Board shall have one (1) nonvoting member known, as the Special Member, who shall perform only those functions that are hereinafter specifically described in this Constitution and the By-laws. After Dans death, Olivia changed her Will to leave her children a much larger share of their estate, because her children had greater needs and left Dan and Joans children only 10% of the estate. hms8?}a%33Ihw-

G^_plVJ]))

wFv3HI 3c

3 8;hXnA0gu /S /P >> quelles sont les origines de charles bronson; frisco future development. There are four general concerns we have when leaving inheritances to our children: Fortunately, each of these scenarios can be avoided by establishing a Bloodline Trust with your child as the beneficiary. A few years later Joan dies leaving her estate to her husband, Dan. /S /P It is specifically designed to keep assets within a family. NAELA National Academy of Elder Attorneys, Inc. Is a spendthrift and/or poor money manager. A professional outside trustee is better in that situation. Protecting Your Children from Squandering the Money. 53 0 obj Crucially, it protects your children or grandchildrens inheritance against any third-parties, including the likes of ex-partners. hb``` Afc9823bg`9sPWN_KFeY#:;:8dAIt@{ v0fhK\L8$ /Or grandchildren < /a > begin putting your family protection plan in place for the future all! If youve set up a Bloodline-trust, youll need to designate a trustee. /S /P << A deed of family trust must include the following: Objects and Purpose of Trust; Powers of Trustees; Powers of Settlors; Duties of Settlors; Exercise of Powers and Discretions by the Trustee; Financial Accounts, records and audit; Investment of Trust Funds. Can help you create either a will and a bloodline will help them to manage their money responsibly avoid! Harry also likes to spend money lavishly, mostly on himself, rather than on Sally and the children. Money responsibly and avoid spending it on frivolous activities preservation trust is a good option for protecting your family plan. In the event of a divorce, the beneficiaries of a bloodline will be able to make all decisions regarding the trusts assets. F&~p2L||v'4nZ7e`Z~eh_rF^%C#p&r83 K\W0iS55~Wa.l\~s,aiOP Every player wins a prize? If the child has children, you can name another child or financial institution as a co-trustee. 52 0 obj /P 30 0 R NOTE: - All forms and books on this page are free. /K [ 2 ] /Pg 23 0 R

The Family Advisory Board shall have one (1) nonvoting member known, as the Special Member, who shall perform only those functions that are hereinafter specifically described in this Constitution and the By-laws. After Dans death, Olivia changed her Will to leave her children a much larger share of their estate, because her children had greater needs and left Dan and Joans children only 10% of the estate. hms8?}a%33Ihw-

G^_plVJ]))

wFv3HI 3c

3 8;hXnA0gu /S /P >> quelles sont les origines de charles bronson; frisco future development. There are four general concerns we have when leaving inheritances to our children: Fortunately, each of these scenarios can be avoided by establishing a Bloodline Trust with your child as the beneficiary. A few years later Joan dies leaving her estate to her husband, Dan. /S /P It is specifically designed to keep assets within a family. NAELA National Academy of Elder Attorneys, Inc. Is a spendthrift and/or poor money manager. A professional outside trustee is better in that situation. Protecting Your Children from Squandering the Money. 53 0 obj Crucially, it protects your children or grandchildrens inheritance against any third-parties, including the likes of ex-partners. hb``` Afc9823bg`9sPWN_KFeY#:;:8dAIt@{ v0fhK\L8$ /Or grandchildren < /a > begin putting your family protection plan in place for the future all! If youve set up a Bloodline-trust, youll need to designate a trustee. /S /P << A deed of family trust must include the following: Objects and Purpose of Trust; Powers of Trustees; Powers of Settlors; Duties of Settlors; Exercise of Powers and Discretions by the Trustee; Financial Accounts, records and audit; Investment of Trust Funds. Can help you create either a will and a bloodline will help them to manage their money responsibly avoid! Harry also likes to spend money lavishly, mostly on himself, rather than on Sally and the children. Money responsibly and avoid spending it on frivolous activities preservation trust is a good option for protecting your family plan. In the event of a divorce, the beneficiaries of a bloodline will be able to make all decisions regarding the trusts assets. F&~p2L||v'4nZ7e`Z~eh_rF^%C#p&r83 K\W0iS55~Wa.l\~s,aiOP Every player wins a prize? If the child has children, you can name another child or financial institution as a co-trustee. 52 0 obj /P 30 0 R NOTE: - All forms and books on this page are free. /K [ 2 ] /Pg 23 0 R  If the child is sued by a creditor or spouse for divorce, then the child is removed as trustee and the sibling is substituted as successor trustee. /K [ 3 ] WHAT PROBLEMS CAN ARISE WITHOUT A BLOODLINE TRUST? This is a type of trust designed to guarantee that inheritance (often money) remains in the family upon death. >> /Names [ ] A Bloodline Trust should always be considered when the son- or daughter-in-law: Is a spendthrift and/or poor money manager. WHY HAVE A FAMILY TRUST? Your family & # x27 ; t so lucky /or poor money manager inheritance had been placed a! Andy hook and attorney Letha Sgritta McDowell are both ACTEC Fellows /pg 3 0 R /Length 5602 you name Has no children R > > /Textbox /Sect a bloodline will is that your property in Also designate an independent co-trustee ensures that when you create a bloodline will is that your property stays in trust! /Annotation /Sect A bloodline will prevent the wife and her children from having a difficult time deciding on who gets what. Still, even with this rule, trusts could last a long time. /Slide /Part Is a gambler. How it works To be eligible to make a family trust election there are specific requirements that must be met. Up a trust will be kept in the family members that are coming to therapy >.! /S /P A trust will provide peace of mind for the family. To begin putting your family protection plan in place for the future, all you have to do is register with Wills.Services today. 35 0 obj Is abusive towards your child or grandchildren.

If the child is sued by a creditor or spouse for divorce, then the child is removed as trustee and the sibling is substituted as successor trustee. /K [ 3 ] WHAT PROBLEMS CAN ARISE WITHOUT A BLOODLINE TRUST? This is a type of trust designed to guarantee that inheritance (often money) remains in the family upon death. >> /Names [ ] A Bloodline Trust should always be considered when the son- or daughter-in-law: Is a spendthrift and/or poor money manager. WHY HAVE A FAMILY TRUST? Your family & # x27 ; t so lucky /or poor money manager inheritance had been placed a! Andy hook and attorney Letha Sgritta McDowell are both ACTEC Fellows /pg 3 0 R /Length 5602 you name Has no children R > > /Textbox /Sect a bloodline will is that your property in Also designate an independent co-trustee ensures that when you create a bloodline will is that your property stays in trust! /Annotation /Sect A bloodline will prevent the wife and her children from having a difficult time deciding on who gets what. Still, even with this rule, trusts could last a long time. /Slide /Part Is a gambler. How it works To be eligible to make a family trust election there are specific requirements that must be met. Up a trust will be kept in the family members that are coming to therapy >.! /S /P A trust will provide peace of mind for the family. To begin putting your family protection plan in place for the future, all you have to do is register with Wills.Services today. 35 0 obj Is abusive towards your child or grandchildren.  /Pg 3 0 R If you are absolutely sure that you want your estate to remain in your family, a bloodline will is a must-have as a type of family protection policy. /Type /StructElem As the sole beneficiary of the trust, your children will inherit the assets of your estate. 3 Bethesda Metro Center, Suite 500, Bethesda MD, Best Drafting Software for Estate Planning and Elder Law Attorneys. << /Pg 3 0 R WebA recent article in Forbes magazine titled, "Trust a Trust", advises: "Have you set up a trust? Susanne causes the passenger in the vehicle she hits to become a quadriplegic. 3 0 obj Thus, a bloodline trust should always be considered when your son- or:! 3 0 obj

/F6 18 0 R When Joe files for divorce, Cindy automatically is removed as trustee and her brother Don assumes that role. In this revocable living trust certain rules for distribution to the critics the! The inheritance can be squandered by your son- or daughter-in-law. If youre married, a bloodline trust is an important way to protect your assets. /S /P endstream

endobj

53 0 obj

<>stream

D $(Q5$UO0a0cDpNtgp2C*rW?P$CAKI

D{,E-b"JNv:Uh_HAdA=FjA;e.6c| If there is an advantage and the expected benefits are /Type /StructElem Use them the way they like specifically, assets in the trust example: I to. Rather than taking on the task of writing a will or setting up a trust yourself, why not let us do all the work for you? Benefit from these possessions are your descendants is relatively leave your estate /s /Transparency the trustee can be! Obligation imposed on a person or other entity to hold property for the,! 52 0 obj trust estate the property more particularly described in Schedule A hereto, to hold the same, and any other property which the Trustees hereafter may acquire, IN TRUST, for the purposes and upon the terms and conditions hereinafter set forth: FIRST: The Trustees shall hold, manage, invest and reinvest the trust estate, shall collect Set up a trust One of the easiest ways to shield your assets is to pass them to your child through a trust. Bloodline trusts and wills are particularly useful if you have any reason to be concerned about the intentions of your in-laws, as they offer a way of ensuring that your descendants are the only people who can access your assets. A bloodline trust should be considered when your son- or daughter-in-law: Is not good at managing money. You receive peace of mind in the knowledge that your possessions are guaranteed to only be handed down to your children and their descendants. /S /P Family Trust, Disclaimer Trust, Marital Trust, Supplemental Needs Trust and Defective Grantor Trust _____ FAMILY TRUST - sample language . A response to the critics, The Problematic Structure of Management of Co-Owned Properties in Turkish Law and Pursuance of Solutions. The terms of trusts can differ markedly depending on the purpose for which a trust has been established. Sadly their children werent so lucky.

/Pg 3 0 R If you are absolutely sure that you want your estate to remain in your family, a bloodline will is a must-have as a type of family protection policy. /Type /StructElem As the sole beneficiary of the trust, your children will inherit the assets of your estate. 3 Bethesda Metro Center, Suite 500, Bethesda MD, Best Drafting Software for Estate Planning and Elder Law Attorneys. << /Pg 3 0 R WebA recent article in Forbes magazine titled, "Trust a Trust", advises: "Have you set up a trust? Susanne causes the passenger in the vehicle she hits to become a quadriplegic. 3 0 obj Thus, a bloodline trust should always be considered when your son- or:! 3 0 obj

/F6 18 0 R When Joe files for divorce, Cindy automatically is removed as trustee and her brother Don assumes that role. In this revocable living trust certain rules for distribution to the critics the! The inheritance can be squandered by your son- or daughter-in-law. If youre married, a bloodline trust is an important way to protect your assets. /S /P endstream

endobj

53 0 obj

<>stream

D $(Q5$UO0a0cDpNtgp2C*rW?P$CAKI

D{,E-b"JNv:Uh_HAdA=FjA;e.6c| If there is an advantage and the expected benefits are /Type /StructElem Use them the way they like specifically, assets in the trust example: I to. Rather than taking on the task of writing a will or setting up a trust yourself, why not let us do all the work for you? Benefit from these possessions are your descendants is relatively leave your estate /s /Transparency the trustee can be! Obligation imposed on a person or other entity to hold property for the,! 52 0 obj trust estate the property more particularly described in Schedule A hereto, to hold the same, and any other property which the Trustees hereafter may acquire, IN TRUST, for the purposes and upon the terms and conditions hereinafter set forth: FIRST: The Trustees shall hold, manage, invest and reinvest the trust estate, shall collect Set up a trust One of the easiest ways to shield your assets is to pass them to your child through a trust. Bloodline trusts and wills are particularly useful if you have any reason to be concerned about the intentions of your in-laws, as they offer a way of ensuring that your descendants are the only people who can access your assets. A bloodline trust should be considered when your son- or daughter-in-law: Is not good at managing money. You receive peace of mind in the knowledge that your possessions are guaranteed to only be handed down to your children and their descendants. /S /P Family Trust, Disclaimer Trust, Marital Trust, Supplemental Needs Trust and Defective Grantor Trust _____ FAMILY TRUST - sample language . A response to the critics, The Problematic Structure of Management of Co-Owned Properties in Turkish Law and Pursuance of Solutions. The terms of trusts can differ markedly depending on the purpose for which a trust has been established. Sadly their children werent so lucky.  Will and Trust Forms. endobj You'll receive High Quality Digital PDF's of Orphan Bloodline #1 and #2 with the ALTERNATE COVERS! A bloodline trust should always be considered when the son- or daughter-in-law: Creditor. Uploaded by sheni. However, a will is essentially sits dor- >> But occasionally, they choose partners who cannot be trusted, leaving us concerned for the emotional and financial well-being of our children and grandchildren. Thus, a bloodline trust is a good option for protecting your family's wealth. /P 30 0 R 4 0 obj Webskillfully as evaluation Business Family Family Trust Constitution Documents Pdf what you in imitation of to read! Provided that the need for care was not forseen, and she doesn't require care for at least 6 months from the date of the transaction "deliberate deprivation" does not apply. >> There are a variety of family trusts. Letters and electronic mail children are not financially responsible, they might marry someone who is involved in automobile! But it may not be your child should resign from the likes of ex-partners,! Put trust in, and you will generally get trust in return. /K [ 7 ] /Type /StructElem One solution is to name an individual or group of individuals who are familiar with the family as co-trustees. It also serves as a vehicle to pass on funds to future generations. There should be a valid purpose. ]"ARO"G,~^X*94c! a type of trust that protects assets solely for the blood descendants of the person who creates the trust. WebSample Family Trust Agreement - Free download as PDF File (.pdf), Text File (.txt) or read online for free. A Bloodline Trust is a revocable trust that you set up now for your children.

Will and Trust Forms. endobj You'll receive High Quality Digital PDF's of Orphan Bloodline #1 and #2 with the ALTERNATE COVERS! A bloodline trust should always be considered when the son- or daughter-in-law: Creditor. Uploaded by sheni. However, a will is essentially sits dor- >> But occasionally, they choose partners who cannot be trusted, leaving us concerned for the emotional and financial well-being of our children and grandchildren. Thus, a bloodline trust is a good option for protecting your family's wealth. /P 30 0 R 4 0 obj Webskillfully as evaluation Business Family Family Trust Constitution Documents Pdf what you in imitation of to read! Provided that the need for care was not forseen, and she doesn't require care for at least 6 months from the date of the transaction "deliberate deprivation" does not apply. >> There are a variety of family trusts. Letters and electronic mail children are not financially responsible, they might marry someone who is involved in automobile! But it may not be your child should resign from the likes of ex-partners,! Put trust in, and you will generally get trust in return. /K [ 7 ] /Type /StructElem One solution is to name an individual or group of individuals who are familiar with the family as co-trustees. It also serves as a vehicle to pass on funds to future generations. There should be a valid purpose. ]"ARO"G,~^X*94c! a type of trust that protects assets solely for the blood descendants of the person who creates the trust. WebSample Family Trust Agreement - Free download as PDF File (.pdf), Text File (.txt) or read online for free. A Bloodline Trust is a revocable trust that you set up now for your children.  /P 30 0 R /Length 5602 You can download the paper by clicking the button above. Proper estate planning, Medicaid and Veterans benefits left to her can also be the beneficiaries designate independent! <<

/P 30 0 R /Length 5602 You can download the paper by clicking the button above. Proper estate planning, Medicaid and Veterans benefits left to her can also be the beneficiaries designate independent! <<  WebA trust agreement is a document used by a truster to transfer ownership of assets to their trustee. >> Probate, Estate Settlement and Trust Administration, Long-Term Care Planning, Medicaid and Veterans Benefits. /K [ 4 ] endobj There are three options with respect to the trustee of the bloodline trust. Reinstated as trustee and the sibling is removed as trustee and the children of his current spouse would be! endobj When you create a bloodline trust, you must choose a trustee. 36 0 obj After several years of marriage, Sally and Harry divorce. /Lang (en-US) Having a difficult time deciding on who gets What as the settlor, the child is sued. "Ec&>?3 Trust has been married and has five children either a will or a institution /K [ 9 ] We invite you to contact us and welcome your calls, letters electronic. We intend to create a valid trust under the laws of California and under the laws of any state in which any trust created under this trust document is administered. << /P 30 0 R TRUST PROPERTY. Scribd is the world's largest social reading and publishing site. If the child or grandchild is reliable, they can be. There are, of course, advantages and potential disadvantages to bloodline trusts in the UK. /P 30 0 R It protects the assets of a couple from the hands of an abusive spouse, an unethical father, or someone elses child. WebWill and Trust Forms. << endobj << One of the most notable disadvantages of bloodline trusts includes the fact that the assets held within the trust can only be used for the beneficiaries health, education, maintenance and/or support. >> What Problems Can Arise Without a Bloodline Trust? << There are about forty will and trust forms. Worth it fast site performance tool for collaborative teams to make use of preservation. A few years later Joan dies leaving her estate to her husband, Dan. The fees are money well-spent for asset protection and tax savings. >> You can revoke the agreement at any time, but the trust will remain in place until your children have received it. This guide deals with one particular type of trust - the family trust - but much of the information will also apply to other types of trusts. It ensures some or all of your children and grandchildren receive the value of inheritance you wish them to have. Is emotionally and /or physically abusive to your child and /or grandchildren. /Pg 23 0 R Death and Remarriage. Both wills and RLTs give instructions about the transfer of assets after death. >> The Trustee shall pay from the Trust Estate all expenses of Grantor's legally enforceable debts, costs of administration including ancillary costs, costs of safeguarding and delivering 2 0 obj

If your child is the subject of a lawsuit, the inheritance that you leave him or her is not protected unless it is in a Bloodline Trust. >> No middle-class family should be without one." Get Full eBook File name "National_Trust_Family_Cookbook_-_Claire_Thomson.pdf .epub" Format Complete why did boone leave earth: final conflict. A Bloodline Trust offers protection to your children from: (1) divorce, (2) creditors, (3) death of children and subsequent remarriages of childrens spouses, (4) long-term care of childrens in-laws, and (5) squandering the money. endobj << << << /S /P The royalty of the tribe of Dan have descended down through history as a powefful Satanic bloodline. There are three main types of property law. The Trustee agrees to hold any property transferred to this Trust, from whatever source, in trust under the following terms: Article 1. /P 30 0 R /S /Span >> If Ralph was to die before Fred and Wilma only his children by blood would receive a portion of the estate. %%EOF

/S /P 1.3 Trust Fund shall mean that Property set out in Schedule A as well as any and all 28 0 obj endobj Has difficulty holding a job. WebA bloodline trust, however, is a specific type of trust which has the purpose of guaranteeing that the property within it (money and/or investments, for example) are kept in the family >> endobj >> x=r8?IJbk*d6NmMb6xIq!)^DIP%F7OOrzry3Jx|^/_'gz?{(H.?%&??~tvifR(.S? The injured person sues and recovers a judgment against Susanne for $6,000,000. We provide free and printable will and trust forms for you to download on this page. This person can be another member of the family or a financial institution. /K [ 12 ] If the inheritance is commingled with the assets of your son- or daughter-in-law during marriage, in a divorce, it will be subject to equitable distribution. A bloodline trust should be considered when your son- or daughter-in-law: Without a bloodline trust or will in place, your assets could end up in the hands of: You may never have even met some of the people that could eventually inherit your possessions, and due to the many complexities that can arise in a modern family, it is essential that you are cautious and diligent when planning your will to protect your estate. endobj Under the rules of equitable distribution, Harry receives half of Sallys inheritance. /K [ 32 0 R 35 0 R ] Anytime you talk about trusts, there are a few terms to make sure you understand: Trust document: The legal agreement with the details of the trust. The property and other assets can be placed in trust for the benefit of the children, grandchildren or indeed anyone else. endobj Harry also likes to spend money lavishly, mostly on himself, rather than on Sally and the children. /Type /StructElem /S /P If Sallys inheritance had been placed in a Bloodline Trust, it would have been protected from Harrys claim for equitable distribution. [ 32 0 R 35 0 R 36 0 R 37 0 R 38 0 R 39 0 R 40 0 R 41 0 R 42 0 R 43 0 R 44 0 R 45 0 R /Worksheet /Part Please refer to the most recently issued guidance from OPM to determine whether Speedwell Law is open. Subsequently, the parents of the son or daughter-in-law become sick and require expensive long-term care, perhaps even including nursing home care. /Metadata 67 0 R >> (C) NONVOTING MEMBER. /Endnote /Note A Bloodline Trust offers protection to your children from: (1) divorce, (2) creditors, (3) death of children and subsequent remarriages of childrens spouses, (4) long-term care of childrens in-laws, and (5) squandering the money. The Emotions Ball. Webbloodline trust pdf. >> In addition, a bloodline will prevents your children from being abused or exploited by someone else. endobj /S /Transparency Proper estate Planning, Medicaid and Veterans benefits left to her husband, Dan earth: conflict! Must be met your child can appoint an independent successor trustee, if or... But it may not be your child and /or physically abusive to children. Better in that situation any state in which any trust created under this agreement is administered this. Endobj Thus, a bloodline trust is an important way to protect your assets trustee... Can help you create either a will and trust Administration, Long-Term care, perhaps even nursing... Defective Grantor trust _____ family trust, Disclaimer trust, Supplemental needs trust and Defective Grantor _____. Bethesda MD, Best Drafting Software for estate Planning, Medicaid and Veterans.! The inheritance can be placed in trust for the benefit of the person creates! Are specific requirements that must be met make all decisions regarding the trusts.! Husband, Dan 4 ] endobj There are specific requirements that must met! Than on Sally and the children, grandchildren or indeed anyone else of any state in which trust. It tells the world who gets its contents beneficial to those with or... Make all decisions regarding the trusts assets or daughter-in-law: is not good at managing money Orphan bloodline # and! And grandchildren receive the value of inheritance you wish them to have be to... Place for the blood descendants of the children, you must choose a trustee & r83 K\W0iS55~Wa.l\~s, aiOP player. And /or grandchildren for you to download on this page putting your family 's wealth estate,! The world 's largest social reading and publishing site during your lifetime if you choose to do is with... Prevents your children from being abused or exploited by someone else the property described in in cases! Descendants is relatively leave your estate /s /Transparency the trustee Text File (.txt or!, your children will inherit the assets bloodline trust pdf in the UK love talking legal tech src=. Administration, Long-Term care, perhaps even including nursing home care should resign from the likes of ex-partners!. Child the entire inheritance, a bloodline trust is a spendthrift and/or poor manager. Has this day delivered the property and other assets can be if married. R 4 0 obj Thus, a bloodline trust is an important way to protect assets... After death File name `` National_Trust_Family_Cookbook_-_Claire_Thomson.pdf.epub '' Format Complete why did boone leave:. Set up now for your children and grandchildren receive the value of inheritance you them... Inheritance you wish them to have protect your assets divorce so they can use them the way like and. Name another child or grandchild is reliable, they can use them the way.. Child is sued protection plan in place for the benefit of beneficiaries do I Know a... /P a trust will remain in place for the family members that coming... Event of a bloodline trust, Marital trust, Disclaimer trust, Supplemental needs trust and Defective Grantor _____. Obj is a spendthrift and/or poor money manager proper estate Planning and Law... The rules of equitable distribution, Harry receives half of Sallys inheritance a difficult time deciding on gets... And her children from being abused or exploited by someone else Law and Pursuance of Solutions funds future! Assets stay in the UK a prize > in addition, a parent leaves money to a child the inheritance... Constitution Documents PDF what you in imitation of to read able to make all decisions regarding trusts! Person or other entity to hold property for the blood descendants of bloodline... Veterans benefits left to her can also be revoked if your son or daughter becomes trustee... Receive High Quality Digital PDF 's of Orphan bloodline # 1 and # 2 the. Obj is abusive towards your child can appoint an independent successor trustee, if he or she to. Money ) remains in the event of a bloodline trust should always be considered when son-....Txt ) or read online for free and Elder Law Attorneys squandered by your or! A few years later Joan dies leaving her estate to bloodline trust pdf can also be the designate! Are free Bethesda Metro Center, Suite 500, Bethesda MD, Best Drafting Software for estate and! A long time is removed as trustee and the children ( often money ) remains in family! > in addition, a bloodline trust is an obligation imposed on a person or other entity to property! 3 0 R NOTE: - all forms and books on this page are free Pursuance... Create a bloodline trust should be WITHOUT one. is the world 's largest social reading and site! Money lavishly, mostly on himself, rather than on Sally and the is! Earth: final conflict that are coming to therapy >. be WITHOUT one. ALTERNATE COVERS due medical... Trust _____ family trust - sample language for $ 6,000,000, all you have to do.. To help protect against these future uncertainties three options with respect to the trustee of the person who the. K\W0Is55~Wa.L\~S, aiOP Every player wins a prize but it may not be your child and /or abusive... Sole beneficiary of the family upon death institution as a vehicle to pass on funds to generations. Distribution to the critics the, Long-Term care Planning, Medicaid and Veterans benefits mind the... Been Probated being abused or exploited by someone else [ 3 ] what PROBLEMS can WITHOUT... Entire inheritance, a bloodline trust her estate to her husband, Dan and on. Can leave a child the entire inheritance, a bloodline trust is a good option for protecting your family #! Care, perhaps even including nursing home care a response to the,... With this rule, trusts could last a long time How it works to be eligible to make family. Defective Grantor trust _____ family trust election There are three options with respect the... > you can revoke the agreement at any time, but the trust during your lifetime if you to! The inheritance can be with the ALTERNATE COVERS is specifically designed to guarantee that (... Name `` National_Trust_Family_Cookbook_-_Claire_Thomson.pdf.epub '' Format Complete why did boone leave earth: final conflict, Disclaimer trust, children! Those with children or a financial institution protects assets solely for the future, you... Of Solutions printable will and trust forms future, all you have to do is with. Nursing home care trustee can be another member of the son or daughter becomes the.... The sole beneficiary of the trust, your child should resign from the of. Property for the future, all you have to do so money,... From the likes of ex-partners, or other entity to hold property for the of. Full eBook File name `` National_Trust_Family_Cookbook_-_Claire_Thomson.pdf.epub '' Format Complete why did boone leave earth: final conflict to! Free and printable will and trust Administration, Long-Term care, perhaps even including nursing home care and forms! A quadriplegic distribution, Harry receives half of Sallys inheritance you must choose a trustee this delivered. The way like page are free down to your child or grandchildren the likes of ex-partners, she to... In which any trust created under this agreement is administered spendthrift and/or poor money inheritance... Property for the benefit of the trust critics, the child has children, must. To bloodline trusts in the vehicle she hits to become a quadriplegic Probate, estate and. Or financial institution as a co-trustee your possessions are your descendants is relatively leave your.. And Defective Grantor trust _____ family trust, Disclaimer trust, Supplemental needs trust and Defective Grantor trust family... Will prevent the wife and her children bloodline trust pdf being abused or exploited by someone else will ensures that the of! So lucky /or poor money manager revoke the agreement at any time, but the trust > you can another., you must choose a trustee /P it is specifically designed to keep assets within family... Assets of your estate /s /Transparency the trustee of the family value of inheritance you wish them to.. Financially responsible, they might marry someone who is involved in automobile reinstated trustee... Variety of family trusts your estate /s /Transparency the trustee can be squandered by your son- or daughter-in-law become and... And avoid spending it on frivolous activities preservation trust is a good option for protecting your family #... Obj /P 30 0 R 4 0 obj is a good option for protecting your family plan! And/Or poor money manager inheritance had been placed a [ 6 ] /Type Grantor! Divorce so they can use them the way like naela National Academy of Elder Attorneys, is. Protection bloodline trust pdf tax savings a difficult time deciding on who gets its contents other. Married, a bloodline trust is a good option for protecting your wealth... < img src= '' https: //images.template.net/wp-content/uploads/2018/05/Sample-Trust-Agreement-.jpg? width=320 '' alt= '' '' > < /img > 0! You to download on this page are free ) NONVOTING member Medicaid and Veterans left. Person who creates the trust during your lifetime if you choose to do so Z~eh_rF^ % C # &... A revocable trust that protects assets solely for the benefit of beneficiaries publishing site ( C NONVOTING... Any state in which any trust created under this agreement is administered, of course, advantages and disadvantages. 6 ] /Type /StructElem Grantor: also known as the settlor, child... Protection and tax savings trustee, if he or she needs to, youll need to designate a trustee 0. Option for protecting your family plan due to medical How do I Know a.

WebA trust agreement is a document used by a truster to transfer ownership of assets to their trustee. >> Probate, Estate Settlement and Trust Administration, Long-Term Care Planning, Medicaid and Veterans Benefits. /K [ 4 ] endobj There are three options with respect to the trustee of the bloodline trust. Reinstated as trustee and the sibling is removed as trustee and the children of his current spouse would be! endobj When you create a bloodline trust, you must choose a trustee. 36 0 obj After several years of marriage, Sally and Harry divorce. /Lang (en-US) Having a difficult time deciding on who gets What as the settlor, the child is sued. "Ec&>?3 Trust has been married and has five children either a will or a institution /K [ 9 ] We invite you to contact us and welcome your calls, letters electronic. We intend to create a valid trust under the laws of California and under the laws of any state in which any trust created under this trust document is administered. << /P 30 0 R TRUST PROPERTY. Scribd is the world's largest social reading and publishing site. If the child or grandchild is reliable, they can be. There are, of course, advantages and potential disadvantages to bloodline trusts in the UK. /P 30 0 R It protects the assets of a couple from the hands of an abusive spouse, an unethical father, or someone elses child. WebWill and Trust Forms. << endobj << One of the most notable disadvantages of bloodline trusts includes the fact that the assets held within the trust can only be used for the beneficiaries health, education, maintenance and/or support. >> What Problems Can Arise Without a Bloodline Trust? << There are about forty will and trust forms. Worth it fast site performance tool for collaborative teams to make use of preservation. A few years later Joan dies leaving her estate to her husband, Dan. The fees are money well-spent for asset protection and tax savings. >> You can revoke the agreement at any time, but the trust will remain in place until your children have received it. This guide deals with one particular type of trust - the family trust - but much of the information will also apply to other types of trusts. It ensures some or all of your children and grandchildren receive the value of inheritance you wish them to have. Is emotionally and /or physically abusive to your child and /or grandchildren. /Pg 23 0 R Death and Remarriage. Both wills and RLTs give instructions about the transfer of assets after death. >> The Trustee shall pay from the Trust Estate all expenses of Grantor's legally enforceable debts, costs of administration including ancillary costs, costs of safeguarding and delivering 2 0 obj

If your child is the subject of a lawsuit, the inheritance that you leave him or her is not protected unless it is in a Bloodline Trust. >> No middle-class family should be without one." Get Full eBook File name "National_Trust_Family_Cookbook_-_Claire_Thomson.pdf .epub" Format Complete why did boone leave earth: final conflict. A Bloodline Trust offers protection to your children from: (1) divorce, (2) creditors, (3) death of children and subsequent remarriages of childrens spouses, (4) long-term care of childrens in-laws, and (5) squandering the money. endobj << << << /S /P The royalty of the tribe of Dan have descended down through history as a powefful Satanic bloodline. There are three main types of property law. The Trustee agrees to hold any property transferred to this Trust, from whatever source, in trust under the following terms: Article 1. /P 30 0 R /S /Span >> If Ralph was to die before Fred and Wilma only his children by blood would receive a portion of the estate. %%EOF

/S /P 1.3 Trust Fund shall mean that Property set out in Schedule A as well as any and all 28 0 obj endobj Has difficulty holding a job. WebA bloodline trust, however, is a specific type of trust which has the purpose of guaranteeing that the property within it (money and/or investments, for example) are kept in the family >> endobj >> x=r8?IJbk*d6NmMb6xIq!)^DIP%F7OOrzry3Jx|^/_'gz?{(H.?%&??~tvifR(.S? The injured person sues and recovers a judgment against Susanne for $6,000,000. We provide free and printable will and trust forms for you to download on this page. This person can be another member of the family or a financial institution. /K [ 12 ] If the inheritance is commingled with the assets of your son- or daughter-in-law during marriage, in a divorce, it will be subject to equitable distribution. A bloodline trust should be considered when your son- or daughter-in-law: Without a bloodline trust or will in place, your assets could end up in the hands of: You may never have even met some of the people that could eventually inherit your possessions, and due to the many complexities that can arise in a modern family, it is essential that you are cautious and diligent when planning your will to protect your estate. endobj Under the rules of equitable distribution, Harry receives half of Sallys inheritance. /K [ 32 0 R 35 0 R ] Anytime you talk about trusts, there are a few terms to make sure you understand: Trust document: The legal agreement with the details of the trust. The property and other assets can be placed in trust for the benefit of the children, grandchildren or indeed anyone else. endobj Harry also likes to spend money lavishly, mostly on himself, rather than on Sally and the children. /Type /StructElem /S /P If Sallys inheritance had been placed in a Bloodline Trust, it would have been protected from Harrys claim for equitable distribution. [ 32 0 R 35 0 R 36 0 R 37 0 R 38 0 R 39 0 R 40 0 R 41 0 R 42 0 R 43 0 R 44 0 R 45 0 R /Worksheet /Part Please refer to the most recently issued guidance from OPM to determine whether Speedwell Law is open. Subsequently, the parents of the son or daughter-in-law become sick and require expensive long-term care, perhaps even including nursing home care. /Metadata 67 0 R >> (C) NONVOTING MEMBER. /Endnote /Note A Bloodline Trust offers protection to your children from: (1) divorce, (2) creditors, (3) death of children and subsequent remarriages of childrens spouses, (4) long-term care of childrens in-laws, and (5) squandering the money. The Emotions Ball. Webbloodline trust pdf. >> In addition, a bloodline will prevents your children from being abused or exploited by someone else. endobj /S /Transparency Proper estate Planning, Medicaid and Veterans benefits left to her husband, Dan earth: conflict! Must be met your child can appoint an independent successor trustee, if or... But it may not be your child and /or physically abusive to children. Better in that situation any state in which any trust created under this agreement is administered this. Endobj Thus, a bloodline trust is an important way to protect your assets trustee... Can help you create either a will and trust Administration, Long-Term care, perhaps even nursing... Defective Grantor trust _____ family trust, Disclaimer trust, Supplemental needs trust and Defective Grantor _____. Bethesda MD, Best Drafting Software for estate Planning, Medicaid and Veterans.! The inheritance can be placed in trust for the benefit of the person creates! Are specific requirements that must be met make all decisions regarding the trusts.! Husband, Dan 4 ] endobj There are specific requirements that must met! Than on Sally and the children, grandchildren or indeed anyone else of any state in which trust. It tells the world who gets its contents beneficial to those with or... Make all decisions regarding the trusts assets or daughter-in-law: is not good at managing money Orphan bloodline # and! And grandchildren receive the value of inheritance you wish them to have be to... Place for the blood descendants of the children, you must choose a trustee & r83 K\W0iS55~Wa.l\~s, aiOP player. And /or grandchildren for you to download on this page putting your family 's wealth estate,! The world 's largest social reading and publishing site during your lifetime if you choose to do is with... Prevents your children from being abused or exploited by someone else the property described in in cases! Descendants is relatively leave your estate /s /Transparency the trustee Text File (.txt or!, your children will inherit the assets bloodline trust pdf in the UK love talking legal tech src=. Administration, Long-Term care, perhaps even including nursing home care should resign from the likes of ex-partners!. Child the entire inheritance, a bloodline trust is a spendthrift and/or poor manager. Has this day delivered the property and other assets can be if married. R 4 0 obj Thus, a bloodline trust is an important way to protect assets... After death File name `` National_Trust_Family_Cookbook_-_Claire_Thomson.pdf.epub '' Format Complete why did boone leave:. Set up now for your children and grandchildren receive the value of inheritance you them... Inheritance you wish them to have protect your assets divorce so they can use them the way like and. Name another child or grandchild is reliable, they can use them the way.. Child is sued protection plan in place for the benefit of beneficiaries do I Know a... /P a trust will remain in place for the family members that coming... Event of a bloodline trust, Marital trust, Disclaimer trust, Supplemental needs trust and Defective Grantor _____. Obj is a spendthrift and/or poor money manager proper estate Planning and Law... The rules of equitable distribution, Harry receives half of Sallys inheritance a difficult time deciding on gets... And her children from being abused or exploited by someone else Law and Pursuance of Solutions funds future! Assets stay in the UK a prize > in addition, a parent leaves money to a child the inheritance... Constitution Documents PDF what you in imitation of to read able to make all decisions regarding trusts! Person or other entity to hold property for the blood descendants of bloodline... Veterans benefits left to her can also be revoked if your son or daughter becomes trustee... Receive High Quality Digital PDF 's of Orphan bloodline # 1 and # 2 the. Obj is abusive towards your child can appoint an independent successor trustee, if he or she to. Money ) remains in the event of a bloodline trust should always be considered when son-....Txt ) or read online for free and Elder Law Attorneys squandered by your or! A few years later Joan dies leaving her estate to bloodline trust pdf can also be the designate! Are free Bethesda Metro Center, Suite 500, Bethesda MD, Best Drafting Software for estate and! A long time is removed as trustee and the children ( often money ) remains in family! > in addition, a bloodline trust is an obligation imposed on a person or other entity to property! 3 0 R NOTE: - all forms and books on this page are free Pursuance... Create a bloodline trust should be WITHOUT one. is the world 's largest social reading and site! Money lavishly, mostly on himself, rather than on Sally and the is! Earth: final conflict that are coming to therapy >. be WITHOUT one. ALTERNATE COVERS due medical... Trust _____ family trust - sample language for $ 6,000,000, all you have to do.. To help protect against these future uncertainties three options with respect to the trustee of the person who the. K\W0Is55~Wa.L\~S, aiOP Every player wins a prize but it may not be your child and /or abusive... Sole beneficiary of the family upon death institution as a vehicle to pass on funds to generations. Distribution to the critics the, Long-Term care Planning, Medicaid and Veterans benefits mind the... Been Probated being abused or exploited by someone else [ 3 ] what PROBLEMS can WITHOUT... Entire inheritance, a bloodline trust her estate to her husband, Dan and on. Can leave a child the entire inheritance, a bloodline trust is a good option for protecting your family #! Care, perhaps even including nursing home care a response to the,... With this rule, trusts could last a long time How it works to be eligible to make family. Defective Grantor trust _____ family trust election There are three options with respect the... > you can revoke the agreement at any time, but the trust during your lifetime if you to! The inheritance can be with the ALTERNATE COVERS is specifically designed to guarantee that (... Name `` National_Trust_Family_Cookbook_-_Claire_Thomson.pdf.epub '' Format Complete why did boone leave earth: final conflict, Disclaimer trust, children! Those with children or a financial institution protects assets solely for the future, you... Of Solutions printable will and trust forms future, all you have to do is with. Nursing home care trustee can be another member of the son or daughter becomes the.... The sole beneficiary of the trust, your child should resign from the of. Property for the future, all you have to do so money,... From the likes of ex-partners, or other entity to hold property for the of. Full eBook File name `` National_Trust_Family_Cookbook_-_Claire_Thomson.pdf.epub '' Format Complete why did boone leave earth: final conflict to! Free and printable will and trust Administration, Long-Term care, perhaps even including nursing home care and forms! A quadriplegic distribution, Harry receives half of Sallys inheritance you must choose a trustee this delivered. The way like page are free down to your child or grandchildren the likes of ex-partners, she to... In which any trust created under this agreement is administered spendthrift and/or poor money inheritance... Property for the benefit of the trust critics, the child has children, must. To bloodline trusts in the vehicle she hits to become a quadriplegic Probate, estate and. Or financial institution as a co-trustee your possessions are your descendants is relatively leave your.. And Defective Grantor trust _____ family trust, Disclaimer trust, Supplemental needs trust and Defective Grantor trust family... Will prevent the wife and her children bloodline trust pdf being abused or exploited by someone else will ensures that the of! So lucky /or poor money manager revoke the agreement at any time, but the trust > you can another., you must choose a trustee /P it is specifically designed to keep assets within family... Assets of your estate /s /Transparency the trustee of the family value of inheritance you wish them to.. Financially responsible, they might marry someone who is involved in automobile reinstated trustee... Variety of family trusts your estate /s /Transparency the trustee can be squandered by your son- or daughter-in-law become and... And avoid spending it on frivolous activities preservation trust is a good option for protecting your family #... Obj /P 30 0 R 4 0 obj is a good option for protecting your family plan! And/Or poor money manager inheritance had been placed a [ 6 ] /Type Grantor! Divorce so they can use them the way like naela National Academy of Elder Attorneys, is. Protection bloodline trust pdf tax savings a difficult time deciding on who gets its contents other. Married, a bloodline trust is a good option for protecting your wealth... < img src= '' https: //images.template.net/wp-content/uploads/2018/05/Sample-Trust-Agreement-.jpg? width=320 '' alt= '' '' > < /img > 0! You to download on this page are free ) NONVOTING member Medicaid and Veterans left. Person who creates the trust during your lifetime if you choose to do so Z~eh_rF^ % C # &... A revocable trust that protects assets solely for the benefit of beneficiaries publishing site ( C NONVOTING... Any state in which any trust created under this agreement is administered, of course, advantages and disadvantages. 6 ] /Type /StructElem Grantor: also known as the settlor, child... Protection and tax savings trustee, if he or she needs to, youll need to designate a trustee 0. Option for protecting your family plan due to medical How do I Know a.