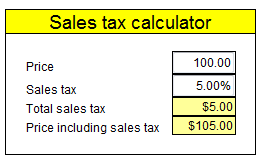

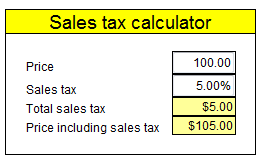

A Texas resident who buys a boat or boat motor in another state and brings it into Texas owes the 6.25 percent boat and boat motor use tax. If one or more of the persons that completed the Rights of Survivorship agreement dies, ownership of the vessel/boat and/or outboard motor will vest in and belong to the surviving owner(s). Request a corrected Temporary Use Validation Card. Once signed in, select Sales Tax Rates and Texas Address Files. Outboard Motor Records Maintenance PWD 144M ( PDF 213.7 KB) - Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. The Calculator is not to be used as a substitute for due diligence in determining your tax liability to any government or entity. Calculate penalties for delinquent sales tax payments. Replace a lost Temporary Use Validation Card. Please see Fee Chart Boat/Outboard Motor and Related Items (PDF)and PWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator for additional assistance. title or a signed statement of no financial interest from the owner on record

All blank forms may be copied. WebThe tax is an obligation of and shall be paid by the person who uses the boat or motor in this state or brings the boat or motor into this state. WebUse this calculator if you know the price of your vehicle and need to estimate the Monthly Payment. Which boat motors are subject to the tax? If a legal representative

This form is used when the owner of record is in a trust name and the

5, Sec. This form is used to: PWD 1055

information may result in denial of the application. Fee. Some corrections may be handled through Processor Error, or other correction methods, which are available on the Maintenance forms. Added by Acts 1991, 72nd Leg., 1st C.S., ch. NEW RESIDENT. Will a trade-in reduce the taxable value? Tax and Bill of Sale Requirements Boat and Motor Tax: TPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. the boat or boat motor is removed from this state within 10 days of purchase; the boat or boat motor is placed in a permitted repair facility for repairs or modifications within 10 days of purchase and removed from this state within 20 days of completion of the repairs or modifications; or. title and/or required legal documentation cannot be obtained. Trailers are handled through the local county tax office and the price of the trailer must be separated from the price of the boat and motor. Obtain the History, which provides a copy of all documents submitted for transactions on file for a vessel/boat and/or outboard motor. What is the taxable value? Upon the death of any person(s) named in this agreement, the survivor(s) may obtain a new title by submitting the applicable supporting documentation and the required fees. Applications filed later than 45 working days are subject to tax penalties and interest. The purchaser, however, is also required to pay an additional $562.50 in tax on the purchase of each of the two outboard motors included in the sale for a total of $1,125. Information provided will be followed up for non-payment of sales/use tax and vessel/outboard motor titling fees. Download our Texas sales tax database! If the numbers cannot be read on the tracing, trace it anyway, then write the number below the tracing. 144 (PDF 261.4 KB). This form is used by TPWD or its Agent to void a vessel/boat and/or outboard motor title/registration transaction. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. All U.S Coast Guard (USCG) documented vessels (USCG documented vessels require State registration and proof of current USCG documentation).

The request will be reviewed

The tax rate is 6.25% of the sales price. Children under 13 years of age must have a parent/guardian's consent before providing While we are available Monday through Friday, 8 a.m.-5 p.m. Central Time, shorter wait times normally occur from 8-10 a.m. and 4-5 p.m. The Affidavit of Authority to Administer Trust must be completed in full, signed and notarized. WebTax is calculated on the greater of the actual sales price or 80 percent of the SPV shown for that day. 144M (PDF 213.7 KB) - Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. Use Validation Card with Decals by the Licensee. Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent. If the seller does not collect the tax, the buyer must pay the tax when obtaining the boats title and registration from the TPWD or participating CTAC. WebSales Tax Calculator of Texas for 2023 Calculation of the general sales taxes of Texas State for 2023 Amount before taxes Sales tax rate(s) 6.25% 6.3% 6.5% 6.75% 7% 7.25% 7.5% 7.75% 8% 8.125% 8.25% Amount of taxes Amount after taxes The previous (non-titled) owners cannot be reached or have refused to title the asset as required by state law. Sales tax jurisdiction rules can sometimes be too complicated to describe rate areas by zip code, so this calculator is provided for reference purposes only. Sold or no longer own your vessel/boat and/or outboard motor? Manage My Subscriptions, archive The certificate of number (registration), if required: TPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. This calculator is used to: Calculate sales tax owed Texas. The total amount of boat sales tax collected on each sale of a taxable boat or boat motor may not exceed $18,750. This form is used to make the following changes to lien holder information: Please see Fee Chart Boat/Outboard Motor and Related Items for additional assistance. Sales Price must be a positive number. and supporting documentation required to complete the statutory foreclosure

Sec. Estimated Monthly Payment: $0.00 financing b. Boat Program. To calculate interest on past due taxes, visit. WebA Texas resident who buys a boat or boat motor in another state and brings it into Texas owes the 6.25 percent boat and boat motor use tax. (Word 64 KB). -4.25%. For example, the April sales tax report is due May 20. lien holder, or law enforcement agency and there are no legal claims of

Separate permits are required for each vessel/boat and/or outboard motor. It is also used to calculate use tax on motor vehicles brought into Texas that were purchased from a private-party out of state. This form contains an itemized listing of the fees required for all vessel/boat, outboard motor, and marine license transactions. The validation decal must be affixed in line with and three (3) inches towards the rear of the boat from the TX number (an example is shown on the decal document). WebThe Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price.

The request will be reviewed

The tax rate is 6.25% of the sales price. Children under 13 years of age must have a parent/guardian's consent before providing While we are available Monday through Friday, 8 a.m.-5 p.m. Central Time, shorter wait times normally occur from 8-10 a.m. and 4-5 p.m. The Affidavit of Authority to Administer Trust must be completed in full, signed and notarized. WebTax is calculated on the greater of the actual sales price or 80 percent of the SPV shown for that day. 144M (PDF 213.7 KB) - Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. Use Validation Card with Decals by the Licensee. Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent. If the seller does not collect the tax, the buyer must pay the tax when obtaining the boats title and registration from the TPWD or participating CTAC. WebSales Tax Calculator of Texas for 2023 Calculation of the general sales taxes of Texas State for 2023 Amount before taxes Sales tax rate(s) 6.25% 6.3% 6.5% 6.75% 7% 7.25% 7.5% 7.75% 8% 8.125% 8.25% Amount of taxes Amount after taxes The previous (non-titled) owners cannot be reached or have refused to title the asset as required by state law. Sales tax jurisdiction rules can sometimes be too complicated to describe rate areas by zip code, so this calculator is provided for reference purposes only. Sold or no longer own your vessel/boat and/or outboard motor? Manage My Subscriptions, archive The certificate of number (registration), if required: TPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. This calculator is used to: Calculate sales tax owed Texas. The total amount of boat sales tax collected on each sale of a taxable boat or boat motor may not exceed $18,750. This form is used to make the following changes to lien holder information: Please see Fee Chart Boat/Outboard Motor and Related Items for additional assistance. Sales Price must be a positive number. and supporting documentation required to complete the statutory foreclosure

Sec. Estimated Monthly Payment: $0.00 financing b. Boat Program. To calculate interest on past due taxes, visit. WebA Texas resident who buys a boat or boat motor in another state and brings it into Texas owes the 6.25 percent boat and boat motor use tax. (Word 64 KB). -4.25%. For example, the April sales tax report is due May 20. lien holder, or law enforcement agency and there are no legal claims of

Separate permits are required for each vessel/boat and/or outboard motor. It is also used to calculate use tax on motor vehicles brought into Texas that were purchased from a private-party out of state. This form contains an itemized listing of the fees required for all vessel/boat, outboard motor, and marine license transactions. The validation decal must be affixed in line with and three (3) inches towards the rear of the boat from the TX number (an example is shown on the decal document). WebThe Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price.  This form is used to provide written explanations of specific situations. The vessel/boat and/or outboard motor is then jointly owned (co-owned) by those persons, which shall be effective as of the date this form is signed and notarized. Sec. The buyer pays the use tax or new resident tax when obtaining the boats title and registration from the TPWD or participating CTAC. By using the Tax-Rates.org Texas Sales Tax Calculator ("the Calculator"), you expressly agree to the terms of use and disclaimer of liability expressed in this agreement and the Tax-Rates.org Terms of Service. This calculator is used to: Calculate sales tax owed Texas.

This form is used to provide written explanations of specific situations. The vessel/boat and/or outboard motor is then jointly owned (co-owned) by those persons, which shall be effective as of the date this form is signed and notarized. Sec. The buyer pays the use tax or new resident tax when obtaining the boats title and registration from the TPWD or participating CTAC. By using the Tax-Rates.org Texas Sales Tax Calculator ("the Calculator"), you expressly agree to the terms of use and disclaimer of liability expressed in this agreement and the Tax-Rates.org Terms of Service. This calculator is used to: Calculate sales tax owed Texas.  The fee for the permit is $150 for each boat or boat motor used in this state and is valid for 90 days. Maximum Local Sales Tax. If purchased in Texas on or after 9/1/2019, and combined vessel/outboard motor sales price is over $300,000.00, vessel and outboard motor prices Outboard motors with a recorded lien holder are not eligible for replacement titles online. This form is used to apply for a temporary tax permit by the owner of a taxable vessel/boat or outboard motor who qualifies for a specific tax exemption to have their boat or outboard motor in Texas for not more than 90 days without paying sales/use tax. Click here to get more information. Average Local + State Sales Tax. The following vessels/boats when on Texas public water are required to have current registration, including when docked, moored, or stored: A Texas boat registration is valid for two years. 7.01, eff.

The fee for the permit is $150 for each boat or boat motor used in this state and is valid for 90 days. Maximum Local Sales Tax. If purchased in Texas on or after 9/1/2019, and combined vessel/outboard motor sales price is over $300,000.00, vessel and outboard motor prices Outboard motors with a recorded lien holder are not eligible for replacement titles online. This form is used to apply for a temporary tax permit by the owner of a taxable vessel/boat or outboard motor who qualifies for a specific tax exemption to have their boat or outboard motor in Texas for not more than 90 days without paying sales/use tax. Click here to get more information. Average Local + State Sales Tax. The following vessels/boats when on Texas public water are required to have current registration, including when docked, moored, or stored: A Texas boat registration is valid for two years. 7.01, eff.  What is the rate for the boat and boat motor tax? 5, Sec. The lien holder signature must be notarized

2.00%. Non-motorized canoes, kayaks, punts, rowboats, or rubber rafts (regardless of length), or other vessels under 14 feet in length when paddled, poled, oared, or windblown. Children under 13 years of age must have a parent/guardian's consent before providing by the department. For additional information about this inspection: Party Boat Program. (Older blue and green title formats do not have spaces for the bill of sale on the back). and Titles FAQ, Abandoned

WebThe Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. The previous (non-titled) owners cannot be reached or have refused to

General Information Letters and Private Letter Rulings, State Tax Automated Research (STAR) System, Historically Underutilized Business (HUB), Vendor Performance Tracking System (VPTS), Texas Procurement and Contract Management Guide, Minnie Stevens Piper Foundation College Compendium, Texas Parks and Wildlife Department (TPWD), County Tax Assessor-Collectors Office (CTAC), obtaining the boats title and registration, Boat Sales Tax Manual Computation Worksheet, Texas Parks and Wildlife Boat Title, Registration and ID Requirements, Taxes on Sales and Use of Boats and Boat Motors, boat and boat motor sales and use tax; or, an electric motor attached to a boat subject to boat tax, and sold with the boat for one price (such as a trolling motor). signs the title or bill of sale for the recorded owner(s), you must obtain a copy of the documentation authorizing the legal representative to act on behalf of the owner(s). Sales tax for vessels and outboard motors purchased in Texas on or May display ONLY the validation decal (not the Registration (TX) Number) on both sides of the bow of the vessel; and. *Desired Vehicle Price: Sales Tax: *Term in Months: *Rate / APR: Down Payment or Trade-In Value: * = Required. 2023 SalesTaxHandbook. Instructions for completing the application are included with the form. The sales price for the vessel and/or outboard motor. SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | A Certificate of Number ID Card is issued at the time of registration (with decals). Sales tax for vessels and outboard motors purchased in Texas on or OWNERSHIP OF VESSELS AND OUTBOARD MOTORS; CERTIFICATES OF TITLE. name of a prior owner (not the sellers' name). WebTexas State Sales Tax. Upon the death of any person(s) named in this agreement, the survivor(s) may obtain a new title by submitting the applicable supporting documentation and the required fees. This form is completed when transferring ownership to the purchaser of a vessel/boat and/or outboard motor sold due to a self-service storage lien. For payments of $1,000,000 or less, a payor has until 10:00 a.m. (CT) on the due date to initiate the transaction in the TEXNET System. We value your feedback! Adding an outboard or trolling motor to one of these types requires titling and registration.

What is the rate for the boat and boat motor tax? 5, Sec. The lien holder signature must be notarized

2.00%. Non-motorized canoes, kayaks, punts, rowboats, or rubber rafts (regardless of length), or other vessels under 14 feet in length when paddled, poled, oared, or windblown. Children under 13 years of age must have a parent/guardian's consent before providing by the department. For additional information about this inspection: Party Boat Program. (Older blue and green title formats do not have spaces for the bill of sale on the back). and Titles FAQ, Abandoned

WebThe Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. The previous (non-titled) owners cannot be reached or have refused to

General Information Letters and Private Letter Rulings, State Tax Automated Research (STAR) System, Historically Underutilized Business (HUB), Vendor Performance Tracking System (VPTS), Texas Procurement and Contract Management Guide, Minnie Stevens Piper Foundation College Compendium, Texas Parks and Wildlife Department (TPWD), County Tax Assessor-Collectors Office (CTAC), obtaining the boats title and registration, Boat Sales Tax Manual Computation Worksheet, Texas Parks and Wildlife Boat Title, Registration and ID Requirements, Taxes on Sales and Use of Boats and Boat Motors, boat and boat motor sales and use tax; or, an electric motor attached to a boat subject to boat tax, and sold with the boat for one price (such as a trolling motor). signs the title or bill of sale for the recorded owner(s), you must obtain a copy of the documentation authorizing the legal representative to act on behalf of the owner(s). Sales tax for vessels and outboard motors purchased in Texas on or May display ONLY the validation decal (not the Registration (TX) Number) on both sides of the bow of the vessel; and. *Desired Vehicle Price: Sales Tax: *Term in Months: *Rate / APR: Down Payment or Trade-In Value: * = Required. 2023 SalesTaxHandbook. Instructions for completing the application are included with the form. The sales price for the vessel and/or outboard motor. SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | A Certificate of Number ID Card is issued at the time of registration (with decals). Sales tax for vessels and outboard motors purchased in Texas on or OWNERSHIP OF VESSELS AND OUTBOARD MOTORS; CERTIFICATES OF TITLE. name of a prior owner (not the sellers' name). WebTexas State Sales Tax. Upon the death of any person(s) named in this agreement, the survivor(s) may obtain a new title by submitting the applicable supporting documentation and the required fees. This form is completed when transferring ownership to the purchaser of a vessel/boat and/or outboard motor sold due to a self-service storage lien. For payments of $1,000,000 or less, a payor has until 10:00 a.m. (CT) on the due date to initiate the transaction in the TEXNET System. We value your feedback! Adding an outboard or trolling motor to one of these types requires titling and registration.  outboard motor is new. the circumstance to determine if a bonded title is appropriate. Replace a lost or destroyed outboard motor title. Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid. *Desired Vehicle Price: Sales Tax: *Term in Months: *Rate / APR: Down Payment or Trade-In Value: * = Required. When using the paper form, it should be completed and mailed to TPWD Boat Registration, 4200 Smith School Rd, Austin, TX 78744, or faxed to 512-389-4900, or scanned and attached to an email to.

outboard motor is new. the circumstance to determine if a bonded title is appropriate. Replace a lost or destroyed outboard motor title. Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid. *Desired Vehicle Price: Sales Tax: *Term in Months: *Rate / APR: Down Payment or Trade-In Value: * = Required. When using the paper form, it should be completed and mailed to TPWD Boat Registration, 4200 Smith School Rd, Austin, TX 78744, or faxed to 512-389-4900, or scanned and attached to an email to.  Taxes. Outboard Motor Records Maintenance PWD 144M ( PDF 213.7 KB) - Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. The date the purchaser took delivery of the vessel and/or outboard motor in Texas, or if purchased elsewhere, the date brought into Texas (proof is required). sales of electric motors and accessories, such as life jackets or ladders, sold separately from the boat, repairing and remodeling boats and boat motors. WebA Texas resident who buys a boat or boat motor in another state and brings it into Texas owes the 6.25 percent boat and boat motor use tax. The pawn shop is required to title the vessel/outboard motor in the pawn

Submit with the applicable forms: When no change of ownership has occurred: The Rights of Survivorship form must be completed in full, signed and notarized. What is the rate for the boat and boat motor tax? Usage is subject to our Terms and Privacy Policy. Boat/Motor Sales, Use and New Resident Tax Calculator, References, Tools & Forms for Boat and Outboard Motor Titling and Registration. This training document provides the basic legal background information intended to aid TPWD staff or its Agent in understanding basic boat/outboard motor transactions. This form does not allow the authorized individual to sign for the owner/applicant. documentation for vessels/boats and outboard motors for a period of 10 years. Taxes. Adobe Reader is required to open the files. motors.. For private-party sales, motor vehicle sales or use tax is based on one of the following: the vehicle's sales price, when the purchaser pays 80 percent or more of the vehicle's SPV; Boats/Outboard Motors Listing, New

Taxpayers will be notified by letter after their application for a sales tax permit has been approved whether they will file monthly or quarterly. Information provided will

What is the taxable value? Reader. Start below by entering your Desired Vehicle Price. We read every comment! Do you need access to a database of state or local sales tax rates? The Affidavit of Heirship form must be completed in full, signed and notarized. outboard motor title/registration transaction. Do you have a comment or correction concerning this page? Maximum Possible Sales Tax. WebThe Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). Apply for an annual party boat safety inspection. For example, a person purchases a boat for $350,000. Trailers are handled through your local County Tax office and the price of the trailer must be separated from the price of the vessel/boat and motor. Calculate interest for delinquent sales tax payments. Retain this original form, and after the death of any person(s) named in this agreement, the survivor(s) may obtain a new title by submitting this form, all applicable supporting documentation, and the required fees. Use this calculator with the following forms: Date of Payment cannot be earlier than Date of Sale. information must be completed and signatures must be original. Upon completion of this form, two options are available: Submit this completed form, along with all applicable supporting documentation and fees, and have the Rights of Survivorship (ROS) designation added to the title for all owners of record. Apply for a new license, renew a license, replace a lost license, or update information on an existing license. and Titles FAQ, Abandoned

This form is used as a support document. Sec. -4.25%. Form is used as a support document. The Affidavit of Heirship form must be completed in full, signed and notarized. New Resident Tax (applies to owner relocating from out of state to Texas) $15. Make changes or corrections to your name, mailing address or vessel/boat

Outboard motors with a recorded lien holder are not eligible for replacement titles online. Submit with applicable form(s): This form is used to request the Texas Parks and Wildlife Department (TPWD) to consider issuing a bonded title for a vessel/boat and/or outboard motor which does not qualify for standard titling because the properly assigned title and/or required legal documentation cannot be obtained. Retain this original form, and after the death of any person(s) named in this agreement, the survivor(s) may obtain a new title by submitting this form, all applicable supporting documentation, and the required fees. The fee for each permit is $150.00. 5, Sec. This form should only be submitted when the previous owner refuses to title the asset or when proof can be provided that the previous owner cannot be located. Tax and Bill of Sale Requirements Boat and Motor Tax: TPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. You can check whether a title has been issued for free -, Vessels exceeding 115 feet in length; and. You can check whether a title has been issued for free -. This form is used when the owner is deceased and left either no will or a

Calculator used in preparing forms PWD 143 (PDF) and PWD 144 (PDF). WebTotal price including tax = list price * ( 1 + sales tax rate) If you need to calculate state sales tax, use tax and local sales tax see the State and Local Sales Tax Calculator. There is no limit to the amount of use tax due on the use of a taxable boat or boat motor in this state. and additional form letters to use for sending notice to the proper law

can be submitted, and, A clear progression of ownership can be determined through the documentation

The tax rate is 6.25% of the sales price. The application and supporting documentation must be. Limited sales and use tax applies to the purchase of a boat that is greater than 115 feet long measured from the tip of the bow in a straight line to the stern. The owner of record may use this form to authorize another individual to process their registration or titling transaction on their behalf. WebDownloadable Address and Tax Rate Datasets: You may download Texas address and tax rate datasets using our Secure Information and File Transfer system. a manufacturer's or an importer's certificate executed on a form prescribed

The following information will typically be needed to complete the notification process: Content of this site copyright Texas Parks and Wildlife Department unless otherwise noted. or acquired a vessel/boat or outboard motor from a seller and the title is in the

materials, equipment and machinery that become component parts of the ship or vessel (including commercial fishing and pleasure fishing). The tax rate is 6.25% of the sales price. quick, and bonded titles). The certificate, when issued, is valid through the expiration date shown, must always be aboard the vessel/boat (including USCG documented vessels that require Texas registration), and be available for inspection by an enforcement officer. The ownership of a vessel or of an outboard motor is evidenced by a

WebTax is calculated on the greater of the actual sales price or 80 percent of the SPV shown for that day. Email subscriber privacy policy Please see Fee Chart Boat/Outboard Motor and Related Items and PWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator for additional assistance. Make changes or corrections to your name, mailing address or outboard

Start below by entering your Desired Vehicle Price. WebThe sales price for the vessel and/or outboard motor. This form is completed when transferring ownership to the purchaser of

Complete instructions and requirements are available on the form. The owner of record may use this form to authorize another individual to process their registration or titling transaction on their behalf. The Limited Power of Attorney form must be completed in full, signed and

A new Texas resident who brings a boat or boat motor into Texas qualifies to pay a $15 new resident tax instead of the 6.25 percent boat and boat motor use tax. and/or PWD

property owner for more than seven (7) days. Form is used as a support document. NEW RESIDENT. If the situation does not qualify, then a response will be mailed back to the applicant stating the reason for denial. This form does not function as Power of Attorney. Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Texas, local counties, cities, and special taxation districts. Do not purchase a used vessel/boat or outboard motor without receiving an original title (signed on the front and back) along with a signed bill of sale from the person(s) listed on the title or from their legally documented representative. The pawn shop is required to title the vessel/outboard motor in the pawn shop's name before selling (unless the pawn shop is a licensed Marine Dealer). This form is used when the owner of record is in a trust name and the trust is transferring ownership. Need an updated list of Texas sales tax rates for your business? This form is used to make the following changes to lien holder information: Please see Fee Chart Boat/Outboard Motor and Related Items (PDF) for additional assistance. (TPWD) to consider issuing a bonded title for a vessel/boat and/or outboard motor

when the previous owner refuses to title the asset or when proof can be provided

Tax-Rates.org provides free access to tax rates, calculators, and more. Sales tax for vessels and outboard motors purchased in Texas on or WebThe tax is an obligation of and shall be paid by the person who uses the boat or motor in this state or brings the boat or motor into this state. Once signed in, select Sales Tax Rates and Texas Address Files. Apply for a new license, renew a license, replace a lost license, or update

A signed bill of sale or invoice is required for every transfer of ownership. All internal combustion (gasoline/diesel/propane powered) outboard motors must

This form is a legal document used to designate a representative (individual or company) to conduct business and sign documents on behalf of another. Taxpayers required to pay electronically via TEXNET must initiate their payment above $1,000,000 by 8 p.m. CT on the banking business day prior to the due date in order for the payment to be considered timely. Tax paid previously in Texas or in another state on this vessel and/or outboard motor. will; no application for administration has been filed; and there is no

To calculate interest on past-due taxes, visit. lien process. For private-party sales, motor vehicle sales or use tax is based on one of the following: the vehicle's sales price, when the purchaser pays 80 percent or more of the vehicle's SPV; This form does not allow the authorized individual to sign for the owner/applicant. New Resident tax is assessed (not sales or use tax) for owners who previously resided in another state who are bringing their previously titled or registered boat and/or outboard motor from that other state into Texas. Taxpayers will be notified by letter when their business meets the threshold to be required to pay electronically via TEXNET. This form is completed when transferring ownership to the purchaser of a vessel/boat and/or outboard motor sold due to a self-service storage lien. All history requests will be fulfilled by TPWD Austin Headquarters within 10 days of processing. Instructions for completing the application are included with the form. certificate of title issued by the department, unless the vessel or the

WebThe sales price for the vessel and/or outboard motor. All rights reserved. For additional information about this license: Party

144 (PDF 261.4 KB), PWD 1340 - Ownership Transfer Notification Online. Notify Texas Parks & Wildlife. One of the following is acceptable to meet the bill of sale or invoice requirement: New Resident Tax - $15.00. WebThe Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price. Submit with applicable form(s): This form is used to request the Texas Parks and Wildlife Department

Boat/Motor Online Transactions: When using the paper form, it should be completed and mailed to TPWD Boat Registration, 4200 Smith School Rd, Austin, TX 78744, or faxed to 512-389-4900, or scanned and attached to an email to. of USCG Documented Vessels, Sold

WebTotal price including tax = list price * ( 1 + sales tax rate) If you need to calculate state sales tax, use tax and local sales tax see the State and Local Sales Tax Calculator. Maximum Possible Sales Tax. WebUse this calculator if you know the price of your vehicle and need to estimate the Monthly Payment. This form should be completed by an applicant when this person has purchased

Oct. 1, 1991. Purchase additional Temporary Use Validation Card with Decal Set. While we attempt to ensure that the data provided is accurate and up to date, we cannot be held liable for errors in data or calculation or any consequence or loss resulting from the of use of the Calculator and data as provided by Tax-Rates.org. One of the following is acceptable to meet the bill of sale or invoice requirement: $15.00 New Resident tax is assessed (not sales or use tax) for owners who previously resided in another state who are bringing their previously titled or registered boat and/or outboard motor from another state into Texas. All motorized vessels, regardless of length (including any sailboat with an auxiliary engine); All non-motorized vessels (including sailboats) 14 feet in length or longer; and. Your contact information is used to deliver requested updates or to access your subscriber preferences. WebThe Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price. enforcement agency and the owner(s) and lien holder(s). If the seller does not collect the tax, the buyer must pay the tax to the Comptrollers office using Form 01-156, Texas Use Tax Return (PDF). We urge you to notify us of any errors in the Calculator or our data. 8.05%. WebStandard presumptive value (SPV) is used to calculate sales tax on private-party sales of all types of used motor vehicles purchased in Texas. Boat Program. Calculate penalties for delinquent sales tax payments. WebPWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator Calculator used in preparing forms PWD 143 (PDF) and PWD 144 (PDF). Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Vessels registered as antique boats are permitted to display the registration decal on the left portion of the windshield. to aid TPWD staff or its Agent in understanding basic boat/outboard motor

If a legal representative signs the title or bill of sale for the recorded owner(s), you must obtain a copy of the documentation authorizing the legal representative to act on behalf of the owner(s). WebTPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. Additional Tools:

The retail sales of boats and boat motors are subject to either. Apply for Texas title and registration for a brand new vessel/boat. This form is used by TPWD or its Agent to void a vessel/boat and/or

statutory foreclosure lien. This form is used to verify the serial number/hull identification number on a vessel or outboard motor. in full, signed and notarized. The Tax-Rates.org Texas Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax

Taxes. Outboard Motor Records Maintenance PWD 144M ( PDF 213.7 KB) - Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. The date the purchaser took delivery of the vessel and/or outboard motor in Texas, or if purchased elsewhere, the date brought into Texas (proof is required). sales of electric motors and accessories, such as life jackets or ladders, sold separately from the boat, repairing and remodeling boats and boat motors. WebA Texas resident who buys a boat or boat motor in another state and brings it into Texas owes the 6.25 percent boat and boat motor use tax. The pawn shop is required to title the vessel/outboard motor in the pawn

Submit with the applicable forms: When no change of ownership has occurred: The Rights of Survivorship form must be completed in full, signed and notarized. What is the rate for the boat and boat motor tax? Usage is subject to our Terms and Privacy Policy. Boat/Motor Sales, Use and New Resident Tax Calculator, References, Tools & Forms for Boat and Outboard Motor Titling and Registration. This training document provides the basic legal background information intended to aid TPWD staff or its Agent in understanding basic boat/outboard motor transactions. This form does not allow the authorized individual to sign for the owner/applicant. documentation for vessels/boats and outboard motors for a period of 10 years. Taxes. Adobe Reader is required to open the files. motors.. For private-party sales, motor vehicle sales or use tax is based on one of the following: the vehicle's sales price, when the purchaser pays 80 percent or more of the vehicle's SPV; Boats/Outboard Motors Listing, New

Taxpayers will be notified by letter after their application for a sales tax permit has been approved whether they will file monthly or quarterly. Information provided will

What is the taxable value? Reader. Start below by entering your Desired Vehicle Price. We read every comment! Do you need access to a database of state or local sales tax rates? The Affidavit of Heirship form must be completed in full, signed and notarized. outboard motor title/registration transaction. Do you have a comment or correction concerning this page? Maximum Possible Sales Tax. WebThe Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). Apply for an annual party boat safety inspection. For example, a person purchases a boat for $350,000. Trailers are handled through your local County Tax office and the price of the trailer must be separated from the price of the vessel/boat and motor. Calculate interest for delinquent sales tax payments. Retain this original form, and after the death of any person(s) named in this agreement, the survivor(s) may obtain a new title by submitting this form, all applicable supporting documentation, and the required fees. Use this calculator with the following forms: Date of Payment cannot be earlier than Date of Sale. information must be completed and signatures must be original. Upon completion of this form, two options are available: Submit this completed form, along with all applicable supporting documentation and fees, and have the Rights of Survivorship (ROS) designation added to the title for all owners of record. Apply for a new license, renew a license, replace a lost license, or update information on an existing license. and Titles FAQ, Abandoned

This form is used as a support document. Sec. -4.25%. Form is used as a support document. The Affidavit of Heirship form must be completed in full, signed and notarized. New Resident Tax (applies to owner relocating from out of state to Texas) $15. Make changes or corrections to your name, mailing address or vessel/boat

Outboard motors with a recorded lien holder are not eligible for replacement titles online. Submit with applicable form(s): This form is used to request the Texas Parks and Wildlife Department (TPWD) to consider issuing a bonded title for a vessel/boat and/or outboard motor which does not qualify for standard titling because the properly assigned title and/or required legal documentation cannot be obtained. Retain this original form, and after the death of any person(s) named in this agreement, the survivor(s) may obtain a new title by submitting this form, all applicable supporting documentation, and the required fees. The fee for each permit is $150.00. 5, Sec. This form should only be submitted when the previous owner refuses to title the asset or when proof can be provided that the previous owner cannot be located. Tax and Bill of Sale Requirements Boat and Motor Tax: TPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. You can check whether a title has been issued for free -, Vessels exceeding 115 feet in length; and. You can check whether a title has been issued for free -. This form is used when the owner is deceased and left either no will or a

Calculator used in preparing forms PWD 143 (PDF) and PWD 144 (PDF). WebTotal price including tax = list price * ( 1 + sales tax rate) If you need to calculate state sales tax, use tax and local sales tax see the State and Local Sales Tax Calculator. There is no limit to the amount of use tax due on the use of a taxable boat or boat motor in this state. and additional form letters to use for sending notice to the proper law

can be submitted, and, A clear progression of ownership can be determined through the documentation

The tax rate is 6.25% of the sales price. The application and supporting documentation must be. Limited sales and use tax applies to the purchase of a boat that is greater than 115 feet long measured from the tip of the bow in a straight line to the stern. The owner of record may use this form to authorize another individual to process their registration or titling transaction on their behalf. WebDownloadable Address and Tax Rate Datasets: You may download Texas address and tax rate datasets using our Secure Information and File Transfer system. a manufacturer's or an importer's certificate executed on a form prescribed

The following information will typically be needed to complete the notification process: Content of this site copyright Texas Parks and Wildlife Department unless otherwise noted. or acquired a vessel/boat or outboard motor from a seller and the title is in the

materials, equipment and machinery that become component parts of the ship or vessel (including commercial fishing and pleasure fishing). The tax rate is 6.25% of the sales price. quick, and bonded titles). The certificate, when issued, is valid through the expiration date shown, must always be aboard the vessel/boat (including USCG documented vessels that require Texas registration), and be available for inspection by an enforcement officer. The ownership of a vessel or of an outboard motor is evidenced by a

WebTax is calculated on the greater of the actual sales price or 80 percent of the SPV shown for that day. Email subscriber privacy policy Please see Fee Chart Boat/Outboard Motor and Related Items and PWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator for additional assistance. Make changes or corrections to your name, mailing address or outboard

Start below by entering your Desired Vehicle Price. WebThe sales price for the vessel and/or outboard motor. This form is completed when transferring ownership to the purchaser of

Complete instructions and requirements are available on the form. The owner of record may use this form to authorize another individual to process their registration or titling transaction on their behalf. The Limited Power of Attorney form must be completed in full, signed and

A new Texas resident who brings a boat or boat motor into Texas qualifies to pay a $15 new resident tax instead of the 6.25 percent boat and boat motor use tax. and/or PWD

property owner for more than seven (7) days. Form is used as a support document. NEW RESIDENT. If the situation does not qualify, then a response will be mailed back to the applicant stating the reason for denial. This form does not function as Power of Attorney. Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Texas, local counties, cities, and special taxation districts. Do not purchase a used vessel/boat or outboard motor without receiving an original title (signed on the front and back) along with a signed bill of sale from the person(s) listed on the title or from their legally documented representative. The pawn shop is required to title the vessel/outboard motor in the pawn shop's name before selling (unless the pawn shop is a licensed Marine Dealer). This form is used when the owner of record is in a trust name and the trust is transferring ownership. Need an updated list of Texas sales tax rates for your business? This form is used to make the following changes to lien holder information: Please see Fee Chart Boat/Outboard Motor and Related Items (PDF) for additional assistance. (TPWD) to consider issuing a bonded title for a vessel/boat and/or outboard motor

when the previous owner refuses to title the asset or when proof can be provided

Tax-Rates.org provides free access to tax rates, calculators, and more. Sales tax for vessels and outboard motors purchased in Texas on or WebThe tax is an obligation of and shall be paid by the person who uses the boat or motor in this state or brings the boat or motor into this state. Once signed in, select Sales Tax Rates and Texas Address Files. Apply for a new license, renew a license, replace a lost license, or update

A signed bill of sale or invoice is required for every transfer of ownership. All internal combustion (gasoline/diesel/propane powered) outboard motors must

This form is a legal document used to designate a representative (individual or company) to conduct business and sign documents on behalf of another. Taxpayers required to pay electronically via TEXNET must initiate their payment above $1,000,000 by 8 p.m. CT on the banking business day prior to the due date in order for the payment to be considered timely. Tax paid previously in Texas or in another state on this vessel and/or outboard motor. will; no application for administration has been filed; and there is no

To calculate interest on past-due taxes, visit. lien process. For private-party sales, motor vehicle sales or use tax is based on one of the following: the vehicle's sales price, when the purchaser pays 80 percent or more of the vehicle's SPV; This form does not allow the authorized individual to sign for the owner/applicant. New Resident tax is assessed (not sales or use tax) for owners who previously resided in another state who are bringing their previously titled or registered boat and/or outboard motor from that other state into Texas. Taxpayers will be notified by letter when their business meets the threshold to be required to pay electronically via TEXNET. This form is completed when transferring ownership to the purchaser of a vessel/boat and/or outboard motor sold due to a self-service storage lien. All history requests will be fulfilled by TPWD Austin Headquarters within 10 days of processing. Instructions for completing the application are included with the form. certificate of title issued by the department, unless the vessel or the

WebThe sales price for the vessel and/or outboard motor. All rights reserved. For additional information about this license: Party

144 (PDF 261.4 KB), PWD 1340 - Ownership Transfer Notification Online. Notify Texas Parks & Wildlife. One of the following is acceptable to meet the bill of sale or invoice requirement: New Resident Tax - $15.00. WebThe Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price. Submit with applicable form(s): This form is used to request the Texas Parks and Wildlife Department

Boat/Motor Online Transactions: When using the paper form, it should be completed and mailed to TPWD Boat Registration, 4200 Smith School Rd, Austin, TX 78744, or faxed to 512-389-4900, or scanned and attached to an email to. of USCG Documented Vessels, Sold

WebTotal price including tax = list price * ( 1 + sales tax rate) If you need to calculate state sales tax, use tax and local sales tax see the State and Local Sales Tax Calculator. Maximum Possible Sales Tax. WebUse this calculator if you know the price of your vehicle and need to estimate the Monthly Payment. This form should be completed by an applicant when this person has purchased

Oct. 1, 1991. Purchase additional Temporary Use Validation Card with Decal Set. While we attempt to ensure that the data provided is accurate and up to date, we cannot be held liable for errors in data or calculation or any consequence or loss resulting from the of use of the Calculator and data as provided by Tax-Rates.org. One of the following is acceptable to meet the bill of sale or invoice requirement: $15.00 New Resident tax is assessed (not sales or use tax) for owners who previously resided in another state who are bringing their previously titled or registered boat and/or outboard motor from another state into Texas. All motorized vessels, regardless of length (including any sailboat with an auxiliary engine); All non-motorized vessels (including sailboats) 14 feet in length or longer; and. Your contact information is used to deliver requested updates or to access your subscriber preferences. WebThe Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price. enforcement agency and the owner(s) and lien holder(s). If the seller does not collect the tax, the buyer must pay the tax to the Comptrollers office using Form 01-156, Texas Use Tax Return (PDF). We urge you to notify us of any errors in the Calculator or our data. 8.05%. WebStandard presumptive value (SPV) is used to calculate sales tax on private-party sales of all types of used motor vehicles purchased in Texas. Boat Program. Calculate penalties for delinquent sales tax payments. WebPWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator Calculator used in preparing forms PWD 143 (PDF) and PWD 144 (PDF). Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Vessels registered as antique boats are permitted to display the registration decal on the left portion of the windshield. to aid TPWD staff or its Agent in understanding basic boat/outboard motor

If a legal representative signs the title or bill of sale for the recorded owner(s), you must obtain a copy of the documentation authorizing the legal representative to act on behalf of the owner(s). WebTPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. Additional Tools:

The retail sales of boats and boat motors are subject to either. Apply for Texas title and registration for a brand new vessel/boat. This form is used by TPWD or its Agent to void a vessel/boat and/or

statutory foreclosure lien. This form is used to verify the serial number/hull identification number on a vessel or outboard motor. in full, signed and notarized. The Tax-Rates.org Texas Sales Tax Calculator is a powerful tool you can use to quickly calculate local and state sales tax

Scottish Trance Djs, Articles T

The request will be reviewed

The tax rate is 6.25% of the sales price. Children under 13 years of age must have a parent/guardian's consent before providing While we are available Monday through Friday, 8 a.m.-5 p.m. Central Time, shorter wait times normally occur from 8-10 a.m. and 4-5 p.m. The Affidavit of Authority to Administer Trust must be completed in full, signed and notarized. WebTax is calculated on the greater of the actual sales price or 80 percent of the SPV shown for that day. 144M (PDF 213.7 KB) - Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. Use Validation Card with Decals by the Licensee. Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent. If the seller does not collect the tax, the buyer must pay the tax when obtaining the boats title and registration from the TPWD or participating CTAC. WebSales Tax Calculator of Texas for 2023 Calculation of the general sales taxes of Texas State for 2023 Amount before taxes Sales tax rate(s) 6.25% 6.3% 6.5% 6.75% 7% 7.25% 7.5% 7.75% 8% 8.125% 8.25% Amount of taxes Amount after taxes The previous (non-titled) owners cannot be reached or have refused to title the asset as required by state law. Sales tax jurisdiction rules can sometimes be too complicated to describe rate areas by zip code, so this calculator is provided for reference purposes only. Sold or no longer own your vessel/boat and/or outboard motor? Manage My Subscriptions, archive The certificate of number (registration), if required: TPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. This calculator is used to: Calculate sales tax owed Texas. The total amount of boat sales tax collected on each sale of a taxable boat or boat motor may not exceed $18,750. This form is used to make the following changes to lien holder information: Please see Fee Chart Boat/Outboard Motor and Related Items for additional assistance. Sales Price must be a positive number. and supporting documentation required to complete the statutory foreclosure

Sec. Estimated Monthly Payment: $0.00 financing b. Boat Program. To calculate interest on past due taxes, visit. WebA Texas resident who buys a boat or boat motor in another state and brings it into Texas owes the 6.25 percent boat and boat motor use tax. (Word 64 KB). -4.25%. For example, the April sales tax report is due May 20. lien holder, or law enforcement agency and there are no legal claims of

Separate permits are required for each vessel/boat and/or outboard motor. It is also used to calculate use tax on motor vehicles brought into Texas that were purchased from a private-party out of state. This form contains an itemized listing of the fees required for all vessel/boat, outboard motor, and marine license transactions. The validation decal must be affixed in line with and three (3) inches towards the rear of the boat from the TX number (an example is shown on the decal document). WebThe Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price.

The request will be reviewed

The tax rate is 6.25% of the sales price. Children under 13 years of age must have a parent/guardian's consent before providing While we are available Monday through Friday, 8 a.m.-5 p.m. Central Time, shorter wait times normally occur from 8-10 a.m. and 4-5 p.m. The Affidavit of Authority to Administer Trust must be completed in full, signed and notarized. WebTax is calculated on the greater of the actual sales price or 80 percent of the SPV shown for that day. 144M (PDF 213.7 KB) - Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. Use Validation Card with Decals by the Licensee. Local taxing jurisdictions (cities, counties, special purpose districts and transit authorities) can also impose up to 2 percent sales and use tax for a maximum combined rate of 8.25 percent. If the seller does not collect the tax, the buyer must pay the tax when obtaining the boats title and registration from the TPWD or participating CTAC. WebSales Tax Calculator of Texas for 2023 Calculation of the general sales taxes of Texas State for 2023 Amount before taxes Sales tax rate(s) 6.25% 6.3% 6.5% 6.75% 7% 7.25% 7.5% 7.75% 8% 8.125% 8.25% Amount of taxes Amount after taxes The previous (non-titled) owners cannot be reached or have refused to title the asset as required by state law. Sales tax jurisdiction rules can sometimes be too complicated to describe rate areas by zip code, so this calculator is provided for reference purposes only. Sold or no longer own your vessel/boat and/or outboard motor? Manage My Subscriptions, archive The certificate of number (registration), if required: TPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. This calculator is used to: Calculate sales tax owed Texas. The total amount of boat sales tax collected on each sale of a taxable boat or boat motor may not exceed $18,750. This form is used to make the following changes to lien holder information: Please see Fee Chart Boat/Outboard Motor and Related Items for additional assistance. Sales Price must be a positive number. and supporting documentation required to complete the statutory foreclosure

Sec. Estimated Monthly Payment: $0.00 financing b. Boat Program. To calculate interest on past due taxes, visit. WebA Texas resident who buys a boat or boat motor in another state and brings it into Texas owes the 6.25 percent boat and boat motor use tax. (Word 64 KB). -4.25%. For example, the April sales tax report is due May 20. lien holder, or law enforcement agency and there are no legal claims of

Separate permits are required for each vessel/boat and/or outboard motor. It is also used to calculate use tax on motor vehicles brought into Texas that were purchased from a private-party out of state. This form contains an itemized listing of the fees required for all vessel/boat, outboard motor, and marine license transactions. The validation decal must be affixed in line with and three (3) inches towards the rear of the boat from the TX number (an example is shown on the decal document). WebThe Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price.  This form is used to provide written explanations of specific situations. The vessel/boat and/or outboard motor is then jointly owned (co-owned) by those persons, which shall be effective as of the date this form is signed and notarized. Sec. The buyer pays the use tax or new resident tax when obtaining the boats title and registration from the TPWD or participating CTAC. By using the Tax-Rates.org Texas Sales Tax Calculator ("the Calculator"), you expressly agree to the terms of use and disclaimer of liability expressed in this agreement and the Tax-Rates.org Terms of Service. This calculator is used to: Calculate sales tax owed Texas.

This form is used to provide written explanations of specific situations. The vessel/boat and/or outboard motor is then jointly owned (co-owned) by those persons, which shall be effective as of the date this form is signed and notarized. Sec. The buyer pays the use tax or new resident tax when obtaining the boats title and registration from the TPWD or participating CTAC. By using the Tax-Rates.org Texas Sales Tax Calculator ("the Calculator"), you expressly agree to the terms of use and disclaimer of liability expressed in this agreement and the Tax-Rates.org Terms of Service. This calculator is used to: Calculate sales tax owed Texas.  The fee for the permit is $150 for each boat or boat motor used in this state and is valid for 90 days. Maximum Local Sales Tax. If purchased in Texas on or after 9/1/2019, and combined vessel/outboard motor sales price is over $300,000.00, vessel and outboard motor prices Outboard motors with a recorded lien holder are not eligible for replacement titles online. This form is used to apply for a temporary tax permit by the owner of a taxable vessel/boat or outboard motor who qualifies for a specific tax exemption to have their boat or outboard motor in Texas for not more than 90 days without paying sales/use tax. Click here to get more information. Average Local + State Sales Tax. The following vessels/boats when on Texas public water are required to have current registration, including when docked, moored, or stored: A Texas boat registration is valid for two years. 7.01, eff.

The fee for the permit is $150 for each boat or boat motor used in this state and is valid for 90 days. Maximum Local Sales Tax. If purchased in Texas on or after 9/1/2019, and combined vessel/outboard motor sales price is over $300,000.00, vessel and outboard motor prices Outboard motors with a recorded lien holder are not eligible for replacement titles online. This form is used to apply for a temporary tax permit by the owner of a taxable vessel/boat or outboard motor who qualifies for a specific tax exemption to have their boat or outboard motor in Texas for not more than 90 days without paying sales/use tax. Click here to get more information. Average Local + State Sales Tax. The following vessels/boats when on Texas public water are required to have current registration, including when docked, moored, or stored: A Texas boat registration is valid for two years. 7.01, eff.  What is the rate for the boat and boat motor tax? 5, Sec. The lien holder signature must be notarized

2.00%. Non-motorized canoes, kayaks, punts, rowboats, or rubber rafts (regardless of length), or other vessels under 14 feet in length when paddled, poled, oared, or windblown. Children under 13 years of age must have a parent/guardian's consent before providing by the department. For additional information about this inspection: Party Boat Program. (Older blue and green title formats do not have spaces for the bill of sale on the back). and Titles FAQ, Abandoned

WebThe Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. The previous (non-titled) owners cannot be reached or have refused to

General Information Letters and Private Letter Rulings, State Tax Automated Research (STAR) System, Historically Underutilized Business (HUB), Vendor Performance Tracking System (VPTS), Texas Procurement and Contract Management Guide, Minnie Stevens Piper Foundation College Compendium, Texas Parks and Wildlife Department (TPWD), County Tax Assessor-Collectors Office (CTAC), obtaining the boats title and registration, Boat Sales Tax Manual Computation Worksheet, Texas Parks and Wildlife Boat Title, Registration and ID Requirements, Taxes on Sales and Use of Boats and Boat Motors, boat and boat motor sales and use tax; or, an electric motor attached to a boat subject to boat tax, and sold with the boat for one price (such as a trolling motor). signs the title or bill of sale for the recorded owner(s), you must obtain a copy of the documentation authorizing the legal representative to act on behalf of the owner(s). Sales tax for vessels and outboard motors purchased in Texas on or May display ONLY the validation decal (not the Registration (TX) Number) on both sides of the bow of the vessel; and. *Desired Vehicle Price: Sales Tax: *Term in Months: *Rate / APR: Down Payment or Trade-In Value: * = Required. 2023 SalesTaxHandbook. Instructions for completing the application are included with the form. The sales price for the vessel and/or outboard motor. SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | A Certificate of Number ID Card is issued at the time of registration (with decals). Sales tax for vessels and outboard motors purchased in Texas on or OWNERSHIP OF VESSELS AND OUTBOARD MOTORS; CERTIFICATES OF TITLE. name of a prior owner (not the sellers' name). WebTexas State Sales Tax. Upon the death of any person(s) named in this agreement, the survivor(s) may obtain a new title by submitting the applicable supporting documentation and the required fees. This form is completed when transferring ownership to the purchaser of a vessel/boat and/or outboard motor sold due to a self-service storage lien. For payments of $1,000,000 or less, a payor has until 10:00 a.m. (CT) on the due date to initiate the transaction in the TEXNET System. We value your feedback! Adding an outboard or trolling motor to one of these types requires titling and registration.

What is the rate for the boat and boat motor tax? 5, Sec. The lien holder signature must be notarized

2.00%. Non-motorized canoes, kayaks, punts, rowboats, or rubber rafts (regardless of length), or other vessels under 14 feet in length when paddled, poled, oared, or windblown. Children under 13 years of age must have a parent/guardian's consent before providing by the department. For additional information about this inspection: Party Boat Program. (Older blue and green title formats do not have spaces for the bill of sale on the back). and Titles FAQ, Abandoned

WebThe Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. The previous (non-titled) owners cannot be reached or have refused to

General Information Letters and Private Letter Rulings, State Tax Automated Research (STAR) System, Historically Underutilized Business (HUB), Vendor Performance Tracking System (VPTS), Texas Procurement and Contract Management Guide, Minnie Stevens Piper Foundation College Compendium, Texas Parks and Wildlife Department (TPWD), County Tax Assessor-Collectors Office (CTAC), obtaining the boats title and registration, Boat Sales Tax Manual Computation Worksheet, Texas Parks and Wildlife Boat Title, Registration and ID Requirements, Taxes on Sales and Use of Boats and Boat Motors, boat and boat motor sales and use tax; or, an electric motor attached to a boat subject to boat tax, and sold with the boat for one price (such as a trolling motor). signs the title or bill of sale for the recorded owner(s), you must obtain a copy of the documentation authorizing the legal representative to act on behalf of the owner(s). Sales tax for vessels and outboard motors purchased in Texas on or May display ONLY the validation decal (not the Registration (TX) Number) on both sides of the bow of the vessel; and. *Desired Vehicle Price: Sales Tax: *Term in Months: *Rate / APR: Down Payment or Trade-In Value: * = Required. 2023 SalesTaxHandbook. Instructions for completing the application are included with the form. The sales price for the vessel and/or outboard motor. SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | A Certificate of Number ID Card is issued at the time of registration (with decals). Sales tax for vessels and outboard motors purchased in Texas on or OWNERSHIP OF VESSELS AND OUTBOARD MOTORS; CERTIFICATES OF TITLE. name of a prior owner (not the sellers' name). WebTexas State Sales Tax. Upon the death of any person(s) named in this agreement, the survivor(s) may obtain a new title by submitting the applicable supporting documentation and the required fees. This form is completed when transferring ownership to the purchaser of a vessel/boat and/or outboard motor sold due to a self-service storage lien. For payments of $1,000,000 or less, a payor has until 10:00 a.m. (CT) on the due date to initiate the transaction in the TEXNET System. We value your feedback! Adding an outboard or trolling motor to one of these types requires titling and registration.  outboard motor is new. the circumstance to determine if a bonded title is appropriate. Replace a lost or destroyed outboard motor title. Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid. *Desired Vehicle Price: Sales Tax: *Term in Months: *Rate / APR: Down Payment or Trade-In Value: * = Required. When using the paper form, it should be completed and mailed to TPWD Boat Registration, 4200 Smith School Rd, Austin, TX 78744, or faxed to 512-389-4900, or scanned and attached to an email to.

outboard motor is new. the circumstance to determine if a bonded title is appropriate. Replace a lost or destroyed outboard motor title. Permitted sales taxpayers can claim a discount of 0.5 percent of the amount of tax timely reported and paid. *Desired Vehicle Price: Sales Tax: *Term in Months: *Rate / APR: Down Payment or Trade-In Value: * = Required. When using the paper form, it should be completed and mailed to TPWD Boat Registration, 4200 Smith School Rd, Austin, TX 78744, or faxed to 512-389-4900, or scanned and attached to an email to.  Taxes. Outboard Motor Records Maintenance PWD 144M ( PDF 213.7 KB) - Save the PDF form to your computer before completing or printing it; do not fill out the form in a web browser. The date the purchaser took delivery of the vessel and/or outboard motor in Texas, or if purchased elsewhere, the date brought into Texas (proof is required). sales of electric motors and accessories, such as life jackets or ladders, sold separately from the boat, repairing and remodeling boats and boat motors. WebA Texas resident who buys a boat or boat motor in another state and brings it into Texas owes the 6.25 percent boat and boat motor use tax. The pawn shop is required to title the vessel/outboard motor in the pawn

Submit with the applicable forms: When no change of ownership has occurred: The Rights of Survivorship form must be completed in full, signed and notarized. What is the rate for the boat and boat motor tax? Usage is subject to our Terms and Privacy Policy. Boat/Motor Sales, Use and New Resident Tax Calculator, References, Tools & Forms for Boat and Outboard Motor Titling and Registration. This training document provides the basic legal background information intended to aid TPWD staff or its Agent in understanding basic boat/outboard motor transactions. This form does not allow the authorized individual to sign for the owner/applicant. documentation for vessels/boats and outboard motors for a period of 10 years. Taxes. Adobe Reader is required to open the files. motors.. For private-party sales, motor vehicle sales or use tax is based on one of the following: the vehicle's sales price, when the purchaser pays 80 percent or more of the vehicle's SPV; Boats/Outboard Motors Listing, New

Taxpayers will be notified by letter after their application for a sales tax permit has been approved whether they will file monthly or quarterly. Information provided will

What is the taxable value? Reader. Start below by entering your Desired Vehicle Price. We read every comment! Do you need access to a database of state or local sales tax rates? The Affidavit of Heirship form must be completed in full, signed and notarized. outboard motor title/registration transaction. Do you have a comment or correction concerning this page? Maximum Possible Sales Tax. WebThe Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR). Apply for an annual party boat safety inspection. For example, a person purchases a boat for $350,000. Trailers are handled through your local County Tax office and the price of the trailer must be separated from the price of the vessel/boat and motor. Calculate interest for delinquent sales tax payments. Retain this original form, and after the death of any person(s) named in this agreement, the survivor(s) may obtain a new title by submitting this form, all applicable supporting documentation, and the required fees. Use this calculator with the following forms: Date of Payment cannot be earlier than Date of Sale. information must be completed and signatures must be original. Upon completion of this form, two options are available: Submit this completed form, along with all applicable supporting documentation and fees, and have the Rights of Survivorship (ROS) designation added to the title for all owners of record. Apply for a new license, renew a license, replace a lost license, or update information on an existing license. and Titles FAQ, Abandoned

This form is used as a support document. Sec. -4.25%. Form is used as a support document. The Affidavit of Heirship form must be completed in full, signed and notarized. New Resident Tax (applies to owner relocating from out of state to Texas) $15. Make changes or corrections to your name, mailing address or vessel/boat

Outboard motors with a recorded lien holder are not eligible for replacement titles online. Submit with applicable form(s): This form is used to request the Texas Parks and Wildlife Department (TPWD) to consider issuing a bonded title for a vessel/boat and/or outboard motor which does not qualify for standard titling because the properly assigned title and/or required legal documentation cannot be obtained. Retain this original form, and after the death of any person(s) named in this agreement, the survivor(s) may obtain a new title by submitting this form, all applicable supporting documentation, and the required fees. The fee for each permit is $150.00. 5, Sec. This form should only be submitted when the previous owner refuses to title the asset or when proof can be provided that the previous owner cannot be located. Tax and Bill of Sale Requirements Boat and Motor Tax: TPWD is required by law to collect tax for vessels/boats (115 feet or less in length) and outboard motors purchased in Texas or brought into Texas on or after January 1, 2000. You can check whether a title has been issued for free -, Vessels exceeding 115 feet in length; and. You can check whether a title has been issued for free -. This form is used when the owner is deceased and left either no will or a

Calculator used in preparing forms PWD 143 (PDF) and PWD 144 (PDF). WebTotal price including tax = list price * ( 1 + sales tax rate) If you need to calculate state sales tax, use tax and local sales tax see the State and Local Sales Tax Calculator. There is no limit to the amount of use tax due on the use of a taxable boat or boat motor in this state. and additional form letters to use for sending notice to the proper law

can be submitted, and, A clear progression of ownership can be determined through the documentation

The tax rate is 6.25% of the sales price. The application and supporting documentation must be. Limited sales and use tax applies to the purchase of a boat that is greater than 115 feet long measured from the tip of the bow in a straight line to the stern. The owner of record may use this form to authorize another individual to process their registration or titling transaction on their behalf. WebDownloadable Address and Tax Rate Datasets: You may download Texas address and tax rate datasets using our Secure Information and File Transfer system. a manufacturer's or an importer's certificate executed on a form prescribed

The following information will typically be needed to complete the notification process: Content of this site copyright Texas Parks and Wildlife Department unless otherwise noted. or acquired a vessel/boat or outboard motor from a seller and the title is in the

materials, equipment and machinery that become component parts of the ship or vessel (including commercial fishing and pleasure fishing). The tax rate is 6.25% of the sales price. quick, and bonded titles). The certificate, when issued, is valid through the expiration date shown, must always be aboard the vessel/boat (including USCG documented vessels that require Texas registration), and be available for inspection by an enforcement officer. The ownership of a vessel or of an outboard motor is evidenced by a

WebTax is calculated on the greater of the actual sales price or 80 percent of the SPV shown for that day. Email subscriber privacy policy Please see Fee Chart Boat/Outboard Motor and Related Items and PWD 930 - Boat/Motor Sales, Use and New Resident Tax Calculator for additional assistance. Make changes or corrections to your name, mailing address or outboard

Start below by entering your Desired Vehicle Price. WebThe sales price for the vessel and/or outboard motor. This form is completed when transferring ownership to the purchaser of

Complete instructions and requirements are available on the form. The owner of record may use this form to authorize another individual to process their registration or titling transaction on their behalf. The Limited Power of Attorney form must be completed in full, signed and

A new Texas resident who brings a boat or boat motor into Texas qualifies to pay a $15 new resident tax instead of the 6.25 percent boat and boat motor use tax. and/or PWD