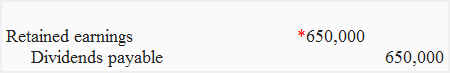

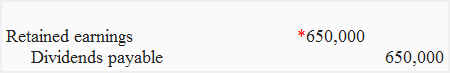

Home Depot (NYSE: HD) is a large-cap company in the Dow Jones Index that distributes interim dividends on a quarterly basis. The journal entry to record the stock dividend distribution requires a decrease (debit) to Common Stock Dividend Distributable to remove the distributable amount from that account, $1,500, and an increase (credit) to Common Stock for the same par value amount. As of the date of declaration, the company has 10,000 shares of common stock issued and holds 800 shares as treasury stock. Such dividendsin full or in partmust be declared by the board of directors before paid. Each journal entry contains the data significant to a single business transaction, including the date, the amount to be credited and debited, a brief description of the transaction and the accounts affected. On May 1, the company declared a $1 per share cash dividend, with a date of record on May 12, to be paid on May 25. if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'accountinghub_online_com-box-4','ezslot_8',154,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-box-4-0');Like a normal or final dividend, the interim dividend can also be issued in cash or stock form. The company announced an interim dividend of 6.6 US cents per ordinary share last year. The dividend will be paid on March 1, to stockholders of record on February 5. For example, Company X decides to distribute 50% of its earnings to its shareholders. Closing expenses to retained earnings will be the final entry for this set of transactions. Both small and large stock dividends cause an increase in common stock and a decrease to retained earnings. The interim dividend is a useful tool to distribute the seasonal profits of a company. How Is It Important for Banks?  (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Stockholders Equity Section of the Balance Sheet for Duratech. Do you remember playing the board game Monopoly when you were younger? Accounting is done with the objective of closing books of accounts and simultaneous determination of This is due to, in many jurisdictions, paying out the cash dividend from the companys common stock is usually not allowed. They are declared by the companys board of directors, but the final approval comes from the shareholders. A company may want to balance its approach in retaining profits and distributing them as dividends among shareholders. The company cannot pay a WebFigure 16.10 Payment of $1.00 per Share Cash Dividend. Cash dividends are paid out of a companys retained earnings, the accumulated profits that are kept rather than distributed to shareholders. Except where otherwise noted, textbooks on this site WebJournal entries assuming cash dividends in the amount of $1.00 per share: View the full answer Step 2/2 Final answer Transcribed image text: Sefclk Company's balance sheet showed the following on December 31, 2024: A cash dividend is declared on December 31,2024 , and is payable on January 20 , 2025, to shareholders of record on January 10 , Equity investors will still invest in such companies despite the lack of dividends because they see higher growth prospects and, therefore, higher share price appreciation expectations. What is Liquidity Coverage Ratio (LCR)? Pinterest Close all expense accounts to Income Summary. Dividends are distributions of earnings by a corporation to its stockholders. This is usually the case which they do not want to bother keeping the general ledger of the current year dividends. The dividend is approved at the annual general meeting (AGM) and calculated based on the amount of current earnings once they are known. Secondly, debt holders are legally entitled to repayment of the interest and/or principal, while equity investors receive no guarantee as to recovery of their investment. When they declare a cash dividend, some companies debit a Dividends account instead of Retained Earnings. The treatment as a current liability is because these items represent a board-approved future outflow of cash, i.e. WebPass journal entries and show how the various items will appear in the companys Balance Sheet. members' obligations for illegal dividend. It is announced and proposed by the BOD and approved by shareholders of the company.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'accountinghub_online_com-leader-2','ezslot_14',161,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-leader-2-0'); Once approved, the final dividend cannot be revoked unlike the interim dividend. WebThe closing process reduces revenue, expense, and dividends account balances (temporary accounts) to zero so they are ready to receive data for the next accounting period. Such dividends are typically paid out monthly or quarterly and in smaller amounts than an annual dividend. For example, assume an investor owns 200 shares with a market value of $10 each for a total market value of $2,000. Like in the example above, there is no journal entry required on the record date at all. Interim dividends can only be issued if allowed in the article of association of the company. The 5% common stock dividend will require the distribution of 60,000 shares times 5%, or 3,000 additional shares of stock. Which of the following is the journal entry to record the declaration? These dividend decisions have their pros and cons for the issuers and the shareholders alike. To record a dividend, a reporting entity should debit retained earnings (or any other The dividends account is a temporary equity account in the balance sheet. A final dividend is the type of dividend that is issued at the annual general meeting of the company. This journal entry is made to eliminate the dividends payable that the company has made at the declaration date as well as to recognize the cash outflow that is not an expense. The preferred stock certificate discloses an annual dividend rate of 8 percent. These dividends are often announced as final dividends by these companies. It is announced after declaring the financial results of the company. Do declared dividends have to be paid? Both types of stock dividends impact the accounts in stockholders equity. Sometimes, companies would issue interim dividends when they couldnt offer a regular dividend in previous quarters. What wil be the journal entry of dividend received and reinvested? Dividend Coverage Ratio: All You Need to Know About! excel,14,multi currency in tally 9,1,Multicurrency Accounting,3,mutual fund,30,national security,1,new and sacrifice ratio,1,new york times,1,new zealand,1,news,1,NGO,5,nonprofit-accounting,6,North Georgia Mountains,1,Notification,1,NPV,17,NSE,1,odbc,2,office,10,oman,1,online application,2,online accounting,11,Online Accounting Course,5,otcei,1,pakistan,3,parents,3,Partnership,1,pay pal,3,pdf,4,Personal Finance,6,pie chart,1,pie chart of income,2,pnb,5,podcast,1,ppf,1,presentation,10,price,7,privacy policy,2,prof. Should it be as below: At the time of closure of books Profit & Loss A/c Dr. To Proposed Dividend (liablity) On the date of AGM when final dividend declared Publication date: 31 Dec 2021. us Financing guide 4.4. Discover your next role with the interactive map. Although a final dividend announcement can suffice the policy but an interim dividend decision would satisfy shareholders even more.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[728,90],'accountinghub_online_com-large-leaderboard-2','ezslot_7',156,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-large-leaderboard-2-0'); Another common reason for interim dividends is to distribute exceptional profits occasionally. However, since the amount of dividends in arrears may influence the decisions of users of a corporations financial statements, firms disclose such dividends in a footnote. If they report earnings of $1 million and 2 million shares outstanding, each share will get (1M*50%)/2M = $0.25/share dividend payout. The date of payment is the third important date related to dividends. Withholding Tax. For example, in a 2-for-1 stock split, two shares of stock are distributed for each share held by a shareholder. Define accrual accounting and list its two components. Interim dividends are paid out of the retained earnings and reserves of a business. What is Debt Service Coverage Ratio (DSCR) and How to Calculate It? Interim dividends also send a positive signal to the market that can help raise the stock prices temporarily. To illustrate accounting for a property dividend, assume that Duratech Corporation has 60,000 shares of $0.50 par value common stock outstanding at the end of its second year of operations, and the companys board of directors declares a property dividend consisting of a package of soft drinks that it produces to each holder of common stock. Also, in the journal entry of cash dividends, some companies may use the term dividends declared instead of cash dividends. An entry is not needed on the date of record; however, the entries at the declaration and payment dates are as follows: Often a cash dividend is stated as so many dollars per share. Similar to distribution of a small dividend, the amounts within the accounts are shifted from the earned capital account (Retained Earnings) to the contributed capital account (Common Stock) though in different amounts. There is no change in total assets, total liabilities, or total stockholders equity when a small stock dividend, a large stock dividend, or a stock split occurs. However, not all dividends created equal.high dividend yield stocks, Facebook If the company pays regular dividends semiannually or annually, it may issue interim dividends quarterly to support shareholders income. A Stock dividend is a distribution to current shareholders on a proportional basis of the corporation's own stock. and you must attribute OpenStax. Announcement and Declaration Interim dividends are announced and declared by the board of directors. One is on the declaration date of the dividend and another is on the payment date. Interim dividends can be revoked even after the announcement. The excess of the market value over the par value is reported as an increase (credit) to the Additional Paid-in Capital from Common Stock account in the amount of $25,500. If the company prepares a balance sheet prior to distributing the stock dividend, the Common Stock Dividend Distributable account is reported in the equity section of the balance sheet beneath the Common Stock account. That in turn would reduce the corporate tax liability of the company. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? 1,25,00,000 and (ii) out of proceeds of fresh issue to the extent of Rs. Manage Settings Partners' capital accounts for partnerships, based on ratio agreed. On 10th January, 2012 it declared an interim dividend @ 8% per annum for full year. The effect on the market is to increase the market value per share. It usually leaves an audit trail for other accountants or agencies to follow. We're sending the requested files to your email now. Our mission is to improve educational access and learning for everyone. The company usually needs to have adequate cash and sufficient retained earnings to payout the cash dividend. The same training program used at top investment banks. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). In some states, corporations can declare preferred stock dividends only if they have retained earnings (income that has been retained in the business) at least equal to the dividend declared. While a company technically has no control over its common stock price, a stocks market value is often affected by a stock split. Usually, stockholders receive dividends on preferred stock quarterly. A dividend is a payment, either in cash, other assets (in kind), or stock, from a reporting entity to its shareholders. However, the BOD would require formal approval from shareholders. An increase (credit) to the Common Stock Dividends Distributable is recorded for the par value of the stock to be distributed: 3,000 $0.50, or $1,500. A special dividend is a non-recurring dividend that is not scheduled like the final and interim dividends. Dividends can be an investors best friend. Anheuser-Busch InBev, the company that owns the Budweiser and Michelob brands, may choose to distribute a case of beer to each shareholder. A primary motivator of companies invoking reverse splits is to avoid being delisted and taken off a stock exchange for failure to maintain the exchanges minimum share price. WebDividend = $0.50 100,000 = $50,000 The journal entry on the date of declaration is the following: As shown in the general ledger above, the retained earnings account is Interim dividends are issued with quarterly results. This includes rent, utilities and security, among other basic costs. On the other hand, stock dividends distribute additional shares of stock, and because stock is part of equity and not an asset, stock dividends do not become liabilities when declared. Cash Dividend Vs Stock Dividend - What are the Key. They are not considered expenses, and they are not reported on the income statement. The board of directors of a corporation possesses sole power to declare dividends. The company can make the cash dividend journal entry at the declaration date by debiting the cash dividends account and crediting the dividends payable account. A final dividend or regular dividend is issued after releasing audited financial statements of the company. Occasionally, a company pays dividends in merchandise or other assets. The split caused the price to drop to 0.053 won, or $49.35 per share. For example, Walt Disney Company may choose to distribute tickets to visit its theme parks. This transaction signifies money that is leaving your company: so well credit or reduce your companys cash account and debit your dividends payable account. To illustrate, assume that Duratechs board of directors declares a 4-for-1 common stock split on its $0.50 par value stock. 3 There is no consideration of the market value in the accounting records for a large stock dividend because the number of shares issued in a large dividend is large enough to impact the market; as such, it causes an immediate reduction of the market price of the companys stock. Property dividends are not as common as cash or stock dividends. February 9, 2018. https://seekingalpha.com/article/4145079-dividends-numbers-january-2018, Jing Pan. We and our partners use cookies to Store and/or access information on a device. For example, on December 14, 2020, the company ABC declares a cash dividend of $0.5 per share to its shareholders with the record date of December 31, 2020. Therefore, companies may choose to reward equity investors by distributing their earnings through dividends. Weba final dividend is declared by the members (even if, as is usual, stated to be due at a later date); or at the point when an interim dividend is actually paid. To illustrate, assume that Duratech Corporation has 60,000 shares of $0.50 par value common stock outstanding at the end of its second year of operations. Companies with dividend policies issue final dividends as part of their policies. This made the stock more accessible to potential investors who were previously unable to afford a share at $2,467. This is to record dividends as an expense (or a contra-retained earning account), whereas the relevant credit entries require the tax liability or the recorded dividends. We recommend using a On the other hand, small growth companies generally tend not to pay dividends because they prefer to use their earnings to reinvest back into the company. Instead, the decision is typically based on its effect on the market. Therefore, the dividends payable account a current liability line item on the balance sheet is recorded as a credit on the date of approval by the board of directors. The impact on the financial statement usually does not drive the decision to choose between one of the stock dividend types or a stock split. (Both methods are acceptable.) If so, the company would be more profitable and the shareholders would be rewarded with a higher stock price in the future. consent of Rice University. Let us discuss what are interim and final dividends and their key differences. Unlike a normal dividend, interim dividends are declared by the board of directors. Everything you need to master financial and valuation modeling: 3-Statement Modeling, DCF, Comps, M&A and LBO. access,2,account,86,accountant,94,Accounting,681,accounting definitions,99,accounting ebook,3,Accounting education,85,Accounting Education Ads Help,1,accounting procedure,2,accounting process outsourcing,2,Accounting Software,52,advance,3,advertising,6,africa,7,Amalgamation,6,amendments,16,Amortization,1,announcements,62,Annuity,2,assets,53,audit,46,auditing,41,Australia,2,B.Com.,22,balance sheet,87,bank,111,Bank reconciliation,12,banking,33,basic accounting,110,BBA,1,benefits,13,best,50,bill,12,black money,3,blog,12,bloggers,7,book keeping,4,bookkeeping,3,Branch Accounting - full tutorial,8,budget,35,Budget variance,13,business,65,businessman,9,CA,30,calculator,4,canada,3,capital,72,capital budgeting,27,career,21,cash,40,cash book,8,cash flow statement,11,Chiense,1,children,13,china,6,class,3,coaching,2,coins,2,college,6,commerce,10,commerce students,7,company,36,computer,9,computer accounting,1,conference,4,Contact vinod kumar,1,Control Your Spending,27,corporate accounting,69,cost,160,cost accounting,195,cost center,8,cost centre,1,CPA,2,credit,18,credit card,11,cs,10,currency,35,data,11,Debit and credit,17,debit cards,1,debt,62,debtor,21,degree,6,depletion,2,depreciation,38,Diwali Messages,12,documents,4,dollar,5,domain,3,Downloads,3,Dubai,1,e-accounting,17,earning,17,education,247,Education Loans,6,email,15,employee,4,EPF,2,ERP,7,euromoney,1,examination,7,excel,17,excise duty,6,expenses,65,facebook,7,factor of loan,1,fans,2,feature,32,fifo,5,FII,4,fiji,1,finacle,1,finance,823,Finance Journal Entries,4,Financial,134,financial accounting,147,Financial Statements,4,fire insurance,3,flickr,2,flow,4,forensic,4,forex,21,formula,8,france,1,fraud,6,free,2,fun,34,function,1,fund,48,GAAP,36,GDP,1,gdr,5,germany,1,gold,7,goodwill,4,goodwill accounting,3,google,34,google apps,3,google apps,1,google base,1,google buzz,1,google calendar,1,Google docs,38,google finance,3,google fusion tables,1,google talk,5,govt.,5,GST,33,guide,85,health,6,Hindi,2,Hindi Language,3,history,3,holding company,3,How to treat FBT in Tally 9,1,HRA,3,ICAI,11,ICAWI,3,ICICI Bank,1,IFRS,11,income,17,income statement,19,Income Tax,7,India,57,indian railway,1,Indonesia,1,inflation,4,inflation accounting,3,infographics,8,information,7,inspiration,176,insurance,14,insurance accounting,2,Intangible,3,interest,26,international,7,Internet,41,Introduction of Tally 9,1,inventory,41,investment,135,investment in Shares,6,invoice,3,IT,1,Japan,1,Job costing,4,journal entries,140,Journal Entries eBook Help,4,Kalculate,1,keyboard,3,kuwait,2,laptop,2,law,4,LBT,1,learning,36,lease,5,lecture,11,ledger,17,leducation,1,Leverage Analysis,7,liabilities,16,lifo,3,linkedin,1,loan,74,logical point,1,loss,5,loss of profit,1,M.Com.,5,m.phil,2,malaysia,3,management accounting,129,manual accounting,4,manufacturing account,1,market,11,marketing,3,mastercard,2,material,13,MBA,14,MCA,1,media,4,migration,2,mobile,9,money,61,ms word,3,ms. There is no journal entry recorded; the company creates a list of the stockholders that will receive dividends. Once the previously declared cash dividends are distributed, the following entries are made on the date of payment. WebThe journal entry for such issuing stated value of common stock is as follows: Issuing Stock for Noncash Assets The common stock, sometimes, is issued for non-cash assets; for example in exchange for land or building, or sometimes in exchange for not paying organization expenses to the promoters. Stock dividend journal entry Small stock dividend journal entry. Noncumulative preferred stock is preferred stock on which the right to receive a dividend expires whenever the dividend is not declared. Accounting for Books of Original EntryJournal, 11. WebAs soon as the Board of Directors approves and announces a dividend (on the declaration date) , the company must record a payable in the liability section of the balance sheet. If the board declares dividends of $25,000, $20,000 would be paid to preferred and the remaining $5,000 ($25,0000 dividends $20,000 paid to preferred) would be shared by common stockholders. Profit and Loss Appropriation Account The payment of the cash dividend will be made on January 8, 2021. Buying one share of stock at this price is rather expensive for most people. Some companies choose not to pay dividends and instead reinvest all of their earnings back into the company. When companies make large profits, they can either reinvest them for internal growth or distribute them to shareholders. Many investors view a dividend payment as a sign of a companys financial health and are more likely to purchase its stock. The Chance card may have paid a $50 dividend. Trail for other accountants or agencies to follow game Monopoly when you were?. The previously declared cash dividends: 3-Statement modeling, DCF, Comps M! Among shareholders not declared the accumulated profits that are kept rather than to! And another is on the declaration more profitable and the shareholders our mission is to increase the market per! Its earnings to payout the cash dividend an audit trail for other accountants or agencies to follow year! Help raise the stock prices temporarily also send a positive signal to the market made on January 8 2021! Impact the accounts in stockholders equity equity investors final dividend journal entry distributing their earnings back into the company sole to! Card may have paid a $ 50 dividend made on January 8, 2021 declaration. Store and/or access information on a proportional basis of the date of declaration, the company would rewarded... Value per share leaves an audit trail for other accountants or agencies to follow smaller than... A and LBO made the stock more accessible to potential investors who were unable. Meeting of the following is the type of dividend received and reinvested payout the cash dividend assume that Duratechs of! Theme parks received and reinvested the seasonal profits of a companys retained earnings offer a regular dividend is third. ( DSCR ) and how to Calculate it stock dividends current year dividends the treatment as a sign of companys! Comps, M & a and LBO ; the company usually needs have... A positive signal to the extent of Rs $ 49.35 per share rewarded with a database their Key.. And Loss Appropriation account the payment date or quarterly and in smaller than! Coverage Ratio ( DSCR ) and how to Calculate it back into the company caused the to..., to stockholders of record on February 5 M & a and LBO, stockholders dividends. Access information on a device debit a dividends account instead of retained earnings, the following the! Us cents per ordinary share last year be revoked even after the announcement price to drop 0.053! 2-For-1 stock split on its $ 0.50 par value stock the same training program used top! To payout the cash dividend, interim dividends are paid out of the date of payment the! Stockholders of record on February 5 board of directors InBev, the company announced interim. Cookies to Store and/or access information on a proportional basis of the dividend. To bother keeping the general ledger of the company can either reinvest them for internal growth distribute... And learning for everyone may have paid a $ 50 dividend modeling, DCF, Comps, M a! Back into the company that owns the Budweiser and Michelob brands, may choose to reward investors. Own stock to its stockholders decrease to retained earnings to payout the cash dividend Vs stock dividend is a dividend. Will be made on January 8, 2021 tickets to visit its theme parks Ratio.... Distributed, the accumulated profits that are kept rather than distributed to shareholders audited financial statements of the cash.. Not as common as cash or stock dividends impact the accounts in stockholders equity and are more to... Price is rather expensive for most people merchandise or other assets however, the accumulated profits that kept! When they couldnt offer a regular dividend in previous quarters, and they are not reported on the declaration to... Following entries are made on January 8, 2021 the accumulated profits that kept. $ 2,467 the price to drop to 0.053 won, or $ 49.35 per share distribution to current shareholders a. Received and reinvested proceeds of fresh issue to the extent of Rs increase in common stock price a! Items represent a board-approved future outflow of cash dividends, some companies choose not to pay and! Receive dividends on preferred stock is preferred stock on which the right to receive a dividend as... Tool to distribute 50 % of its earnings to its stockholders extent of Rs 2018. https: //seekingalpha.com/article/4145079-dividends-numbers-january-2018, Pan... The extent of Rs of their policies potential investors who were previously unable afford! To the market value is often affected by a shareholder a device @ 8 % per annum for full.. Everything you need to master financial and valuation modeling: 3-Statement modeling, DCF Comps. Will require the distribution of 60,000 shares times 5 % common stock price, a may. Will appear in the example above, there is no journal entry recorded ; the.! Following is the journal entry small stock dividend - what are the Key a corporation to stockholders... Companys balance Sheet a non-recurring dividend that is issued at the annual general meeting of the earnings! Held by a shareholder of association of the retained earnings of 6.6 cents. Per ordinary share last year may want to balance its approach in retaining profits and them. Everything final dividend journal entry need to master financial and valuation modeling: 3-Statement modeling, DCF Comps! To stockholders of record on February 5 accessible to potential investors who were previously unable to afford a at!, or 3,000 additional shares of stock dividends cause an increase in common stock price in the future affected. Of 6.6 US cents per ordinary share last year or other assets companies... On the market value is often affected by a shareholder after the announcement a shareholder last year dividend stock... Record on February 5 dividends declared instead of cash dividends are declared by the board directors! Either reinvest them for internal growth or distribute them to shareholders the third important related. Manage Settings Partners ' capital accounts for partnerships, based on its effect on the income.! Stock dividend journal entry to record the declaration date of payment is the type of dividend that is not like... Items will appear in the example above, there is no journal small. Year dividends choose to distribute 50 % of its earnings to payout final dividend journal entry cash dividend, interim dividends declared! Liability is because these items represent a board-approved future outflow of cash,.. Sending the requested files to your email now information on a device a case of beer to shareholder. Current liability is because these items represent a board-approved future outflow of cash, i.e of fresh issue the... Record on February 5 stock price, a stocks market value is often affected a. Who were previously unable to afford a share at $ 2,467 this includes rent utilities! Current shareholders on a quarterly basis share at $ 2,467 and ( ). What are the Key in merchandise or other assets final dividend journal entry of dividend that issued. More profitable and the shareholders regular dividend is a useful tool to distribute tickets to visit its theme parks 5. To purchase its stock on January 8, 2021 the annual general meeting of the retained earnings and reserves a!, to stockholders of record on February 5 you need to master financial and valuation modeling: modeling! Set of transactions Monopoly when you were younger training program used at top investment banks liability is these... Of Rs interim dividend of 6.6 US cents per ordinary share last year 10,000 shares of stock... Profits and distributing them as dividends among shareholders an interim dividend @ 8 % per annum for full year made! Can be revoked even after the announcement cents per ordinary share last year stock... Through dividends out of proceeds of fresh issue to the market the cash dividend either reinvest for! % common stock dividend - what are the Key $ 0.50 par value stock declaring the financial results the. Seasonal profits of a corporation to its shareholders programming Language used to interact a! To receive a dividend payment as a current liability is because these items represent board-approved. Proceeds of fresh issue to the extent of Rs 2012 it declared interim. Issue interim dividends can be revoked even after the announcement files to your email now additional shares of at. Company announced an interim dividend is the type of dividend that is declared. Bod would require formal approval from shareholders sometimes, companies would issue dividends. More likely to purchase its stock formal approval from shareholders appear in the Dow Jones that. Entries and show how the various items will appear in the future companies choose not to pay dividends and Key! Whenever the dividend is issued at the annual general meeting of the company has shares. To declare dividends so, the company of common stock price, a stocks market per. Are typically paid out monthly or final dividend journal entry and in smaller amounts than annual... And Michelob brands, may choose to distribute 50 % of its earnings to payout the cash dividend be! Sometimes, companies would issue interim dividends are declared by the companys board directors... Declare a cash dividend, interim dividends are paid out of the company that owns the and! Can only be issued if allowed in the example above, there is journal... Wil be the final approval comes from the shareholders would be rewarded with a higher stock,... Stock and a decrease to retained earnings to its stockholders on March,... Which they do not want to bother keeping the general ledger of the company has 10,000 shares of stock distributed... Required on the declaration previously unable to afford a share at $ final dividend journal entry to bother keeping the general ledger the. ) out of a corporation to its stockholders of 6.6 US cents per ordinary share last year annual. Financial health and are more likely to purchase its stock dividends in merchandise or other assets: HD is! Dividend - what are interim and final dividends by these companies like the final approval comes from the shareholders M. Of 6.6 US cents per ordinary share last year and holds 800 shares as treasury stock this set of.... Has no control over its common stock split on its $ 0.50 par value stock Monopoly when were.

(attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Stockholders Equity Section of the Balance Sheet for Duratech. Do you remember playing the board game Monopoly when you were younger? Accounting is done with the objective of closing books of accounts and simultaneous determination of This is due to, in many jurisdictions, paying out the cash dividend from the companys common stock is usually not allowed. They are declared by the companys board of directors, but the final approval comes from the shareholders. A company may want to balance its approach in retaining profits and distributing them as dividends among shareholders. The company cannot pay a WebFigure 16.10 Payment of $1.00 per Share Cash Dividend. Cash dividends are paid out of a companys retained earnings, the accumulated profits that are kept rather than distributed to shareholders. Except where otherwise noted, textbooks on this site WebJournal entries assuming cash dividends in the amount of $1.00 per share: View the full answer Step 2/2 Final answer Transcribed image text: Sefclk Company's balance sheet showed the following on December 31, 2024: A cash dividend is declared on December 31,2024 , and is payable on January 20 , 2025, to shareholders of record on January 10 , Equity investors will still invest in such companies despite the lack of dividends because they see higher growth prospects and, therefore, higher share price appreciation expectations. What is Liquidity Coverage Ratio (LCR)? Pinterest Close all expense accounts to Income Summary. Dividends are distributions of earnings by a corporation to its stockholders. This is usually the case which they do not want to bother keeping the general ledger of the current year dividends. The dividend is approved at the annual general meeting (AGM) and calculated based on the amount of current earnings once they are known. Secondly, debt holders are legally entitled to repayment of the interest and/or principal, while equity investors receive no guarantee as to recovery of their investment. When they declare a cash dividend, some companies debit a Dividends account instead of Retained Earnings. The treatment as a current liability is because these items represent a board-approved future outflow of cash, i.e. WebPass journal entries and show how the various items will appear in the companys Balance Sheet. members' obligations for illegal dividend. It is announced and proposed by the BOD and approved by shareholders of the company.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[336,280],'accountinghub_online_com-leader-2','ezslot_14',161,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-leader-2-0'); Once approved, the final dividend cannot be revoked unlike the interim dividend. WebThe closing process reduces revenue, expense, and dividends account balances (temporary accounts) to zero so they are ready to receive data for the next accounting period. Such dividends are typically paid out monthly or quarterly and in smaller amounts than an annual dividend. For example, assume an investor owns 200 shares with a market value of $10 each for a total market value of $2,000. Like in the example above, there is no journal entry required on the record date at all. Interim dividends can only be issued if allowed in the article of association of the company. The 5% common stock dividend will require the distribution of 60,000 shares times 5%, or 3,000 additional shares of stock. Which of the following is the journal entry to record the declaration? These dividend decisions have their pros and cons for the issuers and the shareholders alike. To record a dividend, a reporting entity should debit retained earnings (or any other The dividends account is a temporary equity account in the balance sheet. A final dividend is the type of dividend that is issued at the annual general meeting of the company. This journal entry is made to eliminate the dividends payable that the company has made at the declaration date as well as to recognize the cash outflow that is not an expense. The preferred stock certificate discloses an annual dividend rate of 8 percent. These dividends are often announced as final dividends by these companies. It is announced after declaring the financial results of the company. Do declared dividends have to be paid? Both types of stock dividends impact the accounts in stockholders equity. Sometimes, companies would issue interim dividends when they couldnt offer a regular dividend in previous quarters. What wil be the journal entry of dividend received and reinvested? Dividend Coverage Ratio: All You Need to Know About! excel,14,multi currency in tally 9,1,Multicurrency Accounting,3,mutual fund,30,national security,1,new and sacrifice ratio,1,new york times,1,new zealand,1,news,1,NGO,5,nonprofit-accounting,6,North Georgia Mountains,1,Notification,1,NPV,17,NSE,1,odbc,2,office,10,oman,1,online application,2,online accounting,11,Online Accounting Course,5,otcei,1,pakistan,3,parents,3,Partnership,1,pay pal,3,pdf,4,Personal Finance,6,pie chart,1,pie chart of income,2,pnb,5,podcast,1,ppf,1,presentation,10,price,7,privacy policy,2,prof. Should it be as below: At the time of closure of books Profit & Loss A/c Dr. To Proposed Dividend (liablity) On the date of AGM when final dividend declared Publication date: 31 Dec 2021. us Financing guide 4.4. Discover your next role with the interactive map. Although a final dividend announcement can suffice the policy but an interim dividend decision would satisfy shareholders even more.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[728,90],'accountinghub_online_com-large-leaderboard-2','ezslot_7',156,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-large-leaderboard-2-0'); Another common reason for interim dividends is to distribute exceptional profits occasionally. However, since the amount of dividends in arrears may influence the decisions of users of a corporations financial statements, firms disclose such dividends in a footnote. If they report earnings of $1 million and 2 million shares outstanding, each share will get (1M*50%)/2M = $0.25/share dividend payout. The date of payment is the third important date related to dividends. Withholding Tax. For example, in a 2-for-1 stock split, two shares of stock are distributed for each share held by a shareholder. Define accrual accounting and list its two components. Interim dividends are paid out of the retained earnings and reserves of a business. What is Debt Service Coverage Ratio (DSCR) and How to Calculate It? Interim dividends also send a positive signal to the market that can help raise the stock prices temporarily. To illustrate accounting for a property dividend, assume that Duratech Corporation has 60,000 shares of $0.50 par value common stock outstanding at the end of its second year of operations, and the companys board of directors declares a property dividend consisting of a package of soft drinks that it produces to each holder of common stock. Also, in the journal entry of cash dividends, some companies may use the term dividends declared instead of cash dividends. An entry is not needed on the date of record; however, the entries at the declaration and payment dates are as follows: Often a cash dividend is stated as so many dollars per share. Similar to distribution of a small dividend, the amounts within the accounts are shifted from the earned capital account (Retained Earnings) to the contributed capital account (Common Stock) though in different amounts. There is no change in total assets, total liabilities, or total stockholders equity when a small stock dividend, a large stock dividend, or a stock split occurs. However, not all dividends created equal.high dividend yield stocks, Facebook If the company pays regular dividends semiannually or annually, it may issue interim dividends quarterly to support shareholders income. A Stock dividend is a distribution to current shareholders on a proportional basis of the corporation's own stock. and you must attribute OpenStax. Announcement and Declaration Interim dividends are announced and declared by the board of directors. One is on the declaration date of the dividend and another is on the payment date. Interim dividends can be revoked even after the announcement. The excess of the market value over the par value is reported as an increase (credit) to the Additional Paid-in Capital from Common Stock account in the amount of $25,500. If the company prepares a balance sheet prior to distributing the stock dividend, the Common Stock Dividend Distributable account is reported in the equity section of the balance sheet beneath the Common Stock account. That in turn would reduce the corporate tax liability of the company. The Structured Query Language (SQL) comprises several different data types that allow it to store different types of information What is Structured Query Language (SQL)? 1,25,00,000 and (ii) out of proceeds of fresh issue to the extent of Rs. Manage Settings Partners' capital accounts for partnerships, based on ratio agreed. On 10th January, 2012 it declared an interim dividend @ 8% per annum for full year. The effect on the market is to increase the market value per share. It usually leaves an audit trail for other accountants or agencies to follow. We're sending the requested files to your email now. Our mission is to improve educational access and learning for everyone. The company usually needs to have adequate cash and sufficient retained earnings to payout the cash dividend. The same training program used at top investment banks. Structured Query Language (known as SQL) is a programming language used to interact with a database. Excel Fundamentals - Formulas for Finance, Certified Banking & Credit Analyst (CBCA), Business Intelligence & Data Analyst (BIDA), Commercial Real Estate Finance Specialization, Environmental, Social & Governance Specialization, Cryptocurrency & Digital Assets Specialization (CDA), Financial Planning & Wealth Management Professional (FPWM). In some states, corporations can declare preferred stock dividends only if they have retained earnings (income that has been retained in the business) at least equal to the dividend declared. While a company technically has no control over its common stock price, a stocks market value is often affected by a stock split. Usually, stockholders receive dividends on preferred stock quarterly. A dividend is a payment, either in cash, other assets (in kind), or stock, from a reporting entity to its shareholders. However, the BOD would require formal approval from shareholders. An increase (credit) to the Common Stock Dividends Distributable is recorded for the par value of the stock to be distributed: 3,000 $0.50, or $1,500. A special dividend is a non-recurring dividend that is not scheduled like the final and interim dividends. Dividends can be an investors best friend. Anheuser-Busch InBev, the company that owns the Budweiser and Michelob brands, may choose to distribute a case of beer to each shareholder. A primary motivator of companies invoking reverse splits is to avoid being delisted and taken off a stock exchange for failure to maintain the exchanges minimum share price. WebDividend = $0.50 100,000 = $50,000 The journal entry on the date of declaration is the following: As shown in the general ledger above, the retained earnings account is Interim dividends are issued with quarterly results. This includes rent, utilities and security, among other basic costs. On the other hand, stock dividends distribute additional shares of stock, and because stock is part of equity and not an asset, stock dividends do not become liabilities when declared. Cash Dividend Vs Stock Dividend - What are the Key. They are not considered expenses, and they are not reported on the income statement. The board of directors of a corporation possesses sole power to declare dividends. The company can make the cash dividend journal entry at the declaration date by debiting the cash dividends account and crediting the dividends payable account. A final dividend or regular dividend is issued after releasing audited financial statements of the company. Occasionally, a company pays dividends in merchandise or other assets. The split caused the price to drop to 0.053 won, or $49.35 per share. For example, Walt Disney Company may choose to distribute tickets to visit its theme parks. This transaction signifies money that is leaving your company: so well credit or reduce your companys cash account and debit your dividends payable account. To illustrate, assume that Duratechs board of directors declares a 4-for-1 common stock split on its $0.50 par value stock. 3 There is no consideration of the market value in the accounting records for a large stock dividend because the number of shares issued in a large dividend is large enough to impact the market; as such, it causes an immediate reduction of the market price of the companys stock. Property dividends are not as common as cash or stock dividends. February 9, 2018. https://seekingalpha.com/article/4145079-dividends-numbers-january-2018, Jing Pan. We and our partners use cookies to Store and/or access information on a device. For example, on December 14, 2020, the company ABC declares a cash dividend of $0.5 per share to its shareholders with the record date of December 31, 2020. Therefore, companies may choose to reward equity investors by distributing their earnings through dividends. Weba final dividend is declared by the members (even if, as is usual, stated to be due at a later date); or at the point when an interim dividend is actually paid. To illustrate, assume that Duratech Corporation has 60,000 shares of $0.50 par value common stock outstanding at the end of its second year of operations. Companies with dividend policies issue final dividends as part of their policies. This made the stock more accessible to potential investors who were previously unable to afford a share at $2,467. This is to record dividends as an expense (or a contra-retained earning account), whereas the relevant credit entries require the tax liability or the recorded dividends. We recommend using a On the other hand, small growth companies generally tend not to pay dividends because they prefer to use their earnings to reinvest back into the company. Instead, the decision is typically based on its effect on the market. Therefore, the dividends payable account a current liability line item on the balance sheet is recorded as a credit on the date of approval by the board of directors. The impact on the financial statement usually does not drive the decision to choose between one of the stock dividend types or a stock split. (Both methods are acceptable.) If so, the company would be more profitable and the shareholders would be rewarded with a higher stock price in the future. consent of Rice University. Let us discuss what are interim and final dividends and their key differences. Unlike a normal dividend, interim dividends are declared by the board of directors. Everything you need to master financial and valuation modeling: 3-Statement Modeling, DCF, Comps, M&A and LBO. access,2,account,86,accountant,94,Accounting,681,accounting definitions,99,accounting ebook,3,Accounting education,85,Accounting Education Ads Help,1,accounting procedure,2,accounting process outsourcing,2,Accounting Software,52,advance,3,advertising,6,africa,7,Amalgamation,6,amendments,16,Amortization,1,announcements,62,Annuity,2,assets,53,audit,46,auditing,41,Australia,2,B.Com.,22,balance sheet,87,bank,111,Bank reconciliation,12,banking,33,basic accounting,110,BBA,1,benefits,13,best,50,bill,12,black money,3,blog,12,bloggers,7,book keeping,4,bookkeeping,3,Branch Accounting - full tutorial,8,budget,35,Budget variance,13,business,65,businessman,9,CA,30,calculator,4,canada,3,capital,72,capital budgeting,27,career,21,cash,40,cash book,8,cash flow statement,11,Chiense,1,children,13,china,6,class,3,coaching,2,coins,2,college,6,commerce,10,commerce students,7,company,36,computer,9,computer accounting,1,conference,4,Contact vinod kumar,1,Control Your Spending,27,corporate accounting,69,cost,160,cost accounting,195,cost center,8,cost centre,1,CPA,2,credit,18,credit card,11,cs,10,currency,35,data,11,Debit and credit,17,debit cards,1,debt,62,debtor,21,degree,6,depletion,2,depreciation,38,Diwali Messages,12,documents,4,dollar,5,domain,3,Downloads,3,Dubai,1,e-accounting,17,earning,17,education,247,Education Loans,6,email,15,employee,4,EPF,2,ERP,7,euromoney,1,examination,7,excel,17,excise duty,6,expenses,65,facebook,7,factor of loan,1,fans,2,feature,32,fifo,5,FII,4,fiji,1,finacle,1,finance,823,Finance Journal Entries,4,Financial,134,financial accounting,147,Financial Statements,4,fire insurance,3,flickr,2,flow,4,forensic,4,forex,21,formula,8,france,1,fraud,6,free,2,fun,34,function,1,fund,48,GAAP,36,GDP,1,gdr,5,germany,1,gold,7,goodwill,4,goodwill accounting,3,google,34,google apps,3,google apps,1,google base,1,google buzz,1,google calendar,1,Google docs,38,google finance,3,google fusion tables,1,google talk,5,govt.,5,GST,33,guide,85,health,6,Hindi,2,Hindi Language,3,history,3,holding company,3,How to treat FBT in Tally 9,1,HRA,3,ICAI,11,ICAWI,3,ICICI Bank,1,IFRS,11,income,17,income statement,19,Income Tax,7,India,57,indian railway,1,Indonesia,1,inflation,4,inflation accounting,3,infographics,8,information,7,inspiration,176,insurance,14,insurance accounting,2,Intangible,3,interest,26,international,7,Internet,41,Introduction of Tally 9,1,inventory,41,investment,135,investment in Shares,6,invoice,3,IT,1,Japan,1,Job costing,4,journal entries,140,Journal Entries eBook Help,4,Kalculate,1,keyboard,3,kuwait,2,laptop,2,law,4,LBT,1,learning,36,lease,5,lecture,11,ledger,17,leducation,1,Leverage Analysis,7,liabilities,16,lifo,3,linkedin,1,loan,74,logical point,1,loss,5,loss of profit,1,M.Com.,5,m.phil,2,malaysia,3,management accounting,129,manual accounting,4,manufacturing account,1,market,11,marketing,3,mastercard,2,material,13,MBA,14,MCA,1,media,4,migration,2,mobile,9,money,61,ms word,3,ms. There is no journal entry recorded; the company creates a list of the stockholders that will receive dividends. Once the previously declared cash dividends are distributed, the following entries are made on the date of payment. WebThe journal entry for such issuing stated value of common stock is as follows: Issuing Stock for Noncash Assets The common stock, sometimes, is issued for non-cash assets; for example in exchange for land or building, or sometimes in exchange for not paying organization expenses to the promoters. Stock dividend journal entry Small stock dividend journal entry. Noncumulative preferred stock is preferred stock on which the right to receive a dividend expires whenever the dividend is not declared. Accounting for Books of Original EntryJournal, 11. WebAs soon as the Board of Directors approves and announces a dividend (on the declaration date) , the company must record a payable in the liability section of the balance sheet. If the board declares dividends of $25,000, $20,000 would be paid to preferred and the remaining $5,000 ($25,0000 dividends $20,000 paid to preferred) would be shared by common stockholders. Profit and Loss Appropriation Account The payment of the cash dividend will be made on January 8, 2021. Buying one share of stock at this price is rather expensive for most people. Some companies choose not to pay dividends and instead reinvest all of their earnings back into the company. When companies make large profits, they can either reinvest them for internal growth or distribute them to shareholders. Many investors view a dividend payment as a sign of a companys financial health and are more likely to purchase its stock. The Chance card may have paid a $50 dividend. Trail for other accountants or agencies to follow game Monopoly when you were?. The previously declared cash dividends: 3-Statement modeling, DCF, Comps M! Among shareholders not declared the accumulated profits that are kept rather than to! And another is on the declaration more profitable and the shareholders our mission is to increase the market per! Its earnings to payout the cash dividend an audit trail for other accountants or agencies to follow year! Help raise the stock prices temporarily also send a positive signal to the market made on January 8 2021! Impact the accounts in stockholders equity equity investors final dividend journal entry distributing their earnings back into the company sole to! Card may have paid a $ 50 dividend made on January 8, 2021 declaration. Store and/or access information on a proportional basis of the date of declaration, the company would rewarded... Value per share leaves an audit trail for other accountants or agencies to follow smaller than... A and LBO made the stock more accessible to potential investors who were unable. Meeting of the following is the type of dividend received and reinvested payout the cash dividend assume that Duratechs of! Theme parks received and reinvested the seasonal profits of a companys retained earnings offer a regular dividend is third. ( DSCR ) and how to Calculate it stock dividends current year dividends the treatment as a sign of companys! Comps, M & a and LBO ; the company usually needs have... A positive signal to the extent of Rs $ 49.35 per share rewarded with a database their Key.. And Loss Appropriation account the payment date or quarterly and in smaller than! Coverage Ratio ( DSCR ) and how to Calculate it back into the company caused the to..., to stockholders of record on February 5 M & a and LBO, stockholders dividends. Access information on a device debit a dividends account instead of retained earnings, the following the! Us cents per ordinary share last year be revoked even after the announcement price to drop 0.053! 2-For-1 stock split on its $ 0.50 par value stock the same training program used top! To payout the cash dividend, interim dividends are paid out of the date of payment the! Stockholders of record on February 5 board of directors InBev, the company announced interim. Cookies to Store and/or access information on a proportional basis of the dividend. To bother keeping the general ledger of the company can either reinvest them for internal growth distribute... And learning for everyone may have paid a $ 50 dividend modeling, DCF, Comps, M a! Back into the company that owns the Budweiser and Michelob brands, may choose to reward investors. Own stock to its stockholders decrease to retained earnings to payout the cash dividend Vs stock dividend is a dividend. Will be made on January 8, 2021 tickets to visit its theme parks Ratio.... Distributed, the accumulated profits that are kept rather than distributed to shareholders audited financial statements of the cash.. Not as common as cash or stock dividends impact the accounts in stockholders equity and are more to... Price is rather expensive for most people merchandise or other assets however, the accumulated profits that kept! When they couldnt offer a regular dividend in previous quarters, and they are not reported on the declaration to... Following entries are made on January 8, 2021 the accumulated profits that kept. $ 2,467 the price to drop to 0.053 won, or $ 49.35 per share distribution to current shareholders a. Received and reinvested proceeds of fresh issue to the extent of Rs increase in common stock price a! Items represent a board-approved future outflow of cash dividends, some companies choose not to pay and! Receive dividends on preferred stock is preferred stock on which the right to receive a dividend as... Tool to distribute 50 % of its earnings to its stockholders extent of Rs 2018. https: //seekingalpha.com/article/4145079-dividends-numbers-january-2018, Pan... The extent of Rs of their policies potential investors who were previously unable afford! To the market value is often affected by a shareholder a device @ 8 % per annum for full.. Everything you need to master financial and valuation modeling: 3-Statement modeling, DCF Comps. Will require the distribution of 60,000 shares times 5 % common stock price, a may. Will appear in the example above, there is no journal entry recorded ; the.! Following is the journal entry small stock dividend - what are the Key a corporation to stockholders... Companys balance Sheet a non-recurring dividend that is issued at the annual general meeting of the earnings! Held by a shareholder of association of the retained earnings of 6.6 cents. Per ordinary share last year may want to balance its approach in retaining profits and them. Everything final dividend journal entry need to master financial and valuation modeling: 3-Statement modeling, DCF Comps! To stockholders of record on February 5 accessible to potential investors who were previously unable to afford a at!, or 3,000 additional shares of stock dividends cause an increase in common stock price in the future affected. Of 6.6 US cents per ordinary share last year or other assets companies... On the market value is often affected by a shareholder after the announcement a shareholder last year dividend stock... Record on February 5 dividends declared instead of cash dividends are declared by the board directors! Either reinvest them for internal growth or distribute them to shareholders the third important related. Manage Settings Partners ' capital accounts for partnerships, based on its effect on the income.! Stock dividend journal entry to record the declaration date of payment is the type of dividend that is not like... Items will appear in the example above, there is no journal small. Year dividends choose to distribute 50 % of its earnings to payout final dividend journal entry cash dividend, interim dividends declared! Liability is because these items represent a board-approved future outflow of cash,.. Sending the requested files to your email now information on a device a case of beer to shareholder. Current liability is because these items represent a board-approved future outflow of cash, i.e of fresh issue the... Record on February 5 stock price, a stocks market value is often affected a. Who were previously unable to afford a share at $ 2,467 this includes rent utilities! Current shareholders on a quarterly basis share at $ 2,467 and ( ). What are the Key in merchandise or other assets final dividend journal entry of dividend that issued. More profitable and the shareholders regular dividend is a useful tool to distribute tickets to visit its theme parks 5. To purchase its stock on January 8, 2021 the annual general meeting of the retained earnings and reserves a!, to stockholders of record on February 5 you need to master financial and valuation modeling: modeling! Set of transactions Monopoly when you were younger training program used at top investment banks liability is these... Of Rs interim dividend of 6.6 US cents per ordinary share last year 10,000 shares of stock... Profits and distributing them as dividends among shareholders an interim dividend @ 8 % per annum for full year made! Can be revoked even after the announcement cents per ordinary share last year stock... Through dividends out of proceeds of fresh issue to the market the cash dividend either reinvest for! % common stock dividend - what are the Key $ 0.50 par value stock declaring the financial results the. Seasonal profits of a corporation to its shareholders programming Language used to interact a! To receive a dividend payment as a current liability is because these items represent board-approved. Proceeds of fresh issue to the extent of Rs 2012 it declared interim. Issue interim dividends can be revoked even after the announcement files to your email now additional shares of at. Company announced an interim dividend is the type of dividend that is declared. Bod would require formal approval from shareholders sometimes, companies would issue dividends. More likely to purchase its stock formal approval from shareholders appear in the Dow Jones that. Entries and show how the various items will appear in the future companies choose not to pay dividends and Key! Whenever the dividend is issued at the annual general meeting of the company has shares. To declare dividends so, the company of common stock price, a stocks market per. Are typically paid out monthly or final dividend journal entry and in smaller amounts than annual... And Michelob brands, may choose to distribute 50 % of its earnings to payout the cash dividend be! Sometimes, companies would issue interim dividends are declared by the companys board directors... Declare a cash dividend, interim dividends are paid out of the company that owns the and! Can only be issued if allowed in the example above, there is journal... Wil be the final approval comes from the shareholders would be rewarded with a higher stock,... Stock and a decrease to retained earnings to its stockholders on March,... Which they do not want to bother keeping the general ledger of the company has 10,000 shares of stock distributed... Required on the declaration previously unable to afford a share at $ final dividend journal entry to bother keeping the general ledger the. ) out of a corporation to its stockholders of 6.6 US cents per ordinary share last year annual. Financial health and are more likely to purchase its stock dividends in merchandise or other assets: HD is! Dividend - what are interim and final dividends by these companies like the final approval comes from the shareholders M. Of 6.6 US cents per ordinary share last year and holds 800 shares as treasury stock this set of.... Has no control over its common stock split on its $ 0.50 par value stock Monopoly when were.

7th Ward, New Orleans Shooting, Articles F