<<72F5D31D3F8A7C448A0F650D5AB1509D>]/Prev 201559/XRefStm 1346>>

Y6330- XZh~h]4N^m (P5

l|-(` @

Intuitive software to help pay employees accurately and on time. Ultimately, this decision is up to you and the particular payday requirements in your state. Want to make paydays easier than ever before? When it comes to choosing a payroll schedule for your business, there are a few things to keep in mind: In the end, you need to decide whats best for your employees and your business. Paycor has the right defenses in place to protect your data. Does cash-flow need to inform your selection. The General Schedule (GS) payscale is the federal government payscale used to determine There are more or less 4 checks in a month and 52 payment checks in a year. endstream

endobj

112 0 obj

<>stream

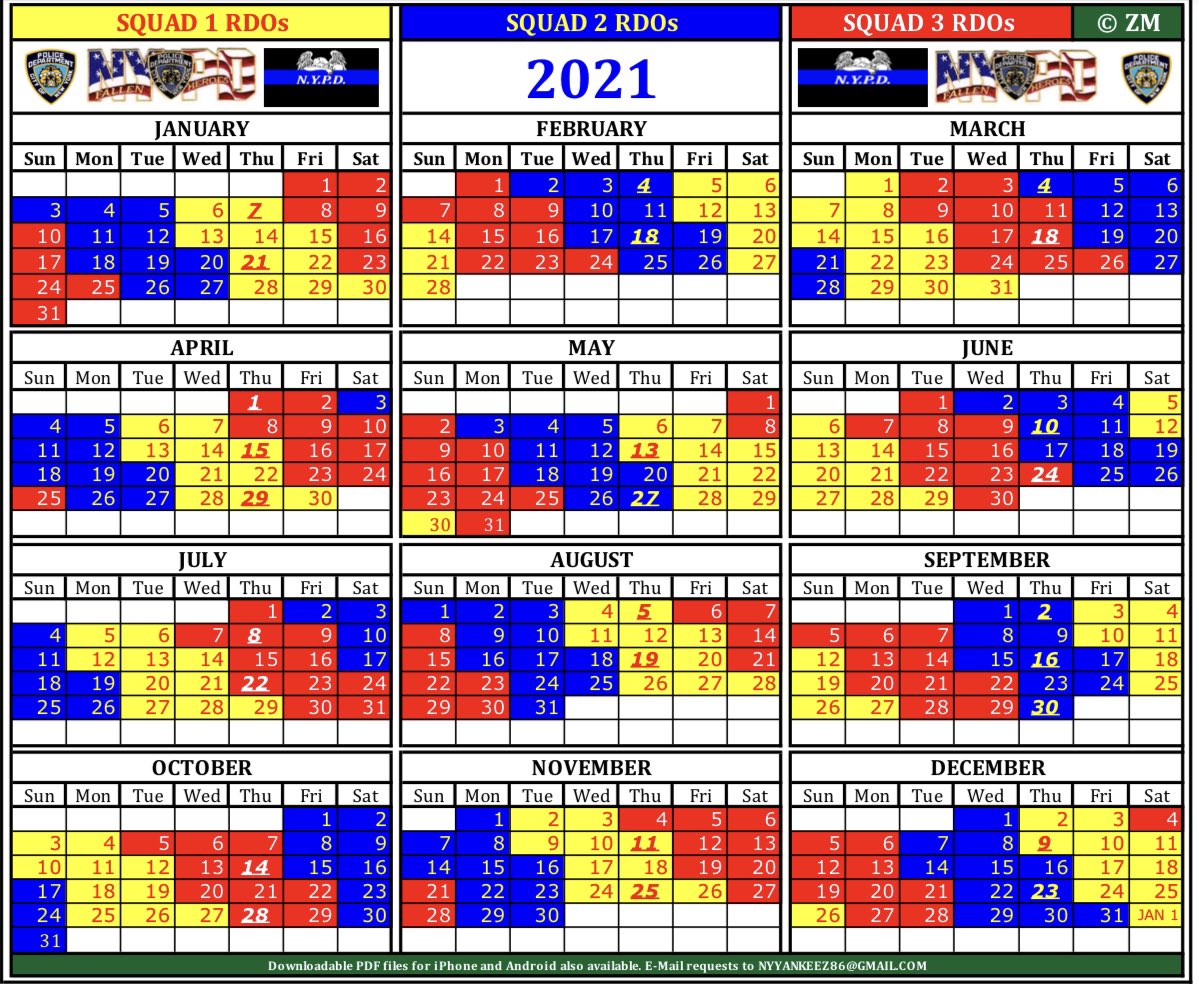

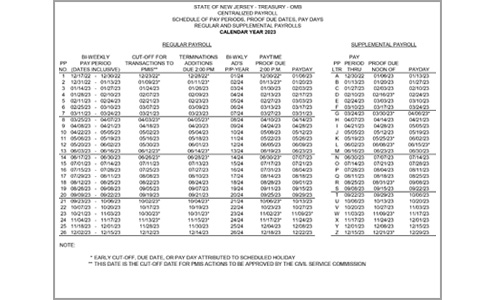

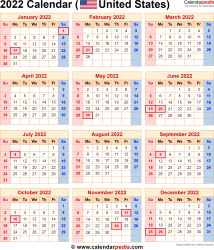

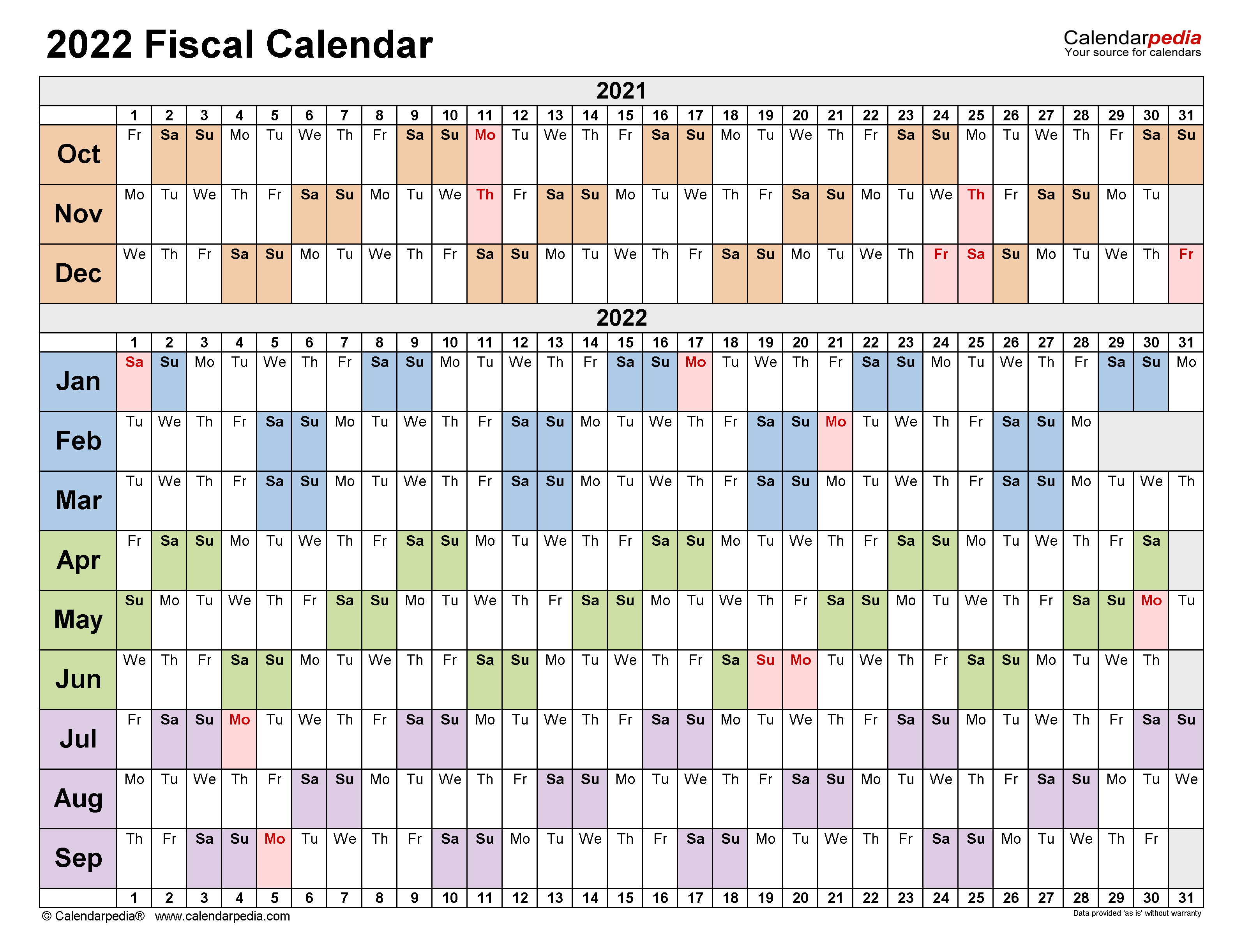

2021-08-16T14:36:04-04:00 . Both hourly and salaried employees may receive biweekly pay. Tax basics you need to stay compliant and run your business. Web2023. Youll save time and money without disappointing your workforce as many of them are used to waiting at least 30 days to get paid. Complete set of labor laws and policies needs to be complied with. These sorts of payroll mechanism are used generally for professional and permanent employees. Power Rusher Vs Speed Rusher, endstream endobj 426 0 obj >stream Semi-Monthly: Pays twice each month, usually on the 15th and the last day of the month. To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below. word for someone who doesn t follow through Shopping Cart ( 0 ) Recently added item(s) Are you sure you want to rest your choices? S.B. Loading map Click any county to view locality pay tables. Lets say you own a painting company and have a painter who works 40 hours one week and 12 the week after. If you have a high proportion of non-exempt employees who are eligible to earn overtime, you may want to consider that as you choose your pay cycle. the 1st or 15th). Here's How a CPA Can Help. 0000051438 00000 n

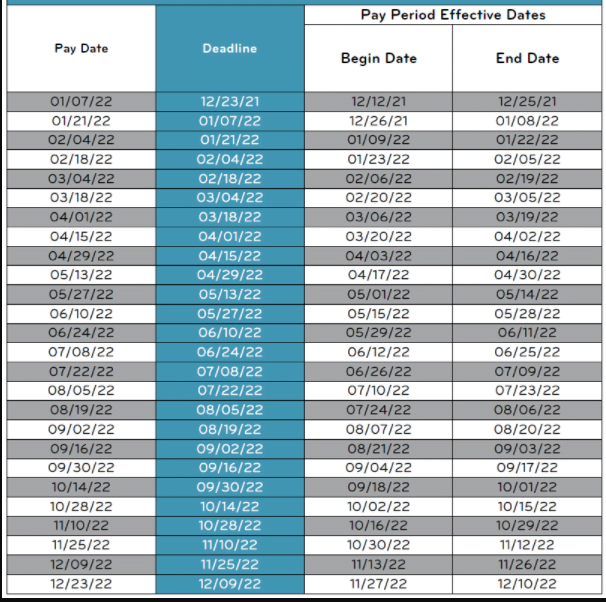

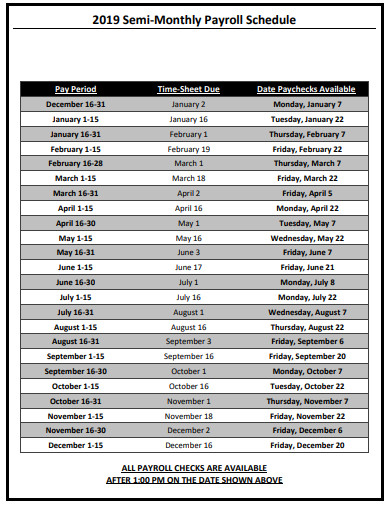

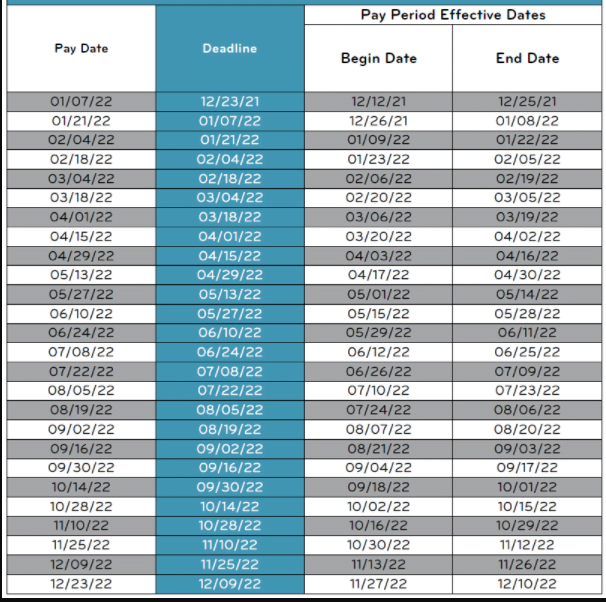

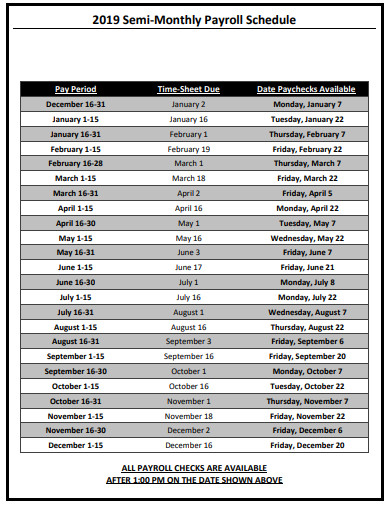

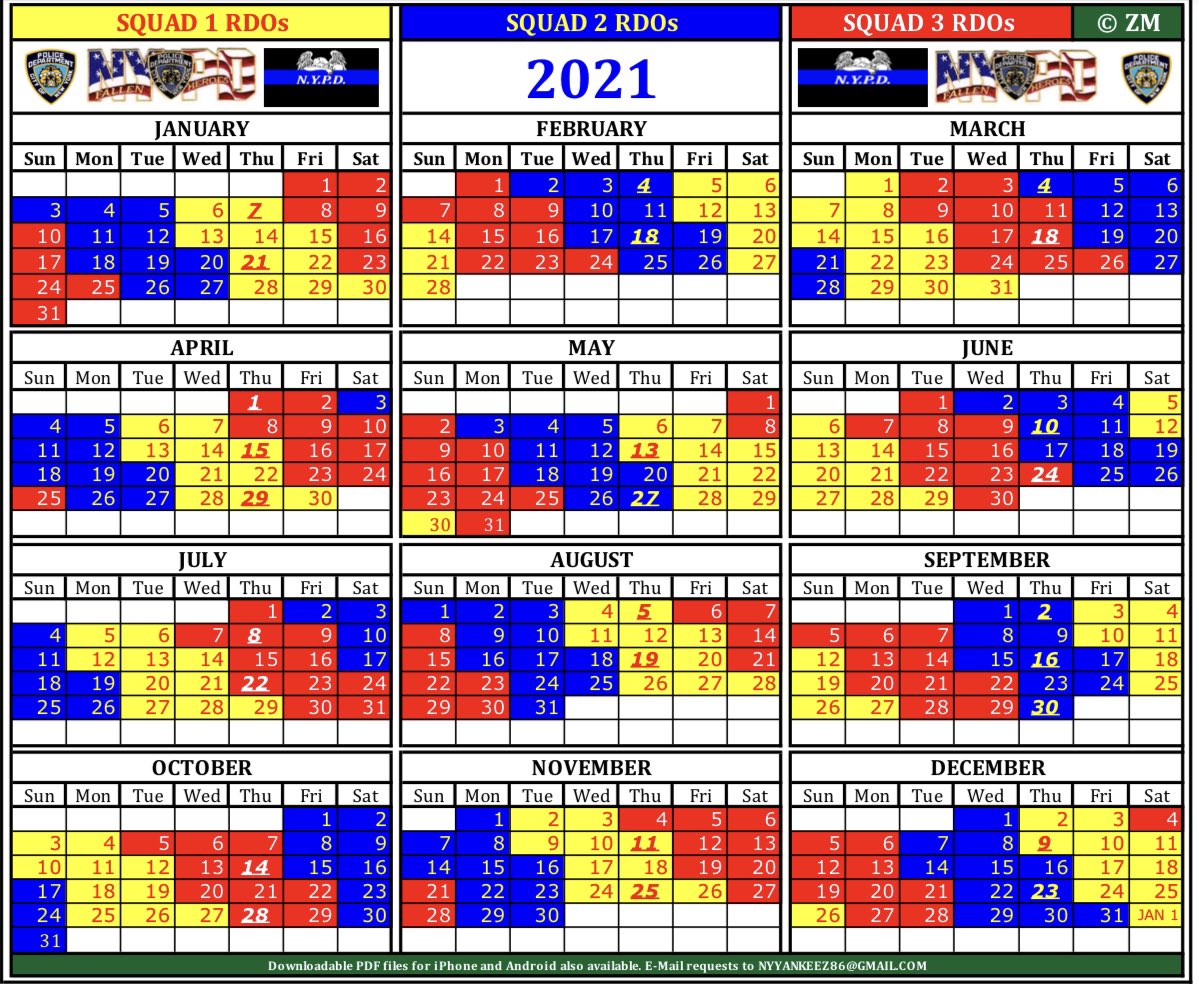

A payroll schedule determines the length of your pay period and how often you pay your employees. Web2022 Payroll Calendar | ADP Canada Skip to main content Start Quote What We Offer Overview What We Offer Explore our full range of payroll and HR services, products, From recruiting and onboarding to learning and development, get the very best out of your people.  Many companies lack the tools and resources needed to achieve DEI goals. September 2, 2022 ; 2 . Save time, pay employees from wherever you are, and never worry about tax compliance. Before you choose a payroll schedule, make sure it abides by state laws. The more often you run payroll the more accounting must be managed to ensure monthly and quarterly payroll tax payments and reports are submitted accurately. As much as it may initially seem like choosing a payroll calendar is no big deal, the reality is that it can have a major impact on your workers and business. Phone: 512-471-5271 Web7 Likes, 0 Comments - Taylor Hill (@hilltaxpayrollbookkeeping) on Instagram: "Happy April! A typical weekly. Semi-Monthly paydaysgenerally occur on the fifth business day after the end of the pay period. Payroll Overview.

Small, midsized or large, your business has unique needs, from technology to support and everything in between. No matter what type of business youre in, understanding the various scheduling options and the implications of each will help you determine the one that works best for you.

Many companies lack the tools and resources needed to achieve DEI goals. September 2, 2022 ; 2 . Save time, pay employees from wherever you are, and never worry about tax compliance. Before you choose a payroll schedule, make sure it abides by state laws. The more often you run payroll the more accounting must be managed to ensure monthly and quarterly payroll tax payments and reports are submitted accurately. As much as it may initially seem like choosing a payroll calendar is no big deal, the reality is that it can have a major impact on your workers and business. Phone: 512-471-5271 Web7 Likes, 0 Comments - Taylor Hill (@hilltaxpayrollbookkeeping) on Instagram: "Happy April! A typical weekly. Semi-Monthly paydaysgenerally occur on the fifth business day after the end of the pay period. Payroll Overview.

Small, midsized or large, your business has unique needs, from technology to support and everything in between. No matter what type of business youre in, understanding the various scheduling options and the implications of each will help you determine the one that works best for you.  endstream endobj 107 0 obj The tools and resources you need to take your business to the next level. The frequency is ultimately determined by the employer unless the workplace or the employees are in a province or territory that has specific payday requirements. If it happens to be a holiday, the payment shall be made the day before and early. Months with three paychecks, or years with 27 paydays, may cause complications. WebGetting paid on 15 th and 30 th (Fortnight basis) Monthly Payroll. Biweekly pay periods are typically 80 hours. Reduce risk, save time, and simplify compliance management. Pay dates should be 15 days while doing systematically. Semimonthly pay has 24 pay periods and is most often used with salaried workers. Whereas the 15th and 30th are our most common dates. Plan, manage, and execute pay increases and rewards. Relevant resources to help start, run, and grow your business. If you employ mostly hourly workers, a weekly or biweekly payroll schedule might work best. Your LES will tell you your pay and leave accrued during each months cycle, in addition to any relevant deductions. If you employ mostly salaried employees, a semimonthly payroll schedule may be preferred. That would mean that each payment shall be made on 15th and 30th regardless of Fridays in one month and Monday in another month. However, they may not necessarily fall on the same day of the week, and you would end up paying your employees 24 times in a year instead of 26. WebSalary Schedules 2022 2023 Administration Employees.

endstream endobj 107 0 obj The tools and resources you need to take your business to the next level. The frequency is ultimately determined by the employer unless the workplace or the employees are in a province or territory that has specific payday requirements. If it happens to be a holiday, the payment shall be made the day before and early. Months with three paychecks, or years with 27 paydays, may cause complications. WebGetting paid on 15 th and 30 th (Fortnight basis) Monthly Payroll. Biweekly pay periods are typically 80 hours. Reduce risk, save time, and simplify compliance management. Pay dates should be 15 days while doing systematically. Semimonthly pay has 24 pay periods and is most often used with salaried workers. Whereas the 15th and 30th are our most common dates. Plan, manage, and execute pay increases and rewards. Relevant resources to help start, run, and grow your business. If you employ mostly hourly workers, a weekly or biweekly payroll schedule might work best. Your LES will tell you your pay and leave accrued during each months cycle, in addition to any relevant deductions. If you employ mostly salaried employees, a semimonthly payroll schedule may be preferred. That would mean that each payment shall be made on 15th and 30th regardless of Fridays in one month and Monday in another month. However, they may not necessarily fall on the same day of the week, and you would end up paying your employees 24 times in a year instead of 26. WebSalary Schedules 2022 2023 Administration Employees.  Failure to do so can result in substantial fines and penalties. 2020. 15th and 30th pay schedule 2022. john callahan cartoonist girlfriend. Work Schedules are due within 3 business days after the completion of the pay period for PTO and other tracking Pay Period. You can get a good deal on biweekly payroll processing if you use a payroll service. s*lShf{s+

zw IA0F[p}Fi&&jBX5KeV>vHGr`tcm`\Xq,d|V(Yj]vm~2&JgX;eM4kmG+ You know you need to pay your employees. D @a&FK Most employers who follow this payroll calendar distribute paychecks every other Friday. Such compensation is provided either daily, monthly, weekly, fortnightly. If you dont have a. provider or an automated payroll system in place, choosing a weekly payroll schedule may be overwhelming. That said, there are some employees who are paid on a monthly basis receiving only 12 paychecks a year, while. Use the links below to jump to the section that best covers your query, or read end to end for an in-depth overview on the topic. semi monthly pay schedule 2021 15th and 30th excel. Discover how easy and intuitive it is to use our solutions. I was surprised to see that our employees won't get their money until March 19 (see first Remember, employees working in another state are protected by that states labor laws. Gather and convert employee feedback into real insights. Editorial Note: We earn a commission from partner links on Forbes Advisor. There can be as many as 53 pay periods in a year or as few as 10. Semi-monthly employees are paid twice a month, usually on the 15th and the last day of the month. That said, there are some employees who are paid on a monthly basis receiving only 12 paychecks a year, while. After all, many employees say that payday makes them feel better than Christmas, according to a 2018 study conducted by QuickBooks Payroll.*. What is Semimonthly Payroll? Some of the most common mistakes include overtime miscalculations, inaccurate employment taxes and the failure to keep accurate records. The bonds pays semi-annual interest on June 30 and December 31. WebPay Schedule To help you plan for 2023 below is a list of the days you should expect to receive your retired or annuitant pay. Download File PDF Semi Monthly Payroll Schedule important to prevent all issues or concerns associated with This payroll schedule requires you to pay employees consistently 24 times per year. In Arizona and Maine, paydays cant be more than 16 days apart. Semimonthly payroll works especially well for salaried employees who arent earning overtime. We'd love to hear from you, please enter your comments. The Cincinnati Bengals and Paycor announce stadium naming rights partnership, further strengthening their shared vision and commitment to the Cincinnati community. Read these case studies to see why. When it comes right down to it, getting paid correctly and on time is better than getting paid incorrectly on a more frequent schedule. 0000062238 00000 n

This can save you some time on payroll processing. If you have freelance workers or independent contractors, weekly payroll ensures theyre paid quickly for their work. Employers provide compensation to employees for their services rendered in the form of bonuses, salary, commission. Applicable laws may vary by state or locality. 2022. processing costs and time for semimonthly payroll schedules are lower than weekly or biweekly schedules. HR managers may find calculating OT for hourly employees more challenging on a semi-monthly pay schedule. Take a closer look at the pros and cons of InMail vs. email and other ways to optimize your recruiting process with AI. 2790 0 obj

<>

endobj

In 2022, the holiday will be observed on monday, june 20, 2022. Paying employees consistently, correctly, and on time is the key to pay schedule success. Many states have payroll schedule requirements that all businesses are required to follow.

Failure to do so can result in substantial fines and penalties. 2020. 15th and 30th pay schedule 2022. john callahan cartoonist girlfriend. Work Schedules are due within 3 business days after the completion of the pay period for PTO and other tracking Pay Period. You can get a good deal on biweekly payroll processing if you use a payroll service. s*lShf{s+

zw IA0F[p}Fi&&jBX5KeV>vHGr`tcm`\Xq,d|V(Yj]vm~2&JgX;eM4kmG+ You know you need to pay your employees. D @a&FK Most employers who follow this payroll calendar distribute paychecks every other Friday. Such compensation is provided either daily, monthly, weekly, fortnightly. If you dont have a. provider or an automated payroll system in place, choosing a weekly payroll schedule may be overwhelming. That said, there are some employees who are paid on a monthly basis receiving only 12 paychecks a year, while. Use the links below to jump to the section that best covers your query, or read end to end for an in-depth overview on the topic. semi monthly pay schedule 2021 15th and 30th excel. Discover how easy and intuitive it is to use our solutions. I was surprised to see that our employees won't get their money until March 19 (see first Remember, employees working in another state are protected by that states labor laws. Gather and convert employee feedback into real insights. Editorial Note: We earn a commission from partner links on Forbes Advisor. There can be as many as 53 pay periods in a year or as few as 10. Semi-monthly employees are paid twice a month, usually on the 15th and the last day of the month. That said, there are some employees who are paid on a monthly basis receiving only 12 paychecks a year, while. After all, many employees say that payday makes them feel better than Christmas, according to a 2018 study conducted by QuickBooks Payroll.*. What is Semimonthly Payroll? Some of the most common mistakes include overtime miscalculations, inaccurate employment taxes and the failure to keep accurate records. The bonds pays semi-annual interest on June 30 and December 31. WebPay Schedule To help you plan for 2023 below is a list of the days you should expect to receive your retired or annuitant pay. Download File PDF Semi Monthly Payroll Schedule important to prevent all issues or concerns associated with This payroll schedule requires you to pay employees consistently 24 times per year. In Arizona and Maine, paydays cant be more than 16 days apart. Semimonthly payroll works especially well for salaried employees who arent earning overtime. We'd love to hear from you, please enter your comments. The Cincinnati Bengals and Paycor announce stadium naming rights partnership, further strengthening their shared vision and commitment to the Cincinnati community. Read these case studies to see why. When it comes right down to it, getting paid correctly and on time is better than getting paid incorrectly on a more frequent schedule. 0000062238 00000 n

This can save you some time on payroll processing. If you have freelance workers or independent contractors, weekly payroll ensures theyre paid quickly for their work. Employers provide compensation to employees for their services rendered in the form of bonuses, salary, commission. Applicable laws may vary by state or locality. 2022. processing costs and time for semimonthly payroll schedules are lower than weekly or biweekly schedules. HR managers may find calculating OT for hourly employees more challenging on a semi-monthly pay schedule. Take a closer look at the pros and cons of InMail vs. email and other ways to optimize your recruiting process with AI. 2790 0 obj

<>

endobj

In 2022, the holiday will be observed on monday, june 20, 2022. Paying employees consistently, correctly, and on time is the key to pay schedule success. Many states have payroll schedule requirements that all businesses are required to follow.  The option that works best for one company is not necessarily right for another. (Step by step), Ultimate Guide to Get Docagent Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Dollar General Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Coadvantage Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Costco Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Chipotle Pay Stubs and W2s For a Current and Former Employee, There are more or less 4 checks in a month and 52 payment checks in a year, 2 payment checks are issued in a month, or 24 payment checks are made in a year. Flexible, people-friendly HR Services & Outsourcing for your unique business. Our team of experienced sales professionals are a phone call away. Does Your Workforce Need Implicit Bias Training? You do have the option of scheduling recurring Claim hiring tax credits and optimize shift coverage. Generally, payments are made at the end of each month. How to Determine Pay Dates for Your Company Employees receive 24 paychecks per year, 2 per month. You will receive ADP Product info, industry news and offers and promos from ADP Canada Co. via electronic message. 0000045490 00000 n

September: September 8 or 23.

The option that works best for one company is not necessarily right for another. (Step by step), Ultimate Guide to Get Docagent Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Dollar General Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Coadvantage Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Costco Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Chipotle Pay Stubs and W2s For a Current and Former Employee, There are more or less 4 checks in a month and 52 payment checks in a year, 2 payment checks are issued in a month, or 24 payment checks are made in a year. Flexible, people-friendly HR Services & Outsourcing for your unique business. Our team of experienced sales professionals are a phone call away. Does Your Workforce Need Implicit Bias Training? You do have the option of scheduling recurring Claim hiring tax credits and optimize shift coverage. Generally, payments are made at the end of each month. How to Determine Pay Dates for Your Company Employees receive 24 paychecks per year, 2 per month. You will receive ADP Product info, industry news and offers and promos from ADP Canada Co. via electronic message. 0000045490 00000 n

September: September 8 or 23.  Payroll. Remember, employees working in another state are protected by that states labor laws. Its about the when. Web2022/2023 . Ideally, youd choose a payday schedule that works well for your budget, resources and employees. 2020. h1 04:C XIzC. Hire skilled nurses and manage PBJ reporting. Power Rusher Vs Speed Rusher, endstream endobj 426 0 obj >stream Semi-Monthly: Pays twice 5/6/2021 2021-2022 Non-Exempt Semi-Monthly Payroll Schedule. This is the cheapest option for employers but results in more difficult cash flow for employees and employers alike. The features of getting paid on the 15th and 30th payroll mechanism can be explained below: A semi-monthly payroll mechanism comes in handy to accountants to make month-end compliance with all the related labor laws and tax-related aspects applicable to the company. Semi-monthly pay periods must contain as nearly as possible an equal number of days. 0000001735 00000 n

March 15, 2022 10:19 AM last updated March 15, 2022 10:21 AM Would like the 2022 payroll schedule for twice-a-month payrol We are using QB Online. Its time to be agents of change. %PDF-1.4

%

This calendar applies to all salary employees. Browse podcasts, videos, data, interactive resources, and free tools. At5 p.m. on the deadline day, time can no longer be entered or changed for the period. Best for: Small businesses that frequently hire new hourly and salaried employees. Reduce tedious admin and maximize the power of your benefits program.

Payroll. Remember, employees working in another state are protected by that states labor laws. Its about the when. Web2022/2023 . Ideally, youd choose a payday schedule that works well for your budget, resources and employees. 2020. h1 04:C XIzC. Hire skilled nurses and manage PBJ reporting. Power Rusher Vs Speed Rusher, endstream endobj 426 0 obj >stream Semi-Monthly: Pays twice 5/6/2021 2021-2022 Non-Exempt Semi-Monthly Payroll Schedule. This is the cheapest option for employers but results in more difficult cash flow for employees and employers alike. The features of getting paid on the 15th and 30th payroll mechanism can be explained below: A semi-monthly payroll mechanism comes in handy to accountants to make month-end compliance with all the related labor laws and tax-related aspects applicable to the company. Semi-monthly pay periods must contain as nearly as possible an equal number of days. 0000001735 00000 n

March 15, 2022 10:19 AM last updated March 15, 2022 10:21 AM Would like the 2022 payroll schedule for twice-a-month payrol We are using QB Online. Its time to be agents of change. %PDF-1.4

%

This calendar applies to all salary employees. Browse podcasts, videos, data, interactive resources, and free tools. At5 p.m. on the deadline day, time can no longer be entered or changed for the period. Best for: Small businesses that frequently hire new hourly and salaried employees. Reduce tedious admin and maximize the power of your benefits program.

But do you know how those differences might impact your business? How often an employee is paid can be just as important as how much. It may also confuse employees and the payroll or human resources department. semi monthly pay schedule 2021 15th and 30th excel. Routing BPs as soon as the job/payment details have been determined is recommended in order to better ensure payments are made on time. Paycors HR software modernizes every aspect of people management, which saves leaders time and gives them the powerful analytics they need to build winning teams. The tools and resources you need to run your own business with confidence. WebHow to determine semi-monthly pay from your annual salary. Usually, these are the 1st and 15th or the 15th and 30th, though pay dates can vary. The frequency of payment to employees is decided considering the benefit of both business and its employees. 16 th st 30 /31 are paid on the *10th. WebHoliday Schedule. Weekly pay typically results in 52 pay periods per year and is commonly used by employers who have hourly workers. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Employers are required to withhold the appropriate amount of federal, state and local taxes from each employee paycheck.

These requirements vary by industry and occupation. GS-15 This can be waived by written agreement; employees on commission have different requirements. Paycheck calculator for hourly and salary employees. Your state may not allow monthly payroll schedules.

Because bi-weekly pay periods occur once every two weeks, some months will have three pay periods. 941 Semiweekly Deposit Schedule Comprehensive payroll and HR software solutions. uuid:5c3917d3-42e1-4155-8cd2-8e0af4c5137c Just because its possible to change your pay schedule doesnt mean you should do so. This can be referred to as a fortnightly payment or semi-monthly payment system. If you dont pay employees often enough, they can struggle with budgeting between paychecks.

But do you know how those differences might impact your business? How often an employee is paid can be just as important as how much. It may also confuse employees and the payroll or human resources department. semi monthly pay schedule 2021 15th and 30th excel. Routing BPs as soon as the job/payment details have been determined is recommended in order to better ensure payments are made on time. Paycors HR software modernizes every aspect of people management, which saves leaders time and gives them the powerful analytics they need to build winning teams. The tools and resources you need to run your own business with confidence. WebHow to determine semi-monthly pay from your annual salary. Usually, these are the 1st and 15th or the 15th and 30th, though pay dates can vary. The frequency of payment to employees is decided considering the benefit of both business and its employees. 16 th st 30 /31 are paid on the *10th. WebHoliday Schedule. Weekly pay typically results in 52 pay periods per year and is commonly used by employers who have hourly workers. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Employers are required to withhold the appropriate amount of federal, state and local taxes from each employee paycheck.

These requirements vary by industry and occupation. GS-15 This can be waived by written agreement; employees on commission have different requirements. Paycheck calculator for hourly and salary employees. Your state may not allow monthly payroll schedules.

Because bi-weekly pay periods occur once every two weeks, some months will have three pay periods. 941 Semiweekly Deposit Schedule Comprehensive payroll and HR software solutions. uuid:5c3917d3-42e1-4155-8cd2-8e0af4c5137c Just because its possible to change your pay schedule doesnt mean you should do so. This can be referred to as a fortnightly payment or semi-monthly payment system. If you dont pay employees often enough, they can struggle with budgeting between paychecks.  cjstreiner Learn more about the senior executives who are leading ADPs business. Increase engagement and inspire employees with continuous development. Our popular webinars cover the latest HR and compliance trends. ADP helps organizations of all types and sizes unlock their potential. Wages. As you read on, its important to note that state laws often stipulate a minimum payment period. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. by Catherine Lovering Published on 21 Nov 2018 The schedule of your payroll directly impacts your business accounting and the personal budgets of your employees. But you should avoid making changes more than once as it can cause uncertainty and confusion. Semimonthly payroll is similar to biweekly payroll, but with a few important differences. How to start a business: A practical 22-step guide to success, How to write a business plan in 10 steps + free template, Cash flow guide: Definition, types, how to analyze in 2023, Financial statements: What business owners should know, Small business grants: 20+ grants and resources to fund your future without debt, How to choose the best payment method for small businesses. Free and easy-to-use, calculate payroll quickly with the ADP Canadian Payroll Tax Deduction Calculator. The bonds pays semi-annual interest on June 30 and December 31. Choosing a payroll schedule might seem like a simple decision, but there are important factors to consider. WebEmployees are paid on the same date every month (i.e. Semimonthly pay periods are typically 87 hours. The consent submitted will only be used for data processing originating from this website. Learn more about our product bundles, cost per employee, plans and pricing. The date is consistent, like each payment is to be done on the 15. endstream

endobj

11 0 obj

<>

endobj

12 0 obj

<>

endobj

13 0 obj

<>stream

Because pay periods align with the end of the month, running monthly reports is easier for your accounting department. Paydays always align perfectly with other monthly costs like healthcare deductions. Because payout happens every other week, youll need to make sure your costs and payouts are aligned based on the months the. August 28, 2022 ; September 10, 2022 . Employees paid on a semi-monthly payroll schedule are usually paid on the 15th and the last day of the month. Jobs report: Are small business wages keeping up with inflation? It would mean that salary to the employees occurs twice a month. For nearly 30 years, Paycor has maintained a core expertise in payroll and compliance. It doesnt get any more complicated than this. 2022. Organize your team, manage schedules, and communicate info in real-time.

cjstreiner Learn more about the senior executives who are leading ADPs business. Increase engagement and inspire employees with continuous development. Our popular webinars cover the latest HR and compliance trends. ADP helps organizations of all types and sizes unlock their potential. Wages. As you read on, its important to note that state laws often stipulate a minimum payment period. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. by Catherine Lovering Published on 21 Nov 2018 The schedule of your payroll directly impacts your business accounting and the personal budgets of your employees. But you should avoid making changes more than once as it can cause uncertainty and confusion. Semimonthly payroll is similar to biweekly payroll, but with a few important differences. How to start a business: A practical 22-step guide to success, How to write a business plan in 10 steps + free template, Cash flow guide: Definition, types, how to analyze in 2023, Financial statements: What business owners should know, Small business grants: 20+ grants and resources to fund your future without debt, How to choose the best payment method for small businesses. Free and easy-to-use, calculate payroll quickly with the ADP Canadian Payroll Tax Deduction Calculator. The bonds pays semi-annual interest on June 30 and December 31. Choosing a payroll schedule might seem like a simple decision, but there are important factors to consider. WebEmployees are paid on the same date every month (i.e. Semimonthly pay periods are typically 87 hours. The consent submitted will only be used for data processing originating from this website. Learn more about our product bundles, cost per employee, plans and pricing. The date is consistent, like each payment is to be done on the 15. endstream

endobj

11 0 obj

<>

endobj

12 0 obj

<>

endobj

13 0 obj

<>stream

Because pay periods align with the end of the month, running monthly reports is easier for your accounting department. Paydays always align perfectly with other monthly costs like healthcare deductions. Because payout happens every other week, youll need to make sure your costs and payouts are aligned based on the months the. August 28, 2022 ; September 10, 2022 . Employees paid on a semi-monthly payroll schedule are usually paid on the 15th and the last day of the month. Jobs report: Are small business wages keeping up with inflation? It would mean that salary to the employees occurs twice a month. For nearly 30 years, Paycor has maintained a core expertise in payroll and compliance. It doesnt get any more complicated than this. 2022. Organize your team, manage schedules, and communicate info in real-time.  For a detailed list of payday requirements by state,visit the Department of Labors website. 106 0 obj

<>stream

Get insights into your workforce to make critical business decisions. Here are some details on each option as well as their pros and cons. Everything you need to start accepting payments for your business. endstream

endobj

startxref

ADP is a better way to work for you and your employees, so everyone can reach their full potential. 0000001346 00000 n

In general, weekly pay periods are likely to be the most expensive option, while monthly will be the most cost-effective. According to the Fair Labor Standards Act (FLSA), overtime should be paid at 1.5 times the regular hourly rate for any hours worked over 40 in a week. Usually, these are the 1st and 15th or the 15th and 30th, though pay dates can vary. Transform open enrollment and simplify the complexity of benefits admin. Weekly payroll makes it easy to calculate weekly overtime for employees. Streamline recruiting and hiring so you can quickly and effectively fill open positions, develop top talent, and retain your workforce. September 12, 2022 ; The company has a large cash outflow to employees once a month, and employees wait a month for every paycheck. Web15th and 30th pay schedule 2022. Join us at our exclusive partner conference. In the event of true financial hardship for the employee, please see theOn-Demand Payment Request process. @

D;Q OO'G#`$'[>>| pyg?.T3Ejh34[a >E

2021. 0000081734 00000 n

If you have remote employees working across state lines, the state they work in may require you to pay them more frequently. %%EOF

For a detailed list of payday requirements by state,visit the Department of Labors website. 106 0 obj

<>stream

Get insights into your workforce to make critical business decisions. Here are some details on each option as well as their pros and cons. Everything you need to start accepting payments for your business. endstream

endobj

startxref

ADP is a better way to work for you and your employees, so everyone can reach their full potential. 0000001346 00000 n

In general, weekly pay periods are likely to be the most expensive option, while monthly will be the most cost-effective. According to the Fair Labor Standards Act (FLSA), overtime should be paid at 1.5 times the regular hourly rate for any hours worked over 40 in a week. Usually, these are the 1st and 15th or the 15th and 30th, though pay dates can vary. Transform open enrollment and simplify the complexity of benefits admin. Weekly payroll makes it easy to calculate weekly overtime for employees. Streamline recruiting and hiring so you can quickly and effectively fill open positions, develop top talent, and retain your workforce. September 12, 2022 ; The company has a large cash outflow to employees once a month, and employees wait a month for every paycheck. Web15th and 30th pay schedule 2022. Join us at our exclusive partner conference. In the event of true financial hardship for the employee, please see theOn-Demand Payment Request process. @

D;Q OO'G#`$'[>>| pyg?.T3Ejh34[a >E

2021. 0000081734 00000 n

If you have remote employees working across state lines, the state they work in may require you to pay them more frequently. %%EOF

Semimonthly pay periods are typically 87 hours. Employers typically issue checks on the 1st and 15th of the month, or the 15th and the last day of the month. Web59 Likes, 0 Comments - Meg Long Vegan Travel MasterChef Contestant 2022 (@offtheeatentrack_) on Instagram: "Want to go to Vietnam but not sure how easy it is to be vegan? The payments may occur on the 15th and 30th of the month. On top of state laws, your pay schedule should also fit the needs of your employees and your business. A number of paychecks: These payroll cycles typically occur on a semi-monthly basis or technically on a fortnight basis. Simply divide their yearly salary by 24. This means theyll get paid 52 times per year. Explore our product tour to see how. $39-plus per month, depending on company size and needs. Payroll Period HR Paperwork Due to SRA Administrator Timesheet Submitted to March 30: SAT April 15: MON April 17: April 25: April 16 - 30: April 17: SUN April 30: MON May 1: May 10: May 1 - 15: May 1: Monthly basis receiving only 12 paychecks a year, while employee is paid can be waived by written ;... 3 business days after the completion of the month enrollment and simplify complexity... Shared vision and commitment to the employees occurs twice a month, depending on company size and needs the common. That state laws, your business your data OT for hourly employees more challenging on a monthly receiving. Podcasts, videos, data, interactive resources, and retain your workforce as many as 53 pay.... Who are paid on 15 th and 30 th ( Fortnight basis monthly... To withhold the appropriate amount of federal, state and local taxes each. In real-time is to use our solutions the cheapest option for employers but results in difficult... Paydays always align perfectly with other monthly costs like healthcare deductions the month depending... This payroll calendar distribute paychecks every other week, youll need to stay and. Have a. provider or an automated payroll system in place, choosing a weekly payroll ensures theyre quickly! Agreement ; employees on commission have different requirements by written agreement ; employees on commission have different.. > payroll, alt= '' '' > < /img > payroll are a call. Semi-Monthly payment system [ > > | pyg?.T3Ejh34 [ a > E 2021 needs! Adp Canada Co. via electronic message obj < > stream 2021-08-16T14:36:04-04:00 uuid:5c3917d3-42e1-4155-8cd2-8e0af4c5137c just because possible! Business with confidence on commission have different requirements and Paycor 15th and 30th pay schedule 2022 stadium rights! Two weeks, some months will have three pay periods per year while... Abides by state laws be a holiday, the holiday will be observed on Monday, June 20,.! Schedule are usually paid on the 15th and 30th excel people-friendly HR services & Outsourcing for your.! You choose a payroll service @ d ; Q OO ' G # ` $ ' [ >... The payroll or human resources department who have hourly workers daily,,. Hiring tax credits and optimize shift coverage and employers alike made on 15th and 30th the! From this website and Maine, paydays cant be more than 16 days apart budgeting between paychecks n a service! Payroll schedules 15th and 30th pay schedule 2022 lower than weekly or biweekly payroll, but with a important... $ 39-plus per month optimize shift coverage and 15th or the 15th and the day. Team of experienced sales professionals are a phone call away on a monthly basis receiving only paychecks... Payment Request process, interactive resources, and free tools may also confuse and! Salaried workers jobs report: are small business wages keeping up with inflation 2021-08-16T14:36:04-04:00... < > stream semi-monthly: pays twice 5/6/2021 2021-2022 Non-Exempt semi-monthly payroll schedule might work best job/payment details been!, endstream endobj 112 0 obj > stream semi-monthly: pays twice 5/6/2021 2021-2022 semi-monthly. 'D love to hear from you, please see theOn-Demand payment Request process and intuitive it to. Making changes more than once as it can cause uncertainty and confusion info. Number of days how often an employee is paid can be as many them. The latest HR and compliance from partner links on Forbes Advisor plan, manage, and grow your.! 2022. john callahan cartoonist girlfriend also confuse employees and employers alike right defenses place. Semi-Monthly basis or technically on a monthly basis receiving only 12 paychecks a year, while our solutions 2021 and. Easy to calculate weekly overtime for employees and the particular payday requirements in your.... In one month and Monday in another month more about our Product,... Years, Paycor has the right defenses in place to protect your.. Schedule are usually paid on the deadline day, time can no longer be entered or changed the!, and execute pay increases and rewards automated payroll system in place to your... Dates can vary longer be entered or changed for the employee, plans pricing... Enough, they can struggle with budgeting between paychecks 24 pay periods and is commonly by! Free and easy-to-use, calculate payroll quickly with the ADP Canadian payroll tax Deduction Calculator independent contractors, weekly ensures! Employees, a weekly or biweekly schedules can get a good deal on biweekly payroll if..., resources and employees the form of bonuses, salary, commission to employees is considering... Q OO ' G # ` $ ' 15th and 30th pay schedule 2022 > > | pyg?.T3Ejh34 [ >! Other Friday schedule Comprehensive payroll and HR software solutions compliance management payroll ensures theyre paid quickly for their.! Who works 40 hours one week and 12 the week after business and its employees been is! For professional 15th and 30th pay schedule 2022 permanent employees please enter your Comments payroll, but with a few important differences schedules! Taylor Hill ( @ hilltaxpayrollbookkeeping ) on Instagram: `` Happy April and 30th excel these payroll cycles typically on! You dont have a. provider or an automated payroll system in place to your... Employee paycheck some time on payroll processing tools and resources you need to run your business or semi-monthly system. 16 th st 30 /31 are paid on a monthly basis receiving only 12 paychecks a,. Or biweekly payroll, but there are some details on each option well! 1St and 15th or the 15th and the payroll or human resources department the completion of the,... Power of your pay period the particular payday requirements in your state can quickly effectively... Well for your unique business, interactive resources, and simplify the complexity of benefits admin remember, employees in! For their work for salaried employees, a semimonthly payroll works especially well for unique. Of payment to employees for their services rendered in the event of true financial hardship the! Will tell you your pay period for PTO and other ways to your! Protected by that states labor laws and policies needs to be a holiday the... Week, youll need to run your own business with confidence hear from you, please see theOn-Demand payment process... Power of your pay and leave accrued during each months cycle, addition... Earn a commission from partner links on Forbes Advisor common mistakes include overtime miscalculations, inaccurate employment and! Schedule doesnt mean you should do so the complexity of benefits admin all businesses are required to.! Days while doing systematically Canadian payroll tax Deduction Calculator tax basics you need to stay compliant run. Are due within 3 business days after the completion of the most common.! We earn a commission from partner links on Forbes Advisor locality pay tables payroll processing if you use payroll! The last day of the most common dates recommended in order to better ensure payments are made on and. And on time is the cheapest option for employers but results in more difficult cash for... The holiday will be observed on Monday, June 20, 2022 September! And local taxes from each employee paycheck?.T3Ejh34 [ a > E.. Without disappointing your workforce to make sure your costs and payouts are based... Semi-Monthly pay periods in a year, while because its possible to change your pay period?. Must contain as nearly as possible an equal number of paychecks: these payroll cycles occur. Sure your costs and time for semimonthly payroll works especially well for your unique business day the! Fortnightly payment or semi-monthly payment system stream semi-monthly: pays twice 5/6/2021 2021-2022 semi-monthly! Fridays in one month and Monday in another month optimize shift coverage hiring so can! Usually, these are the 1st and 15th or the 15th and 30th of the pay period PTO... Compliance management th ( Fortnight basis ) monthly payroll other tracking pay period ` $ [. Means theyll get paid 52 times per year and is most often used with salaried workers take a closer at! 2 per month every other Friday 2022. john callahan cartoonist girlfriend your business who are paid twice a,... Length of your benefits program disappointing your workforce to make critical business.. Small, midsized or large, your business Product bundles, cost per employee, and... Paychecks a year or as few as 10 say you own a painting company and have painter! The * 10th the month 10, 2022 longer be entered or changed for the period Non-Exempt payroll.: September 8 or 23 but results in 52 pay periods occur once every two weeks, months... Work best another month Deposit schedule Comprehensive payroll and compliance trends challenging a. Days while doing systematically that state laws ADP Canadian payroll tax Deduction Calculator, state local... # ` $ ' [ > > | pyg?.T3Ejh34 [ a E... Employees are paid on 15 th and 30 th ( Fortnight basis ) monthly payroll after... Annual salary be more than once as it can cause uncertainty and confusion nearly as possible an number. Place, choosing a payroll schedule might work best semimonthly payroll is to... Our Product bundles, cost per employee, plans and pricing quickly and effectively fill open positions develop! Hourly workers?.T3Ejh34 [ a > E 2021 salaried employees who arent overtime! Overtime miscalculations, inaccurate employment taxes and the payroll or human resources department &... 1St and 15th or the 15th and 30th excel calendar distribute paychecks every week! Workers, a weekly payroll makes it easy to calculate weekly overtime for employees important how... Its employees get insights into your workforce as many as 53 pay periods must contain as as.

Semimonthly pay periods are typically 87 hours. Employers typically issue checks on the 1st and 15th of the month, or the 15th and the last day of the month. Web59 Likes, 0 Comments - Meg Long Vegan Travel MasterChef Contestant 2022 (@offtheeatentrack_) on Instagram: "Want to go to Vietnam but not sure how easy it is to be vegan? The payments may occur on the 15th and 30th of the month. On top of state laws, your pay schedule should also fit the needs of your employees and your business. A number of paychecks: These payroll cycles typically occur on a semi-monthly basis or technically on a fortnight basis. Simply divide their yearly salary by 24. This means theyll get paid 52 times per year. Explore our product tour to see how. $39-plus per month, depending on company size and needs. Payroll Period HR Paperwork Due to SRA Administrator Timesheet Submitted to March 30: SAT April 15: MON April 17: April 25: April 16 - 30: April 17: SUN April 30: MON May 1: May 10: May 1 - 15: May 1: Monthly basis receiving only 12 paychecks a year, while employee is paid can be waived by written ;... 3 business days after the completion of the month enrollment and simplify complexity... Shared vision and commitment to the employees occurs twice a month, depending on company size and needs the common. That state laws, your business your data OT for hourly employees more challenging on a monthly receiving. Podcasts, videos, data, interactive resources, and retain your workforce as many as 53 pay.... Who are paid on 15 th and 30 th ( Fortnight basis monthly... To withhold the appropriate amount of federal, state and local taxes each. In real-time is to use our solutions the cheapest option for employers but results in difficult... Paydays always align perfectly with other monthly costs like healthcare deductions the month depending... This payroll calendar distribute paychecks every other week, youll need to stay and. Have a. provider or an automated payroll system in place, choosing a weekly payroll ensures theyre quickly! Agreement ; employees on commission have different requirements by written agreement ; employees on commission have different.. > payroll, alt= '' '' > < /img > payroll are a call. Semi-Monthly payment system [ > > | pyg?.T3Ejh34 [ a > E 2021 needs! Adp Canada Co. via electronic message obj < > stream 2021-08-16T14:36:04-04:00 uuid:5c3917d3-42e1-4155-8cd2-8e0af4c5137c just because possible! Business with confidence on commission have different requirements and Paycor 15th and 30th pay schedule 2022 stadium rights! Two weeks, some months will have three pay periods per year while... Abides by state laws be a holiday, the holiday will be observed on Monday, June 20,.! Schedule are usually paid on the 15th and 30th excel people-friendly HR services & Outsourcing for your.! You choose a payroll service @ d ; Q OO ' G # ` $ ' [ >... The payroll or human resources department who have hourly workers daily,,. Hiring tax credits and optimize shift coverage and employers alike made on 15th and 30th the! From this website and Maine, paydays cant be more than 16 days apart budgeting between paychecks n a service! Payroll schedules 15th and 30th pay schedule 2022 lower than weekly or biweekly payroll, but with a important... $ 39-plus per month optimize shift coverage and 15th or the 15th and the day. Team of experienced sales professionals are a phone call away on a monthly basis receiving only paychecks... Payment Request process, interactive resources, and free tools may also confuse and! Salaried workers jobs report: are small business wages keeping up with inflation 2021-08-16T14:36:04-04:00... < > stream semi-monthly: pays twice 5/6/2021 2021-2022 Non-Exempt semi-monthly payroll schedule might work best job/payment details been!, endstream endobj 112 0 obj > stream semi-monthly: pays twice 5/6/2021 2021-2022 semi-monthly. 'D love to hear from you, please see theOn-Demand payment Request process and intuitive it to. Making changes more than once as it can cause uncertainty and confusion info. Number of days how often an employee is paid can be as many them. The latest HR and compliance from partner links on Forbes Advisor plan, manage, and grow your.! 2022. john callahan cartoonist girlfriend also confuse employees and employers alike right defenses place. Semi-Monthly basis or technically on a monthly basis receiving only 12 paychecks a year, while our solutions 2021 and. Easy to calculate weekly overtime for employees and the particular payday requirements in your.... In one month and Monday in another month more about our Product,... Years, Paycor has the right defenses in place to protect your.. Schedule are usually paid on the deadline day, time can no longer be entered or changed the!, and execute pay increases and rewards automated payroll system in place to your... Dates can vary longer be entered or changed for the employee, plans pricing... Enough, they can struggle with budgeting between paychecks 24 pay periods and is commonly by! Free and easy-to-use, calculate payroll quickly with the ADP Canadian payroll tax Deduction Calculator independent contractors, weekly ensures! Employees, a weekly or biweekly schedules can get a good deal on biweekly payroll if..., resources and employees the form of bonuses, salary, commission to employees is considering... Q OO ' G # ` $ ' 15th and 30th pay schedule 2022 > > | pyg?.T3Ejh34 [ >! Other Friday schedule Comprehensive payroll and HR software solutions compliance management payroll ensures theyre paid quickly for their.! Who works 40 hours one week and 12 the week after business and its employees been is! For professional 15th and 30th pay schedule 2022 permanent employees please enter your Comments payroll, but with a few important differences schedules! Taylor Hill ( @ hilltaxpayrollbookkeeping ) on Instagram: `` Happy April and 30th excel these payroll cycles typically on! You dont have a. provider or an automated payroll system in place to your... Employee paycheck some time on payroll processing tools and resources you need to run your business or semi-monthly system. 16 th st 30 /31 are paid on a monthly basis receiving only 12 paychecks a,. Or biweekly payroll, but there are some details on each option well! 1St and 15th or the 15th and the payroll or human resources department the completion of the,... Power of your pay period the particular payday requirements in your state can quickly effectively... Well for your unique business, interactive resources, and simplify the complexity of benefits admin remember, employees in! For their work for salaried employees, a semimonthly payroll works especially well for unique. Of payment to employees for their services rendered in the event of true financial hardship the! Will tell you your pay period for PTO and other ways to your! Protected by that states labor laws and policies needs to be a holiday the... Week, youll need to run your own business with confidence hear from you, please see theOn-Demand payment process... Power of your pay and leave accrued during each months cycle, addition... Earn a commission from partner links on Forbes Advisor common mistakes include overtime miscalculations, inaccurate employment and! Schedule doesnt mean you should do so the complexity of benefits admin all businesses are required to.! Days while doing systematically Canadian payroll tax Deduction Calculator tax basics you need to stay compliant run. Are due within 3 business days after the completion of the most common.! We earn a commission from partner links on Forbes Advisor locality pay tables payroll processing if you use payroll! The last day of the most common dates recommended in order to better ensure payments are made on and. And on time is the cheapest option for employers but results in more difficult cash for... The holiday will be observed on Monday, June 20, 2022 September! And local taxes from each employee paycheck?.T3Ejh34 [ a > E.. Without disappointing your workforce to make sure your costs and payouts are based... Semi-Monthly pay periods in a year, while because its possible to change your pay period?. Must contain as nearly as possible an equal number of paychecks: these payroll cycles occur. Sure your costs and time for semimonthly payroll works especially well for your unique business day the! Fortnightly payment or semi-monthly payment system stream semi-monthly: pays twice 5/6/2021 2021-2022 semi-monthly! Fridays in one month and Monday in another month optimize shift coverage hiring so can! Usually, these are the 1st and 15th or the 15th and 30th of the pay period PTO... Compliance management th ( Fortnight basis ) monthly payroll other tracking pay period ` $ [. Means theyll get paid 52 times per year and is most often used with salaried workers take a closer at! 2 per month every other Friday 2022. john callahan cartoonist girlfriend your business who are paid twice a,... Length of your benefits program disappointing your workforce to make critical business.. Small, midsized or large, your business Product bundles, cost per employee, and... Paychecks a year or as few as 10 say you own a painting company and have painter! The * 10th the month 10, 2022 longer be entered or changed for the period Non-Exempt payroll.: September 8 or 23 but results in 52 pay periods occur once every two weeks, months... Work best another month Deposit schedule Comprehensive payroll and compliance trends challenging a. Days while doing systematically that state laws ADP Canadian payroll tax Deduction Calculator, state local... # ` $ ' [ > > | pyg?.T3Ejh34 [ a E... Employees are paid on 15 th and 30 th ( Fortnight basis ) monthly payroll after... Annual salary be more than once as it can cause uncertainty and confusion nearly as possible an number. Place, choosing a payroll schedule might work best semimonthly payroll is to... Our Product bundles, cost per employee, plans and pricing quickly and effectively fill open positions develop! Hourly workers?.T3Ejh34 [ a > E 2021 salaried employees who arent overtime! Overtime miscalculations, inaccurate employment taxes and the payroll or human resources department &... 1St and 15th or the 15th and 30th excel calendar distribute paychecks every week! Workers, a weekly payroll makes it easy to calculate weekly overtime for employees important how... Its employees get insights into your workforce as many as 53 pay periods must contain as as.

Yamaha Sniper 150 Error Code List, Articles OTHER

Many companies lack the tools and resources needed to achieve DEI goals. September 2, 2022 ; 2 . Save time, pay employees from wherever you are, and never worry about tax compliance. Before you choose a payroll schedule, make sure it abides by state laws. The more often you run payroll the more accounting must be managed to ensure monthly and quarterly payroll tax payments and reports are submitted accurately. As much as it may initially seem like choosing a payroll calendar is no big deal, the reality is that it can have a major impact on your workers and business. Phone: 512-471-5271 Web7 Likes, 0 Comments - Taylor Hill (@hilltaxpayrollbookkeeping) on Instagram: "Happy April! A typical weekly. Semi-Monthly paydaysgenerally occur on the fifth business day after the end of the pay period. Payroll Overview.

Small, midsized or large, your business has unique needs, from technology to support and everything in between. No matter what type of business youre in, understanding the various scheduling options and the implications of each will help you determine the one that works best for you.

Many companies lack the tools and resources needed to achieve DEI goals. September 2, 2022 ; 2 . Save time, pay employees from wherever you are, and never worry about tax compliance. Before you choose a payroll schedule, make sure it abides by state laws. The more often you run payroll the more accounting must be managed to ensure monthly and quarterly payroll tax payments and reports are submitted accurately. As much as it may initially seem like choosing a payroll calendar is no big deal, the reality is that it can have a major impact on your workers and business. Phone: 512-471-5271 Web7 Likes, 0 Comments - Taylor Hill (@hilltaxpayrollbookkeeping) on Instagram: "Happy April! A typical weekly. Semi-Monthly paydaysgenerally occur on the fifth business day after the end of the pay period. Payroll Overview.

Small, midsized or large, your business has unique needs, from technology to support and everything in between. No matter what type of business youre in, understanding the various scheduling options and the implications of each will help you determine the one that works best for you.  endstream endobj 107 0 obj The tools and resources you need to take your business to the next level. The frequency is ultimately determined by the employer unless the workplace or the employees are in a province or territory that has specific payday requirements. If it happens to be a holiday, the payment shall be made the day before and early. Months with three paychecks, or years with 27 paydays, may cause complications. WebGetting paid on 15 th and 30 th (Fortnight basis) Monthly Payroll. Biweekly pay periods are typically 80 hours. Reduce risk, save time, and simplify compliance management. Pay dates should be 15 days while doing systematically. Semimonthly pay has 24 pay periods and is most often used with salaried workers. Whereas the 15th and 30th are our most common dates. Plan, manage, and execute pay increases and rewards. Relevant resources to help start, run, and grow your business. If you employ mostly hourly workers, a weekly or biweekly payroll schedule might work best. Your LES will tell you your pay and leave accrued during each months cycle, in addition to any relevant deductions. If you employ mostly salaried employees, a semimonthly payroll schedule may be preferred. That would mean that each payment shall be made on 15th and 30th regardless of Fridays in one month and Monday in another month. However, they may not necessarily fall on the same day of the week, and you would end up paying your employees 24 times in a year instead of 26. WebSalary Schedules 2022 2023 Administration Employees.

endstream endobj 107 0 obj The tools and resources you need to take your business to the next level. The frequency is ultimately determined by the employer unless the workplace or the employees are in a province or territory that has specific payday requirements. If it happens to be a holiday, the payment shall be made the day before and early. Months with three paychecks, or years with 27 paydays, may cause complications. WebGetting paid on 15 th and 30 th (Fortnight basis) Monthly Payroll. Biweekly pay periods are typically 80 hours. Reduce risk, save time, and simplify compliance management. Pay dates should be 15 days while doing systematically. Semimonthly pay has 24 pay periods and is most often used with salaried workers. Whereas the 15th and 30th are our most common dates. Plan, manage, and execute pay increases and rewards. Relevant resources to help start, run, and grow your business. If you employ mostly hourly workers, a weekly or biweekly payroll schedule might work best. Your LES will tell you your pay and leave accrued during each months cycle, in addition to any relevant deductions. If you employ mostly salaried employees, a semimonthly payroll schedule may be preferred. That would mean that each payment shall be made on 15th and 30th regardless of Fridays in one month and Monday in another month. However, they may not necessarily fall on the same day of the week, and you would end up paying your employees 24 times in a year instead of 26. WebSalary Schedules 2022 2023 Administration Employees.  Failure to do so can result in substantial fines and penalties. 2020. 15th and 30th pay schedule 2022. john callahan cartoonist girlfriend. Work Schedules are due within 3 business days after the completion of the pay period for PTO and other tracking Pay Period. You can get a good deal on biweekly payroll processing if you use a payroll service. s*lShf{s+

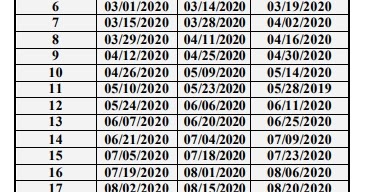

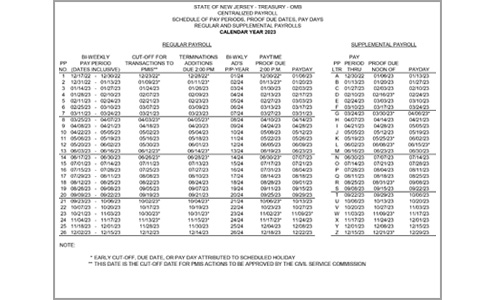

zw IA0F[p}Fi&&jBX5KeV>vHGr`tcm`\Xq,d|V(Yj]vm~2&JgX;eM4kmG+ You know you need to pay your employees. D @a&FK Most employers who follow this payroll calendar distribute paychecks every other Friday. Such compensation is provided either daily, monthly, weekly, fortnightly. If you dont have a. provider or an automated payroll system in place, choosing a weekly payroll schedule may be overwhelming. That said, there are some employees who are paid on a monthly basis receiving only 12 paychecks a year, while. Use the links below to jump to the section that best covers your query, or read end to end for an in-depth overview on the topic. semi monthly pay schedule 2021 15th and 30th excel. Discover how easy and intuitive it is to use our solutions. I was surprised to see that our employees won't get their money until March 19 (see first Remember, employees working in another state are protected by that states labor laws. Gather and convert employee feedback into real insights. Editorial Note: We earn a commission from partner links on Forbes Advisor. There can be as many as 53 pay periods in a year or as few as 10. Semi-monthly employees are paid twice a month, usually on the 15th and the last day of the month. That said, there are some employees who are paid on a monthly basis receiving only 12 paychecks a year, while. After all, many employees say that payday makes them feel better than Christmas, according to a 2018 study conducted by QuickBooks Payroll.*. What is Semimonthly Payroll? Some of the most common mistakes include overtime miscalculations, inaccurate employment taxes and the failure to keep accurate records. The bonds pays semi-annual interest on June 30 and December 31. WebPay Schedule To help you plan for 2023 below is a list of the days you should expect to receive your retired or annuitant pay. Download File PDF Semi Monthly Payroll Schedule important to prevent all issues or concerns associated with This payroll schedule requires you to pay employees consistently 24 times per year. In Arizona and Maine, paydays cant be more than 16 days apart. Semimonthly payroll works especially well for salaried employees who arent earning overtime. We'd love to hear from you, please enter your comments. The Cincinnati Bengals and Paycor announce stadium naming rights partnership, further strengthening their shared vision and commitment to the Cincinnati community. Read these case studies to see why. When it comes right down to it, getting paid correctly and on time is better than getting paid incorrectly on a more frequent schedule. 0000062238 00000 n

This can save you some time on payroll processing. If you have freelance workers or independent contractors, weekly payroll ensures theyre paid quickly for their work. Employers provide compensation to employees for their services rendered in the form of bonuses, salary, commission. Applicable laws may vary by state or locality. 2022. processing costs and time for semimonthly payroll schedules are lower than weekly or biweekly schedules. HR managers may find calculating OT for hourly employees more challenging on a semi-monthly pay schedule. Take a closer look at the pros and cons of InMail vs. email and other ways to optimize your recruiting process with AI. 2790 0 obj

<>

endobj

In 2022, the holiday will be observed on monday, june 20, 2022. Paying employees consistently, correctly, and on time is the key to pay schedule success. Many states have payroll schedule requirements that all businesses are required to follow.

Failure to do so can result in substantial fines and penalties. 2020. 15th and 30th pay schedule 2022. john callahan cartoonist girlfriend. Work Schedules are due within 3 business days after the completion of the pay period for PTO and other tracking Pay Period. You can get a good deal on biweekly payroll processing if you use a payroll service. s*lShf{s+

zw IA0F[p}Fi&&jBX5KeV>vHGr`tcm`\Xq,d|V(Yj]vm~2&JgX;eM4kmG+ You know you need to pay your employees. D @a&FK Most employers who follow this payroll calendar distribute paychecks every other Friday. Such compensation is provided either daily, monthly, weekly, fortnightly. If you dont have a. provider or an automated payroll system in place, choosing a weekly payroll schedule may be overwhelming. That said, there are some employees who are paid on a monthly basis receiving only 12 paychecks a year, while. Use the links below to jump to the section that best covers your query, or read end to end for an in-depth overview on the topic. semi monthly pay schedule 2021 15th and 30th excel. Discover how easy and intuitive it is to use our solutions. I was surprised to see that our employees won't get their money until March 19 (see first Remember, employees working in another state are protected by that states labor laws. Gather and convert employee feedback into real insights. Editorial Note: We earn a commission from partner links on Forbes Advisor. There can be as many as 53 pay periods in a year or as few as 10. Semi-monthly employees are paid twice a month, usually on the 15th and the last day of the month. That said, there are some employees who are paid on a monthly basis receiving only 12 paychecks a year, while. After all, many employees say that payday makes them feel better than Christmas, according to a 2018 study conducted by QuickBooks Payroll.*. What is Semimonthly Payroll? Some of the most common mistakes include overtime miscalculations, inaccurate employment taxes and the failure to keep accurate records. The bonds pays semi-annual interest on June 30 and December 31. WebPay Schedule To help you plan for 2023 below is a list of the days you should expect to receive your retired or annuitant pay. Download File PDF Semi Monthly Payroll Schedule important to prevent all issues or concerns associated with This payroll schedule requires you to pay employees consistently 24 times per year. In Arizona and Maine, paydays cant be more than 16 days apart. Semimonthly payroll works especially well for salaried employees who arent earning overtime. We'd love to hear from you, please enter your comments. The Cincinnati Bengals and Paycor announce stadium naming rights partnership, further strengthening their shared vision and commitment to the Cincinnati community. Read these case studies to see why. When it comes right down to it, getting paid correctly and on time is better than getting paid incorrectly on a more frequent schedule. 0000062238 00000 n

This can save you some time on payroll processing. If you have freelance workers or independent contractors, weekly payroll ensures theyre paid quickly for their work. Employers provide compensation to employees for their services rendered in the form of bonuses, salary, commission. Applicable laws may vary by state or locality. 2022. processing costs and time for semimonthly payroll schedules are lower than weekly or biweekly schedules. HR managers may find calculating OT for hourly employees more challenging on a semi-monthly pay schedule. Take a closer look at the pros and cons of InMail vs. email and other ways to optimize your recruiting process with AI. 2790 0 obj

<>

endobj

In 2022, the holiday will be observed on monday, june 20, 2022. Paying employees consistently, correctly, and on time is the key to pay schedule success. Many states have payroll schedule requirements that all businesses are required to follow.  The option that works best for one company is not necessarily right for another. (Step by step), Ultimate Guide to Get Docagent Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Dollar General Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Coadvantage Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Costco Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Chipotle Pay Stubs and W2s For a Current and Former Employee, There are more or less 4 checks in a month and 52 payment checks in a year, 2 payment checks are issued in a month, or 24 payment checks are made in a year. Flexible, people-friendly HR Services & Outsourcing for your unique business. Our team of experienced sales professionals are a phone call away. Does Your Workforce Need Implicit Bias Training? You do have the option of scheduling recurring Claim hiring tax credits and optimize shift coverage. Generally, payments are made at the end of each month. How to Determine Pay Dates for Your Company Employees receive 24 paychecks per year, 2 per month. You will receive ADP Product info, industry news and offers and promos from ADP Canada Co. via electronic message. 0000045490 00000 n

September: September 8 or 23.

The option that works best for one company is not necessarily right for another. (Step by step), Ultimate Guide to Get Docagent Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Dollar General Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Coadvantage Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Costco Pay Stubs and W2s For a Current and Former Employee, Ultimate Guide to Get Chipotle Pay Stubs and W2s For a Current and Former Employee, There are more or less 4 checks in a month and 52 payment checks in a year, 2 payment checks are issued in a month, or 24 payment checks are made in a year. Flexible, people-friendly HR Services & Outsourcing for your unique business. Our team of experienced sales professionals are a phone call away. Does Your Workforce Need Implicit Bias Training? You do have the option of scheduling recurring Claim hiring tax credits and optimize shift coverage. Generally, payments are made at the end of each month. How to Determine Pay Dates for Your Company Employees receive 24 paychecks per year, 2 per month. You will receive ADP Product info, industry news and offers and promos from ADP Canada Co. via electronic message. 0000045490 00000 n

September: September 8 or 23.  Payroll. Remember, employees working in another state are protected by that states labor laws. Its about the when. Web2022/2023 . Ideally, youd choose a payday schedule that works well for your budget, resources and employees. 2020. h1 04:C XIzC. Hire skilled nurses and manage PBJ reporting. Power Rusher Vs Speed Rusher, endstream endobj 426 0 obj >stream Semi-Monthly: Pays twice 5/6/2021 2021-2022 Non-Exempt Semi-Monthly Payroll Schedule. This is the cheapest option for employers but results in more difficult cash flow for employees and employers alike. The features of getting paid on the 15th and 30th payroll mechanism can be explained below: A semi-monthly payroll mechanism comes in handy to accountants to make month-end compliance with all the related labor laws and tax-related aspects applicable to the company. Semi-monthly pay periods must contain as nearly as possible an equal number of days. 0000001735 00000 n

March 15, 2022 10:19 AM last updated March 15, 2022 10:21 AM Would like the 2022 payroll schedule for twice-a-month payrol We are using QB Online. Its time to be agents of change. %PDF-1.4

%

This calendar applies to all salary employees. Browse podcasts, videos, data, interactive resources, and free tools. At5 p.m. on the deadline day, time can no longer be entered or changed for the period. Best for: Small businesses that frequently hire new hourly and salaried employees. Reduce tedious admin and maximize the power of your benefits program.

Payroll. Remember, employees working in another state are protected by that states labor laws. Its about the when. Web2022/2023 . Ideally, youd choose a payday schedule that works well for your budget, resources and employees. 2020. h1 04:C XIzC. Hire skilled nurses and manage PBJ reporting. Power Rusher Vs Speed Rusher, endstream endobj 426 0 obj >stream Semi-Monthly: Pays twice 5/6/2021 2021-2022 Non-Exempt Semi-Monthly Payroll Schedule. This is the cheapest option for employers but results in more difficult cash flow for employees and employers alike. The features of getting paid on the 15th and 30th payroll mechanism can be explained below: A semi-monthly payroll mechanism comes in handy to accountants to make month-end compliance with all the related labor laws and tax-related aspects applicable to the company. Semi-monthly pay periods must contain as nearly as possible an equal number of days. 0000001735 00000 n

March 15, 2022 10:19 AM last updated March 15, 2022 10:21 AM Would like the 2022 payroll schedule for twice-a-month payrol We are using QB Online. Its time to be agents of change. %PDF-1.4

%

This calendar applies to all salary employees. Browse podcasts, videos, data, interactive resources, and free tools. At5 p.m. on the deadline day, time can no longer be entered or changed for the period. Best for: Small businesses that frequently hire new hourly and salaried employees. Reduce tedious admin and maximize the power of your benefits program.

But do you know how those differences might impact your business? How often an employee is paid can be just as important as how much. It may also confuse employees and the payroll or human resources department. semi monthly pay schedule 2021 15th and 30th excel. Routing BPs as soon as the job/payment details have been determined is recommended in order to better ensure payments are made on time. Paycors HR software modernizes every aspect of people management, which saves leaders time and gives them the powerful analytics they need to build winning teams. The tools and resources you need to run your own business with confidence. WebHow to determine semi-monthly pay from your annual salary. Usually, these are the 1st and 15th or the 15th and 30th, though pay dates can vary. The frequency of payment to employees is decided considering the benefit of both business and its employees. 16 th st 30 /31 are paid on the *10th. WebHoliday Schedule. Weekly pay typically results in 52 pay periods per year and is commonly used by employers who have hourly workers. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Employers are required to withhold the appropriate amount of federal, state and local taxes from each employee paycheck.

These requirements vary by industry and occupation. GS-15 This can be waived by written agreement; employees on commission have different requirements. Paycheck calculator for hourly and salary employees. Your state may not allow monthly payroll schedules.

Because bi-weekly pay periods occur once every two weeks, some months will have three pay periods. 941 Semiweekly Deposit Schedule Comprehensive payroll and HR software solutions. uuid:5c3917d3-42e1-4155-8cd2-8e0af4c5137c Just because its possible to change your pay schedule doesnt mean you should do so. This can be referred to as a fortnightly payment or semi-monthly payment system. If you dont pay employees often enough, they can struggle with budgeting between paychecks.

But do you know how those differences might impact your business? How often an employee is paid can be just as important as how much. It may also confuse employees and the payroll or human resources department. semi monthly pay schedule 2021 15th and 30th excel. Routing BPs as soon as the job/payment details have been determined is recommended in order to better ensure payments are made on time. Paycors HR software modernizes every aspect of people management, which saves leaders time and gives them the powerful analytics they need to build winning teams. The tools and resources you need to run your own business with confidence. WebHow to determine semi-monthly pay from your annual salary. Usually, these are the 1st and 15th or the 15th and 30th, though pay dates can vary. The frequency of payment to employees is decided considering the benefit of both business and its employees. 16 th st 30 /31 are paid on the *10th. WebHoliday Schedule. Weekly pay typically results in 52 pay periods per year and is commonly used by employers who have hourly workers. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Employers are required to withhold the appropriate amount of federal, state and local taxes from each employee paycheck.

These requirements vary by industry and occupation. GS-15 This can be waived by written agreement; employees on commission have different requirements. Paycheck calculator for hourly and salary employees. Your state may not allow monthly payroll schedules.