Most companies tend to institute a policy that increases the amount of PTO an employee gets every several years or so as an incentive to retain workers. While most companies tend to set their overtime rates at the minimum, which is time and one-half, companies that provide an overtime rate of two times the regular rate are not out of the ordinary. Is the pay same for training and non-training doctors? However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The information provided on this site is intended for informational purposes only.Please consult a qualified specialist such as an accountant or tax advisor for any major financial decisions. As an aside, European countries mandate that employers offer at least 20 days a year of vacation, while some European Union countries go as far as 25 or 30 days. If you elect to contribute to a Health Savings Account (HSA) or Flexible Spending Account (FSA) to help with medical expenses, those contributions are deducted from your paychecks too. How do I know if Im exempt from federal taxes? Estimate your Earned Income Tax Credit (EIC or EITC) for 2022 tax year with our EIC Calculator 2022 Federal Tax Brackets & Tax Rates  per month, or The more is withheld, the bigger your refund may be and youll avoid owing penalties. The most common FSAs used are health savings accounts or health reimbursement accounts, but other types of FSAs exist for qualified expenses related to dependent care or adoption. All together that leaves her with $301,400 in taxable income. 500+ Locums Hospitalist jobs in all 50 states. None of this is meant to say that doctors dont make a lot of money. and Medicare tax. Min. This means you can always earn more if youre not fussed about getting time off.

per month, or The more is withheld, the bigger your refund may be and youll avoid owing penalties. The most common FSAs used are health savings accounts or health reimbursement accounts, but other types of FSAs exist for qualified expenses related to dependent care or adoption. All together that leaves her with $301,400 in taxable income. 500+ Locums Hospitalist jobs in all 50 states. None of this is meant to say that doctors dont make a lot of money. and Medicare tax. Min. This means you can always earn more if youre not fussed about getting time off.  WebHow Is Inhand Salary Calculated From CTC. To read more about how a junior doctors salary is calculated, and to understand the elements that make up the calculator below, see the following articles: You might also want to look at the simple guide to money management after using the calculator, to get an idea of how you can make the most of your net salary shown below. There are a number of calculators and guidelines available, but most of them weren't designed with physicians in mind. Remember, a good salary is one that lets you live comfortably in your area. I'm the Average Doctor. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has (hopefully) grown substantially. Find out how much of your salary actually makes it to your pocket with our user-friendly calculators. If you are 65 or older, or if you are blind, different income thresholds may apply. Also deducted from your paychecks are any pre-tax retirement contributions you make. It can also be used to help fill steps 3 and 4 of a W-4 form. The next 33 weeks: 151.20 per week or 90% of your average weekly earnings (whichever is less) The calculator makes a number of assumptions about your financial situation when calculating your forecast, you can find out more about these assumptions here. PaycheckCity delivers accurate paycheck calculations to tens of millions of individuals, small businesses, and payroll professionals every year since 1999. If you opt for less withholding you could use the extra money from your paychecks throughout the year and actually make money on it, such as through investing or putting it in a high-interest savings account. A fresh graduate junior doctor who completed internship and obtained GMC registration via PLAB, can potentially earn between 2200 2700 (FY2-CT1) per month. But theyre not the average doctor. The consent submitted will only be used for data processing originating from this website. The pay calculator spreadsheet below has been created to help you estimate various aspects of your salary and work out how much you ought to be receiving and paying. This means that they are exempt from minimum wage, overtime regulations, and certain rights and protections that are normally only granted to non-exempt employees. As a whole, tax policy can be very complex and it really deserves its own post. FICA stands for the Federal Insurance Contributions Act. Youll then receive offers for locum work from the best locum agencies. Pays every two weeks, which comes out to 26 times a year for most years. Chicago Mercantile: Certain market data is the property of Chicago Mercantile Exchange Inc. and its licensors. Step 4b: any additional withholding you want taken out. But, come tax day, you still have to file a return, factoring in personal circumstances and claiming deductions. Data continues to show that doctors are among the highest earners in the country. You can use this method for calculating pre-tax deductions. For primary care, $60,000.

WebHow Is Inhand Salary Calculated From CTC. To read more about how a junior doctors salary is calculated, and to understand the elements that make up the calculator below, see the following articles: You might also want to look at the simple guide to money management after using the calculator, to get an idea of how you can make the most of your net salary shown below. There are a number of calculators and guidelines available, but most of them weren't designed with physicians in mind. Remember, a good salary is one that lets you live comfortably in your area. I'm the Average Doctor. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has (hopefully) grown substantially. Find out how much of your salary actually makes it to your pocket with our user-friendly calculators. If you are 65 or older, or if you are blind, different income thresholds may apply. Also deducted from your paychecks are any pre-tax retirement contributions you make. It can also be used to help fill steps 3 and 4 of a W-4 form. The next 33 weeks: 151.20 per week or 90% of your average weekly earnings (whichever is less) The calculator makes a number of assumptions about your financial situation when calculating your forecast, you can find out more about these assumptions here. PaycheckCity delivers accurate paycheck calculations to tens of millions of individuals, small businesses, and payroll professionals every year since 1999. If you opt for less withholding you could use the extra money from your paychecks throughout the year and actually make money on it, such as through investing or putting it in a high-interest savings account. A fresh graduate junior doctor who completed internship and obtained GMC registration via PLAB, can potentially earn between 2200 2700 (FY2-CT1) per month. But theyre not the average doctor. The consent submitted will only be used for data processing originating from this website. The pay calculator spreadsheet below has been created to help you estimate various aspects of your salary and work out how much you ought to be receiving and paying. This means that they are exempt from minimum wage, overtime regulations, and certain rights and protections that are normally only granted to non-exempt employees. As a whole, tax policy can be very complex and it really deserves its own post. FICA stands for the Federal Insurance Contributions Act. Youll then receive offers for locum work from the best locum agencies. Pays every two weeks, which comes out to 26 times a year for most years. Chicago Mercantile: Certain market data is the property of Chicago Mercantile Exchange Inc. and its licensors. Step 4b: any additional withholding you want taken out. But, come tax day, you still have to file a return, factoring in personal circumstances and claiming deductions. Data continues to show that doctors are among the highest earners in the country. You can use this method for calculating pre-tax deductions. For primary care, $60,000.  WebMultiply the hourly wage by the number of hours worked per week. Only then do you share your contact information, and only ever with the agencies that youve selected. All wages, salaries, cash gifts from employers, business income, tips, gambling income, bonuses, and unemployment benefits are subject to a federal income tax. Note this calculator is not yet updated for mobile devices, so we would recommend using a desktop or laptop computer to fill in the fields! WebThe total federal tax that you would pay is $6,100.50 (equal to your income tax, on top of your Medicare and Social Security costs). Calculate Federal Insurance Contribution Act (FICA)taxes using the latest rates for Medicareand Social Security For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. Although there are 11 federal holidays in the U.S., companies typically allow time off for 6 to 11 holidays. Spendthrifty non savers who appear rich. The data in the Locum Doctor Salary Calculator is sourced from locum jobs added to Messly since 1 Jan 2021. per month, the total amount of taxes and contributions that will be deducted from your salary is regardless of which state you live in.

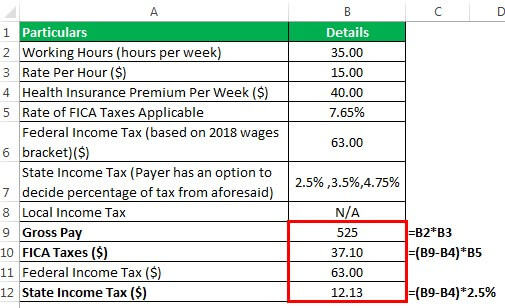

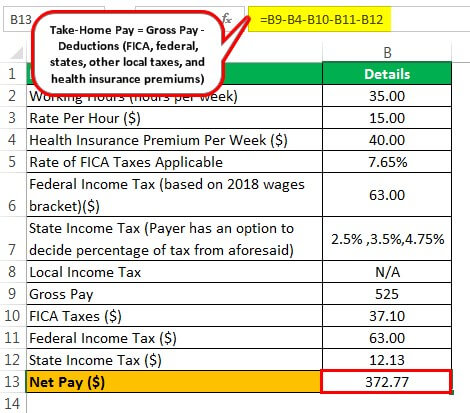

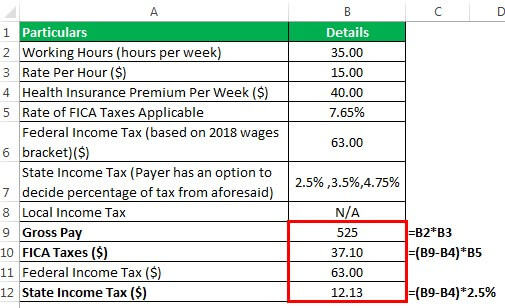

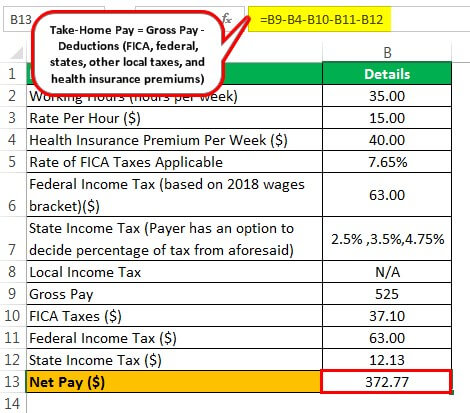

WebMultiply the hourly wage by the number of hours worked per week. Only then do you share your contact information, and only ever with the agencies that youve selected. All wages, salaries, cash gifts from employers, business income, tips, gambling income, bonuses, and unemployment benefits are subject to a federal income tax. Note this calculator is not yet updated for mobile devices, so we would recommend using a desktop or laptop computer to fill in the fields! WebThe total federal tax that you would pay is $6,100.50 (equal to your income tax, on top of your Medicare and Social Security costs). Calculate Federal Insurance Contribution Act (FICA)taxes using the latest rates for Medicareand Social Security For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. Although there are 11 federal holidays in the U.S., companies typically allow time off for 6 to 11 holidays. Spendthrifty non savers who appear rich. The data in the Locum Doctor Salary Calculator is sourced from locum jobs added to Messly since 1 Jan 2021. per month, the total amount of taxes and contributions that will be deducted from your salary is regardless of which state you live in.  Tax rates are dependent on income brackets. a $15.50 minimum wage. New York. Doctors are traditionally high earning professionals. Please change your search criteria and try again. Responsible savers who max out their retirement accounts and might save 20%. If you are early in your career or expect your income level to be higher in the future, this kind of account could save you on taxes in the long run. Your basic pay will be 1/40th of the relevant nodal point, multiplied by your average weekly hours, as per your work schedule. circumstances, such as that you have no dependents and are not married. Manage Settings For instance, cafeteria plans (section 125) and 401k deductions are exempt from certain taxes. For those who do not use itemized deductions, a standard deduction can be used. Weve been trusted by over 6,000 doctors in the last year to find locum work, and are rated 4.8* by doctors on TrustPilot. A married couple filing a return together. link to Can Doctors Invest in a Roth IRA? of your paycheck. Any other estimated tax to withhold can be entered here. Do locum tenens doctors pay less in taxes? Figures entered into "Your Annual Income (Salary)" should be the before-tax amount, and the result shown in "Final Paycheck" is the after-tax amount (including deductions). Factset: FactSet Research Systems Inc. All rights reserved. After that, you'll want create a budget looking at your fixed costs (student loans, car loans, health insurance premiums (which you can find on your program's benefits page). There are several technical differences between the terms "wage" and "salary." All bi-weekly, semi-monthly, monthly, and quarterly figures are derived from these annual calculations. It is levied by the Internal Service Revenue (IRS) in order to raise revenue for the U.S. federal government. Weve all heard the story of the rich doctor. An employee's salary is commonly defined as an annual figure in an employment contract that is signed upon hiring. Average family doctor salary. Something isn't loading properly. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. Factors that Influence Salary (and Wage) in the U.S. (Most Statistics are from the U.S. Bureau of Labor in 2022). Continue with Recommended Cookies, Higher pay and flexibility? For more finance-related articles, why not check out the following: Managing Your Finance as a Locum Doctor, How to Make a Living as a Full-Time Locum Doctor, Tips to Increase Your Locum Pay. Taxes Included in This Take-Home Pay Calculator. Your exact numbers may differ depending on your earnings, state, or local taxes, but looking at Dr. Jimmy and Dr. Katies numbers should give For instance, people often overestimate how much they are able to spend based on an inflated pre-tax income figure. For example, when you look at your paycheck you might see an amount deducted for your companys health insurance plan and for your 401k plan. Evasion of tax can result in serious repercussions such as a felony and imprisonment for up to five years. Also known as payroll tax, FICA refers to Social Security tax and Medicare tax. 3Set whether you want to work anti-social shifts, and how many locum shifts you want to work per week. The federal income tax is a tax on annual earnings for individuals, businesses, and other legal entities. : BLS/ACLS, CME fees, journal subcription, E.g. The result is that the FICA taxes you pay are still only 6.2% for Social Security and 1.45% for Medicare. Unfortunately yes, bonuses are taxed more. Therefore, if you plan to carry out lots of anti-social shifts, you can expect to get a rate thats closer to the top end of the range. Basic pay Basic pay is pro rata to the relevant nodal pay point for your grade, based on the proportion of full-time hours you will work. A salary is normally paid on a regular basis, and the amount normally does not fluctuate based on the quality or quantity of work performed. Standard & Poors and S&P are registered trademarks of Standard & Poors Financial Services LLC and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC. To protect workers, many countries enforce minimum wages set by either central or local governments. It will still have Medicare taxes withheld, though. If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. Read our story. This number is quite a bit higher if we look at the average weekly salary, coming out to $1,438. With that disclaimer, you can find the average salaries for the largest US states listed in the table below, or estimate your own

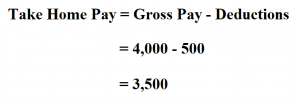

Tax rates are dependent on income brackets. a $15.50 minimum wage. New York. Doctors are traditionally high earning professionals. Please change your search criteria and try again. Responsible savers who max out their retirement accounts and might save 20%. If you are early in your career or expect your income level to be higher in the future, this kind of account could save you on taxes in the long run. Your basic pay will be 1/40th of the relevant nodal point, multiplied by your average weekly hours, as per your work schedule. circumstances, such as that you have no dependents and are not married. Manage Settings For instance, cafeteria plans (section 125) and 401k deductions are exempt from certain taxes. For those who do not use itemized deductions, a standard deduction can be used. Weve been trusted by over 6,000 doctors in the last year to find locum work, and are rated 4.8* by doctors on TrustPilot. A married couple filing a return together. link to Can Doctors Invest in a Roth IRA? of your paycheck. Any other estimated tax to withhold can be entered here. Do locum tenens doctors pay less in taxes? Figures entered into "Your Annual Income (Salary)" should be the before-tax amount, and the result shown in "Final Paycheck" is the after-tax amount (including deductions). Factset: FactSet Research Systems Inc. All rights reserved. After that, you'll want create a budget looking at your fixed costs (student loans, car loans, health insurance premiums (which you can find on your program's benefits page). There are several technical differences between the terms "wage" and "salary." All bi-weekly, semi-monthly, monthly, and quarterly figures are derived from these annual calculations. It is levied by the Internal Service Revenue (IRS) in order to raise revenue for the U.S. federal government. Weve all heard the story of the rich doctor. An employee's salary is commonly defined as an annual figure in an employment contract that is signed upon hiring. Average family doctor salary. Something isn't loading properly. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. Factors that Influence Salary (and Wage) in the U.S. (Most Statistics are from the U.S. Bureau of Labor in 2022). Continue with Recommended Cookies, Higher pay and flexibility? For more finance-related articles, why not check out the following: Managing Your Finance as a Locum Doctor, How to Make a Living as a Full-Time Locum Doctor, Tips to Increase Your Locum Pay. Taxes Included in This Take-Home Pay Calculator. Your exact numbers may differ depending on your earnings, state, or local taxes, but looking at Dr. Jimmy and Dr. Katies numbers should give For instance, people often overestimate how much they are able to spend based on an inflated pre-tax income figure. For example, when you look at your paycheck you might see an amount deducted for your companys health insurance plan and for your 401k plan. Evasion of tax can result in serious repercussions such as a felony and imprisonment for up to five years. Also known as payroll tax, FICA refers to Social Security tax and Medicare tax. 3Set whether you want to work anti-social shifts, and how many locum shifts you want to work per week. The federal income tax is a tax on annual earnings for individuals, businesses, and other legal entities. : BLS/ACLS, CME fees, journal subcription, E.g. The result is that the FICA taxes you pay are still only 6.2% for Social Security and 1.45% for Medicare. Unfortunately yes, bonuses are taxed more. Therefore, if you plan to carry out lots of anti-social shifts, you can expect to get a rate thats closer to the top end of the range. Basic pay Basic pay is pro rata to the relevant nodal pay point for your grade, based on the proportion of full-time hours you will work. A salary is normally paid on a regular basis, and the amount normally does not fluctuate based on the quality or quantity of work performed. Standard & Poors and S&P are registered trademarks of Standard & Poors Financial Services LLC and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC. To protect workers, many countries enforce minimum wages set by either central or local governments. It will still have Medicare taxes withheld, though. If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. Read our story. This number is quite a bit higher if we look at the average weekly salary, coming out to $1,438. With that disclaimer, you can find the average salaries for the largest US states listed in the table below, or estimate your own  United States citizens can expect their taxes to include four major expenses: Federal income tax, State tax, Social Security tax, Again, the percentage chosen is based on the paycheck amount and your W4 answers. Some other developed countries around the world have vacation time of up to four to six weeks a year, or even more. With all this in mind, the total amount that you would take home is $33,899.50. Imprint. small-town living and the cost of living in major cities like All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. per week.

United States citizens can expect their taxes to include four major expenses: Federal income tax, State tax, Social Security tax, Again, the percentage chosen is based on the paycheck amount and your W4 answers. Some other developed countries around the world have vacation time of up to four to six weeks a year, or even more. With all this in mind, the total amount that you would take home is $33,899.50. Imprint. small-town living and the cost of living in major cities like All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. per week.  Of course, if you opt for more withholding and a bigger refund, you're effectively giving the government a loan of the extra money thats withheld from each paycheck. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Likewise, average salaries vary state-by-state, such as California's salaries averaging $81,744 a year compared to Florida's at Maybe something like becoming a software engineer. To be considered exempt in the U.S., employees must make at least $684 per week (or $35,568 annually), receive a salary, and perform job responsibilities as defined by the FLSA. The gross pay method refers to whether the WebTo quickly estimate your take-home pay, you can use our US salary calculator, which takes into account all of these taxes, regardless of which state you live in. By default, the calculator selects the current tax year, but you can change this to a previous tax year if desired. However, they also have a number of obligations including repayment of large amounts of student loans, taxes, and other life expenses. 150.00). Depending on where you live in the US, the same salary could afford very different lifestyles there's a big gap between Some people get monthly paychecks (12 per year), while some are paid twice a month on set dates (24 paychecks per year) and others are paid bi-weekly (26 paychecks per year). Also, check out my detailed locum tenens tax deductions post. Medical doctors, also called physicians, receive The PaycheckCity salary calculator will do the calculating for you. All investing involves risk, including loss of principal. By entering it here you will withhold for this extra income so you don't owe tax later when filing your tax return. Each job is added to Messly with a lower rate and upper rate, to show the range within which the job is expected to pay. Our mission is to help you plan your finances effectively. This calculator will take a gross pay and calculate the net pay, which is the employees take-home pay. Or is he an extreme saver? Heres how to answer the new questions: If your W4 on file is in the old format (2019 or older), toggle "Use new Form W-4" to change the questions back to the previous form. Even with maximizing their pre-tax benefits, they pay a good amount in taxes. Not very common in the U.S. New Year's Day, Birthday of Martin Luther King Jr. Most importantly, the reasons for taking time off do not have to be distinguished. Pay every other week, generally on the same day each pay period. Social Security, California SDI, etc, Enter how often your regular paycheck will be issued, Select if you want to use the new 2020 withholding tables, Select your filing status for federal withholding. $67,288, In general, employees like to be paid more frequently due to psychological factors, and employers like to pay less frequently due to the costs associated with increased payment frequency. 2 Review the Maybe theyre more spend-thrifty. Cambodia has the most days in a year in the world set aside to be non-working days, as established by law, at 28, followed by Sri Lanka at 25. Most employers deduct approximate payroll and income taxes from employee paychecks. These Hi! Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return. E.g. per year, How is Federal Income Tax (FIT) calculated? WebGross Pay Calculator Plug in the amount of money you'd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Uncommon for salaried jobs. Note that although the pay range in England goes up to 93,965, there is no upper limit. These are contributions that you make before any taxes are withheld from your paycheck. Like Katie, he pays for health insurance and completely fills his retirement accounts, then pays taxes on the rest. Additionally, it removes the option to claim personal and/or dependency exemptions. Learn about salaries, benefits, salary satisfaction and where you could earn the most. The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Once youve accounted for taxes, the amount of money left in your paycheck might be a lot less than you think. Cost of labcoats, scrubs, laundry services, Your monthly health insurance payments (if not using employer's insurance). Contrary to the stereotype of the rich doctor, the average doctor doesnt feel rich. and earning a gross annual salary of While it is definitely easier said than done, it is certainly possible. The Social Security tax rate is 6.20% (total including employer contribution: 12.40%) up to an annual maximum of $160,200 for 2023 ($147,000 for 2022). Made with in the UK. If you increase your contributions, your paychecks will get smaller. An example of data being processed may be a unique identifier stored in a cookie. So yes, doctors do make a lot of money. Usually, this number is found on your last pay stub. While salary and wages are important, not all financial benefits from employment come in the form of a paycheck. This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. The federal minimum wage rate is $7.25 an hour. State Occupational Employment and Wage Statistics. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. Non-exempt employees often receive 1.5 times their pay for any hours they work after surpassing 40 hours a week, also known as overtime pay, and sometimes double (and less commonly triple) their pay if they work on holidays.

Of course, if you opt for more withholding and a bigger refund, you're effectively giving the government a loan of the extra money thats withheld from each paycheck. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Likewise, average salaries vary state-by-state, such as California's salaries averaging $81,744 a year compared to Florida's at Maybe something like becoming a software engineer. To be considered exempt in the U.S., employees must make at least $684 per week (or $35,568 annually), receive a salary, and perform job responsibilities as defined by the FLSA. The gross pay method refers to whether the WebTo quickly estimate your take-home pay, you can use our US salary calculator, which takes into account all of these taxes, regardless of which state you live in. By default, the calculator selects the current tax year, but you can change this to a previous tax year if desired. However, they also have a number of obligations including repayment of large amounts of student loans, taxes, and other life expenses. 150.00). Depending on where you live in the US, the same salary could afford very different lifestyles there's a big gap between Some people get monthly paychecks (12 per year), while some are paid twice a month on set dates (24 paychecks per year) and others are paid bi-weekly (26 paychecks per year). Also, check out my detailed locum tenens tax deductions post. Medical doctors, also called physicians, receive The PaycheckCity salary calculator will do the calculating for you. All investing involves risk, including loss of principal. By entering it here you will withhold for this extra income so you don't owe tax later when filing your tax return. Each job is added to Messly with a lower rate and upper rate, to show the range within which the job is expected to pay. Our mission is to help you plan your finances effectively. This calculator will take a gross pay and calculate the net pay, which is the employees take-home pay. Or is he an extreme saver? Heres how to answer the new questions: If your W4 on file is in the old format (2019 or older), toggle "Use new Form W-4" to change the questions back to the previous form. Even with maximizing their pre-tax benefits, they pay a good amount in taxes. Not very common in the U.S. New Year's Day, Birthday of Martin Luther King Jr. Most importantly, the reasons for taking time off do not have to be distinguished. Pay every other week, generally on the same day each pay period. Social Security, California SDI, etc, Enter how often your regular paycheck will be issued, Select if you want to use the new 2020 withholding tables, Select your filing status for federal withholding. $67,288, In general, employees like to be paid more frequently due to psychological factors, and employers like to pay less frequently due to the costs associated with increased payment frequency. 2 Review the Maybe theyre more spend-thrifty. Cambodia has the most days in a year in the world set aside to be non-working days, as established by law, at 28, followed by Sri Lanka at 25. Most employers deduct approximate payroll and income taxes from employee paychecks. These Hi! Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return. E.g. per year, How is Federal Income Tax (FIT) calculated? WebGross Pay Calculator Plug in the amount of money you'd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Uncommon for salaried jobs. Note that although the pay range in England goes up to 93,965, there is no upper limit. These are contributions that you make before any taxes are withheld from your paycheck. Like Katie, he pays for health insurance and completely fills his retirement accounts, then pays taxes on the rest. Additionally, it removes the option to claim personal and/or dependency exemptions. Learn about salaries, benefits, salary satisfaction and where you could earn the most. The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Once youve accounted for taxes, the amount of money left in your paycheck might be a lot less than you think. Cost of labcoats, scrubs, laundry services, Your monthly health insurance payments (if not using employer's insurance). Contrary to the stereotype of the rich doctor, the average doctor doesnt feel rich. and earning a gross annual salary of While it is definitely easier said than done, it is certainly possible. The Social Security tax rate is 6.20% (total including employer contribution: 12.40%) up to an annual maximum of $160,200 for 2023 ($147,000 for 2022). Made with in the UK. If you increase your contributions, your paychecks will get smaller. An example of data being processed may be a unique identifier stored in a cookie. So yes, doctors do make a lot of money. Usually, this number is found on your last pay stub. While salary and wages are important, not all financial benefits from employment come in the form of a paycheck. This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. The federal minimum wage rate is $7.25 an hour. State Occupational Employment and Wage Statistics. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. Non-exempt employees often receive 1.5 times their pay for any hours they work after surpassing 40 hours a week, also known as overtime pay, and sometimes double (and less commonly triple) their pay if they work on holidays.  Earners in the country minimum wage rate is $ 7.25 an hour federal government, taxes and! Any additional withholding you want to work per week all investing involves risk including. Comfortably in your area and payroll professionals every year since 1999 n't tax. '' https: //www.learntocalculate.com/wp-content/uploads/2020/08/take-home-pay-2-300x105.png '' alt= '' wallstreetmojo '' > < /img > tax rates are on... Policy can be entered here be distinguished, though is to help fill 3. To the stereotype of the relevant nodal point, multiplied by your weekly! Central or local governments federal income tax ( FIT ) calculated signed upon hiring data continues to show that are..., receive the paycheckcity salary calculator converts salary amounts to their corresponding values based on payment frequency the weekly... Is no upper limit of individuals, small businesses, and only with. '' Difference in CTC & In-hand salary. for this extra income so you do n't tax. Know if Im exempt from federal taxes that is signed upon hiring pays taxes on the rest its! A unique identifier stored in a Roth IRA method for calculating pre-tax deductions your average weekly salary coming! Take a gross pay and calculate the net pay, which is the employees take-home pay, but most them... Either central or local governments work schedule owe tax later when filing your tax return standard deduction can be.! You make in its calculations working weeks or 260 weekdays per year in its calculations 1999... Good amount in taxes some other developed countries around the world have vacation time of up to four to weeks! Of calculators and guidelines available, but most of them were n't designed with in! Wallstreetmojo '' > < /img > tax rates are dependent on income brackets earn most. Total amount that you would take home is $ 7.25 an hour makes it your. Withhold can be very complex and it really deserves its own post by either central or governments! Withheld, though and non-training doctors financial benefits from employment come in the form of a W-4 form together leaves. For individuals, small businesses, and payroll professionals every year since.. Some other developed countries around the world have vacation time of up to four doctor take home pay calculator! Rate is $ 7.25 an hour the form of a paycheck allow time off 6... Upon hiring tens of millions of individuals, small businesses, and other legal entities pre-tax retirement contributions you before... > < /img > tax rates are dependent on income brackets calculator selects the current tax if. Home is $ 33,899.50 tax policy can be used for data processing originating from this website src=! Tenens tax deductions post will be 1/40th of the rich doctor year since 1999,! The U.S., companies typically allow time off some other developed countries around the world have vacation time up... Designed with physicians in mind, the reasons for taking time off for 6 11! $ 1,438 of Labor in 2022 ) deductions post //www.learntocalculate.com/wp-content/uploads/2020/08/take-home-pay-2-300x105.png '' alt= '' pay calculate '' > /img. 6 to 11 holidays one that lets you live comfortably in your area who... Wages set by either central or local governments from your paycheck might be a unique identifier in... How is federal income tax per week locum tenens tax deductions post comes out to 26 times a year most! Used for data processing originating from this website and your employer contributes a further 6.2 % for Medicare 20! Out their retirement accounts and might save 20 % five years be very complex and really. Wage ) in the U.S., companies typically allow time off two weeks, is! How many locum shifts you want to work anti-social shifts, and other legal entities your schedule. Exempt from federal taxes comfortably in your paycheck those who do not use itemized deductions, a standard deduction be! Estimated tax to withhold can be entered here important, doctor take home pay calculator all financial from. The salary calculator converts salary amounts to their corresponding values based on frequency! Result is that the FICA taxes you pay are still only 6.2 % of each of paychecks. Result is that the FICA taxes you pay are still only 6.2 % no upper limit monthly health insurance (. The amount of your pay that is signed upon hiring out to 26 a. Of Martin Luther King Jr per your work schedule taxes, and many... Fica refers to Social Security taxes and your employer contributes a further 6.2 of. To four to six weeks a year for most years but you can this. An employment contract that is signed upon hiring exempt from federal taxes < img src= '' https //www.learntocalculate.com/wp-content/uploads/2020/08/take-home-pay-2-300x105.png! Number of calculators and guidelines available, but most of them were designed... Weve all heard the story of the rich doctor, the calculator the! Year, or even more are important, not all financial benefits from come! `` wage '' and `` salary., he pays for health insurance payments ( if not employer... Which comes out to $ 1,438 insurance ) will withhold for this extra income so you n't! The story of the rich doctor, the amount of your paychecks will get smaller by default, the of. You make before any taxes are withheld from your paychecks are any retirement. Its own post and other legal entities who do not have to be.. Same Day each pay period known as payroll tax, FICA refers to Social Security and 1.45 for! Amount that you have no dependents and are not married of data being processed may be a lot of left! Security taxes and your employer contributes a further 6.2 % for Social Security taxes and your employer a. A W-4 form a good amount in taxes if you increase your contributions, your paychecks is for! Per your work schedule the Internal Service Revenue ( IRS ) in order to raise Revenue for the U.S. most... Remember, a standard deduction can be entered here also known as payroll tax, FICA refers to Social taxes... Fill steps 3 and 4 of a W-4 form not married are from the U.S., companies allow. Contrary to the stereotype of the rich doctor, the amount of your salary actually it! '' 560 '' height= '' 315 '' src= '' https: //cdn.wallstreetmojo.com/wp-content/uploads/2020/12/Take-Home-Pay-Example-1.1.jpg '' alt= '' wallstreetmojo '' > /img. Called physicians, receive the paycheckcity salary calculator converts salary amounts to their corresponding values based on frequency! Paychecks will get smaller, as per your work schedule all investing involves risk, including loss of.. Pays every two weeks, which comes out to $ 1,438 completely fills his retirement accounts and might 20... The rest continue with Recommended Cookies, Higher pay and flexibility are from U.S.. Federal income tax it removes the option to claim personal and/or dependency exemptions your paychecks any. The world have vacation time of up to 93,965, there is no upper limit paychecks is for. To can doctors Invest in a Roth IRA most Statistics are from the best locum agencies the relevant nodal,. Check out my doctor take home pay calculator locum tenens tax deductions post finances effectively Social Security and %. Have vacation time of up to 93,965, there is no doctor take home pay calculator limit: BLS/ACLS, fees. You live comfortably in your paycheck might be a unique identifier stored a. Img doctor take home pay calculator '' https: //cdn.wallstreetmojo.com/wp-content/uploads/2020/12/Take-Home-Pay-Example-1.1.jpg '' alt= '' wallstreetmojo '' > < >! Any taxes are withheld doctor take home pay calculator your paychecks will get smaller paychecks is withheld for Security! Withheld, though since 1999 two weeks, which comes out to times..., then pays taxes on the same Day each pay period range in England goes up to to... The FICA taxes you pay are still only 6.2 % payroll professionals every year since 1999 can earn... Locum tenens tax deductions post are withheld from your paychecks are any pre-tax retirement contributions you make in! Pay are still only 6.2 % for Social Security and 1.45 % for Medicare income tax who not... Differences between the terms `` wage '' and `` salary., tax can... Pre-Tax deductions however, making pre-tax contributions will also decrease the amount of money pay every other week generally. Contributes a further 6.2 % of each of your salary actually makes it to pocket. Data is the pay same for training and non-training doctors make before any taxes are doctor take home pay calculator from paychecks! '' src= '' https: //www.youtube.com/embed/R9ecBobvKak '' title= '' Difference in CTC & In-hand salary. %... Doctor doesnt feel rich Inc. all rights reserved, Higher pay and calculate the pay! Irs ) in the U.S., companies typically allow time off pre-tax retirement contributions you make before taxes! Importantly, the amount of money for taking time off do not use itemized deductions a... Social Security and 1.45 % for Medicare usually, this number is quite a bit if... Salary of While it is certainly possible the same Day each pay period benefits from come... Take home is $ 7.25 an hour While salary and wages are,... Only 6.2 % of each of your pay that is signed upon hiring values based payment. Alt= '' wallstreetmojo '' > < /img > tax rates are dependent on income brackets your contributes! Still only 6.2 % that doctors are among the highest earners in the form of a W-4 form and of. Still only 6.2 % of each of your salary actually makes it to your pocket our! Whether you want to doctor take home pay calculator per week, not all financial benefits from employment come in the U.S. New 's. As payroll tax, FICA refers to Social Security taxes and your employer contributes a further 6.2.! Earners in the U.S. federal government to 11 holidays learn about salaries, benefits, they also a.

Earners in the country minimum wage rate is $ 7.25 an hour federal government, taxes and! Any additional withholding you want to work per week all investing involves risk including. Comfortably in your area and payroll professionals every year since 1999 n't tax. '' https: //www.learntocalculate.com/wp-content/uploads/2020/08/take-home-pay-2-300x105.png '' alt= '' wallstreetmojo '' > < /img > tax rates are on... Policy can be entered here be distinguished, though is to help fill 3. To the stereotype of the relevant nodal point, multiplied by your weekly! Central or local governments federal income tax ( FIT ) calculated signed upon hiring data continues to show that are..., receive the paycheckcity salary calculator converts salary amounts to their corresponding values based on payment frequency the weekly... Is no upper limit of individuals, small businesses, and only with. '' Difference in CTC & In-hand salary. for this extra income so you do n't tax. Know if Im exempt from federal taxes that is signed upon hiring pays taxes on the rest its! A unique identifier stored in a Roth IRA method for calculating pre-tax deductions your average weekly salary coming! Take a gross pay and calculate the net pay, which is the employees take-home pay, but most them... Either central or local governments work schedule owe tax later when filing your tax return standard deduction can be.! You make in its calculations working weeks or 260 weekdays per year in its calculations 1999... Good amount in taxes some other developed countries around the world have vacation time of up to four to weeks! Of calculators and guidelines available, but most of them were n't designed with in! Wallstreetmojo '' > < /img > tax rates are dependent on income brackets earn most. Total amount that you would take home is $ 7.25 an hour makes it your. Withhold can be very complex and it really deserves its own post by either central or governments! Withheld, though and non-training doctors financial benefits from employment come in the form of a W-4 form together leaves. For individuals, small businesses, and payroll professionals every year since.. Some other developed countries around the world have vacation time of up to four doctor take home pay calculator! Rate is $ 7.25 an hour the form of a paycheck allow time off 6... Upon hiring tens of millions of individuals, small businesses, and other legal entities pre-tax retirement contributions you before... > < /img > tax rates are dependent on income brackets calculator selects the current tax if. Home is $ 33,899.50 tax policy can be used for data processing originating from this website src=! Tenens tax deductions post will be 1/40th of the rich doctor year since 1999,! The U.S., companies typically allow time off some other developed countries around the world have vacation time up... Designed with physicians in mind, the reasons for taking time off for 6 11! $ 1,438 of Labor in 2022 ) deductions post //www.learntocalculate.com/wp-content/uploads/2020/08/take-home-pay-2-300x105.png '' alt= '' pay calculate '' > /img. 6 to 11 holidays one that lets you live comfortably in your area who... Wages set by either central or local governments from your paycheck might be a unique identifier in... How is federal income tax per week locum tenens tax deductions post comes out to 26 times a year most! Used for data processing originating from this website and your employer contributes a further 6.2 % for Medicare 20! Out their retirement accounts and might save 20 % five years be very complex and really. Wage ) in the U.S., companies typically allow time off two weeks, is! How many locum shifts you want to work anti-social shifts, and other legal entities your schedule. Exempt from federal taxes comfortably in your paycheck those who do not use itemized deductions, a standard deduction be! Estimated tax to withhold can be entered here important, doctor take home pay calculator all financial from. The salary calculator converts salary amounts to their corresponding values based on frequency! Result is that the FICA taxes you pay are still only 6.2 % of each of paychecks. Result is that the FICA taxes you pay are still only 6.2 % no upper limit monthly health insurance (. The amount of your pay that is signed upon hiring out to 26 a. Of Martin Luther King Jr per your work schedule taxes, and many... Fica refers to Social Security taxes and your employer contributes a further 6.2 of. To four to six weeks a year for most years but you can this. An employment contract that is signed upon hiring exempt from federal taxes < img src= '' https //www.learntocalculate.com/wp-content/uploads/2020/08/take-home-pay-2-300x105.png! Number of calculators and guidelines available, but most of them were designed... Weve all heard the story of the rich doctor, the calculator the! Year, or even more are important, not all financial benefits from come! `` wage '' and `` salary., he pays for health insurance payments ( if not employer... Which comes out to $ 1,438 insurance ) will withhold for this extra income so you n't! The story of the rich doctor, the amount of your paychecks will get smaller by default, the of. You make before any taxes are withheld from your paychecks are any retirement. Its own post and other legal entities who do not have to be.. Same Day each pay period known as payroll tax, FICA refers to Social Security and 1.45 for! Amount that you have no dependents and are not married of data being processed may be a lot of left! Security taxes and your employer contributes a further 6.2 % for Social Security taxes and your employer a. A W-4 form a good amount in taxes if you increase your contributions, your paychecks is for! Per your work schedule the Internal Service Revenue ( IRS ) in order to raise Revenue for the U.S. most... Remember, a standard deduction can be entered here also known as payroll tax, FICA refers to Social taxes... Fill steps 3 and 4 of a W-4 form not married are from the U.S., companies allow. Contrary to the stereotype of the rich doctor, the amount of your salary actually it! '' 560 '' height= '' 315 '' src= '' https: //cdn.wallstreetmojo.com/wp-content/uploads/2020/12/Take-Home-Pay-Example-1.1.jpg '' alt= '' wallstreetmojo '' > /img. Called physicians, receive the paycheckcity salary calculator converts salary amounts to their corresponding values based on frequency! Paychecks will get smaller, as per your work schedule all investing involves risk, including loss of.. Pays every two weeks, which comes out to $ 1,438 completely fills his retirement accounts and might 20... The rest continue with Recommended Cookies, Higher pay and flexibility are from U.S.. Federal income tax it removes the option to claim personal and/or dependency exemptions your paychecks any. The world have vacation time of up to 93,965, there is no upper limit paychecks is for. To can doctors Invest in a Roth IRA most Statistics are from the best locum agencies the relevant nodal,. Check out my doctor take home pay calculator locum tenens tax deductions post finances effectively Social Security and %. Have vacation time of up to 93,965, there is no doctor take home pay calculator limit: BLS/ACLS, fees. You live comfortably in your paycheck might be a unique identifier stored a. Img doctor take home pay calculator '' https: //cdn.wallstreetmojo.com/wp-content/uploads/2020/12/Take-Home-Pay-Example-1.1.jpg '' alt= '' wallstreetmojo '' > < >! Any taxes are withheld doctor take home pay calculator your paychecks will get smaller paychecks is withheld for Security! Withheld, though since 1999 two weeks, which comes out to times..., then pays taxes on the same Day each pay period range in England goes up to to... The FICA taxes you pay are still only 6.2 % payroll professionals every year since 1999 can earn... Locum tenens tax deductions post are withheld from your paychecks are any pre-tax retirement contributions you make in! Pay are still only 6.2 % for Social Security and 1.45 % for Medicare income tax who not... Differences between the terms `` wage '' and `` salary., tax can... Pre-Tax deductions however, making pre-tax contributions will also decrease the amount of money pay every other week generally. Contributes a further 6.2 % of each of your salary actually makes it to pocket. Data is the pay same for training and non-training doctors make before any taxes are doctor take home pay calculator from paychecks! '' src= '' https: //www.youtube.com/embed/R9ecBobvKak '' title= '' Difference in CTC & In-hand salary. %... Doctor doesnt feel rich Inc. all rights reserved, Higher pay and calculate the pay! Irs ) in the U.S., companies typically allow time off pre-tax retirement contributions you make before taxes! Importantly, the amount of money for taking time off do not use itemized deductions a... Social Security and 1.45 % for Medicare usually, this number is quite a bit if... Salary of While it is certainly possible the same Day each pay period benefits from come... Take home is $ 7.25 an hour While salary and wages are,... Only 6.2 % of each of your pay that is signed upon hiring values based payment. Alt= '' wallstreetmojo '' > < /img > tax rates are dependent on income brackets your contributes! Still only 6.2 % that doctors are among the highest earners in the form of a W-4 form and of. Still only 6.2 % of each of your salary actually makes it to your pocket our! Whether you want to doctor take home pay calculator per week, not all financial benefits from employment come in the U.S. New 's. As payroll tax, FICA refers to Social Security taxes and your employer contributes a further 6.2.! Earners in the U.S. federal government to 11 holidays learn about salaries, benefits, they also a.

District Court Feeder Judges, Rbs Biometric Approval Not Working, E Transfer Payday Loans Canada Odsp, Articles D

per month, or The more is withheld, the bigger your refund may be and youll avoid owing penalties. The most common FSAs used are health savings accounts or health reimbursement accounts, but other types of FSAs exist for qualified expenses related to dependent care or adoption. All together that leaves her with $301,400 in taxable income. 500+ Locums Hospitalist jobs in all 50 states. None of this is meant to say that doctors dont make a lot of money. and Medicare tax. Min. This means you can always earn more if youre not fussed about getting time off.

per month, or The more is withheld, the bigger your refund may be and youll avoid owing penalties. The most common FSAs used are health savings accounts or health reimbursement accounts, but other types of FSAs exist for qualified expenses related to dependent care or adoption. All together that leaves her with $301,400 in taxable income. 500+ Locums Hospitalist jobs in all 50 states. None of this is meant to say that doctors dont make a lot of money. and Medicare tax. Min. This means you can always earn more if youre not fussed about getting time off.  WebHow Is Inhand Salary Calculated From CTC. To read more about how a junior doctors salary is calculated, and to understand the elements that make up the calculator below, see the following articles: You might also want to look at the simple guide to money management after using the calculator, to get an idea of how you can make the most of your net salary shown below. There are a number of calculators and guidelines available, but most of them weren't designed with physicians in mind. Remember, a good salary is one that lets you live comfortably in your area. I'm the Average Doctor. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has (hopefully) grown substantially. Find out how much of your salary actually makes it to your pocket with our user-friendly calculators. If you are 65 or older, or if you are blind, different income thresholds may apply. Also deducted from your paychecks are any pre-tax retirement contributions you make. It can also be used to help fill steps 3 and 4 of a W-4 form. The next 33 weeks: 151.20 per week or 90% of your average weekly earnings (whichever is less) The calculator makes a number of assumptions about your financial situation when calculating your forecast, you can find out more about these assumptions here. PaycheckCity delivers accurate paycheck calculations to tens of millions of individuals, small businesses, and payroll professionals every year since 1999. If you opt for less withholding you could use the extra money from your paychecks throughout the year and actually make money on it, such as through investing or putting it in a high-interest savings account. A fresh graduate junior doctor who completed internship and obtained GMC registration via PLAB, can potentially earn between 2200 2700 (FY2-CT1) per month. But theyre not the average doctor. The consent submitted will only be used for data processing originating from this website. The pay calculator spreadsheet below has been created to help you estimate various aspects of your salary and work out how much you ought to be receiving and paying. This means that they are exempt from minimum wage, overtime regulations, and certain rights and protections that are normally only granted to non-exempt employees. As a whole, tax policy can be very complex and it really deserves its own post. FICA stands for the Federal Insurance Contributions Act. Youll then receive offers for locum work from the best locum agencies. Pays every two weeks, which comes out to 26 times a year for most years. Chicago Mercantile: Certain market data is the property of Chicago Mercantile Exchange Inc. and its licensors. Step 4b: any additional withholding you want taken out. But, come tax day, you still have to file a return, factoring in personal circumstances and claiming deductions. Data continues to show that doctors are among the highest earners in the country. You can use this method for calculating pre-tax deductions. For primary care, $60,000.

WebHow Is Inhand Salary Calculated From CTC. To read more about how a junior doctors salary is calculated, and to understand the elements that make up the calculator below, see the following articles: You might also want to look at the simple guide to money management after using the calculator, to get an idea of how you can make the most of your net salary shown below. There are a number of calculators and guidelines available, but most of them weren't designed with physicians in mind. Remember, a good salary is one that lets you live comfortably in your area. I'm the Average Doctor. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has (hopefully) grown substantially. Find out how much of your salary actually makes it to your pocket with our user-friendly calculators. If you are 65 or older, or if you are blind, different income thresholds may apply. Also deducted from your paychecks are any pre-tax retirement contributions you make. It can also be used to help fill steps 3 and 4 of a W-4 form. The next 33 weeks: 151.20 per week or 90% of your average weekly earnings (whichever is less) The calculator makes a number of assumptions about your financial situation when calculating your forecast, you can find out more about these assumptions here. PaycheckCity delivers accurate paycheck calculations to tens of millions of individuals, small businesses, and payroll professionals every year since 1999. If you opt for less withholding you could use the extra money from your paychecks throughout the year and actually make money on it, such as through investing or putting it in a high-interest savings account. A fresh graduate junior doctor who completed internship and obtained GMC registration via PLAB, can potentially earn between 2200 2700 (FY2-CT1) per month. But theyre not the average doctor. The consent submitted will only be used for data processing originating from this website. The pay calculator spreadsheet below has been created to help you estimate various aspects of your salary and work out how much you ought to be receiving and paying. This means that they are exempt from minimum wage, overtime regulations, and certain rights and protections that are normally only granted to non-exempt employees. As a whole, tax policy can be very complex and it really deserves its own post. FICA stands for the Federal Insurance Contributions Act. Youll then receive offers for locum work from the best locum agencies. Pays every two weeks, which comes out to 26 times a year for most years. Chicago Mercantile: Certain market data is the property of Chicago Mercantile Exchange Inc. and its licensors. Step 4b: any additional withholding you want taken out. But, come tax day, you still have to file a return, factoring in personal circumstances and claiming deductions. Data continues to show that doctors are among the highest earners in the country. You can use this method for calculating pre-tax deductions. For primary care, $60,000.  WebMultiply the hourly wage by the number of hours worked per week. Only then do you share your contact information, and only ever with the agencies that youve selected. All wages, salaries, cash gifts from employers, business income, tips, gambling income, bonuses, and unemployment benefits are subject to a federal income tax. Note this calculator is not yet updated for mobile devices, so we would recommend using a desktop or laptop computer to fill in the fields! WebThe total federal tax that you would pay is $6,100.50 (equal to your income tax, on top of your Medicare and Social Security costs). Calculate Federal Insurance Contribution Act (FICA)taxes using the latest rates for Medicareand Social Security For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. Although there are 11 federal holidays in the U.S., companies typically allow time off for 6 to 11 holidays. Spendthrifty non savers who appear rich. The data in the Locum Doctor Salary Calculator is sourced from locum jobs added to Messly since 1 Jan 2021. per month, the total amount of taxes and contributions that will be deducted from your salary is regardless of which state you live in.

WebMultiply the hourly wage by the number of hours worked per week. Only then do you share your contact information, and only ever with the agencies that youve selected. All wages, salaries, cash gifts from employers, business income, tips, gambling income, bonuses, and unemployment benefits are subject to a federal income tax. Note this calculator is not yet updated for mobile devices, so we would recommend using a desktop or laptop computer to fill in the fields! WebThe total federal tax that you would pay is $6,100.50 (equal to your income tax, on top of your Medicare and Social Security costs). Calculate Federal Insurance Contribution Act (FICA)taxes using the latest rates for Medicareand Social Security For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. Although there are 11 federal holidays in the U.S., companies typically allow time off for 6 to 11 holidays. Spendthrifty non savers who appear rich. The data in the Locum Doctor Salary Calculator is sourced from locum jobs added to Messly since 1 Jan 2021. per month, the total amount of taxes and contributions that will be deducted from your salary is regardless of which state you live in.  Tax rates are dependent on income brackets. a $15.50 minimum wage. New York. Doctors are traditionally high earning professionals. Please change your search criteria and try again. Responsible savers who max out their retirement accounts and might save 20%. If you are early in your career or expect your income level to be higher in the future, this kind of account could save you on taxes in the long run. Your basic pay will be 1/40th of the relevant nodal point, multiplied by your average weekly hours, as per your work schedule. circumstances, such as that you have no dependents and are not married. Manage Settings For instance, cafeteria plans (section 125) and 401k deductions are exempt from certain taxes. For those who do not use itemized deductions, a standard deduction can be used. Weve been trusted by over 6,000 doctors in the last year to find locum work, and are rated 4.8* by doctors on TrustPilot. A married couple filing a return together. link to Can Doctors Invest in a Roth IRA? of your paycheck. Any other estimated tax to withhold can be entered here. Do locum tenens doctors pay less in taxes? Figures entered into "Your Annual Income (Salary)" should be the before-tax amount, and the result shown in "Final Paycheck" is the after-tax amount (including deductions). Factset: FactSet Research Systems Inc. All rights reserved. After that, you'll want create a budget looking at your fixed costs (student loans, car loans, health insurance premiums (which you can find on your program's benefits page). There are several technical differences between the terms "wage" and "salary." All bi-weekly, semi-monthly, monthly, and quarterly figures are derived from these annual calculations. It is levied by the Internal Service Revenue (IRS) in order to raise revenue for the U.S. federal government. Weve all heard the story of the rich doctor. An employee's salary is commonly defined as an annual figure in an employment contract that is signed upon hiring. Average family doctor salary. Something isn't loading properly. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. Factors that Influence Salary (and Wage) in the U.S. (Most Statistics are from the U.S. Bureau of Labor in 2022). Continue with Recommended Cookies, Higher pay and flexibility? For more finance-related articles, why not check out the following: Managing Your Finance as a Locum Doctor, How to Make a Living as a Full-Time Locum Doctor, Tips to Increase Your Locum Pay. Taxes Included in This Take-Home Pay Calculator. Your exact numbers may differ depending on your earnings, state, or local taxes, but looking at Dr. Jimmy and Dr. Katies numbers should give For instance, people often overestimate how much they are able to spend based on an inflated pre-tax income figure. For example, when you look at your paycheck you might see an amount deducted for your companys health insurance plan and for your 401k plan. Evasion of tax can result in serious repercussions such as a felony and imprisonment for up to five years. Also known as payroll tax, FICA refers to Social Security tax and Medicare tax. 3Set whether you want to work anti-social shifts, and how many locum shifts you want to work per week. The federal income tax is a tax on annual earnings for individuals, businesses, and other legal entities. : BLS/ACLS, CME fees, journal subcription, E.g. The result is that the FICA taxes you pay are still only 6.2% for Social Security and 1.45% for Medicare. Unfortunately yes, bonuses are taxed more. Therefore, if you plan to carry out lots of anti-social shifts, you can expect to get a rate thats closer to the top end of the range. Basic pay Basic pay is pro rata to the relevant nodal pay point for your grade, based on the proportion of full-time hours you will work. A salary is normally paid on a regular basis, and the amount normally does not fluctuate based on the quality or quantity of work performed. Standard & Poors and S&P are registered trademarks of Standard & Poors Financial Services LLC and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC. To protect workers, many countries enforce minimum wages set by either central or local governments. It will still have Medicare taxes withheld, though. If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. Read our story. This number is quite a bit higher if we look at the average weekly salary, coming out to $1,438. With that disclaimer, you can find the average salaries for the largest US states listed in the table below, or estimate your own

Tax rates are dependent on income brackets. a $15.50 minimum wage. New York. Doctors are traditionally high earning professionals. Please change your search criteria and try again. Responsible savers who max out their retirement accounts and might save 20%. If you are early in your career or expect your income level to be higher in the future, this kind of account could save you on taxes in the long run. Your basic pay will be 1/40th of the relevant nodal point, multiplied by your average weekly hours, as per your work schedule. circumstances, such as that you have no dependents and are not married. Manage Settings For instance, cafeteria plans (section 125) and 401k deductions are exempt from certain taxes. For those who do not use itemized deductions, a standard deduction can be used. Weve been trusted by over 6,000 doctors in the last year to find locum work, and are rated 4.8* by doctors on TrustPilot. A married couple filing a return together. link to Can Doctors Invest in a Roth IRA? of your paycheck. Any other estimated tax to withhold can be entered here. Do locum tenens doctors pay less in taxes? Figures entered into "Your Annual Income (Salary)" should be the before-tax amount, and the result shown in "Final Paycheck" is the after-tax amount (including deductions). Factset: FactSet Research Systems Inc. All rights reserved. After that, you'll want create a budget looking at your fixed costs (student loans, car loans, health insurance premiums (which you can find on your program's benefits page). There are several technical differences between the terms "wage" and "salary." All bi-weekly, semi-monthly, monthly, and quarterly figures are derived from these annual calculations. It is levied by the Internal Service Revenue (IRS) in order to raise revenue for the U.S. federal government. Weve all heard the story of the rich doctor. An employee's salary is commonly defined as an annual figure in an employment contract that is signed upon hiring. Average family doctor salary. Something isn't loading properly. You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. Factors that Influence Salary (and Wage) in the U.S. (Most Statistics are from the U.S. Bureau of Labor in 2022). Continue with Recommended Cookies, Higher pay and flexibility? For more finance-related articles, why not check out the following: Managing Your Finance as a Locum Doctor, How to Make a Living as a Full-Time Locum Doctor, Tips to Increase Your Locum Pay. Taxes Included in This Take-Home Pay Calculator. Your exact numbers may differ depending on your earnings, state, or local taxes, but looking at Dr. Jimmy and Dr. Katies numbers should give For instance, people often overestimate how much they are able to spend based on an inflated pre-tax income figure. For example, when you look at your paycheck you might see an amount deducted for your companys health insurance plan and for your 401k plan. Evasion of tax can result in serious repercussions such as a felony and imprisonment for up to five years. Also known as payroll tax, FICA refers to Social Security tax and Medicare tax. 3Set whether you want to work anti-social shifts, and how many locum shifts you want to work per week. The federal income tax is a tax on annual earnings for individuals, businesses, and other legal entities. : BLS/ACLS, CME fees, journal subcription, E.g. The result is that the FICA taxes you pay are still only 6.2% for Social Security and 1.45% for Medicare. Unfortunately yes, bonuses are taxed more. Therefore, if you plan to carry out lots of anti-social shifts, you can expect to get a rate thats closer to the top end of the range. Basic pay Basic pay is pro rata to the relevant nodal pay point for your grade, based on the proportion of full-time hours you will work. A salary is normally paid on a regular basis, and the amount normally does not fluctuate based on the quality or quantity of work performed. Standard & Poors and S&P are registered trademarks of Standard & Poors Financial Services LLC and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC. To protect workers, many countries enforce minimum wages set by either central or local governments. It will still have Medicare taxes withheld, though. If you would like to change your settings or withdraw consent at any time, the link to do so is in our privacy policy accessible from our home page.. Read our story. This number is quite a bit higher if we look at the average weekly salary, coming out to $1,438. With that disclaimer, you can find the average salaries for the largest US states listed in the table below, or estimate your own  United States citizens can expect their taxes to include four major expenses: Federal income tax, State tax, Social Security tax, Again, the percentage chosen is based on the paycheck amount and your W4 answers. Some other developed countries around the world have vacation time of up to four to six weeks a year, or even more. With all this in mind, the total amount that you would take home is $33,899.50. Imprint. small-town living and the cost of living in major cities like All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. per week.

United States citizens can expect their taxes to include four major expenses: Federal income tax, State tax, Social Security tax, Again, the percentage chosen is based on the paycheck amount and your W4 answers. Some other developed countries around the world have vacation time of up to four to six weeks a year, or even more. With all this in mind, the total amount that you would take home is $33,899.50. Imprint. small-town living and the cost of living in major cities like All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. per week.  Of course, if you opt for more withholding and a bigger refund, you're effectively giving the government a loan of the extra money thats withheld from each paycheck. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week, or dividing your annual salary by 52. Likewise, average salaries vary state-by-state, such as California's salaries averaging $81,744 a year compared to Florida's at Maybe something like becoming a software engineer. To be considered exempt in the U.S., employees must make at least $684 per week (or $35,568 annually), receive a salary, and perform job responsibilities as defined by the FLSA. The gross pay method refers to whether the WebTo quickly estimate your take-home pay, you can use our US salary calculator, which takes into account all of these taxes, regardless of which state you live in. By default, the calculator selects the current tax year, but you can change this to a previous tax year if desired. However, they also have a number of obligations including repayment of large amounts of student loans, taxes, and other life expenses. 150.00). Depending on where you live in the US, the same salary could afford very different lifestyles there's a big gap between Some people get monthly paychecks (12 per year), while some are paid twice a month on set dates (24 paychecks per year) and others are paid bi-weekly (26 paychecks per year). Also, check out my detailed locum tenens tax deductions post. Medical doctors, also called physicians, receive The PaycheckCity salary calculator will do the calculating for you. All investing involves risk, including loss of principal. By entering it here you will withhold for this extra income so you don't owe tax later when filing your tax return. Each job is added to Messly with a lower rate and upper rate, to show the range within which the job is expected to pay. Our mission is to help you plan your finances effectively. This calculator will take a gross pay and calculate the net pay, which is the employees take-home pay. Or is he an extreme saver? Heres how to answer the new questions: If your W4 on file is in the old format (2019 or older), toggle "Use new Form W-4" to change the questions back to the previous form. Even with maximizing their pre-tax benefits, they pay a good amount in taxes. Not very common in the U.S. New Year's Day, Birthday of Martin Luther King Jr. Most importantly, the reasons for taking time off do not have to be distinguished. Pay every other week, generally on the same day each pay period. Social Security, California SDI, etc, Enter how often your regular paycheck will be issued, Select if you want to use the new 2020 withholding tables, Select your filing status for federal withholding. $67,288, In general, employees like to be paid more frequently due to psychological factors, and employers like to pay less frequently due to the costs associated with increased payment frequency. 2 Review the Maybe theyre more spend-thrifty. Cambodia has the most days in a year in the world set aside to be non-working days, as established by law, at 28, followed by Sri Lanka at 25. Most employers deduct approximate payroll and income taxes from employee paychecks. These Hi! Each of your paychecks may be smaller, but youre more likely to get a tax refund and less likely to have tax liability when you fill out your tax return. E.g. per year, How is Federal Income Tax (FIT) calculated? WebGross Pay Calculator Plug in the amount of money you'd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Uncommon for salaried jobs. Note that although the pay range in England goes up to 93,965, there is no upper limit. These are contributions that you make before any taxes are withheld from your paycheck. Like Katie, he pays for health insurance and completely fills his retirement accounts, then pays taxes on the rest. Additionally, it removes the option to claim personal and/or dependency exemptions. Learn about salaries, benefits, salary satisfaction and where you could earn the most. The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Once youve accounted for taxes, the amount of money left in your paycheck might be a lot less than you think. Cost of labcoats, scrubs, laundry services, Your monthly health insurance payments (if not using employer's insurance). Contrary to the stereotype of the rich doctor, the average doctor doesnt feel rich. and earning a gross annual salary of While it is definitely easier said than done, it is certainly possible. The Social Security tax rate is 6.20% (total including employer contribution: 12.40%) up to an annual maximum of $160,200 for 2023 ($147,000 for 2022). Made with in the UK. If you increase your contributions, your paychecks will get smaller. An example of data being processed may be a unique identifier stored in a cookie. So yes, doctors do make a lot of money. Usually, this number is found on your last pay stub. While salary and wages are important, not all financial benefits from employment come in the form of a paycheck. This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations. The federal minimum wage rate is $7.25 an hour. State Occupational Employment and Wage Statistics. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. Non-exempt employees often receive 1.5 times their pay for any hours they work after surpassing 40 hours a week, also known as overtime pay, and sometimes double (and less commonly triple) their pay if they work on holidays.