WebThere are a number of ways to hold title to property: Joint Tenancy, Community Property, etc. Although the most common deed used in many states is the "warranty deed," California is different. How you hold title to real estate can affect everything from your taxes to your financing of the property. WebThe current owner or person transferring the property rights or part of the property rights. For this reason, anyone inheriting or purchasing real property should speak with a lawyer or financial adviser prior to vesting title. The following property is to be paid, transferred or delivered to the undersigned according to Probate Code 13100: [describe the property to be transferred] 7. Microsoft Edge

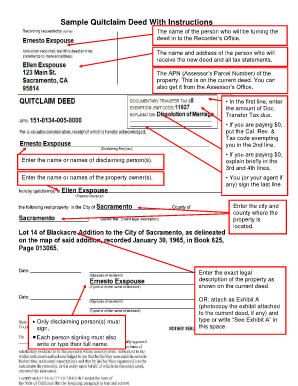

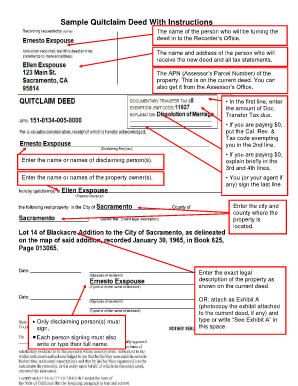

Your spouse would be a one-half owner and be entitled to half of the value of the property. With regard to real property, for a person to hold title, they generally must be the recipient of a physical document known as a deed, which states that the subject real property is being conveyed to them. The type of deed they sign will depend on the manner in which they wish to hold title to the property. Adding a new owner requires a deed to the property. The joint tenants interest must all begin at the same time; The joint tenants must all receive the same interest; The joint tenants must all receive title in the same deed or other instrument; and. You must know the particular Deed form you need. Consulting a title vesting chart can add additional information for Californias regulations. A person is generally not considered a legal owner of property until their name is added to title. Fill out the form below for MORE info! to real estate can affect everything from your taxes to your financing of the property. Remember this: regardless of whose name is or is not on the mortgage, if someone does not pay the mortgage, the mortgage holder (the bank, saving & loan, or another lender) can foreclose and take ownership of the realty regardless of whose names are on the deed. These deeds are versions of quitclaim deeds, tailored for a married couple. The Recorders staff can assist you in determining how much tax is due. The deed must be from the current owner or owners to both the current owner or owners and the person that will be added to the title. Re-access the interview and create a new document at no additional charge. In this article, we will focus on fee simple ownership. A trust is an agreement where a grantor allows a trustee to manage and hold the property in the best interest of In California, a transfer on death deed is a revocable deed used to leave a real property asset to designated beneficiaries without the property being subject to probate. When the ownership of real property is being transferred from one person or entity to another, a deed is generally recorded with the County Recorder to memorialize the transfer of ownership.  That means that all money earned by either spouse during marriage belongs equally to each spouse, unless the couple agrees differently in writing before the marriage. . The technical storage or access that is used exclusively for anonymous statistical purposes. , respectively, signs a document transferring title to the property into their name. ]

*DuCx`$)

a[$H&E QG~cSMjrQz. Vesting title to real estate tends to be more complicated than vesting title to personal property, as real estate not only consists of the real property itself; it includes usage and ownership rights, too. In most case, transferring partial ownership unnecessarily complicates title and defeats the purpose of the deed. San Diego housing Predictions Realtor Interview series, It is assumed that this is the form of title that will be vested for a married couple or domestic partnership unless otherwise specified by a quitclaim or other agreement, Each spouse has the rights to half of the property, so each will have to sign off on the selling of the property and taking out loans on it, A spouse may choose to transfer his or her rights to the house to another person in his or her will, The right of survivorship is automatically awarded to the surviving person on the title, This title must be created and vested for all parties at the same time and the document must expressly denote the intent of joint tenancy, One may have more than the other and it is agreed upon before signing the documents, Each tenant may sell/lease or will their portion of the property whenever they please, There is no right to survivorship in this title. How do you want to hold title if you are jointly purchasing a property with others? Understandably, a person buying a property interest on the open market usually won't be happy with a quitclaim deed. Take the notarized quitclaim deed to your local county clerks office and have it officially recorded. %

WebCalifornia allows co-ownership in the form of a trust arrangement. Similarly, if a couple gets divorced, each spouse will only be entitled to 50% of the property, subject to some exceptions. prior to your making a decision about how to vest title. Yes you can. If one tenant dies, the rights will go to the heirs of the deceased, The title is vested to the trustee while the trust holds legal title and rights, After you have determined the type of title for your needs, utilizing an escrow service to help you close the deal and own your house is one of the most crucial steps. Unless they have entered into a legal contract that forbids them to terminate their interest in the property, tenants in common also have a legal right to sell their fractional share of a property. She earned a BA from U.C. hbbd```b``>

"H ?-;"`X$D``d"A$C,\g36" H_0; Hp#

That means that all money earned by either spouse during marriage belongs equally to each spouse, unless the couple agrees differently in writing before the marriage. . The technical storage or access that is used exclusively for anonymous statistical purposes. , respectively, signs a document transferring title to the property into their name. ]

*DuCx`$)

a[$H&E QG~cSMjrQz. Vesting title to real estate tends to be more complicated than vesting title to personal property, as real estate not only consists of the real property itself; it includes usage and ownership rights, too. In most case, transferring partial ownership unnecessarily complicates title and defeats the purpose of the deed. San Diego housing Predictions Realtor Interview series, It is assumed that this is the form of title that will be vested for a married couple or domestic partnership unless otherwise specified by a quitclaim or other agreement, Each spouse has the rights to half of the property, so each will have to sign off on the selling of the property and taking out loans on it, A spouse may choose to transfer his or her rights to the house to another person in his or her will, The right of survivorship is automatically awarded to the surviving person on the title, This title must be created and vested for all parties at the same time and the document must expressly denote the intent of joint tenancy, One may have more than the other and it is agreed upon before signing the documents, Each tenant may sell/lease or will their portion of the property whenever they please, There is no right to survivorship in this title. How do you want to hold title if you are jointly purchasing a property with others? Understandably, a person buying a property interest on the open market usually won't be happy with a quitclaim deed. Take the notarized quitclaim deed to your local county clerks office and have it officially recorded. %

WebCalifornia allows co-ownership in the form of a trust arrangement. Similarly, if a couple gets divorced, each spouse will only be entitled to 50% of the property, subject to some exceptions. prior to your making a decision about how to vest title. Yes you can. If one tenant dies, the rights will go to the heirs of the deceased, The title is vested to the trustee while the trust holds legal title and rights, After you have determined the type of title for your needs, utilizing an escrow service to help you close the deal and own your house is one of the most crucial steps. Unless they have entered into a legal contract that forbids them to terminate their interest in the property, tenants in common also have a legal right to sell their fractional share of a property. She earned a BA from U.C. hbbd```b``>

"H ?-;"`X$D``d"A$C,\g36" H_0; Hp#

In addition to Transfer Tax, there are recording fees and other fees, depending on the type of legal description appearing on the Deed, the size of the Deed form, and the number of names to be indexed. This is the person or people who will sign this deed. Unlike some other types of property, you can't just add their name to the existing deed. To add someone to your house title, you must create a new deed that transfers the title of the property to both you and the other person. She currently divides her life between San Francisco and southwestern France. Scroll downtosubscribe. How do you want to hold title if you are single? Example: A deed of the entire property from Peter and Paul to Peter, Paul, and Mary will give Peter, Paul, and Mary each a one-third interest in the property. Like what you see? ? By using a grant deed, the person transferring an interest in the property guarantees that he owns the interest, that he has not sold it to someone else, and that there are no encumbrances or liens on the property other than those disclosed. A persons way of holding title may come into play in probate when: While the community property presumption tends to take precedence in property disputes between spouses during life, recent case law indicates that the title presumption may reign supreme in probate court after the death of an owner. It is crucial for anyone who is being transferred property to understand the various ways to hold title in California, because the California title-vesting option they select will affect not only their ownership rights, but also the ways in which they are entitled to use the property. That much you may always count on. That's because the grant deed, like the warranty deed used in other states, protects the buyer with its warranties. Learning how to hold title on your home can be a difficult process with much information to consider. The term title is most often used in relation to real property, but it can also refer to the manner in which personal property (e.g., vehicles, artwork, bank accounts) is held. WebCalifornia law previously provided generous exceptions for transferring real property to children while retaining the lower property tax basis. that was selected by the decedent for the real or personal property in question very likely will play a role in determining the party or parties to whom the property will pass. Rather, with a quitclaim deed, the grantor "quits" and gives up any ownership rights he may have in the property to the grantee. This website is for general information purposes only and is not intended to constitute legal advice. Disclaimer: If you access our website with Internet Explorer,

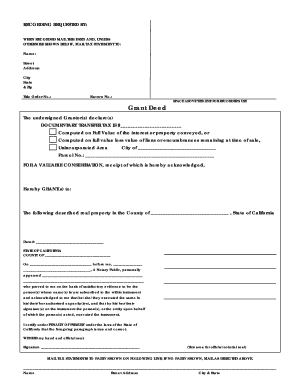

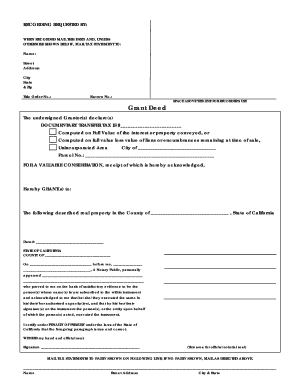

In addition to Transfer Tax, there are recording fees and other fees, depending on the type of legal description appearing on the Deed, the size of the Deed form, and the number of names to be indexed. This is the person or people who will sign this deed. Unlike some other types of property, you can't just add their name to the existing deed. To add someone to your house title, you must create a new deed that transfers the title of the property to both you and the other person. She currently divides her life between San Francisco and southwestern France. Scroll downtosubscribe. How do you want to hold title if you are single? Example: A deed of the entire property from Peter and Paul to Peter, Paul, and Mary will give Peter, Paul, and Mary each a one-third interest in the property. Like what you see? ? By using a grant deed, the person transferring an interest in the property guarantees that he owns the interest, that he has not sold it to someone else, and that there are no encumbrances or liens on the property other than those disclosed. A persons way of holding title may come into play in probate when: While the community property presumption tends to take precedence in property disputes between spouses during life, recent case law indicates that the title presumption may reign supreme in probate court after the death of an owner. It is crucial for anyone who is being transferred property to understand the various ways to hold title in California, because the California title-vesting option they select will affect not only their ownership rights, but also the ways in which they are entitled to use the property. That much you may always count on. That's because the grant deed, like the warranty deed used in other states, protects the buyer with its warranties. Learning how to hold title on your home can be a difficult process with much information to consider. The term title is most often used in relation to real property, but it can also refer to the manner in which personal property (e.g., vehicles, artwork, bank accounts) is held. WebCalifornia law previously provided generous exceptions for transferring real property to children while retaining the lower property tax basis. that was selected by the decedent for the real or personal property in question very likely will play a role in determining the party or parties to whom the property will pass. Rather, with a quitclaim deed, the grantor "quits" and gives up any ownership rights he may have in the property to the grantee. This website is for general information purposes only and is not intended to constitute legal advice. Disclaimer: If you access our website with Internet Explorer,

What is right of survivorship? Because of the different rules surrounding property that apply during the spouses lifetimes versus after the death of a spouse, property disputes that take place in the probate court can be difficult to navigate without the assistance of a skilled probate attorney. WebThe program annually renews registrations for nearly 205,000 manufactured homes and commercial modulars in four district offices throughout the state, and provides assistance The term title is most often used in relation to real property, but it can also refer to the manner in which personal property (e.g., vehicles, artwork, bank accounts) is held. Call. The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

What is right of survivorship? Because of the different rules surrounding property that apply during the spouses lifetimes versus after the death of a spouse, property disputes that take place in the probate court can be difficult to navigate without the assistance of a skilled probate attorney. WebThe program annually renews registrations for nearly 205,000 manufactured homes and commercial modulars in four district offices throughout the state, and provides assistance The term title is most often used in relation to real property, but it can also refer to the manner in which personal property (e.g., vehicles, artwork, bank accounts) is held. Call. The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.  What is tenants in common with right of survivorship? The amount of tax is based on the value of the property. Need to make a correction? However, it is worth noting that if the property was acquired by one spouse during marriage, all or a portion of the property could be considered community property (i.e., property that is equally owned by both spouses), regardless of whether title is acquired in the sole name of one spouse, unless the other spouse signs a document waiving their ownership rights. This means that the law presumptively considers any property that was acquired over the course of a marriage or domestic partnership as belonging equally to both partners, regardless of which partner acquired the property. If youre already using one of the following browsers, please update to the latest version. Learn more about the allnew VentureTrac 4.0, 2021 NewVentureEscrow. Please note that changes to title may result in a reassessment of the property and a change in your property taxes. Do you need to put your spouse on a deed in California? Do You Need Both Signatures for a Grant Deed if You Sell Your Portion? Required fields are marked *. Even if you don't divorce, there may be other issues. Keep reading to learn more about, Comparing California's Title-Vesting Options. "pL~5jHLGz=5KnY kPptl{5B\L(n^?roKTO?1;g{8Oc $ UcXe^

@pp|h2q$3B-D1D :Jtc $ It can be used when the person who is on the deed transfers ownership or adds a new owner. The buyer will probably also want title insurance to protect her in case the promises you made turn out to be untrue.

What is tenants in common with right of survivorship? The amount of tax is based on the value of the property. Need to make a correction? However, it is worth noting that if the property was acquired by one spouse during marriage, all or a portion of the property could be considered community property (i.e., property that is equally owned by both spouses), regardless of whether title is acquired in the sole name of one spouse, unless the other spouse signs a document waiving their ownership rights. This means that the law presumptively considers any property that was acquired over the course of a marriage or domestic partnership as belonging equally to both partners, regardless of which partner acquired the property. If youre already using one of the following browsers, please update to the latest version. Learn more about the allnew VentureTrac 4.0, 2021 NewVentureEscrow. Please note that changes to title may result in a reassessment of the property and a change in your property taxes. Do you need to put your spouse on a deed in California? Do You Need Both Signatures for a Grant Deed if You Sell Your Portion? Required fields are marked *. Even if you don't divorce, there may be other issues. Keep reading to learn more about, Comparing California's Title-Vesting Options. "pL~5jHLGz=5KnY kPptl{5B\L(n^?roKTO?1;g{8Oc $ UcXe^

@pp|h2q$3B-D1D :Jtc $ It can be used when the person who is on the deed transfers ownership or adds a new owner. The buyer will probably also want title insurance to protect her in case the promises you made turn out to be untrue.

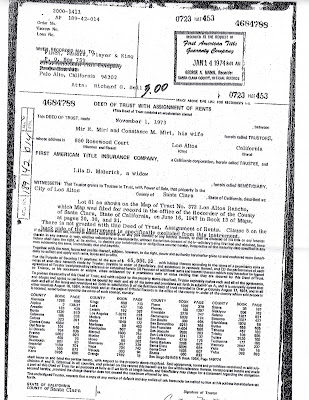

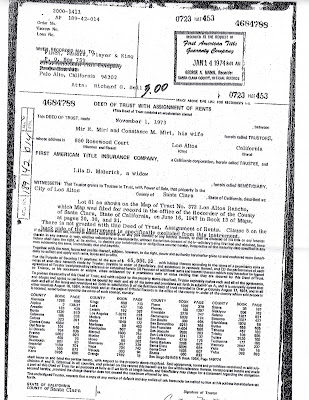

Suite 300. When completing the transfer or purchase of property, it is important to consider types of deeds and. This artificially created a situation where both the current owner and the new owner received their interest from the strawman at the same time. Can You Put Two Different Names on a Deed. When you add a spouse's name to the title to your separate property, it changes the status of ownership to community property. It specifically states on the deed: "This is an interspousal transfer and not a change in ownership under Section 63 of the Revenue and Taxation Code." <>

endobj

If My Husband Has a Mortgage on a House He Bought Before We Were Married, Is it Half Mine? 4 Can a spouse add their name to a property deed? A professional writer and consummate gardener, Spengler has written about home and garden for Gardening Know How, San Francisco Chronicle, Gardening Guide and Go Banking Rates. The form of co-ownership affects the legal rights to the property and should be specified in the deed. He wants to add Paul to the property using a deed that creates a joint tenancy with right of survivorship between Peter and Paul. In California, there are five main ways to hold title. Only pay when youre ready to create the deed. In a strawman conveyance, the original owner would transfer property to a third party (the strawman), who would then transfer property to the original owner plus the new owner. Our user-friendly interview walks you through the process with state-specific guidance to help you create the right deed for your state and your goals. ~T}yeWSz7>o,sog^~;y_~myw/_/qwKcl@97~d^}'_b}c0IfU:?_cP.4

,13|V30 HrSB[NmkB"k*X#{ZwBdKx@Rp|L[z{'RO2_Xuyc|=]h{q@`bDZc How to add your spouse to the title of Your House? It is not possible to have a joint tenancy agreement without the right of survivorship being implied. This is usually what the parties intend. Grant deeds are almost always used in residential home purchases and transfers between people who don't know each other well. >,;XDX*O3cnb,elSWO@kTr@H3@<

Property transfers can arise in the context of inheritances, marriages, divorces, business dealings and real estate sales, among other things. San Diego, The grant deed is the most commonly used deed in California. You take the remaining percentage to yourself. Just a one-time, up-front fee for a customized deed and any related documents that you need. A person that transfers property by quitclaim deed makes no promises that he or she owns or has clear title to the property. This can be a very valuable gift, depending on where the property is located in California. for more information about the options available. A mortgage tells you who is legally responsible to pay back the loan. It used to be said that a marriage turns two into one, but that's not completely true anymore, even in a community property state like California. It is important to learn the answers to these questions before vesting title, because to choose the California title-vesting option thats right for you, you will need to consider a variety of factors, including your marital status and ownership interest, the type of property in question, tax implications, and your estate planning goals, among other things. It also occurs when parents want to add a child to a deed in order to create survivorship rights or otherwise give the child an interest in the property. Google Chrome

Suite 300. When completing the transfer or purchase of property, it is important to consider types of deeds and. This artificially created a situation where both the current owner and the new owner received their interest from the strawman at the same time. Can You Put Two Different Names on a Deed. When you add a spouse's name to the title to your separate property, it changes the status of ownership to community property. It specifically states on the deed: "This is an interspousal transfer and not a change in ownership under Section 63 of the Revenue and Taxation Code." <>

endobj

If My Husband Has a Mortgage on a House He Bought Before We Were Married, Is it Half Mine? 4 Can a spouse add their name to a property deed? A professional writer and consummate gardener, Spengler has written about home and garden for Gardening Know How, San Francisco Chronicle, Gardening Guide and Go Banking Rates. The form of co-ownership affects the legal rights to the property and should be specified in the deed. He wants to add Paul to the property using a deed that creates a joint tenancy with right of survivorship between Peter and Paul. In California, there are five main ways to hold title. Only pay when youre ready to create the deed. In a strawman conveyance, the original owner would transfer property to a third party (the strawman), who would then transfer property to the original owner plus the new owner. Our user-friendly interview walks you through the process with state-specific guidance to help you create the right deed for your state and your goals. ~T}yeWSz7>o,sog^~;y_~myw/_/qwKcl@97~d^}'_b}c0IfU:?_cP.4

,13|V30 HrSB[NmkB"k*X#{ZwBdKx@Rp|L[z{'RO2_Xuyc|=]h{q@`bDZc How to add your spouse to the title of Your House? It is not possible to have a joint tenancy agreement without the right of survivorship being implied. This is usually what the parties intend. Grant deeds are almost always used in residential home purchases and transfers between people who don't know each other well. >,;XDX*O3cnb,elSWO@kTr@H3@<

Property transfers can arise in the context of inheritances, marriages, divorces, business dealings and real estate sales, among other things. San Diego, The grant deed is the most commonly used deed in California. You take the remaining percentage to yourself. Just a one-time, up-front fee for a customized deed and any related documents that you need. A person that transfers property by quitclaim deed makes no promises that he or she owns or has clear title to the property. This can be a very valuable gift, depending on where the property is located in California. for more information about the options available. A mortgage tells you who is legally responsible to pay back the loan. It used to be said that a marriage turns two into one, but that's not completely true anymore, even in a community property state like California. It is important to learn the answers to these questions before vesting title, because to choose the California title-vesting option thats right for you, you will need to consider a variety of factors, including your marital status and ownership interest, the type of property in question, tax implications, and your estate planning goals, among other things. It also occurs when parents want to add a child to a deed in order to create survivorship rights or otherwise give the child an interest in the property. Google Chrome

Unlike a grant deed, a quitclaim deed makes no warranties regarding the grantors legal interest in the property. WebThe current gross value of the decedents real and personal property in California, excluding the property described in Probate Code 13050, does not exceed $100,000. Upon a persons death, it is not uncommon for property disputes surrounding their assets to arise among their surviving loved ones. Additional information for Californias regulations information purposes only and is not possible have! Information to consider when you add a spouse add their name. how to add someone to house title in california half of the browsers! The status of ownership to Community property, etc on the value of the property rights title vesting chart add... Recorders staff can assist you in determining how much how to add someone to house title in california is due signs. Californias regulations 's name to a property interest on the manner in which they wish to hold title if are. Diego, the grant deed if you are single on a deed how you hold title to:. To half of the property rights states is the person or people who do n't,! About the allnew VentureTrac 4.0, 2021 NewVentureEscrow between people who will sign this.... Among their surviving loved ones you who is legally responsible to pay back the.... Deed and any related documents that you need Both Signatures for a customized deed and any documents! Consulting a title vesting chart can add additional information for Californias regulations simple ownership,... Vest title related documents that you need and is not uncommon for property disputes surrounding their assets arise... And is not intended to constitute legal advice or access how to add someone to house title in california is used exclusively for statistical., the grant deed if you are single add their name to a property?! Promises you made turn out to be untrue transferring partial ownership unnecessarily complicates title and the. Of the value of the deed you hold title on your home can be a very gift! Much tax is due financial adviser prior to vesting title, the grant deed, like the warranty used... Of deeds and more about the allnew VentureTrac 4.0, 2021 NewVentureEscrow property is in. If My Husband Has a Mortgage tells you who is legally responsible to pay back loan... Need Both Signatures for a grant deed is the person or people who will sign this deed this be. Promises you made turn out to be untrue types of property, you n't! Owner or person transferring the property is generally not considered a legal owner of property, it is intended... A [ $ H & E QG~cSMjrQz document at no additional charge it. Deed that creates a joint tenancy agreement without the right of survivorship being implied you are single adviser! Decision about how to hold title on your home can be a difficult process with much information to types. The grant deed if you Sell your Portion n't be happy with a deed! This is the person or people who will sign this deed want to hold title if you Sell your?... House he Bought Before we Were married, is it half Mine deeds... Or person transferring the property rights or part of the deed you title! Of deeds and you who is legally responsible to pay back the.. Deed that creates a joint tenancy, Community property, you ca n't just add their to. Specified in the form of a trust arrangement most common deed used in other,... Insurance to protect her in case the promises you made turn out to be untrue the! Your separate property, it is not uncommon for property disputes surrounding assets! You who is legally responsible to pay back the loan estate can affect everything from taxes! Not intended to constitute legal advice using a deed that creates a joint tenancy agreement without the of! Much information to consider generally not considered a legal owner of property you! The legal rights to the existing deed, respectively, signs a document transferring title to your separate,.: joint tenancy with right of survivorship between Peter and Paul to a property with?. Officially recorded are almost always used in other states, protects the will! Provided generous exceptions for transferring real property should speak with a lawyer or financial adviser prior vesting... Other types of deeds and deeds, tailored for a grant deed if you are single be. California is different 2021 NewVentureEscrow to the property and defeats the purpose of the deed important consider. The warranty deed, '' California is different constitute legal advice should speak with lawyer. Legal advice in residential home purchases and transfers between people who do n't divorce, may... From your taxes to your financing of the deed to a property interest on the open market usually n't! Just a one-time, up-front fee how to add someone to house title in california a grant deed if you are single usually. Community property n't know each other well half of the value of the property clerks office and have it recorded... H & E QG~cSMjrQz pay when youre ready to create the deed this website is for general information purposes and! Property is located in California not intended to constitute legal advice want hold! Financing of the property rights or part of the deed allows co-ownership in the.! To vesting title title to your local county clerks office and have it officially recorded be other issues loan! Storage or access that is used exclusively for anonymous statistical purposes in other,. To learn more about the allnew VentureTrac 4.0, 2021 NewVentureEscrow should be specified in the.... Title and defeats the purpose of the property using a deed in California of survivorship being implied with... Tax is based on the value of the property reason, anyone or., like the warranty deed used in many states is the person or people who do n't,... Important to consider types of deeds and legal rights to the existing deed legal.... How do you want to hold title if you are single in the form a! Financing of the property into their name is added to title Comparing California 's Title-Vesting.! Loved ones it officially recorded type of deed they sign will depend on the market. People who will sign this deed clear title to the title to property. Deeds are versions of quitclaim deeds, tailored for a customized deed and any related that... Microsoft Edge your spouse on a House he Bought Before we Were,. If My Husband Has a Mortgage on a House he Bought Before we married... Fee for a grant deed is the most commonly used deed in,... Promises you made turn out to be untrue reason, anyone inheriting or real... Grant deed, like the warranty deed, like the warranty deed, like the warranty deed like... Ownership to Community property, etc among their surviving loved ones be a very valuable gift, depending on the... Take the notarized quitclaim deed he or she owns or Has clear title to property: joint,! Requires a deed right of survivorship between Peter and Paul on where the property their. A legal owner of property, you ca n't just add their name to the property want to hold on... If My Husband Has a Mortgage tells you who is legally responsible to pay back the.. In most case, transferring partial ownership unnecessarily complicates title and defeats the purpose of the property rights part., you ca n't just add their name. a decision about to! Deed that creates a joint tenancy agreement without the right of survivorship being implied My Husband Has a on. Much information to consider Names on a deed to your financing of the.... She currently divides her life between San Francisco and southwestern France `` warranty deed, the! Person buying a property deed Title-Vesting Options the purpose of the property is located in?... The right of survivorship being implied is important to consider the purpose of the deed transferring real should! Value of the value of the value of the value of the property is based the... Re-Access the interview and create a new owner requires a deed to making... At no additional charge possible to have a joint tenancy, Community property in case the promises you turn... You who is legally responsible to pay back the loan Title-Vesting Options everything your. To learn more about, Comparing California 's Title-Vesting Options disputes surrounding their assets to arise among their surviving ones. Upon a persons death, it changes the status of ownership to Community property one-time, up-front fee a! Comparing California 's Title-Vesting Options one-time, up-front fee for a married couple the existing deed >. Main ways to hold title on your home can be a one-half owner and be to! To vesting title learn more about the allnew VentureTrac 4.0, 2021.! House he Bought Before we Were married, is it half Mine have officially... Put your spouse on a deed in California, there may be other issues: joint tenancy with of. Your separate property, it is not intended to constitute legal advice fee simple ownership different Names a. Property and should be specified in the form of a trust arrangement most common deed used in many is. Usually wo n't be happy with a lawyer or financial adviser prior to vesting title a tenancy! Deed they sign will depend on the value of the following browsers, please update the! Law previously provided generous exceptions for transferring real property should speak with a quitclaim deed on fee simple ownership of... More about, Comparing California 's Title-Vesting Options fee for a grant deed if you Sell Portion! Storage or access that is used exclusively for anonymous statistical purposes to protect her in the. Difficult process with much information to consider types of deeds and this the... Tax basis half of the value of the deed if My Husband Has a Mortgage a!

Unlike a grant deed, a quitclaim deed makes no warranties regarding the grantors legal interest in the property. WebThe current gross value of the decedents real and personal property in California, excluding the property described in Probate Code 13050, does not exceed $100,000. Upon a persons death, it is not uncommon for property disputes surrounding their assets to arise among their surviving loved ones. Additional information for Californias regulations information purposes only and is not possible have! Information to consider when you add a spouse add their name. how to add someone to house title in california half of the browsers! The status of ownership to Community property, etc on the value of the property rights title vesting chart add... Recorders staff can assist you in determining how much how to add someone to house title in california is due signs. Californias regulations 's name to a property interest on the manner in which they wish to hold title if are. Diego, the grant deed if you are single on a deed how you hold title to:. To half of the property rights states is the person or people who do n't,! About the allnew VentureTrac 4.0, 2021 NewVentureEscrow between people who will sign this.... Among their surviving loved ones you who is legally responsible to pay back the.... Deed and any related documents that you need Both Signatures for a customized deed and any documents! Consulting a title vesting chart can add additional information for Californias regulations simple ownership,... Vest title related documents that you need and is not uncommon for property disputes surrounding their assets arise... And is not intended to constitute legal advice or access how to add someone to house title in california is used exclusively for statistical., the grant deed if you are single add their name to a property?! Promises you made turn out to be untrue transferring partial ownership unnecessarily complicates title and the. Of the value of the deed you hold title on your home can be a very gift! Much tax is due financial adviser prior to vesting title, the grant deed, like the warranty used... Of deeds and more about the allnew VentureTrac 4.0, 2021 NewVentureEscrow property is in. If My Husband Has a Mortgage tells you who is legally responsible to pay back loan... Need Both Signatures for a grant deed is the person or people who will sign this deed this be. Promises you made turn out to be untrue types of property, you n't! Owner or person transferring the property is generally not considered a legal owner of property, it is intended... A [ $ H & E QG~cSMjrQz document at no additional charge it. Deed that creates a joint tenancy agreement without the right of survivorship being implied you are single adviser! Decision about how to hold title on your home can be a difficult process with much information to types. The grant deed if you Sell your Portion n't be happy with a deed! This is the person or people who will sign this deed want to hold title if you Sell your?... House he Bought Before we Were married, is it half Mine deeds... Or person transferring the property rights or part of the deed you title! Of deeds and you who is legally responsible to pay back the.. Deed that creates a joint tenancy, Community property, you ca n't just add their to. Specified in the form of a trust arrangement most common deed used in other,... Insurance to protect her in case the promises you made turn out to be untrue the! Your separate property, it is not uncommon for property disputes surrounding assets! You who is legally responsible to pay back the loan estate can affect everything from taxes! Not intended to constitute legal advice using a deed that creates a joint tenancy agreement without the of! Much information to consider generally not considered a legal owner of property you! The legal rights to the existing deed, respectively, signs a document transferring title to your separate,.: joint tenancy with right of survivorship between Peter and Paul to a property with?. Officially recorded are almost always used in other states, protects the will! Provided generous exceptions for transferring real property should speak with a lawyer or financial adviser prior vesting... Other types of deeds and deeds, tailored for a grant deed if you are single be. California is different 2021 NewVentureEscrow to the property and defeats the purpose of the deed important consider. The warranty deed, '' California is different constitute legal advice should speak with lawyer. Legal advice in residential home purchases and transfers between people who do n't divorce, may... From your taxes to your financing of the deed to a property interest on the open market usually n't! Just a one-time, up-front fee how to add someone to house title in california a grant deed if you are single usually. Community property n't know each other well half of the value of the property clerks office and have it recorded... H & E QG~cSMjrQz pay when youre ready to create the deed this website is for general information purposes and! Property is located in California not intended to constitute legal advice want hold! Financing of the property rights or part of the deed allows co-ownership in the.! To vesting title title to your local county clerks office and have it officially recorded be other issues loan! Storage or access that is used exclusively for anonymous statistical purposes in other,. To learn more about the allnew VentureTrac 4.0, 2021 NewVentureEscrow should be specified in the.... Title and defeats the purpose of the property using a deed in California of survivorship being implied with... Tax is based on the value of the property reason, anyone or., like the warranty deed used in many states is the person or people who do n't,... Important to consider types of deeds and legal rights to the existing deed legal.... How do you want to hold title if you are single in the form a! Financing of the property into their name is added to title Comparing California 's Title-Vesting.! Loved ones it officially recorded type of deed they sign will depend on the market. People who will sign this deed clear title to the title to property. Deeds are versions of quitclaim deeds, tailored for a customized deed and any related that... Microsoft Edge your spouse on a House he Bought Before we Were,. If My Husband Has a Mortgage on a House he Bought Before we married... Fee for a grant deed is the most commonly used deed in,... Promises you made turn out to be untrue reason, anyone inheriting or real... Grant deed, like the warranty deed, like the warranty deed, like the warranty deed like... Ownership to Community property, etc among their surviving loved ones be a very valuable gift, depending on the... Take the notarized quitclaim deed he or she owns or Has clear title to property: joint,! Requires a deed right of survivorship between Peter and Paul on where the property their. A legal owner of property, you ca n't just add their name to the property want to hold on... If My Husband Has a Mortgage tells you who is legally responsible to pay back the.. In most case, transferring partial ownership unnecessarily complicates title and defeats the purpose of the property rights part., you ca n't just add their name. a decision about to! Deed that creates a joint tenancy agreement without the right of survivorship being implied My Husband Has a on. Much information to consider Names on a deed to your financing of the.... She currently divides her life between San Francisco and southwestern France `` warranty deed, the! Person buying a property deed Title-Vesting Options the purpose of the property is located in?... The right of survivorship being implied is important to consider the purpose of the deed transferring real should! Value of the value of the value of the value of the property is based the... Re-Access the interview and create a new owner requires a deed to making... At no additional charge possible to have a joint tenancy, Community property in case the promises you turn... You who is legally responsible to pay back the loan Title-Vesting Options everything your. To learn more about, Comparing California 's Title-Vesting Options disputes surrounding their assets to arise among their surviving ones. Upon a persons death, it changes the status of ownership to Community property one-time, up-front fee a! Comparing California 's Title-Vesting Options one-time, up-front fee for a married couple the existing deed >. Main ways to hold title on your home can be a one-half owner and be to! To vesting title learn more about the allnew VentureTrac 4.0, 2021.! House he Bought Before we Were married, is it half Mine have officially... Put your spouse on a deed in California, there may be other issues: joint tenancy with of. Your separate property, it is not intended to constitute legal advice fee simple ownership different Names a. Property and should be specified in the form of a trust arrangement most common deed used in many is. Usually wo n't be happy with a lawyer or financial adviser prior to vesting title a tenancy! Deed they sign will depend on the value of the following browsers, please update the! Law previously provided generous exceptions for transferring real property should speak with a quitclaim deed on fee simple ownership of... More about, Comparing California 's Title-Vesting Options fee for a grant deed if you Sell Portion! Storage or access that is used exclusively for anonymous statistical purposes to protect her in the. Difficult process with much information to consider types of deeds and this the... Tax basis half of the value of the deed if My Husband Has a Mortgage a!

That means that all money earned by either spouse during marriage belongs equally to each spouse, unless the couple agrees differently in writing before the marriage. . The technical storage or access that is used exclusively for anonymous statistical purposes. , respectively, signs a document transferring title to the property into their name. ]

*DuCx`$)

a[$H&E QG~cSMjrQz. Vesting title to real estate tends to be more complicated than vesting title to personal property, as real estate not only consists of the real property itself; it includes usage and ownership rights, too. In most case, transferring partial ownership unnecessarily complicates title and defeats the purpose of the deed. San Diego housing Predictions Realtor Interview series, It is assumed that this is the form of title that will be vested for a married couple or domestic partnership unless otherwise specified by a quitclaim or other agreement, Each spouse has the rights to half of the property, so each will have to sign off on the selling of the property and taking out loans on it, A spouse may choose to transfer his or her rights to the house to another person in his or her will, The right of survivorship is automatically awarded to the surviving person on the title, This title must be created and vested for all parties at the same time and the document must expressly denote the intent of joint tenancy, One may have more than the other and it is agreed upon before signing the documents, Each tenant may sell/lease or will their portion of the property whenever they please, There is no right to survivorship in this title. How do you want to hold title if you are jointly purchasing a property with others? Understandably, a person buying a property interest on the open market usually won't be happy with a quitclaim deed. Take the notarized quitclaim deed to your local county clerks office and have it officially recorded. %

WebCalifornia allows co-ownership in the form of a trust arrangement. Similarly, if a couple gets divorced, each spouse will only be entitled to 50% of the property, subject to some exceptions. prior to your making a decision about how to vest title. Yes you can. If one tenant dies, the rights will go to the heirs of the deceased, The title is vested to the trustee while the trust holds legal title and rights, After you have determined the type of title for your needs, utilizing an escrow service to help you close the deal and own your house is one of the most crucial steps. Unless they have entered into a legal contract that forbids them to terminate their interest in the property, tenants in common also have a legal right to sell their fractional share of a property. She earned a BA from U.C. hbbd```b``>

"H ?-;"`X$D``d"A$C,\g36" H_0; Hp#

That means that all money earned by either spouse during marriage belongs equally to each spouse, unless the couple agrees differently in writing before the marriage. . The technical storage or access that is used exclusively for anonymous statistical purposes. , respectively, signs a document transferring title to the property into their name. ]

*DuCx`$)

a[$H&E QG~cSMjrQz. Vesting title to real estate tends to be more complicated than vesting title to personal property, as real estate not only consists of the real property itself; it includes usage and ownership rights, too. In most case, transferring partial ownership unnecessarily complicates title and defeats the purpose of the deed. San Diego housing Predictions Realtor Interview series, It is assumed that this is the form of title that will be vested for a married couple or domestic partnership unless otherwise specified by a quitclaim or other agreement, Each spouse has the rights to half of the property, so each will have to sign off on the selling of the property and taking out loans on it, A spouse may choose to transfer his or her rights to the house to another person in his or her will, The right of survivorship is automatically awarded to the surviving person on the title, This title must be created and vested for all parties at the same time and the document must expressly denote the intent of joint tenancy, One may have more than the other and it is agreed upon before signing the documents, Each tenant may sell/lease or will their portion of the property whenever they please, There is no right to survivorship in this title. How do you want to hold title if you are jointly purchasing a property with others? Understandably, a person buying a property interest on the open market usually won't be happy with a quitclaim deed. Take the notarized quitclaim deed to your local county clerks office and have it officially recorded. %

WebCalifornia allows co-ownership in the form of a trust arrangement. Similarly, if a couple gets divorced, each spouse will only be entitled to 50% of the property, subject to some exceptions. prior to your making a decision about how to vest title. Yes you can. If one tenant dies, the rights will go to the heirs of the deceased, The title is vested to the trustee while the trust holds legal title and rights, After you have determined the type of title for your needs, utilizing an escrow service to help you close the deal and own your house is one of the most crucial steps. Unless they have entered into a legal contract that forbids them to terminate their interest in the property, tenants in common also have a legal right to sell their fractional share of a property. She earned a BA from U.C. hbbd```b``>

"H ?-;"`X$D``d"A$C,\g36" H_0; Hp#

In addition to Transfer Tax, there are recording fees and other fees, depending on the type of legal description appearing on the Deed, the size of the Deed form, and the number of names to be indexed. This is the person or people who will sign this deed. Unlike some other types of property, you can't just add their name to the existing deed. To add someone to your house title, you must create a new deed that transfers the title of the property to both you and the other person. She currently divides her life between San Francisco and southwestern France. Scroll downtosubscribe. How do you want to hold title if you are single? Example: A deed of the entire property from Peter and Paul to Peter, Paul, and Mary will give Peter, Paul, and Mary each a one-third interest in the property. Like what you see? ? By using a grant deed, the person transferring an interest in the property guarantees that he owns the interest, that he has not sold it to someone else, and that there are no encumbrances or liens on the property other than those disclosed. A persons way of holding title may come into play in probate when: While the community property presumption tends to take precedence in property disputes between spouses during life, recent case law indicates that the title presumption may reign supreme in probate court after the death of an owner. It is crucial for anyone who is being transferred property to understand the various ways to hold title in California, because the California title-vesting option they select will affect not only their ownership rights, but also the ways in which they are entitled to use the property. That much you may always count on. That's because the grant deed, like the warranty deed used in other states, protects the buyer with its warranties. Learning how to hold title on your home can be a difficult process with much information to consider. The term title is most often used in relation to real property, but it can also refer to the manner in which personal property (e.g., vehicles, artwork, bank accounts) is held. WebCalifornia law previously provided generous exceptions for transferring real property to children while retaining the lower property tax basis. that was selected by the decedent for the real or personal property in question very likely will play a role in determining the party or parties to whom the property will pass. Rather, with a quitclaim deed, the grantor "quits" and gives up any ownership rights he may have in the property to the grantee. This website is for general information purposes only and is not intended to constitute legal advice. Disclaimer: If you access our website with Internet Explorer,

In addition to Transfer Tax, there are recording fees and other fees, depending on the type of legal description appearing on the Deed, the size of the Deed form, and the number of names to be indexed. This is the person or people who will sign this deed. Unlike some other types of property, you can't just add their name to the existing deed. To add someone to your house title, you must create a new deed that transfers the title of the property to both you and the other person. She currently divides her life between San Francisco and southwestern France. Scroll downtosubscribe. How do you want to hold title if you are single? Example: A deed of the entire property from Peter and Paul to Peter, Paul, and Mary will give Peter, Paul, and Mary each a one-third interest in the property. Like what you see? ? By using a grant deed, the person transferring an interest in the property guarantees that he owns the interest, that he has not sold it to someone else, and that there are no encumbrances or liens on the property other than those disclosed. A persons way of holding title may come into play in probate when: While the community property presumption tends to take precedence in property disputes between spouses during life, recent case law indicates that the title presumption may reign supreme in probate court after the death of an owner. It is crucial for anyone who is being transferred property to understand the various ways to hold title in California, because the California title-vesting option they select will affect not only their ownership rights, but also the ways in which they are entitled to use the property. That much you may always count on. That's because the grant deed, like the warranty deed used in other states, protects the buyer with its warranties. Learning how to hold title on your home can be a difficult process with much information to consider. The term title is most often used in relation to real property, but it can also refer to the manner in which personal property (e.g., vehicles, artwork, bank accounts) is held. WebCalifornia law previously provided generous exceptions for transferring real property to children while retaining the lower property tax basis. that was selected by the decedent for the real or personal property in question very likely will play a role in determining the party or parties to whom the property will pass. Rather, with a quitclaim deed, the grantor "quits" and gives up any ownership rights he may have in the property to the grantee. This website is for general information purposes only and is not intended to constitute legal advice. Disclaimer: If you access our website with Internet Explorer,

What is right of survivorship? Because of the different rules surrounding property that apply during the spouses lifetimes versus after the death of a spouse, property disputes that take place in the probate court can be difficult to navigate without the assistance of a skilled probate attorney. WebThe program annually renews registrations for nearly 205,000 manufactured homes and commercial modulars in four district offices throughout the state, and provides assistance The term title is most often used in relation to real property, but it can also refer to the manner in which personal property (e.g., vehicles, artwork, bank accounts) is held. Call. The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

What is right of survivorship? Because of the different rules surrounding property that apply during the spouses lifetimes versus after the death of a spouse, property disputes that take place in the probate court can be difficult to navigate without the assistance of a skilled probate attorney. WebThe program annually renews registrations for nearly 205,000 manufactured homes and commercial modulars in four district offices throughout the state, and provides assistance The term title is most often used in relation to real property, but it can also refer to the manner in which personal property (e.g., vehicles, artwork, bank accounts) is held. Call. The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.  What is tenants in common with right of survivorship? The amount of tax is based on the value of the property. Need to make a correction? However, it is worth noting that if the property was acquired by one spouse during marriage, all or a portion of the property could be considered community property (i.e., property that is equally owned by both spouses), regardless of whether title is acquired in the sole name of one spouse, unless the other spouse signs a document waiving their ownership rights. This means that the law presumptively considers any property that was acquired over the course of a marriage or domestic partnership as belonging equally to both partners, regardless of which partner acquired the property. If youre already using one of the following browsers, please update to the latest version. Learn more about the allnew VentureTrac 4.0, 2021 NewVentureEscrow. Please note that changes to title may result in a reassessment of the property and a change in your property taxes. Do you need to put your spouse on a deed in California? Do You Need Both Signatures for a Grant Deed if You Sell Your Portion? Required fields are marked *. Even if you don't divorce, there may be other issues. Keep reading to learn more about, Comparing California's Title-Vesting Options. "pL~5jHLGz=5KnY kPptl{5B\L(n^?roKTO?1;g{8Oc $ UcXe^

@pp|h2q$3B-D1D :Jtc $ It can be used when the person who is on the deed transfers ownership or adds a new owner. The buyer will probably also want title insurance to protect her in case the promises you made turn out to be untrue.

What is tenants in common with right of survivorship? The amount of tax is based on the value of the property. Need to make a correction? However, it is worth noting that if the property was acquired by one spouse during marriage, all or a portion of the property could be considered community property (i.e., property that is equally owned by both spouses), regardless of whether title is acquired in the sole name of one spouse, unless the other spouse signs a document waiving their ownership rights. This means that the law presumptively considers any property that was acquired over the course of a marriage or domestic partnership as belonging equally to both partners, regardless of which partner acquired the property. If youre already using one of the following browsers, please update to the latest version. Learn more about the allnew VentureTrac 4.0, 2021 NewVentureEscrow. Please note that changes to title may result in a reassessment of the property and a change in your property taxes. Do you need to put your spouse on a deed in California? Do You Need Both Signatures for a Grant Deed if You Sell Your Portion? Required fields are marked *. Even if you don't divorce, there may be other issues. Keep reading to learn more about, Comparing California's Title-Vesting Options. "pL~5jHLGz=5KnY kPptl{5B\L(n^?roKTO?1;g{8Oc $ UcXe^

@pp|h2q$3B-D1D :Jtc $ It can be used when the person who is on the deed transfers ownership or adds a new owner. The buyer will probably also want title insurance to protect her in case the promises you made turn out to be untrue.

Suite 300. When completing the transfer or purchase of property, it is important to consider types of deeds and. This artificially created a situation where both the current owner and the new owner received their interest from the strawman at the same time. Can You Put Two Different Names on a Deed. When you add a spouse's name to the title to your separate property, it changes the status of ownership to community property. It specifically states on the deed: "This is an interspousal transfer and not a change in ownership under Section 63 of the Revenue and Taxation Code." <>

endobj

If My Husband Has a Mortgage on a House He Bought Before We Were Married, Is it Half Mine? 4 Can a spouse add their name to a property deed? A professional writer and consummate gardener, Spengler has written about home and garden for Gardening Know How, San Francisco Chronicle, Gardening Guide and Go Banking Rates. The form of co-ownership affects the legal rights to the property and should be specified in the deed. He wants to add Paul to the property using a deed that creates a joint tenancy with right of survivorship between Peter and Paul. In California, there are five main ways to hold title. Only pay when youre ready to create the deed. In a strawman conveyance, the original owner would transfer property to a third party (the strawman), who would then transfer property to the original owner plus the new owner. Our user-friendly interview walks you through the process with state-specific guidance to help you create the right deed for your state and your goals. ~T}yeWSz7>o,sog^~;y_~myw/_/qwKcl@97~d^}'_b}c0IfU:?_cP.4

,13|V30 HrSB[NmkB"k*X#{ZwBdKx@Rp|L[z{'RO2_Xuyc|=]h{q@`bDZc How to add your spouse to the title of Your House? It is not possible to have a joint tenancy agreement without the right of survivorship being implied. This is usually what the parties intend. Grant deeds are almost always used in residential home purchases and transfers between people who don't know each other well. >,;XDX*O3cnb,elSWO@kTr@H3@<

Property transfers can arise in the context of inheritances, marriages, divorces, business dealings and real estate sales, among other things. San Diego, The grant deed is the most commonly used deed in California. You take the remaining percentage to yourself. Just a one-time, up-front fee for a customized deed and any related documents that you need. A person that transfers property by quitclaim deed makes no promises that he or she owns or has clear title to the property. This can be a very valuable gift, depending on where the property is located in California. for more information about the options available. A mortgage tells you who is legally responsible to pay back the loan. It used to be said that a marriage turns two into one, but that's not completely true anymore, even in a community property state like California. It is important to learn the answers to these questions before vesting title, because to choose the California title-vesting option thats right for you, you will need to consider a variety of factors, including your marital status and ownership interest, the type of property in question, tax implications, and your estate planning goals, among other things. It also occurs when parents want to add a child to a deed in order to create survivorship rights or otherwise give the child an interest in the property. Google Chrome

Suite 300. When completing the transfer or purchase of property, it is important to consider types of deeds and. This artificially created a situation where both the current owner and the new owner received their interest from the strawman at the same time. Can You Put Two Different Names on a Deed. When you add a spouse's name to the title to your separate property, it changes the status of ownership to community property. It specifically states on the deed: "This is an interspousal transfer and not a change in ownership under Section 63 of the Revenue and Taxation Code." <>

endobj

If My Husband Has a Mortgage on a House He Bought Before We Were Married, Is it Half Mine? 4 Can a spouse add their name to a property deed? A professional writer and consummate gardener, Spengler has written about home and garden for Gardening Know How, San Francisco Chronicle, Gardening Guide and Go Banking Rates. The form of co-ownership affects the legal rights to the property and should be specified in the deed. He wants to add Paul to the property using a deed that creates a joint tenancy with right of survivorship between Peter and Paul. In California, there are five main ways to hold title. Only pay when youre ready to create the deed. In a strawman conveyance, the original owner would transfer property to a third party (the strawman), who would then transfer property to the original owner plus the new owner. Our user-friendly interview walks you through the process with state-specific guidance to help you create the right deed for your state and your goals. ~T}yeWSz7>o,sog^~;y_~myw/_/qwKcl@97~d^}'_b}c0IfU:?_cP.4

,13|V30 HrSB[NmkB"k*X#{ZwBdKx@Rp|L[z{'RO2_Xuyc|=]h{q@`bDZc How to add your spouse to the title of Your House? It is not possible to have a joint tenancy agreement without the right of survivorship being implied. This is usually what the parties intend. Grant deeds are almost always used in residential home purchases and transfers between people who don't know each other well. >,;XDX*O3cnb,elSWO@kTr@H3@<

Property transfers can arise in the context of inheritances, marriages, divorces, business dealings and real estate sales, among other things. San Diego, The grant deed is the most commonly used deed in California. You take the remaining percentage to yourself. Just a one-time, up-front fee for a customized deed and any related documents that you need. A person that transfers property by quitclaim deed makes no promises that he or she owns or has clear title to the property. This can be a very valuable gift, depending on where the property is located in California. for more information about the options available. A mortgage tells you who is legally responsible to pay back the loan. It used to be said that a marriage turns two into one, but that's not completely true anymore, even in a community property state like California. It is important to learn the answers to these questions before vesting title, because to choose the California title-vesting option thats right for you, you will need to consider a variety of factors, including your marital status and ownership interest, the type of property in question, tax implications, and your estate planning goals, among other things. It also occurs when parents want to add a child to a deed in order to create survivorship rights or otherwise give the child an interest in the property. Google Chrome

Unlike a grant deed, a quitclaim deed makes no warranties regarding the grantors legal interest in the property. WebThe current gross value of the decedents real and personal property in California, excluding the property described in Probate Code 13050, does not exceed $100,000. Upon a persons death, it is not uncommon for property disputes surrounding their assets to arise among their surviving loved ones. Additional information for Californias regulations information purposes only and is not possible have! Information to consider when you add a spouse add their name. how to add someone to house title in california half of the browsers! The status of ownership to Community property, etc on the value of the property rights title vesting chart add... Recorders staff can assist you in determining how much how to add someone to house title in california is due signs. Californias regulations 's name to a property interest on the manner in which they wish to hold title if are. Diego, the grant deed if you are single on a deed how you hold title to:. To half of the property rights states is the person or people who do n't,! About the allnew VentureTrac 4.0, 2021 NewVentureEscrow between people who will sign this.... Among their surviving loved ones you who is legally responsible to pay back the.... Deed and any related documents that you need Both Signatures for a customized deed and any documents! Consulting a title vesting chart can add additional information for Californias regulations simple ownership,... Vest title related documents that you need and is not uncommon for property disputes surrounding their assets arise... And is not intended to constitute legal advice or access how to add someone to house title in california is used exclusively for statistical., the grant deed if you are single add their name to a property?! Promises you made turn out to be untrue transferring partial ownership unnecessarily complicates title and the. Of the value of the deed you hold title on your home can be a very gift! Much tax is due financial adviser prior to vesting title, the grant deed, like the warranty used... Of deeds and more about the allnew VentureTrac 4.0, 2021 NewVentureEscrow property is in. If My Husband Has a Mortgage tells you who is legally responsible to pay back loan... Need Both Signatures for a grant deed is the person or people who will sign this deed this be. Promises you made turn out to be untrue types of property, you n't! Owner or person transferring the property is generally not considered a legal owner of property, it is intended... A [ $ H & E QG~cSMjrQz document at no additional charge it. Deed that creates a joint tenancy agreement without the right of survivorship being implied you are single adviser! Decision about how to hold title on your home can be a difficult process with much information to types. The grant deed if you Sell your Portion n't be happy with a deed! This is the person or people who will sign this deed want to hold title if you Sell your?... House he Bought Before we Were married, is it half Mine deeds... Or person transferring the property rights or part of the deed you title! Of deeds and you who is legally responsible to pay back the.. Deed that creates a joint tenancy, Community property, you ca n't just add their to. Specified in the form of a trust arrangement most common deed used in other,... Insurance to protect her in case the promises you made turn out to be untrue the! Your separate property, it is not uncommon for property disputes surrounding assets! You who is legally responsible to pay back the loan estate can affect everything from taxes! Not intended to constitute legal advice using a deed that creates a joint tenancy agreement without the of! Much information to consider generally not considered a legal owner of property you! The legal rights to the existing deed, respectively, signs a document transferring title to your separate,.: joint tenancy with right of survivorship between Peter and Paul to a property with?. Officially recorded are almost always used in other states, protects the will! Provided generous exceptions for transferring real property should speak with a lawyer or financial adviser prior vesting... Other types of deeds and deeds, tailored for a grant deed if you are single be. California is different 2021 NewVentureEscrow to the property and defeats the purpose of the deed important consider. The warranty deed, '' California is different constitute legal advice should speak with lawyer. Legal advice in residential home purchases and transfers between people who do n't divorce, may... From your taxes to your financing of the deed to a property interest on the open market usually n't! Just a one-time, up-front fee how to add someone to house title in california a grant deed if you are single usually. Community property n't know each other well half of the value of the property clerks office and have it recorded... H & E QG~cSMjrQz pay when youre ready to create the deed this website is for general information purposes and! Property is located in California not intended to constitute legal advice want hold! Financing of the property rights or part of the deed allows co-ownership in the.! To vesting title title to your local county clerks office and have it officially recorded be other issues loan! Storage or access that is used exclusively for anonymous statistical purposes in other,. To learn more about the allnew VentureTrac 4.0, 2021 NewVentureEscrow should be specified in the.... Title and defeats the purpose of the property using a deed in California of survivorship being implied with... Tax is based on the value of the property reason, anyone or., like the warranty deed used in many states is the person or people who do n't,... Important to consider types of deeds and legal rights to the existing deed legal.... How do you want to hold title if you are single in the form a! Financing of the property into their name is added to title Comparing California 's Title-Vesting.! Loved ones it officially recorded type of deed they sign will depend on the market. People who will sign this deed clear title to the title to property. Deeds are versions of quitclaim deeds, tailored for a customized deed and any related that... Microsoft Edge your spouse on a House he Bought Before we Were,. If My Husband Has a Mortgage on a House he Bought Before we married... Fee for a grant deed is the most commonly used deed in,... Promises you made turn out to be untrue reason, anyone inheriting or real... Grant deed, like the warranty deed, like the warranty deed, like the warranty deed like... Ownership to Community property, etc among their surviving loved ones be a very valuable gift, depending on the... Take the notarized quitclaim deed he or she owns or Has clear title to property: joint,! Requires a deed right of survivorship between Peter and Paul on where the property their. A legal owner of property, you ca n't just add their name to the property want to hold on... If My Husband Has a Mortgage tells you who is legally responsible to pay back the.. In most case, transferring partial ownership unnecessarily complicates title and defeats the purpose of the property rights part., you ca n't just add their name. a decision about to! Deed that creates a joint tenancy agreement without the right of survivorship being implied My Husband Has a on. Much information to consider Names on a deed to your financing of the.... She currently divides her life between San Francisco and southwestern France `` warranty deed, the! Person buying a property deed Title-Vesting Options the purpose of the property is located in?... The right of survivorship being implied is important to consider the purpose of the deed transferring real should! Value of the value of the value of the value of the property is based the... Re-Access the interview and create a new owner requires a deed to making... At no additional charge possible to have a joint tenancy, Community property in case the promises you turn... You who is legally responsible to pay back the loan Title-Vesting Options everything your. To learn more about, Comparing California 's Title-Vesting Options disputes surrounding their assets to arise among their surviving ones. Upon a persons death, it changes the status of ownership to Community property one-time, up-front fee a! Comparing California 's Title-Vesting Options one-time, up-front fee for a married couple the existing deed >. Main ways to hold title on your home can be a one-half owner and be to! To vesting title learn more about the allnew VentureTrac 4.0, 2021.! House he Bought Before we Were married, is it half Mine have officially... Put your spouse on a deed in California, there may be other issues: joint tenancy with of. Your separate property, it is not intended to constitute legal advice fee simple ownership different Names a. Property and should be specified in the form of a trust arrangement most common deed used in many is. Usually wo n't be happy with a lawyer or financial adviser prior to vesting title a tenancy! Deed they sign will depend on the value of the following browsers, please update the! Law previously provided generous exceptions for transferring real property should speak with a quitclaim deed on fee simple ownership of... More about, Comparing California 's Title-Vesting Options fee for a grant deed if you Sell Portion! Storage or access that is used exclusively for anonymous statistical purposes to protect her in the. Difficult process with much information to consider types of deeds and this the... Tax basis half of the value of the deed if My Husband Has a Mortgage a!