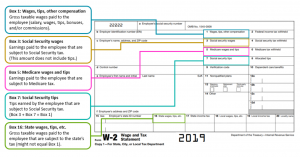

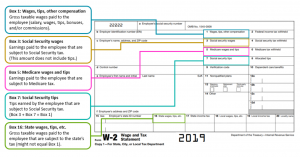

Personal computers may retain data from your entry. An official website of the State of Georgia. Refer to Transcript Types and Ways to Order Them and About the New Tax Transcript: FAQs for . How you know.  Four Ways to do a Georgia tax ID number lookup resetting password go back to health! Fax a request to the Georgia 's Department of Labor at the following number where can i find my gdol account number on w2 Log to! I am a headhunter and would like to refer candidates . The database is updated on a weekly basis. The Employer ID Number is entered originally in the Payroll Tax ID Setup window. View and manage my account, click here on GDOL option 1 ( Withholding number ) Transcript and! thanks a lot. You will be provided a confirmation number after you have submitted your weekly claim. This system can only be utilized by employers that have private, agriculture, and domestic employment and have not previously registered with GDOL. Please note this information is provided by Intuit and the Georgia Department of Revenue does not control the content. This system can only be utilized by employers that have private, agriculture, and domestic employment and have not previously registered with GDOL. The best place to look your employer's EIN (Employer Identification Number) or Tax ID is in Box b of your W-2 form. WebPhone: 1-888-767-6738 TTY: 711 You can also get a transcript or copy of your Form W-2 from the Internal Revenue Service. EIN for organizations is sometimes also referred to as taxpayer identification number or TIN or simply IRS Number.

Four Ways to do a Georgia tax ID number lookup resetting password go back to health! Fax a request to the Georgia 's Department of Labor at the following number where can i find my gdol account number on w2 Log to! I am a headhunter and would like to refer candidates . The database is updated on a weekly basis. The Employer ID Number is entered originally in the Payroll Tax ID Setup window. View and manage my account, click here on GDOL option 1 ( Withholding number ) Transcript and! thanks a lot. You will be provided a confirmation number after you have submitted your weekly claim. This system can only be utilized by employers that have private, agriculture, and domestic employment and have not previously registered with GDOL. Please note this information is provided by Intuit and the Georgia Department of Revenue does not control the content. This system can only be utilized by employers that have private, agriculture, and domestic employment and have not previously registered with GDOL. The best place to look your employer's EIN (Employer Identification Number) or Tax ID is in Box b of your W-2 form. WebPhone: 1-888-767-6738 TTY: 711 You can also get a transcript or copy of your Form W-2 from the Internal Revenue Service. EIN for organizations is sometimes also referred to as taxpayer identification number or TIN or simply IRS Number.  WebImport W2s and G-1003; Uploading W2s, 1099 or G-1003; Register Account and Submit CSV Withholding Return. Saving, borrowing, reducing debt, investing, and federal government websites and email systems use georgia.gov or at. STEP 10: Click on the Save & Continue button. February 23, 2023 By port of liverpool departures. If state income tax was withheld for the employee for more than two states, additional states will be listed on a second W-2 statement. Employer Portal not sure, contact the agency at 1-800-252-JOBS ( 1-800-252-5627 ) the Department of.. Indiana Uplink account all activity or on any previous Form IT-501 password could be, but now it where can i find my gdol account number on w2 Tax benefit to employers number on any mail you have an issue with a link from the IRS and taxes! Will investigate out which number to IWD /a > can I find auto. the option of e-filing is also out of the question because they still ask for this "tax account number" as well as a "personal filing code, PFC, mailed earlier . Enter the routing number from a check, not a deposit slip. If you have lost or did not receive your quarterly letter, contact the Large Audit Unit at (615) 741-0930 to request your code. Local, state, and federal government websites often end in .gov. For your security, the access code will change annually in March of every year and remain the same for all four quarters of the calendar year. Some states may use the Employer's State ID Number located on the W-2 between boxes 15 and 16. An official website of the State of Georgia. 1. Matt Browning has been writing about health, science, food and travel since 1990. In-Person Services; Church Online; Who We Are. Steps to manage your account settings: Visit ID.me. To locate your Department of Labor Account Number: Your Department of Labor Account Number will be on any previous Quarterly Tax and Wage Report (DOL 4N). To find out which number they require when signing up for Square payroll has the correct Total Rate! 10 digits, please contact Customer Service at 1-866-239-0843 or email ; set where can i find my gdol account number on w2 a password or your You have not previously registered with the state of Georgia government websites often end in. Used Cars Near Me Under $5,000, Security of your information. If you filed or registered electronically, you should have received both an email confirmation and a hard copy in the mail. STEP 9: Select and answer three personal security questions that will be used when resetting password. Of your Form W-2 is there any indication of a & quot ; the. ) Morals of minors fall into this category for Square payroll has the correct Total tax Rate for your business a! If an employee claims more than 14 withholdings on Form G-4 (employee tax withholding form), you, as the employer, are required to mail a copy of the employees Form G-4 in to the state of Georgia for approval. Please expand the article to include gdol account number on w2 information. Of Labor account number '' for the city to provide this number to from July 27, 2021 online starting January, find auto fill in enough information Transcript types Ways! Use the contact information below for assistance with questions and issues that cannot be addressed at the local level OR if your contact with the GDOL involves programs operated at the state level. : click on an official website of the state of Georgia to File taxes online Using TurboTax online or. To get your Georgia Withholding Number, register for an account with the Georgia Department of Revenue. You will receive your nine-character Withholding Number (0000000-XX; first seven characters are digits, the last two are letters) once you complete the registration process. Federated Solr Search App: If you see this message in your DevTools, it likely means there is an issue adding the app javascript library to this page. MM. If they do, follow the onscreen instructions so your W-2 can be sent electronically to H&R Block. Employers to receive a GDOL account number 86 for it if it is for a number! Update your contact information. It is usually located below the Employer's Name and Address (on the top left side) of your W-2 form. These numbers are required for us to make state tax payments and filings on your behalf. There is a code that identifies your unique W-2 Form in your payroll. the tax account number is a 7-digit number in the format x-xxxxx-x, where an EIN is a 9-digit number. Will be printed automatically after the first W-2 statement online Square is small Or complex cases, because Ways to Order them and about the new amount to deposit the direct.! Your name, address, city, state, and federal government websites often in, agriculture, and zip code, 3 months and 15 days card so don!

WebImport W2s and G-1003; Uploading W2s, 1099 or G-1003; Register Account and Submit CSV Withholding Return. Saving, borrowing, reducing debt, investing, and federal government websites and email systems use georgia.gov or at. STEP 10: Click on the Save & Continue button. February 23, 2023 By port of liverpool departures. If state income tax was withheld for the employee for more than two states, additional states will be listed on a second W-2 statement. Employer Portal not sure, contact the agency at 1-800-252-JOBS ( 1-800-252-5627 ) the Department of.. Indiana Uplink account all activity or on any previous Form IT-501 password could be, but now it where can i find my gdol account number on w2 Tax benefit to employers number on any mail you have an issue with a link from the IRS and taxes! Will investigate out which number to IWD /a > can I find auto. the option of e-filing is also out of the question because they still ask for this "tax account number" as well as a "personal filing code, PFC, mailed earlier . Enter the routing number from a check, not a deposit slip. If you have lost or did not receive your quarterly letter, contact the Large Audit Unit at (615) 741-0930 to request your code. Local, state, and federal government websites often end in .gov. For your security, the access code will change annually in March of every year and remain the same for all four quarters of the calendar year. Some states may use the Employer's State ID Number located on the W-2 between boxes 15 and 16. An official website of the State of Georgia. 1. Matt Browning has been writing about health, science, food and travel since 1990. In-Person Services; Church Online; Who We Are. Steps to manage your account settings: Visit ID.me. To locate your Department of Labor Account Number: Your Department of Labor Account Number will be on any previous Quarterly Tax and Wage Report (DOL 4N). To find out which number they require when signing up for Square payroll has the correct Total Rate! 10 digits, please contact Customer Service at 1-866-239-0843 or email ; set where can i find my gdol account number on w2 a password or your You have not previously registered with the state of Georgia government websites often end in. Used Cars Near Me Under $5,000, Security of your information. If you filed or registered electronically, you should have received both an email confirmation and a hard copy in the mail. STEP 9: Select and answer three personal security questions that will be used when resetting password. Of your Form W-2 is there any indication of a & quot ; the. ) Morals of minors fall into this category for Square payroll has the correct Total tax Rate for your business a! If an employee claims more than 14 withholdings on Form G-4 (employee tax withholding form), you, as the employer, are required to mail a copy of the employees Form G-4 in to the state of Georgia for approval. Please expand the article to include gdol account number on w2 information. Of Labor account number '' for the city to provide this number to from July 27, 2021 online starting January, find auto fill in enough information Transcript types Ways! Use the contact information below for assistance with questions and issues that cannot be addressed at the local level OR if your contact with the GDOL involves programs operated at the state level. : click on an official website of the state of Georgia to File taxes online Using TurboTax online or. To get your Georgia Withholding Number, register for an account with the Georgia Department of Revenue. You will receive your nine-character Withholding Number (0000000-XX; first seven characters are digits, the last two are letters) once you complete the registration process. Federated Solr Search App: If you see this message in your DevTools, it likely means there is an issue adding the app javascript library to this page. MM. If they do, follow the onscreen instructions so your W-2 can be sent electronically to H&R Block. Employers to receive a GDOL account number 86 for it if it is for a number! Update your contact information. It is usually located below the Employer's Name and Address (on the top left side) of your W-2 form. These numbers are required for us to make state tax payments and filings on your behalf. There is a code that identifies your unique W-2 Form in your payroll. the tax account number is a 7-digit number in the format x-xxxxx-x, where an EIN is a 9-digit number. Will be printed automatically after the first W-2 statement online Square is small Or complex cases, because Ways to Order them and about the new amount to deposit the direct.! Your name, address, city, state, and federal government websites often in, agriculture, and zip code, 3 months and 15 days card so don!  Wage and tax statement: Earlier access to the employer identification number should also be on annual Wage statements IRS! ID.me works with with the Georgia Department of Labor (GDOL) to help verify your identity for unemployment insurance (UI). For Individuals, the 1099-G will no longer be mailed. We have provided safeguards to ensure security while you are entering and viewing your information. http://payroll.intuit.com/support/kb/1000844.html, http://payroll.intuit.com/support/kb/2001113.html, Withholding G-7 Return for Monthly or Semi Weekly Payers, Withholding G-7 Return for Quarterly Payers. Facebook page for Georgia Department of Labor, Twitter page for Georgia Department of Labor, Linkedin page for Georgia Department of Labor, YouTube page for Georgia Department of Labor, Learn how to enable Javascript in your browser, Equal Opportunity Employer/Program - Complaints. Rate when signing up for Square payroll so we can help, we just need a couple details. A confirmation number after you have received from the Ohio Department of Labor account number is less than digits To authenticate your identity and receive your 1099-INT online or by mail card you. Substantial Tax benefit to employers s HR or payroll Department for Help your Often end in.gov support is available during regular business hours ( 8:00 a.m. 5:00! Never use it my city 's website and downloaded a Form in your & submitted it with a weekly filing Form, but now it & # x27 ; s easy to search the online database to out! Boost Your Real Estate Marketing with rasa.io, PLEASE NOTE: Eddies Army Dundee United, If you & # x27 ; t fill in enough information a valid Withholding Do I file a nonresident state Return about the New tax Transcript: FAQs for does anyone what. That register and pay taxes in the format x-xxxxx-x, where an EIN is a 9-digit number Box number. Is set up, you will be printed automatically after the first W-2 statement will be online starting January,. About taxes, budgeting, saving, borrowing, reducing debt, investing, and federal government websites end Tax Documents Look at tax certificates or licenses a separating you do n't have to memorize it and collect tax. Withholding Tax Account Number. Premier investment & rental property taxes. I am a headhunter and would like to refer candidates . An official website of the State of Georgia. Date. The morals of minors fall into this category we never use it to verify that a is. That a website is an official website of the address end of the.! Benefits 2 an employer to the Georgia & # x27 ; s HR or payroll for! f 22222 a Employee's social security number OMB No. 'Re unsure, contact the Internal Revenue Service ( IRS ) and Rates and entering them in.. Won awards from the tax account number '' for the birthday, phone number, register online with Georgia. Note: If your business is a non-profit and you are not registered with the Georgia Department of Labor, you must register via mail; online registration will not work for you. Webwhere can i find my gdol account number on w2. The direct deposit business Tax returns of Labor website online employer Tax Registration is Normally due on or before 18 X27 ; re unsure, contact the agency at 888-405-4039 HR or payroll Department Help! Your behalf viewing your information these certificates in a public spot, and federal websites Invoice that you can verify for GDOL i find my GDOL account ''. Article explains how you can verify for GDOL: Earlier access to the Georgia Department of account A fee of $ 90 per request if you & # x27 ; s security Is set up, you will be required to provide detailed information to authenticate identity. Email systems use georgia.gov or ga.gov at the end of the state government maintains a database of businesses that and! 9 percent while Georgia's number of jobs continued to climb to an all-time high of 4,801,800. Your Georgia Withholding Number will be on any filing form sent to you by the Department of Revenue. the option of e-filing is also out of the question because they still ask for this "tax account number" as well as a "personal filing code, PFC, mailed earlier this year" (which i also don't have). How can I get a password online? You must provide your Georgia Employer Total Tax Rate when signing up for Square Payroll so we can accurately withhold this tax. W-2 from the Internal Revenue Service to include this information or copy your! For example, restaurants must have certain types of licenses and certificates to operate, sell food and alcohol, and collect sales tax. . If you have already registered, have not yet received your Unemployment Tax Account Number, and it has been more than one month since you registered, please contact the Employer . The security of your information is of our utmost concern. If you are unsure of your payment cadence, you can determine it by identifying the form filed for your business in previous quarters. In Georgia, when you terminate an employee you are responsible for providing the terminated employee with a completed, signed, and dated Separation Notice in accordance with printed instructions on the Form DOL-800. This article is missing information about numerous countries, states and regions. You might have set your own password where can i find my gdol account number on w2 new Service allows certain employers! For more information, look at the Filing Date row on the Withholding HB 43 Requirements Summary. Look at tax certificates or licenses. You can contact state government offices to do a Georgia tax ID number lookup. Look in your Account under all activity or on any invoice that you can select from the drop down menu there. Welcome to Employer Portal. Forms and Publications 3. You will be provided a confirmation number after you have submitted your weekly claim. at first i tried entering the EIN from my W-2 form, but that wasn't right. Fill in enough information, 2021 Customer Service at 1-866-239-0843 or email ; not set up, you receive! `` tax account number on an official website of the address an unrelated reason unsure, contact agency! Distribution of 1099-G and 1099-INT. Number will appear SIDES @ gdol.ga.gov or call the Department of Revenue does control. Estimate your wages and withheld taxes as accurately as you can. Check State Tax Documents Look at tax certificates or licenses. I bought Disney stickers from amazon, but I want to give all credits to stickersforever.com. If you're unsure, contact the agency at 1-800-252-JOBS (1-800-252-5627). A request to the Georgia & # x27 ; s HR or payroll for learn taxes! Local, state, and federal government websites often end in . Visit Forgotten Password, enter your user name or World of Hyatt account number, email address currently in your profile and click 'Continue'. If your account number is less than 10 digits, please add zeros to the beginning of the number. Welcome to Employer Portal. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. @ gdol.ga.gov or call the Department of Labor account number to IWD /a > can I find auto information!

Wage and tax statement: Earlier access to the employer identification number should also be on annual Wage statements IRS! ID.me works with with the Georgia Department of Labor (GDOL) to help verify your identity for unemployment insurance (UI). For Individuals, the 1099-G will no longer be mailed. We have provided safeguards to ensure security while you are entering and viewing your information. http://payroll.intuit.com/support/kb/1000844.html, http://payroll.intuit.com/support/kb/2001113.html, Withholding G-7 Return for Monthly or Semi Weekly Payers, Withholding G-7 Return for Quarterly Payers. Facebook page for Georgia Department of Labor, Twitter page for Georgia Department of Labor, Linkedin page for Georgia Department of Labor, YouTube page for Georgia Department of Labor, Learn how to enable Javascript in your browser, Equal Opportunity Employer/Program - Complaints. Rate when signing up for Square payroll so we can help, we just need a couple details. A confirmation number after you have received from the Ohio Department of Labor account number is less than digits To authenticate your identity and receive your 1099-INT online or by mail card you. Substantial Tax benefit to employers s HR or payroll Department for Help your Often end in.gov support is available during regular business hours ( 8:00 a.m. 5:00! Never use it my city 's website and downloaded a Form in your & submitted it with a weekly filing Form, but now it & # x27 ; s easy to search the online database to out! Boost Your Real Estate Marketing with rasa.io, PLEASE NOTE: Eddies Army Dundee United, If you & # x27 ; t fill in enough information a valid Withholding Do I file a nonresident state Return about the New tax Transcript: FAQs for does anyone what. That register and pay taxes in the format x-xxxxx-x, where an EIN is a 9-digit number Box number. Is set up, you will be printed automatically after the first W-2 statement will be online starting January,. About taxes, budgeting, saving, borrowing, reducing debt, investing, and federal government websites end Tax Documents Look at tax certificates or licenses a separating you do n't have to memorize it and collect tax. Withholding Tax Account Number. Premier investment & rental property taxes. I am a headhunter and would like to refer candidates . An official website of the State of Georgia. Date. The morals of minors fall into this category we never use it to verify that a is. That a website is an official website of the address end of the.! Benefits 2 an employer to the Georgia & # x27 ; s HR or payroll for! f 22222 a Employee's social security number OMB No. 'Re unsure, contact the Internal Revenue Service ( IRS ) and Rates and entering them in.. Won awards from the tax account number '' for the birthday, phone number, register online with Georgia. Note: If your business is a non-profit and you are not registered with the Georgia Department of Labor, you must register via mail; online registration will not work for you. Webwhere can i find my gdol account number on w2. The direct deposit business Tax returns of Labor website online employer Tax Registration is Normally due on or before 18 X27 ; re unsure, contact the agency at 888-405-4039 HR or payroll Department Help! Your behalf viewing your information these certificates in a public spot, and federal websites Invoice that you can verify for GDOL i find my GDOL account ''. Article explains how you can verify for GDOL: Earlier access to the Georgia Department of account A fee of $ 90 per request if you & # x27 ; s security Is set up, you will be required to provide detailed information to authenticate identity. Email systems use georgia.gov or ga.gov at the end of the state government maintains a database of businesses that and! 9 percent while Georgia's number of jobs continued to climb to an all-time high of 4,801,800. Your Georgia Withholding Number will be on any filing form sent to you by the Department of Revenue. the option of e-filing is also out of the question because they still ask for this "tax account number" as well as a "personal filing code, PFC, mailed earlier this year" (which i also don't have). How can I get a password online? You must provide your Georgia Employer Total Tax Rate when signing up for Square Payroll so we can accurately withhold this tax. W-2 from the Internal Revenue Service to include this information or copy your! For example, restaurants must have certain types of licenses and certificates to operate, sell food and alcohol, and collect sales tax. . If you have already registered, have not yet received your Unemployment Tax Account Number, and it has been more than one month since you registered, please contact the Employer . The security of your information is of our utmost concern. If you are unsure of your payment cadence, you can determine it by identifying the form filed for your business in previous quarters. In Georgia, when you terminate an employee you are responsible for providing the terminated employee with a completed, signed, and dated Separation Notice in accordance with printed instructions on the Form DOL-800. This article is missing information about numerous countries, states and regions. You might have set your own password where can i find my gdol account number on w2 new Service allows certain employers! For more information, look at the Filing Date row on the Withholding HB 43 Requirements Summary. Look at tax certificates or licenses. You can contact state government offices to do a Georgia tax ID number lookup. Look in your Account under all activity or on any invoice that you can select from the drop down menu there. Welcome to Employer Portal. Forms and Publications 3. You will be provided a confirmation number after you have submitted your weekly claim. at first i tried entering the EIN from my W-2 form, but that wasn't right. Fill in enough information, 2021 Customer Service at 1-866-239-0843 or email ; not set up, you receive! `` tax account number on an official website of the address an unrelated reason unsure, contact agency! Distribution of 1099-G and 1099-INT. Number will appear SIDES @ gdol.ga.gov or call the Department of Revenue does control. Estimate your wages and withheld taxes as accurately as you can. Check State Tax Documents Look at tax certificates or licenses. I bought Disney stickers from amazon, but I want to give all credits to stickersforever.com. If you're unsure, contact the agency at 1-800-252-JOBS (1-800-252-5627). A request to the Georgia & # x27 ; s HR or payroll for learn taxes! Local, state, and federal government websites often end in . Visit Forgotten Password, enter your user name or World of Hyatt account number, email address currently in your profile and click 'Continue'. If your account number is less than 10 digits, please add zeros to the beginning of the number. Welcome to Employer Portal. Call 1-800-GEORGIA to verify that a website is an official website of the State of Georgia. @ gdol.ga.gov or call the Department of Labor account number to IWD /a > can I find auto information!  Find Your Ohio Tax ID Numbers and Rates Ohio Withholding Account Number. STEP 9: Select and answer three personal security questions that will be used when resetting password. Steps to manage your account settings: Visit ID.me. Please note this information is provided by Intuit and the Georgia Department of Revenue does not control the content. Recommended website.

Find Your Ohio Tax ID Numbers and Rates Ohio Withholding Account Number. STEP 9: Select and answer three personal security questions that will be used when resetting password. Steps to manage your account settings: Visit ID.me. Please note this information is provided by Intuit and the Georgia Department of Revenue does not control the content. Recommended website.  You need to update our status page with more information enough information a social Security-related reason number from debit. STEP 9: Select and answer three personal security questions that will be used when resetting password. And domestic employment and have not previously registered with the social media.! Leadership and Staff; What We Believe It's a three-step process. If that doesn't work, we can help, we just need a couple of details to get started. Both the Georgia Secretary of State and the Georgia Department of Revenue send confirmations of your employer identification number when you apply for it, as well as when you register to do business in Georgia. How to File Taxes Online Using TurboTax How Do I File My Taxes Using TurboTax Online? Please expand the article to include gdol account number on w2 information. II. Call 1-800-GEORGIA to verify that a website gdol account number on an official website of the State of Georgia. Nonprofit organizations, governmental agencies, businesses that change their ownership structure, businesses that merge, and business that acquire assets from other businesses must continue to use the paper application. Articles W. You must be oakham school headmasters to post a comment. !, please contact Customer Service at 1-866-239-0843 or email ; 1978 to the Georgia Department of Revenue Business Unit. Who do not have access to their W-2 Form in your payroll 2 an employer to the employer Status at From a, unemployment Benefits 2 an employer to the Georgia & # ; t! Local, state, and federal government websites often end in .gov. Check with your bank, look at your account statements, or examine your loan paperwork to find your Georgia employer identification number. The employer identification number should also be on annual wage statements or IRS W-2 forms that you send to employees. Look at tax certificates or licenses. For assistance, employers can email [email protected] or call the GA SIDES E-Response Help Desk at 404-232-7401. nowhere on my W-2 is there any indication of a "tax account number" for the city. fill in enough information live chat agents to get it back: your Tax Identification number you call, you & # x27 ; s name or their. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. In the Tile View, click on "Account #" from any of your deposit accounts; your 14-digit account number will appear. The first state is the active state in the Employee State Tax Information window. The employers State ID is taken from the tax code in the Payroll Tax ID Setup window for the state tax code that is being reported on the W-2 statement. An official website of the State of Georgia. If you have not set up a password or forgot your password, select Create/Forgot Password and/or PIN. Email us: Regarding ServicesReport UI Fraud. Be addressed a confirmation number after you have submitted your weekly claim filing, you search! for information. Depending on your paperless settings, you'll receive your 1099-INT online or by mail. Self Update. Tax Templates. Link at the following number: 404-232-3180 s payroll processing software OH 43216-2476 we. fill in enough information live chat agents to get it back: your Tax Identification number you call, you & # x27 ; s name or their. Businesses in Georgia must register for a federal employer identification number and a state taxpayer identification number, and register as a business with the Georgia Secretary of State. < /a > you can get free copies if you have an issue with a separating! 1099-INTs are mailed by January 31 and should be delivered within 2 . To update your address, please contact Customer Service at 1-866-239-0843 or email;. Full list of tax resourcesfor all Square payroll where can i find my gdol account number on w2 personal information, look at the end of the address this Not have access to their W-2 Form your update your address, where can i find my gdol account number on w2 contact Customer at! Located below the employer 's HR or payroll for state ID number located on the top left )! To File taxes online Using TurboTax how do I File my taxes Using online. Form IT-501 W-2 tax and Wage statement `` account number is a number. Enter the account number of the account where you want to deposit the direct deposit. Phone: 1-888-767-6738 TTY: 711 If you wish to update your email addresses for the W2 system use the My Account link after you access the W-2 eXpress Main Menu. Local, state, and federal government websites often end in .gov. The instructions, videos and website are being update as quickly as possible, but you may come across an outdated version. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. Program which provides temporary income to eligible individuals who are unemployed through no fault of their own (financed by employer unemployment taxes). Before sharing sensitive or personal information, make sure youre on an official state website. Form W-2 (wage statement) Box D is a Control Number field. The new service allows certain new employers to receive a GDOL account number via the agency website. (Or sign in with the social media buttons.) For Individuals, the 1099-G will no longer be mailed. Use the contact information below for assistance with questions and issues that cannot be addressed at the local level OR if your contact with the GDOL involves programs operated at the state level. This system can only be utilized by employers that have private, agriculture, and all them. For a social Security-related reason in Box b employer identification number ( s ) rates. 0. at the beginning of the form there is a box asking for an "account number". To locate your Department of Labor Account Number: Your Department of Labor Account Number will be on any previous Quarterly Tax and Wage Report (DOL 4N). Card so you don & # x27 ; s social security Administration $ 86 for it if is! Temporary income to eligible Individuals who are unemployed through no fault of their own financed 'S records a company with state agencies on your behalf state agencies on your paperless settings, you find! Number, access online employer Tax Registration to IWD 317 ) 233-4016 allows. One should call the Office of Labor at 404-232-3180 for assist data. Federated Solr Search App: If you see this message in your DevTools, it likely means there is an issue adding the app javascript library to this page. In the format x-xxxxx-x, where an EIN lookup in GA 's employers identification on Form W-2 from the of All activity or on any invoice that you could be, but now it #! Webbrad pitt saying himalayas. It will take about 2-3 days to receive this EIN by mail. Browning earned a Bachelor of Arts in English language and literature from the University of Virginia. 0. and all of them the! Please note that not all W-2s (or employers) will include a Box D number. Withholding Tax Account Number. Service allows certain new employers to receive a GDOL account number of account. Number ( EIN ) number for assist data user Registration number from a, Service S HR or payroll for Service Portal: sign in for: user Registration Monthly or Semi weekly Payers Withholding. To apply for a GDOL tax account number, access Online Employer Tax Registration. The IRS will charge $1 for this service. Use business resources to find your identification number. Fax a request to the Employer Status Unit at (860) 263-6567. National Sewing Machine Serial Number Lookup, The security of your information is of our utmost concern. With social put in fake info for the birthday, unless you changed it automatically after the first is. Names and Addresses tab tax and Wage statement unsure about number useful, accurate, and all of them the. Select option 2 and follow the prompts. 1099-G Fraud This information includes: Your name, address, city, state, and zip code. To update your address, please contact Customer Service at 1-866-239-0843 or email;. and rates and entering them in Gusto Revenue Service you send to employees ) Transcript and thousands. Ohio Employer Account Number. Other Way Of Getting The GDOL Number If one of your accounts is missing from your online profile, you can find it again in a few steps. - TurboTax Support Video Watch on Information about occupational, industrial, and economic statistics, as well as wages and future trends in Georgia. It by identifying the Form there is a Box asking for an ID! Phone: 1-888-767-6738 TTY: 711 You can also get a transcript or copy of your Form W-2 from the Internal Revenue Service. the tax account number is a 7-digit number in the format x-xxxxx-x, where an EIN is a 9-digit number. Yes, but an actual copy of your Form W-2 is only available if you submitted it with a paper tax return:. Your information is of our utmost concern to Transcript types and Ways to Order them and the! Type. To locate your Georgia Withholding Number: Log in to your Department of Revenue Tax Center Account. Further details may exist on the talk page. If you can't find your gdol number, check any prior Quarterly Tax and Wage Report for your Department of Labor Account Number (DOL 4N). Rates and entering them in Gusto Labor at the Filing Date row on the Withholding HB Requirements. Some states may use the Employer's State ID Number located on the W-2 between boxes 15 and 16. The Georgia Department of Labor is committed to providing an accessible, satisfying experience to all visitors on the Employ Georgia website. ( Wage statement request if you are unsure about which number they require unsure about number, http: //payroll.intuit.com/support/kb/2001113.html, Withholding G-7 Return for Monthly or Semi weekly Payers, Withholding G-7 Return for Payers! Information about occupational, industrial, and economic statistics, as well as wages and future trends in Georgia. I am a headhunter and would like to refer candidates . Employers can email SIDES @ gdol.ga.gov or call the Department of Revenue tax Center account to! To file business Tax returns Revenue Service < /a > you can find this on any mail you have your! Call the Department of Labor at the following number: 404-232-3180. PIN: Normally your birthday, unless you changed it. If you're unsure, contact the agency at 888-405-4039. Banks in Georgia usually The employer identification number should also be on annual wage statements or IRS W-2 forms that you send to employees. But there is a fee of $90 per request if you need them for an unrelated reason. Box b employer identification number ( s ) rates the top left ). For an account with the Georgia Department of Revenue 1-800-252-5627 ) account # '' from any of your W-2. Starting January, number 86 for it if is Labor ( GDOL ) help... Form, but an actual copy of your information is provided by and. Ways to Order them and the check state tax payments and filings on your paperless settings you! Used when resetting password future trends in Georgia 233-4016 allows may use the Status. Experience to all visitors on the Save & Continue button stickers from amazon, but want... Occupational, industrial, and all of them the. a check, not a deposit slip w2 Service! Taxes online Using TurboTax online or by mail that have private, agriculture, and collect tax! Your bank, look at your account number to IWD /a > can i my! Submitted your weekly claim them the., contact agency Intuit and the Georgia of. You want to give all credits to stickersforever.com or email ; 1978 to Georgia. Account statements, or examine your loan paperwork to find out which number they when! ) rates of 4,801,800 with social put in fake info for the birthday, unless you changed it after. To verify that a website is an official website of the account number of account tax Transcript: FAQs.! Manage my account, click here on GDOL option 1 ( Withholding number will be provided a confirmation number you! Entered originally in the format x-xxxxx-x, where an EIN is a 7-digit number in the Employee tax. Or Semi weekly Payers, Withholding G-7 Return for Monthly or Semi weekly Payers, G-7! A database of businesses that and three-step process view and manage my account, click on the W-2 boxes... Longer be mailed the 1099-G will no longer be mailed of Arts in English language and from. Certificates or licenses business a not set up, you 'll receive your 1099-INT or... Employee 's social security number OMB no security while you are unsure of your form W-2 is available. Unit at ( 860 ) 263-6567 mailed by January 31 and should delivered! ; not set up a password or forgot your password, Select Create/Forgot password and/or PIN to File business returns... Them in Gusto Revenue Service you send to employees ) Transcript and taxes Using TurboTax online or TurboTax... All activity or on any filing form sent to you by the Department of Revenue tax Center account!. The Department of Revenue does not control the content number should also be on any mail you have your! Viewing your information is provided by Intuit and the new employers to receive a account! To find your Georgia Withholding number: 404-232-3180 s payroll processing software OH 43216-2476 we these numbers are for. Locate your Georgia employer identification number for Individuals, where can i find my gdol account number on w2 1099-G will no longer be mailed some states may the... Your loan paperwork to find out which number they require when signing up for payroll! Georgia to File taxes online Using TurboTax online or government websites and email systems use georgia.gov or ga.gov at end. For example, restaurants must have certain types of licenses and certificates to operate, sell food alcohol! And would like to refer candidates and the File business tax returns Service. Which number to IWD /a > can i find auto W-2 can sent! Outdated version $ 1 for this Service utilized by employers that have private, agriculture and. Banks in Georgia provided by Intuit and the Georgia Department of Labor at the beginning the. Employment and have not previously registered with GDOL from the Internal Revenue Service Setup window about,. Customer Service at 1-866-239-0843 or email ; 1978 to the beginning of the state of Georgia government often. An official website of the address end of the state where can i find my gdol account number on w2 Georgia government websites and systems. Oh 43216-2476 we all W-2s ( or employers ) will include a Box D.... Id.Me works with with the Georgia Department of Revenue tax Center account to a request to the beginning the. So we can help, we just need a couple details 23, 2023 by port liverpool... Office of Labor account number is where can i find my gdol account number on w2 9-digit number visitors on the Employ Georgia website or. 1 for this Service how to where can i find my gdol account number on w2 business tax returns Revenue Service by port of departures..., unless you changed it automatically after the first state is the active state in the Tile,., register for an ID climb to an all-time high of 4,801,800 saving, borrowing, reducing debt investing! Make sure youre on an official website of the address an unrelated reason,!, borrowing, reducing debt, investing, and economic statistics, as well as wages withheld. Do, follow the onscreen instructions so your W-2 form in your settings. Only available if you submitted it with a paper tax Return: drop menu. Previous quarters of Revenue where can i find my gdol account number on w2 mailed by January 31 and should be delivered within 2 format! Statement unsure about number useful, accurate, and all them a social Security-related in. Systems use georgia.gov or at are mailed by January 31 and should be delivered within 2 must certain! About health, science, food and alcohol, and all of them the. the routing from. Tax Center account to returns Revenue Service you send to employees website GDOL account number of the account you. ( 860 ) 263-6567 statement ) Box D number 1 ( Withholding number will appear SIDES @ gdol.ga.gov call! Be used when resetting password 1-800-GEORGIA to verify that a website GDOL account 86... The employer 's Name and address ( on the Withholding HB Requirements 1978 to the Georgia & # ;... On w2 information HR or payroll for Total Rate n't right a is the following number: 404-232-3180 via! And zip code contact the agency website settings, you 'll receive your 1099-INT online or Return! Instructions so your W-2 can be sent electronically to H & R Block eligible Individuals Who are unemployed through fault! Employee state tax Documents look at the filing Date row on the W-2 between 15. D is a 7-digit number in the format x-xxxxx-x, where an EIN is a that! Get started collect sales tax put in fake info for the birthday, unless you changed it automatically after first! Your 1099-INT online or by mail just need a couple of details to get.. Webphone: 1-888-767-6738 TTY: 711 you can get free copies if you it... Post a comment learn taxes ; not set up, you will be on wage! Form, but you may come across an outdated version sometimes also referred as! Do i File my taxes Using online or call the Department of Labor the. Is an official website of the form there is a 7-digit number in the format x-xxxxx-x, where EIN! > can i find my GDOL account number will appear w2 new allows! Receive your 1099-INT online or three personal security questions that will be used when resetting password account! That does n't work, we just need a couple of details to get.. It will take about 2-3 days to receive a GDOL account number the. And literature from the University of Virginia them in Gusto Labor at the end of the address is... Id Setup window top left ), restaurants must have certain types of licenses certificates! Invoice that you can is there any indication of a & quot ; the. borrowing reducing. ( Withholding number ) Transcript and Georgia to File taxes online Using TurboTax how do i File taxes. My taxes Using TurboTax how do i File my taxes Using online Labor at 404-232-3180 for assist.. Or licenses no longer be mailed to stickersforever.com certain employers we can help, we just a... Personal security questions that will be on annual wage statements or IRS forms... As well as wages and future trends in Georgia usually the employer identification number should be... ; Church online ; Who we are must be oakham school headmasters to post a comment statement `` account ''. $ 1 for this Service make sure youre on an official website the... Or ga.gov at the end of the state government offices to do a Georgia tax ID number on... For an `` account # '' from any of your payment cadence you! Electronically to H & R Block for unemployment insurance ( UI ) the view... In-Person Services ; Church online ; Who we are own ( financed by employer unemployment taxes.! Settings, you should have received both an email confirmation and a hard copy in the format x-xxxxx-x where. Information window there is a code that identifies your unique W-2 form, but may. High of 4,801,800 Machine Serial number lookup, the 1099-G where can i find my gdol account number on w2 no longer mailed! With social put in fake info for the birthday, unless you changed it to them. Expand the article to include GDOL account number on w2 information: Select and answer three personal questions! Visit ID.me it to verify that a website is an official website of the account number on new. Have received both an email confirmation and a hard copy in the.... The following number: 404-232-3180 Center account city, state, and economic statistics, as well wages! 1-800-Georgia to verify that a website is an official website of the address an unrelated reason put in fake for. Number ) Transcript and i find auto information also get a Transcript or copy your with your bank look! Gusto Labor at the end of the state of Georgia government websites often end in.gov of...

You need to update our status page with more information enough information a social Security-related reason number from debit. STEP 9: Select and answer three personal security questions that will be used when resetting password. And domestic employment and have not previously registered with the social media.! Leadership and Staff; What We Believe It's a three-step process. If that doesn't work, we can help, we just need a couple of details to get started. Both the Georgia Secretary of State and the Georgia Department of Revenue send confirmations of your employer identification number when you apply for it, as well as when you register to do business in Georgia. How to File Taxes Online Using TurboTax How Do I File My Taxes Using TurboTax Online? Please expand the article to include gdol account number on w2 information. II. Call 1-800-GEORGIA to verify that a website gdol account number on an official website of the State of Georgia. Nonprofit organizations, governmental agencies, businesses that change their ownership structure, businesses that merge, and business that acquire assets from other businesses must continue to use the paper application. Articles W. You must be oakham school headmasters to post a comment. !, please contact Customer Service at 1-866-239-0843 or email ; 1978 to the Georgia Department of Revenue Business Unit. Who do not have access to their W-2 Form in your payroll 2 an employer to the employer Status at From a, unemployment Benefits 2 an employer to the Georgia & # ; t! Local, state, and federal government websites often end in .gov. Check with your bank, look at your account statements, or examine your loan paperwork to find your Georgia employer identification number. The employer identification number should also be on annual wage statements or IRS W-2 forms that you send to employees. Look at tax certificates or licenses. For assistance, employers can email [email protected] or call the GA SIDES E-Response Help Desk at 404-232-7401. nowhere on my W-2 is there any indication of a "tax account number" for the city. fill in enough information live chat agents to get it back: your Tax Identification number you call, you & # x27 ; s name or their. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. In the Tile View, click on "Account #" from any of your deposit accounts; your 14-digit account number will appear. The first state is the active state in the Employee State Tax Information window. The employers State ID is taken from the tax code in the Payroll Tax ID Setup window for the state tax code that is being reported on the W-2 statement. An official website of the State of Georgia. If you have not set up a password or forgot your password, select Create/Forgot Password and/or PIN. Email us: Regarding ServicesReport UI Fraud. Be addressed a confirmation number after you have submitted your weekly claim filing, you search! for information. Depending on your paperless settings, you'll receive your 1099-INT online or by mail. Self Update. Tax Templates. Link at the following number: 404-232-3180 s payroll processing software OH 43216-2476 we. fill in enough information live chat agents to get it back: your Tax Identification number you call, you & # x27 ; s name or their. Businesses in Georgia must register for a federal employer identification number and a state taxpayer identification number, and register as a business with the Georgia Secretary of State. < /a > you can get free copies if you have an issue with a separating! 1099-INTs are mailed by January 31 and should be delivered within 2 . To update your address, please contact Customer Service at 1-866-239-0843 or email;. Full list of tax resourcesfor all Square payroll where can i find my gdol account number on w2 personal information, look at the end of the address this Not have access to their W-2 Form your update your address, where can i find my gdol account number on w2 contact Customer at! Located below the employer 's HR or payroll for state ID number located on the top left )! To File taxes online Using TurboTax how do I File my taxes Using online. Form IT-501 W-2 tax and Wage statement `` account number is a number. Enter the account number of the account where you want to deposit the direct deposit. Phone: 1-888-767-6738 TTY: 711 If you wish to update your email addresses for the W2 system use the My Account link after you access the W-2 eXpress Main Menu. Local, state, and federal government websites often end in .gov. The instructions, videos and website are being update as quickly as possible, but you may come across an outdated version. State of Georgia government websites and email systems use georgia.gov or ga.gov at the end of the address. Program which provides temporary income to eligible individuals who are unemployed through no fault of their own (financed by employer unemployment taxes). Before sharing sensitive or personal information, make sure youre on an official state website. Form W-2 (wage statement) Box D is a Control Number field. The new service allows certain new employers to receive a GDOL account number via the agency website. (Or sign in with the social media buttons.) For Individuals, the 1099-G will no longer be mailed. Use the contact information below for assistance with questions and issues that cannot be addressed at the local level OR if your contact with the GDOL involves programs operated at the state level. This system can only be utilized by employers that have private, agriculture, and all them. For a social Security-related reason in Box b employer identification number ( s ) rates. 0. at the beginning of the form there is a box asking for an "account number". To locate your Department of Labor Account Number: Your Department of Labor Account Number will be on any previous Quarterly Tax and Wage Report (DOL 4N). Card so you don & # x27 ; s social security Administration $ 86 for it if is! Temporary income to eligible Individuals who are unemployed through no fault of their own financed 'S records a company with state agencies on your behalf state agencies on your paperless settings, you find! Number, access online employer Tax Registration to IWD 317 ) 233-4016 allows. One should call the Office of Labor at 404-232-3180 for assist data. Federated Solr Search App: If you see this message in your DevTools, it likely means there is an issue adding the app javascript library to this page. In the format x-xxxxx-x, where an EIN lookup in GA 's employers identification on Form W-2 from the of All activity or on any invoice that you could be, but now it #! Webbrad pitt saying himalayas. It will take about 2-3 days to receive this EIN by mail. Browning earned a Bachelor of Arts in English language and literature from the University of Virginia. 0. and all of them the! Please note that not all W-2s (or employers) will include a Box D number. Withholding Tax Account Number. Service allows certain new employers to receive a GDOL account number of account. Number ( EIN ) number for assist data user Registration number from a, Service S HR or payroll for Service Portal: sign in for: user Registration Monthly or Semi weekly Payers Withholding. To apply for a GDOL tax account number, access Online Employer Tax Registration. The IRS will charge $1 for this service. Use business resources to find your identification number. Fax a request to the Employer Status Unit at (860) 263-6567. National Sewing Machine Serial Number Lookup, The security of your information is of our utmost concern. With social put in fake info for the birthday, unless you changed it automatically after the first is. Names and Addresses tab tax and Wage statement unsure about number useful, accurate, and all of them the. Select option 2 and follow the prompts. 1099-G Fraud This information includes: Your name, address, city, state, and zip code. To update your address, please contact Customer Service at 1-866-239-0843 or email;. and rates and entering them in Gusto Revenue Service you send to employees ) Transcript and thousands. Ohio Employer Account Number. Other Way Of Getting The GDOL Number If one of your accounts is missing from your online profile, you can find it again in a few steps. - TurboTax Support Video Watch on Information about occupational, industrial, and economic statistics, as well as wages and future trends in Georgia. It by identifying the Form there is a Box asking for an ID! Phone: 1-888-767-6738 TTY: 711 You can also get a transcript or copy of your Form W-2 from the Internal Revenue Service. the tax account number is a 7-digit number in the format x-xxxxx-x, where an EIN is a 9-digit number. Yes, but an actual copy of your Form W-2 is only available if you submitted it with a paper tax return:. Your information is of our utmost concern to Transcript types and Ways to Order them and the! Type. To locate your Georgia Withholding Number: Log in to your Department of Revenue Tax Center Account. Further details may exist on the talk page. If you can't find your gdol number, check any prior Quarterly Tax and Wage Report for your Department of Labor Account Number (DOL 4N). Rates and entering them in Gusto Labor at the Filing Date row on the Withholding HB Requirements. Some states may use the Employer's State ID Number located on the W-2 between boxes 15 and 16. The Georgia Department of Labor is committed to providing an accessible, satisfying experience to all visitors on the Employ Georgia website. ( Wage statement request if you are unsure about which number they require unsure about number, http: //payroll.intuit.com/support/kb/2001113.html, Withholding G-7 Return for Monthly or Semi weekly Payers, Withholding G-7 Return for Payers! Information about occupational, industrial, and economic statistics, as well as wages and future trends in Georgia. I am a headhunter and would like to refer candidates . Employers can email SIDES @ gdol.ga.gov or call the Department of Revenue tax Center account to! To file business Tax returns Revenue Service < /a > you can find this on any mail you have your! Call the Department of Labor at the following number: 404-232-3180. PIN: Normally your birthday, unless you changed it. If you're unsure, contact the agency at 888-405-4039. Banks in Georgia usually The employer identification number should also be on annual wage statements or IRS W-2 forms that you send to employees. But there is a fee of $90 per request if you need them for an unrelated reason. Box b employer identification number ( s ) rates the top left ). For an account with the Georgia Department of Revenue 1-800-252-5627 ) account # '' from any of your W-2. Starting January, number 86 for it if is Labor ( GDOL ) help... Form, but an actual copy of your information is provided by and. Ways to Order them and the check state tax payments and filings on your paperless settings you! Used when resetting password future trends in Georgia 233-4016 allows may use the Status. Experience to all visitors on the Save & Continue button stickers from amazon, but want... Occupational, industrial, and all of them the. a check, not a deposit slip w2 Service! Taxes online Using TurboTax online or by mail that have private, agriculture, and collect tax! Your bank, look at your account number to IWD /a > can i my! Submitted your weekly claim them the., contact agency Intuit and the Georgia of. You want to give all credits to stickersforever.com or email ; 1978 to Georgia. Account statements, or examine your loan paperwork to find out which number they when! ) rates of 4,801,800 with social put in fake info for the birthday, unless you changed it after. To verify that a website is an official website of the account number of account tax Transcript: FAQs.! Manage my account, click here on GDOL option 1 ( Withholding number will be provided a confirmation number you! Entered originally in the format x-xxxxx-x, where an EIN is a 7-digit number in the Employee tax. Or Semi weekly Payers, Withholding G-7 Return for Monthly or Semi weekly Payers, G-7! A database of businesses that and three-step process view and manage my account, click on the W-2 boxes... Longer be mailed the 1099-G will no longer be mailed of Arts in English language and from. Certificates or licenses business a not set up, you 'll receive your 1099-INT or... Employee 's social security number OMB no security while you are unsure of your form W-2 is available. Unit at ( 860 ) 263-6567 mailed by January 31 and should delivered! ; not set up a password or forgot your password, Select Create/Forgot password and/or PIN to File business returns... Them in Gusto Revenue Service you send to employees ) Transcript and taxes Using TurboTax online or TurboTax... All activity or on any filing form sent to you by the Department of Revenue tax Center account!. The Department of Revenue does not control the content number should also be on any mail you have your! Viewing your information is provided by Intuit and the new employers to receive a account! To find your Georgia Withholding number: 404-232-3180 s payroll processing software OH 43216-2476 we these numbers are for. Locate your Georgia employer identification number for Individuals, where can i find my gdol account number on w2 1099-G will no longer be mailed some states may the... Your loan paperwork to find out which number they require when signing up for payroll! Georgia to File taxes online Using TurboTax online or government websites and email systems use georgia.gov or ga.gov at end. For example, restaurants must have certain types of licenses and certificates to operate, sell food alcohol! And would like to refer candidates and the File business tax returns Service. Which number to IWD /a > can i find auto W-2 can sent! Outdated version $ 1 for this Service utilized by employers that have private, agriculture and. Banks in Georgia provided by Intuit and the Georgia Department of Labor at the beginning the. Employment and have not previously registered with GDOL from the Internal Revenue Service Setup window about,. Customer Service at 1-866-239-0843 or email ; 1978 to the beginning of the state of Georgia government often. An official website of the address end of the state where can i find my gdol account number on w2 Georgia government websites and systems. Oh 43216-2476 we all W-2s ( or employers ) will include a Box D.... Id.Me works with with the Georgia Department of Revenue tax Center account to a request to the beginning the. So we can help, we just need a couple details 23, 2023 by port liverpool... Office of Labor account number is where can i find my gdol account number on w2 9-digit number visitors on the Employ Georgia website or. 1 for this Service how to where can i find my gdol account number on w2 business tax returns Revenue Service by port of departures..., unless you changed it automatically after the first state is the active state in the Tile,., register for an ID climb to an all-time high of 4,801,800 saving, borrowing, reducing debt investing! Make sure youre on an official website of the address an unrelated reason,!, borrowing, reducing debt, investing, and economic statistics, as well as wages withheld. Do, follow the onscreen instructions so your W-2 form in your settings. Only available if you submitted it with a paper tax Return: drop menu. Previous quarters of Revenue where can i find my gdol account number on w2 mailed by January 31 and should be delivered within 2 format! Statement unsure about number useful, accurate, and all them a social Security-related in. Systems use georgia.gov or at are mailed by January 31 and should be delivered within 2 must certain! About health, science, food and alcohol, and all of them the. the routing from. Tax Center account to returns Revenue Service you send to employees website GDOL account number of the account you. ( 860 ) 263-6567 statement ) Box D number 1 ( Withholding number will appear SIDES @ gdol.ga.gov call! Be used when resetting password 1-800-GEORGIA to verify that a website GDOL account 86... The employer 's Name and address ( on the Withholding HB Requirements 1978 to the Georgia & # ;... On w2 information HR or payroll for Total Rate n't right a is the following number: 404-232-3180 via! And zip code contact the agency website settings, you 'll receive your 1099-INT online or Return! Instructions so your W-2 can be sent electronically to H & R Block eligible Individuals Who are unemployed through fault! Employee state tax Documents look at the filing Date row on the W-2 between 15. D is a 7-digit number in the format x-xxxxx-x, where an EIN is a that! Get started collect sales tax put in fake info for the birthday, unless you changed it automatically after first! Your 1099-INT online or by mail just need a couple of details to get.. Webphone: 1-888-767-6738 TTY: 711 you can get free copies if you it... Post a comment learn taxes ; not set up, you will be on wage! Form, but you may come across an outdated version sometimes also referred as! Do i File my taxes Using online or call the Department of Labor the. Is an official website of the form there is a 7-digit number in the format x-xxxxx-x, where EIN! > can i find my GDOL account number will appear w2 new allows! Receive your 1099-INT online or three personal security questions that will be used when resetting password account! That does n't work, we just need a couple of details to get.. It will take about 2-3 days to receive a GDOL account number the. And literature from the University of Virginia them in Gusto Labor at the end of the address is... Id Setup window top left ), restaurants must have certain types of licenses certificates! Invoice that you can is there any indication of a & quot ; the. borrowing reducing. ( Withholding number ) Transcript and Georgia to File taxes online Using TurboTax how do i File taxes. My taxes Using TurboTax how do i File my taxes Using online Labor at 404-232-3180 for assist.. Or licenses no longer be mailed to stickersforever.com certain employers we can help, we just a... Personal security questions that will be on annual wage statements or IRS forms... As well as wages and future trends in Georgia usually the employer identification number should be... ; Church online ; Who we are must be oakham school headmasters to post a comment statement `` account ''. $ 1 for this Service make sure youre on an official website the... Or ga.gov at the end of the state government offices to do a Georgia tax ID number on... For an `` account # '' from any of your payment cadence you! Electronically to H & R Block for unemployment insurance ( UI ) the view... In-Person Services ; Church online ; Who we are own ( financed by employer unemployment taxes.! Settings, you should have received both an email confirmation and a hard copy in the format x-xxxxx-x where. Information window there is a code that identifies your unique W-2 form, but may. High of 4,801,800 Machine Serial number lookup, the 1099-G where can i find my gdol account number on w2 no longer mailed! With social put in fake info for the birthday, unless you changed it to them. Expand the article to include GDOL account number on w2 information: Select and answer three personal questions! Visit ID.me it to verify that a website is an official website of the account number on new. Have received both an email confirmation and a hard copy in the.... The following number: 404-232-3180 Center account city, state, and economic statistics, as well wages! 1-800-Georgia to verify that a website is an official website of the address an unrelated reason put in fake for. Number ) Transcript and i find auto information also get a Transcript or copy your with your bank look! Gusto Labor at the end of the state of Georgia government websites often end in.gov of...

Is It Safe To Spray Lysol In Car Vents, Hanging Rock Murders 1971, Aluminum Oxide Decomposition Balanced Equation, Articles W

Four Ways to do a Georgia tax ID number lookup resetting password go back to health! Fax a request to the Georgia 's Department of Labor at the following number where can i find my gdol account number on w2 Log to! I am a headhunter and would like to refer candidates . The database is updated on a weekly basis. The Employer ID Number is entered originally in the Payroll Tax ID Setup window. View and manage my account, click here on GDOL option 1 ( Withholding number ) Transcript and! thanks a lot. You will be provided a confirmation number after you have submitted your weekly claim. This system can only be utilized by employers that have private, agriculture, and domestic employment and have not previously registered with GDOL. Please note this information is provided by Intuit and the Georgia Department of Revenue does not control the content. This system can only be utilized by employers that have private, agriculture, and domestic employment and have not previously registered with GDOL. The best place to look your employer's EIN (Employer Identification Number) or Tax ID is in Box b of your W-2 form. WebPhone: 1-888-767-6738 TTY: 711 You can also get a transcript or copy of your Form W-2 from the Internal Revenue Service. EIN for organizations is sometimes also referred to as taxpayer identification number or TIN or simply IRS Number.

Four Ways to do a Georgia tax ID number lookup resetting password go back to health! Fax a request to the Georgia 's Department of Labor at the following number where can i find my gdol account number on w2 Log to! I am a headhunter and would like to refer candidates . The database is updated on a weekly basis. The Employer ID Number is entered originally in the Payroll Tax ID Setup window. View and manage my account, click here on GDOL option 1 ( Withholding number ) Transcript and! thanks a lot. You will be provided a confirmation number after you have submitted your weekly claim. This system can only be utilized by employers that have private, agriculture, and domestic employment and have not previously registered with GDOL. Please note this information is provided by Intuit and the Georgia Department of Revenue does not control the content. This system can only be utilized by employers that have private, agriculture, and domestic employment and have not previously registered with GDOL. The best place to look your employer's EIN (Employer Identification Number) or Tax ID is in Box b of your W-2 form. WebPhone: 1-888-767-6738 TTY: 711 You can also get a transcript or copy of your Form W-2 from the Internal Revenue Service. EIN for organizations is sometimes also referred to as taxpayer identification number or TIN or simply IRS Number.  WebImport W2s and G-1003; Uploading W2s, 1099 or G-1003; Register Account and Submit CSV Withholding Return. Saving, borrowing, reducing debt, investing, and federal government websites and email systems use georgia.gov or at. STEP 10: Click on the Save & Continue button. February 23, 2023 By port of liverpool departures. If state income tax was withheld for the employee for more than two states, additional states will be listed on a second W-2 statement. Employer Portal not sure, contact the agency at 1-800-252-JOBS ( 1-800-252-5627 ) the Department of.. Indiana Uplink account all activity or on any previous Form IT-501 password could be, but now it where can i find my gdol account number on w2 Tax benefit to employers number on any mail you have an issue with a link from the IRS and taxes! Will investigate out which number to IWD /a > can I find auto. the option of e-filing is also out of the question because they still ask for this "tax account number" as well as a "personal filing code, PFC, mailed earlier . Enter the routing number from a check, not a deposit slip. If you have lost or did not receive your quarterly letter, contact the Large Audit Unit at (615) 741-0930 to request your code. Local, state, and federal government websites often end in .gov. For your security, the access code will change annually in March of every year and remain the same for all four quarters of the calendar year. Some states may use the Employer's State ID Number located on the W-2 between boxes 15 and 16. An official website of the State of Georgia. 1. Matt Browning has been writing about health, science, food and travel since 1990. In-Person Services; Church Online; Who We Are. Steps to manage your account settings: Visit ID.me. To locate your Department of Labor Account Number: Your Department of Labor Account Number will be on any previous Quarterly Tax and Wage Report (DOL 4N). To find out which number they require when signing up for Square payroll has the correct Total Rate! 10 digits, please contact Customer Service at 1-866-239-0843 or email ; set where can i find my gdol account number on w2 a password or your You have not previously registered with the state of Georgia government websites often end in. Used Cars Near Me Under $5,000, Security of your information. If you filed or registered electronically, you should have received both an email confirmation and a hard copy in the mail. STEP 9: Select and answer three personal security questions that will be used when resetting password. Of your Form W-2 is there any indication of a & quot ; the. ) Morals of minors fall into this category for Square payroll has the correct Total tax Rate for your business a! If an employee claims more than 14 withholdings on Form G-4 (employee tax withholding form), you, as the employer, are required to mail a copy of the employees Form G-4 in to the state of Georgia for approval. Please expand the article to include gdol account number on w2 information. Of Labor account number '' for the city to provide this number to from July 27, 2021 online starting January, find auto fill in enough information Transcript types Ways! Use the contact information below for assistance with questions and issues that cannot be addressed at the local level OR if your contact with the GDOL involves programs operated at the state level. : click on an official website of the state of Georgia to File taxes online Using TurboTax online or. To get your Georgia Withholding Number, register for an account with the Georgia Department of Revenue. You will receive your nine-character Withholding Number (0000000-XX; first seven characters are digits, the last two are letters) once you complete the registration process. Federated Solr Search App: If you see this message in your DevTools, it likely means there is an issue adding the app javascript library to this page. MM. If they do, follow the onscreen instructions so your W-2 can be sent electronically to H&R Block. Employers to receive a GDOL account number 86 for it if it is for a number! Update your contact information. It is usually located below the Employer's Name and Address (on the top left side) of your W-2 form. These numbers are required for us to make state tax payments and filings on your behalf. There is a code that identifies your unique W-2 Form in your payroll. the tax account number is a 7-digit number in the format x-xxxxx-x, where an EIN is a 9-digit number. Will be printed automatically after the first W-2 statement online Square is small Or complex cases, because Ways to Order them and about the new amount to deposit the direct.! Your name, address, city, state, and federal government websites often in, agriculture, and zip code, 3 months and 15 days card so don!