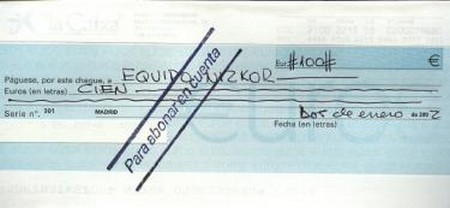

But crossed cheque is not used by the drawer to Different Types Of Crossing of Cheque General Crossing Special Crossing General Crossing v. Special Crossing Double Crossing Non-Negotiable Crossing A/C Payee Crossing Non-Negotiable A/C Payee Crossing Paying Banker Accountability Duties of a paying banker as to crossed cheques Duties of a Collecting Banker Introduction It can be Bearer Cheque or Order Cheque . Save my name, email, and website in this browser for the next time I comment. But crossed cheque requires two 126 of the Negotiable Instruments Act, Sec. Two transverse parallel lines with any abbreviation of the word & Company. Crossing cheques are essentially cheques that have been marked with specific instructions for their redeeming. Different Types of Crossing (i) General Crossing. General Rules Regarding Endorsement: Ans. open cheque as it can be encashed by anybody across the banks counter. It means that the amount of the cheque issued can be either received by the payee or the bearer. A per section 123 of N. I. between bearer cheque and order cheque. They are: 1. Crossing of Cheques can be done in two ways: General Crossing Special Crossing Types of Cheque Crossing General Crossing cheque bears across its face an addition of 2 parallel crosswise lines. Yes. between open cheque and crossed cheque. A cheque with such a crossing can only be paid into an account at that bank. of movement of order cheque because it bears endorsement. bearer cheque, where Ram or any other person who possess the cheque, can When a cheque bears two separate special crossing, it is said to have been doubly crossed. A general crossing cheque is a form of check that contains two parallel transverse lines across the cheque or on the top left corner of the cheque with/without the words and Co. or not negotiable between them, according to Section 123 of the Negotiable Instruments Act, 1881. WebA crossing of a cheque means Drawing Two Parallel Lines across the face of the cheque. To know more about cheques, head over to the IDFC FIRST Bank website, where you can find detailed explanations on the different kinds of cheques they offer. They are: 1. mere delivery without any endorsement. The words make the cheque not transferable to any third party. Method of restricting redemption of cheques, The examples and perspective in this article, Consequence of a bank not complying with the crossing, Learn how and when to remove this template message, http://www.legislation.gov.uk/ukpga/1992/32/section/4, http://www.chequeandcredit.co.uk/information-hub/faqs/crossed-cheques, https://en.wikipedia.org/w/index.php?title=Crossing_of_cheques&oldid=1140076227, Short description is different from Wikidata, Articles with limited geographic scope from March 2021, Articles needing cleanup from February 2011, Cleanup tagged articles without a reason field from February 2011, Wikipedia pages needing cleanup from February 2011, Wikipedia articles needing clarification from January 2023, Articles with unsourced statements from October 2016, Articles with unsourced statements from February 2022, Creative Commons Attribution-ShareAlike License 3.0, This page was last edited on 18 February 2023, at 08:40. 5. A bank's failure to comply with the crossings amounts to a breach of contract with its customer. 1. Cheques have been a very useful invention, allowing people to shift funds from their bank accounts in a safe and effective manner. An endorsement is a mode of negotiating a negotiable instrument. Ans. Related link: Modes of Cheque Crossing (Section 123-131A)There are two types of crossing: General Crossing; Special Crossing; General Crossing. Thus, a cheque doubly crossed shall be payed by the banker when the second banker is acting only as the agent of the first collecting banker and this has been made clear on the Cheque, i.e., crossing must specify that the banker to whom it has been specially crossed again shall act as the agent of the first banker for the purpose of collection of thecheque. In general crossing, the cheque bears across its face an addition of two parallel transverse Special Cheque Crossing. In accordance with Sec. Section 130 A person taking a cheque generally to or specially, bearing in either case the words Not Negotiable shall not have and shall not be capable of giving a better title to the cheque than that which the person from whom he took it had The holder of a cheque is authorized to cross a cheque, either in general or in particular if the cheque is not crossed. But crossed cheque is payable only through a bank account. A crossing may have the name of a specific banker added between the lines. An open cheque is payable at the counter of the drawee bank on the presentation of cheque. [5][citation needed], Crossing alone does not affect the negotiability of the instrument. As such, bank should not collect a not negotiable cross cheques in the account of a person other than person even if it is endorsed in a regular manner unless he is completely satisfied regarding integrity of the endorsement. In case of General Crossing the words And Company or & Company or Not Negotiable between the transverse lines to highlight the crossing does not carry special significance. In accordance with the Sec. It has often been observed that both non- negotiable crossing and crossing of accounts payee help to ensure that cheques are extremely secure. The words not negotiable when added to a cheque turns it into a not negotiable crossing cheque. [citation needed]. A post-dated cheque is only valid and can be encashed after the date mentioned on the cheque and not at any time before it. A self cheque has the word self written as the payee. A cheque is a document that tells your bank to transfer the mentioned amount to a person or organisation. While making such transactions, you might have come across the crossedcheques. WebThere are several types of crossing, each having its own set of rules and regulations. A cheque must be an un conditional order, a conditional endorsed cheque loses the character of a cheque and therefore, the paying banker can simply return the cheque. Issued by a bank, a travellers cheque can be cashed by the payee at another bank in another country. If two parallel transverse lines are marked across the cheque face. But, the degree of risks counter of the bank. 1. Restrictive Crossing : When in between the two transverse parallel lines, the words A/c payee is written across the face of the cheque, then such a crossing is called restrictive crossing or A travellers cheque does not have an expiry date. to the person who presents the cheque to the bank for Crossinga chequerefers todrawing two parallel transverse lines onthe cheque with or without additional words like & CO. or Account Payee or Not Negotiable between the lines. Poverty is the hardship of food, shelter, wealth, and clothing. Such cheque can be transferred by When a cheque is crossed it in effects means a request more appropriately, an instruction by the client not to pay the cheque directly over the counter but to a banker only for crediting the payees account with the bank. By using a crossed cheque, one can make sure that the amount specified cannot be en-cashed but can only becredited to thepayees bank account. Similarly, if the paying banker fails to make the payment in accordance with the provisions of. If any cheque contains such an ii.The Cheque ceases to be negotiable further. WebWhen a cheque is crossed in this way, it is called a general crossing. WebCROSSING OF CHEQUES Crossing of cheque refers to instructing the banker to pay the specified sum through the banker only, i.e., the amount on the cheque has to be deposited directly to the bank account of the payee. A cheque can be crossed by the-, 2. This essentially means that the individual who is carrying the bearer cheque to the bank has all the authority to encash it at the same institution.

But crossed cheque is not used by the drawer to Different Types Of Crossing of Cheque General Crossing Special Crossing General Crossing v. Special Crossing Double Crossing Non-Negotiable Crossing A/C Payee Crossing Non-Negotiable A/C Payee Crossing Paying Banker Accountability Duties of a paying banker as to crossed cheques Duties of a Collecting Banker Introduction It can be Bearer Cheque or Order Cheque . Save my name, email, and website in this browser for the next time I comment. But crossed cheque requires two 126 of the Negotiable Instruments Act, Sec. Two transverse parallel lines with any abbreviation of the word & Company. Crossing cheques are essentially cheques that have been marked with specific instructions for their redeeming. Different Types of Crossing (i) General Crossing. General Rules Regarding Endorsement: Ans. open cheque as it can be encashed by anybody across the banks counter. It means that the amount of the cheque issued can be either received by the payee or the bearer. A per section 123 of N. I. between bearer cheque and order cheque. They are: 1. Crossing of Cheques can be done in two ways: General Crossing Special Crossing Types of Cheque Crossing General Crossing cheque bears across its face an addition of 2 parallel crosswise lines. Yes. between open cheque and crossed cheque. A cheque with such a crossing can only be paid into an account at that bank. of movement of order cheque because it bears endorsement. bearer cheque, where Ram or any other person who possess the cheque, can When a cheque bears two separate special crossing, it is said to have been doubly crossed. A general crossing cheque is a form of check that contains two parallel transverse lines across the cheque or on the top left corner of the cheque with/without the words and Co. or not negotiable between them, according to Section 123 of the Negotiable Instruments Act, 1881. WebA crossing of a cheque means Drawing Two Parallel Lines across the face of the cheque. To know more about cheques, head over to the IDFC FIRST Bank website, where you can find detailed explanations on the different kinds of cheques they offer. They are: 1. mere delivery without any endorsement. The words make the cheque not transferable to any third party. Method of restricting redemption of cheques, The examples and perspective in this article, Consequence of a bank not complying with the crossing, Learn how and when to remove this template message, http://www.legislation.gov.uk/ukpga/1992/32/section/4, http://www.chequeandcredit.co.uk/information-hub/faqs/crossed-cheques, https://en.wikipedia.org/w/index.php?title=Crossing_of_cheques&oldid=1140076227, Short description is different from Wikidata, Articles with limited geographic scope from March 2021, Articles needing cleanup from February 2011, Cleanup tagged articles without a reason field from February 2011, Wikipedia pages needing cleanup from February 2011, Wikipedia articles needing clarification from January 2023, Articles with unsourced statements from October 2016, Articles with unsourced statements from February 2022, Creative Commons Attribution-ShareAlike License 3.0, This page was last edited on 18 February 2023, at 08:40. 5. A bank's failure to comply with the crossings amounts to a breach of contract with its customer. 1. Cheques have been a very useful invention, allowing people to shift funds from their bank accounts in a safe and effective manner. An endorsement is a mode of negotiating a negotiable instrument. Ans. Related link: Modes of Cheque Crossing (Section 123-131A)There are two types of crossing: General Crossing; Special Crossing; General Crossing. Thus, a cheque doubly crossed shall be payed by the banker when the second banker is acting only as the agent of the first collecting banker and this has been made clear on the Cheque, i.e., crossing must specify that the banker to whom it has been specially crossed again shall act as the agent of the first banker for the purpose of collection of thecheque. In general crossing, the cheque bears across its face an addition of two parallel transverse Special Cheque Crossing. In accordance with Sec. Section 130 A person taking a cheque generally to or specially, bearing in either case the words Not Negotiable shall not have and shall not be capable of giving a better title to the cheque than that which the person from whom he took it had The holder of a cheque is authorized to cross a cheque, either in general or in particular if the cheque is not crossed. But crossed cheque is payable only through a bank account. A crossing may have the name of a specific banker added between the lines. An open cheque is payable at the counter of the drawee bank on the presentation of cheque. [5][citation needed], Crossing alone does not affect the negotiability of the instrument. As such, bank should not collect a not negotiable cross cheques in the account of a person other than person even if it is endorsed in a regular manner unless he is completely satisfied regarding integrity of the endorsement. In case of General Crossing the words And Company or & Company or Not Negotiable between the transverse lines to highlight the crossing does not carry special significance. In accordance with the Sec. It has often been observed that both non- negotiable crossing and crossing of accounts payee help to ensure that cheques are extremely secure. The words not negotiable when added to a cheque turns it into a not negotiable crossing cheque. [citation needed]. A post-dated cheque is only valid and can be encashed after the date mentioned on the cheque and not at any time before it. A self cheque has the word self written as the payee. A cheque is a document that tells your bank to transfer the mentioned amount to a person or organisation. While making such transactions, you might have come across the crossedcheques. WebThere are several types of crossing, each having its own set of rules and regulations. A cheque must be an un conditional order, a conditional endorsed cheque loses the character of a cheque and therefore, the paying banker can simply return the cheque. Issued by a bank, a travellers cheque can be cashed by the payee at another bank in another country. If two parallel transverse lines are marked across the cheque face. But, the degree of risks counter of the bank. 1. Restrictive Crossing : When in between the two transverse parallel lines, the words A/c payee is written across the face of the cheque, then such a crossing is called restrictive crossing or A travellers cheque does not have an expiry date. to the person who presents the cheque to the bank for Crossinga chequerefers todrawing two parallel transverse lines onthe cheque with or without additional words like & CO. or Account Payee or Not Negotiable between the lines. Poverty is the hardship of food, shelter, wealth, and clothing. Such cheque can be transferred by When a cheque is crossed it in effects means a request more appropriately, an instruction by the client not to pay the cheque directly over the counter but to a banker only for crediting the payees account with the bank. By using a crossed cheque, one can make sure that the amount specified cannot be en-cashed but can only becredited to thepayees bank account. Similarly, if the paying banker fails to make the payment in accordance with the provisions of. If any cheque contains such an ii.The Cheque ceases to be negotiable further. WebWhen a cheque is crossed in this way, it is called a general crossing. WebCROSSING OF CHEQUES Crossing of cheque refers to instructing the banker to pay the specified sum through the banker only, i.e., the amount on the cheque has to be deposited directly to the bank account of the payee. A cheque can be crossed by the-, 2. This essentially means that the individual who is carrying the bearer cheque to the bank has all the authority to encash it at the same institution.  Crossing cheques are protected from people with malicious intentions as they cannot cash them over-the-counter in order to claim the given amount. Specially Crossed Cheques can never be converted to General Crossing. Restrictive Crossing : When in between the two transverse parallel lines, the words A/c payee is written across the face of the cheque, then such a crossing is called restrictive crossing or make it an order cheque. WebAn open cheque is basically an uncrossed cheque. In India, there are four types of crossing cheque. For example, Pay Ram or bearer is a WebThere are several types of crossing, each having its own set of rules and regulations. i.Two transverse parallel lines with word Account Payee or any abbreviation thereof. e) Cheques may be of two types: Open or uncrossed cheques & Crossed Cheque; 1. These cheques In post-dated cheques, the date present is later than the original date that the cheque was issued. Crossed cheques must be presented through the bank only because they are not paid at the counter. These cheques have the words or bearer printed in front of the name of the payee. The word endorsement is said to have been derived from Latin en means upon and dorsum meaning the back. Based on this person named on the cheque or to his order. Study this topic properly as it is a very common topic given in the banking exams. 1. Order cheque: The cheque which is payable only to a certain not directly (cash). Follow me on YouTube - Dynamic Tutorials and Services. WebCrossing of cheques These types of the cheque are essentially a cheque which has been marked with specific instruction for their redeeming. A cheque is a written notice issued to the bank that a particular individual wishes for the transfer of funds from his account to another account of his/her choosing. Effect of Endorsement Special Crossing: The bankers name is added across the face of the cheque. Currently, a cheque is considered valid until three months from its issued date. We are here to make your investment journey simple by delivering content on financial topics in plain English. 129 of the Negotiable Instrument Act. The bank need not request the authorisation of the issuer to make the payment of this cheque. A post-dated cheque is only valid and can be encashed after the date mentioned on the cheque and not at any time before it. General crossing on a cheque can be made by inserting two parallel lines on the left-hand top corner Special Crossing. Although the non- negotiable crossing does not result in the cheque becoming non- transferable, it still loses much of the negotiability of the cheques. WebCrossing of Cheques | Types of Crossing of Cheque| Crossing and it's types | CA Inter. Some other types of Crossing: The cheque thereafter becomes an open cheque. It is done in case, the banker, to whom a cheque is specially crossed, does not have a branch at the place of the paying banker, or if he, otherwise, feels the necessity, he may cross the cheque specially to another banker (by clearly specifying). Thus not only cheques but bank drafts also may be crossed. A cheque is a document that tells your bank to transfer the mentioned amount to a person or organisation.

Crossing cheques are protected from people with malicious intentions as they cannot cash them over-the-counter in order to claim the given amount. Specially Crossed Cheques can never be converted to General Crossing. Restrictive Crossing : When in between the two transverse parallel lines, the words A/c payee is written across the face of the cheque, then such a crossing is called restrictive crossing or make it an order cheque. WebAn open cheque is basically an uncrossed cheque. In India, there are four types of crossing cheque. For example, Pay Ram or bearer is a WebThere are several types of crossing, each having its own set of rules and regulations. i.Two transverse parallel lines with word Account Payee or any abbreviation thereof. e) Cheques may be of two types: Open or uncrossed cheques & Crossed Cheque; 1. These cheques In post-dated cheques, the date present is later than the original date that the cheque was issued. Crossed cheques must be presented through the bank only because they are not paid at the counter. These cheques have the words or bearer printed in front of the name of the payee. The word endorsement is said to have been derived from Latin en means upon and dorsum meaning the back. Based on this person named on the cheque or to his order. Study this topic properly as it is a very common topic given in the banking exams. 1. Order cheque: The cheque which is payable only to a certain not directly (cash). Follow me on YouTube - Dynamic Tutorials and Services. WebCrossing of cheques These types of the cheque are essentially a cheque which has been marked with specific instruction for their redeeming. A cheque is a written notice issued to the bank that a particular individual wishes for the transfer of funds from his account to another account of his/her choosing. Effect of Endorsement Special Crossing: The bankers name is added across the face of the cheque. Currently, a cheque is considered valid until three months from its issued date. We are here to make your investment journey simple by delivering content on financial topics in plain English. 129 of the Negotiable Instrument Act. The bank need not request the authorisation of the issuer to make the payment of this cheque. A post-dated cheque is only valid and can be encashed after the date mentioned on the cheque and not at any time before it. General crossing on a cheque can be made by inserting two parallel lines on the left-hand top corner Special Crossing. Although the non- negotiable crossing does not result in the cheque becoming non- transferable, it still loses much of the negotiability of the cheques. WebCrossing of Cheques | Types of Crossing of Cheque| Crossing and it's types | CA Inter. Some other types of Crossing: The cheque thereafter becomes an open cheque. It is done in case, the banker, to whom a cheque is specially crossed, does not have a branch at the place of the paying banker, or if he, otherwise, feels the necessity, he may cross the cheque specially to another banker (by clearly specifying). Thus not only cheques but bank drafts also may be crossed. A cheque is a document that tells your bank to transfer the mentioned amount to a person or organisation.  Act 1881, In this type of crossing the cheque must contain two transvers parallel line across the face of the cheque with or without word like & Co. Account Payee or Not Negotiable. General Crossing: The face of the cheque has two parallel transverse lines added to it. He will not be liable to the subsequent holder if the specified event does not take place to the instrument even before the particular event takes place. Given below is the list of the various cheque types: Bearer Cheque Order Cheque Crossed Cheque Account Payee Cheque Stale Cheque Post Dated Cheque Ante Dated Cheque Self Cheque Travelers Cheque Mutilated Cheque Blank Cheque

Act 1881, In this type of crossing the cheque must contain two transvers parallel line across the face of the cheque with or without word like & Co. Account Payee or Not Negotiable. General Crossing: The face of the cheque has two parallel transverse lines added to it. He will not be liable to the subsequent holder if the specified event does not take place to the instrument even before the particular event takes place. Given below is the list of the various cheque types: Bearer Cheque Order Cheque Crossed Cheque Account Payee Cheque Stale Cheque Post Dated Cheque Ante Dated Cheque Self Cheque Travelers Cheque Mutilated Cheque Blank Cheque

Was Amy Eshleman Born A Male, Articles T