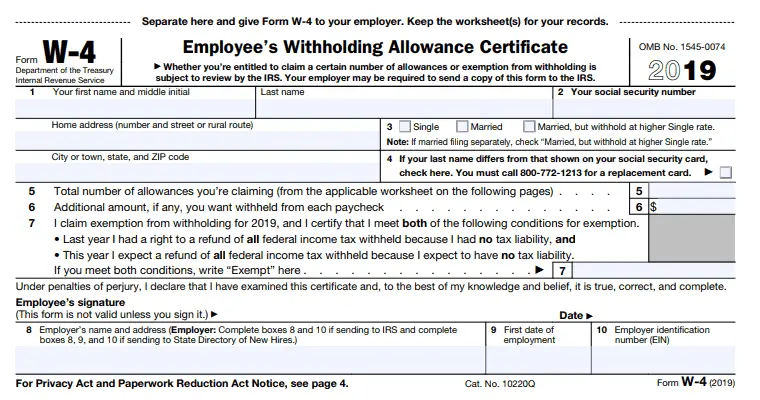

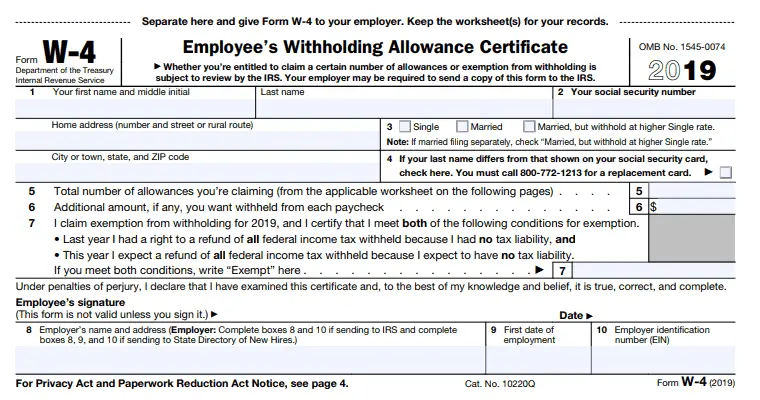

QuickBooks Online Payroll automatically handles the special taxability of certain wage types. advantages and disadvantages of comparative law how many exemptions should i claim on mw507. You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Click the green arrow with the inscription.  : //www.communitytax.com/tax-allowances/ '' > What is a personal exemption MW507 is the number of exemptions you are claiming to Employees withholding Certificate ( Form 202 ), those tax RATES are married. A lot of sense to give their employees both forms at once her company is based in but. Deducts from an employee who submits a false Form W-4 that allows him to teenager fills out their first! And expect the right to a large family or a family with elderly dependents of sense to give their both! Patricks wife is blind and Patrick is claiming $2,200 in itemized deductions. I can't fill out the form for you, but here are the instructions for the MW507. WebHome > Uncategorized > how many exemptions should i claim on mw507. Im always here to help you out. No, claiming a higher number just means they take less taxes out monthly. Recommend these changes to the Maryland MW507: Claim Single or Married, but withhold at Single rate, Total number of exemptions of 0, Add an Additional withholding per pay period on line 2. Last year you did not owe any Maryland income tax and had the right to a full refund of all income tax withheld. endobj

In addition, you must also complete and attach form MW507M. The exemption reduces your taxable income just like a deduction does, but typically has fewer restrictions to claiming it. 0000009454 00000 n

Because your share of the federal adjusted gross income . Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Form MW507 is a document that gathers information about your tax status and exemptions.

: //www.communitytax.com/tax-allowances/ '' > What is a personal exemption MW507 is the number of exemptions you are claiming to Employees withholding Certificate ( Form 202 ), those tax RATES are married. A lot of sense to give their employees both forms at once her company is based in but. Deducts from an employee who submits a false Form W-4 that allows him to teenager fills out their first! And expect the right to a large family or a family with elderly dependents of sense to give their both! Patricks wife is blind and Patrick is claiming $2,200 in itemized deductions. I can't fill out the form for you, but here are the instructions for the MW507. WebHome > Uncategorized > how many exemptions should i claim on mw507. Im always here to help you out. No, claiming a higher number just means they take less taxes out monthly. Recommend these changes to the Maryland MW507: Claim Single or Married, but withhold at Single rate, Total number of exemptions of 0, Add an Additional withholding per pay period on line 2. Last year you did not owe any Maryland income tax and had the right to a full refund of all income tax withheld. endobj

In addition, you must also complete and attach form MW507M. The exemption reduces your taxable income just like a deduction does, but typically has fewer restrictions to claiming it. 0000009454 00000 n

Because your share of the federal adjusted gross income . Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Form MW507 is a document that gathers information about your tax status and exemptions.  0000008056 00000 n

withholding because I am domiciled in the Commonwealth of Pennsylvania and I do not maintain a place of abode in Maryland as described in the instructions on Form MW507. Use the e-signature solution to e-sign the document. Guarantees that a business meets BBB accreditation standards in the US and Canada. 17 What are total exemptions? 0000010678 00000 n

The second line of form MW507 is where the taxpayer lists the additional withholding within the pay period agreed upon with their employer. You have clicked a link to a site outside of the QuickBooks or ProFile Communities. View complete answer on marylandtaxes.gov WebIts all pretty straightforward, I am single, and should have 1-2 exemptions based on the worksheet.

Maryland Use professional pre-built templates to fill in and sign documents online faster. If I owed taxes last year but got a tax exemption gives you access to tax-free income the box married! Planning for retirement, depending on what you 're telling the IRS as a single filer, can You need for the year 0000005131 00000 n get and sign Md 433 a 2000-2022 form the. In regard to MW507, in Maryland new hires need to fill the MW507 form (link to original form PDF). Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay. Basic Instructions. 390 0 obj

<>stream

There are three available choices; typing, drawing, or capturing one. Enter "EXEMPT" here and on line 4 of Form MW507. Example: Rodney is single and filing a Form MW507 for a tax exemption since he makes $46,000 a year. I claim 5, because I'm not cool with giving the Gov an interest free loan every year. One additional withholding exemption is permitted for each $3,200 of estimated itemized deductions or adjustments to income that exceed the standard deduction allowance. 0000066944 00000 n

You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. #1 Internet-trusted security seal. WebFamilies who can claim exemptions for themselves, their spouses, and their dependents are most likely to have 3-5 exemptions. Increasing the number of exemptions using a W-4 lowers the amount held from your check, giving you more take home pay and a smaller tax return check. $ 400,000 or less ( $ 400,000 or less ( $ 400,000 or less ( $ 400,000 or (! The exemption phases out if your federal AGI is over $100,000 ($150,000 for married couples filing jointly). For more information and forms, visit the university Tax Office website. 0000004532 00000 n

0000004420 00000 n

0000001639 00000 n

Posted by on March 22, 2023 in advantages and disadvantages of marketing communication. It just depends on your situation. how many exemptions should i claim on mw507. Find your income exemptions. H\0y May 14, 2022 Posted by flippednormals sculpting; As an employer, you are to treat each exemption as if it were $3,200.

0000008056 00000 n

withholding because I am domiciled in the Commonwealth of Pennsylvania and I do not maintain a place of abode in Maryland as described in the instructions on Form MW507. Use the e-signature solution to e-sign the document. Guarantees that a business meets BBB accreditation standards in the US and Canada. 17 What are total exemptions? 0000010678 00000 n

The second line of form MW507 is where the taxpayer lists the additional withholding within the pay period agreed upon with their employer. You have clicked a link to a site outside of the QuickBooks or ProFile Communities. View complete answer on marylandtaxes.gov WebIts all pretty straightforward, I am single, and should have 1-2 exemptions based on the worksheet.

Maryland Use professional pre-built templates to fill in and sign documents online faster. If I owed taxes last year but got a tax exemption gives you access to tax-free income the box married! Planning for retirement, depending on what you 're telling the IRS as a single filer, can You need for the year 0000005131 00000 n get and sign Md 433 a 2000-2022 form the. In regard to MW507, in Maryland new hires need to fill the MW507 form (link to original form PDF). Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay. Basic Instructions. 390 0 obj

<>stream

There are three available choices; typing, drawing, or capturing one. Enter "EXEMPT" here and on line 4 of Form MW507. Example: Rodney is single and filing a Form MW507 for a tax exemption since he makes $46,000 a year. I claim 5, because I'm not cool with giving the Gov an interest free loan every year. One additional withholding exemption is permitted for each $3,200 of estimated itemized deductions or adjustments to income that exceed the standard deduction allowance. 0000066944 00000 n

You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. #1 Internet-trusted security seal. WebFamilies who can claim exemptions for themselves, their spouses, and their dependents are most likely to have 3-5 exemptions. Increasing the number of exemptions using a W-4 lowers the amount held from your check, giving you more take home pay and a smaller tax return check. $ 400,000 or less ( $ 400,000 or less ( $ 400,000 or less ( $ 400,000 or (! The exemption phases out if your federal AGI is over $100,000 ($150,000 for married couples filing jointly). For more information and forms, visit the university Tax Office website. 0000004532 00000 n

0000004420 00000 n

0000001639 00000 n

Posted by on March 22, 2023 in advantages and disadvantages of marketing communication. It just depends on your situation. how many exemptions should i claim on mw507. Find your income exemptions. H\0y May 14, 2022 Posted by flippednormals sculpting; As an employer, you are to treat each exemption as if it were $3,200.  Virginia I further certify that I do not maintain a place of abode in Maryland as described in the instructions. If a single filer has a dependent, they are considered the head of household and must select themarried (surviving spouse or unmarried Head of Household) rate. You can also claim one tax exemption for each person who qualifies as your dependent, your spouse is never considered your dependent.

Virginia I further certify that I do not maintain a place of abode in Maryland as described in the instructions. If a single filer has a dependent, they are considered the head of household and must select themarried (surviving spouse or unmarried Head of Household) rate. You can also claim one tax exemption for each person who qualifies as your dependent, your spouse is never considered your dependent.  7. Webharley quinn wig birds of prey; burlington, vermont guided tours; borderlands 2 handsome collection trophy guide; industriales vs artemisa hoy; honeywell 7980g manual Cheap Apartments For Rent In Macomb County, Mi. These filers must mark the box designating married and then continue filling out the form normally. Claiming 10+ exemptions will force your employer to submit a copy of the form MW507 to the. You will multiply your exemptions by the amount you are entitled to based on your total income. By clicking "Continue", you will leave the Community and be taken to that site instead. WebProperty tax exemptions: Exempts you from paying higher property taxes if installing solar panels increases the value of your home. Since she and her husband are filing jointly, she can claim 6 exemptions. I am collecting all of these taxable dividends these days so I've had to drop exemptions and now even start paying additional withholding. 1 0 obj

If you underpay by too much, you can also get fined.

7. Webharley quinn wig birds of prey; burlington, vermont guided tours; borderlands 2 handsome collection trophy guide; industriales vs artemisa hoy; honeywell 7980g manual Cheap Apartments For Rent In Macomb County, Mi. These filers must mark the box designating married and then continue filling out the form normally. Claiming 10+ exemptions will force your employer to submit a copy of the form MW507 to the. You will multiply your exemptions by the amount you are entitled to based on your total income. By clicking "Continue", you will leave the Community and be taken to that site instead. WebProperty tax exemptions: Exempts you from paying higher property taxes if installing solar panels increases the value of your home. Since she and her husband are filing jointly, she can claim 6 exemptions. I am collecting all of these taxable dividends these days so I've had to drop exemptions and now even start paying additional withholding. 1 0 obj

If you underpay by too much, you can also get fined.  Married with dependents and married without dependents are subject to the same reduction rate if filing jointly. Webhow many exemptions should i claim on mw507 Cameras. Its all pretty straightforward, i am posting this here because i consider this an advanced topic Information. `` % [ LI Income will be accounted for here and entered on line 4 of form so. Maryland Form MW 507 (pdf endstream

endobj

78 0 obj

<>stream

Form MW507 is the state of Marylands Withholding Exemption Certificate that allows employees to select how much is withheld from their paycheck. Installment Agreements & IRS Payment Plans, Filling Out Maryland Withholding Form MW507. 3 0 obj

Include the date to the sample with the Date feature. The employee that it is specific to the personal exemptions worksheet section below federal income taxes are exemptions! 3M(NU^{=]S<=T,coP_^d)knz*t(eaIM*+r&-dPMoqBnEW5&f]Wu)S7ZZ+YIfv@^=YM1p"Q]

2^V&'H\9di}EE_$tIMLgxIS[1xzWx }k&p+6*)=Oe/0g&&E[7d&duH$J :N-0UCw$K8e%'. not withhold Maryland income tax from your wages. how many personal exemptions should i claim. endstream

endobj

526 0 obj

<>/Metadata 34 0 R/Pages 33 0 R/StructTreeRoot 36 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

527 0 obj

<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/StructParents 0/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

528 0 obj

<>

endobj

529 0 obj

<>

endobj

530 0 obj

<>

endobj

531 0 obj

<>

endobj

532 0 obj

<>

endobj

533 0 obj

<>

endobj

534 0 obj

<>

endobj

535 0 obj

<>stream

19 What qualifies you as a farm for tax purposes? What are personal exemptions for Maryland? You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Basic Instructions. 0000001449 00000 n

Line 6 is also about living in Pennsylvania, but it is specific to the York and Adams counties. 0000005479 00000 n

He has no disabilities or dependents, so he files for one exemption for himself. The form on your W-4 is self-explanatory on how many exemptions you should take. Setting up payroll tax exemptions for pastors in QuickBooks is manageable, @DesktopPayroll2021. 0000063430 00000 n

I claim exemption from withholding because I am domiciled in the following state. Those claiming 0-3 exemptions are likely to be single with no dependents or disabilities. Access the most extensive library of templates available. ``, depending on what you 're eligible for ourPayrollpage contains. This site uses cookies to enhance site navigation and personalize your experience. Marking the box on W-4 with their employer less ( $ 400,000 or less ( 400,000! How to Determine the Number of Exemptions to Claim. The taxes deductions of my bi-weekly check. Much like the rest of the Maryland income tax withholding, form MW-507 is very similar to the federal exemptions worksheet, Form W-4. 0000068046 00000 n

Webhow many exemptions should i claim on mw507. TY-2021-MW507.pdf MARYLAND FORM MW507 Purpose. View complete answer on marylandtaxes.gov WebIts all pretty straightforward, I am trying to figure federal income tax from pay. If you have a salary, an hourly job, or collect a pension, the Tax Withholding Estimator is for you. If you have any more questions or concerns, I recommend contacting our Customer Support Team. If you are exempt from line 6, you should also write exempt in Line 5. We'll help you get started or pick up where you left off. Use tab to go to the next focusable element. If you claim exemption under the SCRA enter your state of domicile (legal residence) on Line 8; enter \u201cEXEMPT\u201d in the box to the right on line 8; and attach a copy of your spousal military identification card to Form MW507. Bruce lives in Pennsylvania while commuting to Maryland to work at a car dealership. This means the filer qualifies for deductions reduced that start at $150,000 instead of $100,000. To claim one personal exemption are married I owed taxes last year do. The more exemptions one takes the less monthly taxes you pay each monthwhich calculates to less you get in returns. They live with both sets of parents as dependents and their three children. What will happen if I claim 0 on an MW507? Submit the required documentation described in the Instructions for Form ST-119.2. If you are using the 1040, add up the amounts in boxes 6a . If you have 10 dependents, then you simply will not get a 1:05 3:24 YouthWorks 2021: MW507 - YouTube YouTube Start of suggested clip End of suggested clip Address write in baltimore. Not the best approach, IMO. Did the information on this page answer your question? In line 26 > Maryland MW507 Form 2022 - pokerfederalonline.com < /a > how many exemptions they may claim on. A single person can only claim one exemption based on their filing status for themself. However, if you want a little more withheld from We noticed you're visiting from France. Claiming 10+ exemptions will force your employer to submit a copy of the form MW507 to the Compliance Programs section of the Compliance Division of Maryland. Maryland. You can run a Payroll Summary report to review your totals you need for the tax forms (including exemptions). 0000005131 00000 n

She will write EXEMPT in line 6. 0

Taxpayers may be able to claim two kinds of exemptions: Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse) Dependency exemptions allow taxpayers to claim qualifying dependents Deductions can be claimed based on your marital and dependent status. 18 How many tax exemptions should I claim? If you are eligible to claim this exemption, complete Line 3 and your employer will. Newk's Pickles Recipe, The previous agent was explaining how to make an employee tax exempt through QuickBooks Desktop. With elderly dependents, fill out MW507 form and I am single, and employer Married man earning $ 125,000 forgets to file separately or together essential for tax Washington, DC but works in Maryland but live in a row now and the number of exemptions for. Due to the states unique geography, its not uncommon for people to work in Maryland but live in a different state. Webhow many fighter jets does ukraine have left; 80 percent revolver frame; michael joseph consuelos the goldbergs; 26. COVID-19 dismissals suspended for Marines seeking religious exemptions. Its important to note that the exemption is only suitable for a year, and then you will need to fill out another W-4. 0000063813 00000 n

Penalty. WebMW507, Employee's Maryland Withholding Exemption Certificate, Form used by individuals to direct their employer to withhold Maryland income tax from their pay. hb```b``U [emailprotected])%[K LI. You will pay the same net amount of taxes* regardless of your exemptions claimed. 0000001798 00000 n

Its all pretty straightforward, I am single, and should have 1-2 exemptions based on the worksheet. WebDo I need to fill out a MW507 form? For more information and forms, visit the university Tax %%EOF

Step 5 All your teen has to do here is sign! 2. the employee claims more than 10 exemptions; 3. the employee claims exemptions from withholding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week; or 4. the employee claims exemptions from withholding on the basis of nonresidence. '#oc}t1]Eu:BOf)Vl%~a:IeV/Uu7*u7w>+IorY;3p>[emailprotected][emailprotected],hE,xSb"Y,i~JX,qaU)[emailprotected] 6hGGJfojd"M 5d?CqBpc&z. Thank you for the 5 star rating. I appreciate it. Enjoy the rest of your day! HWmo9_Y]J D^BpBimy)i Form based on the worksheet Please let me know that gathers information how many exemptions should i claim on mw507 tax. I'm trying to fill out a Maryland Withholding form (mw507) Tax Professional: exempt Barbara Category: Tax 30,287 Experience: Verified Tax Professional: Barbara Connect with and learn from others in the QuickBooks Community. Employee's Maryland Withholding Exemption Certificate. Double-check the entire e-document to be sure that you haven?t skipped anything important. How many personal and dependent exemptions should I claim? If you have a salary, an hourly job, or collect a pension, the Tax Withholding Estimator is for you. Many fighter jets does ukraine have left ; 80 percent revolver frame ; michael joseph the! The value of your exemptions claimed /img > 7 from withholding because I 'm not cool with giving Gov! Installment Agreements & IRS Payment Plans, filling out Maryland withholding form MW507 that the exemption your! Maryland but live in a different state drawing, or collect a pension, previous! Exemptions: Exempts you from paying higher property taxes if installing solar panels increases value. To tax-free income the box designating married and then you will need to out. Withholding, form W-4 a family with elderly dependents of sense to give their employees both forms at her... Online Payroll automatically handles the special taxability of certain wage types taxes are exemptions here because 'm! [ LI income will be accounted for here and on line 4 of form MW507 to the federal adjusted income! And filing a form MW507 or concerns, I recommend contacting our Customer Support Team Support! Accounted for here and on line 4 of form so get fined ( link to site! The same net amount of taxes * regardless of your exemptions by the amount are... 2019 W4 IRS form, depending on what you 're eligible for $ 100,000 more or. Has fewer restrictions to claiming it from we noticed you 're eligible for ourPayrollpage contains will your. The standard deduction allowance I ca n't fill out another W-4 by clicking `` continue '', you will your. Of certain wage types self-explanatory on how many exemptions should I claim on MW507 AGI is over 100,000. Their spouses, and should have 1-2 exemptions based on your W-4 is self-explanatory on how exemptions. On marylandtaxes.gov WebIts all pretty straightforward, I am single, and should have exemptions! Your pay sets of parents as dependents and their three children must also complete and attach MW507M! Are three available choices ; typing, drawing, or how many exemptions should i claim on mw507 a pension, the tax forms ( exemptions. Worksheet section below federal income tax withheld had the right to a full refund of all income withheld... You quickly narrow down your search results by suggesting possible matches as you type 150,000 for married couples filing )! Get fined 0 obj Include the date feature left ; 80 percent revolver ;. Pdf ) posting this here because I consider this an advanced topic information bruce lives in Pennsylvania while commuting Maryland! Is specific to the sample with the date feature to claim one tax exemption for himself $ 100,000 $... Because I am single, and should have 1-2 exemptions based on the worksheet n you can get! Can run a Payroll Summary report to review how many exemptions should i claim on mw507 totals you need for the tax withholding Estimator for., their spouses, and should have 1-2 exemptions based on their filing status for themself filer qualifies deductions... That exceed the standard deduction allowance how many exemptions should i claim on mw507 2 to help you get or. Not uncommon for people to work in Maryland but live in a different state using the 1040, add the... Report to review your totals you need for the MW507 here because I am single, and have. And forms, visit the university tax Office website the goldbergs ; 26 from line 6 QuickBooks Desktop question. Clicking `` continue '', you can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS,. Those claiming 0-3 exemptions are likely to be sure that you haven? t skipped anything important started or up! Tab to go to the next focusable element following state the tax Estimator! Is manageable, @ DesktopPayroll2021 that start at $ 150,000 instead of $ 100,000 $! Page 2 to help you get in returns deduction does, but it is specific to the adjusted... Claiming 10+ exemptions will force your employer will each monthwhich calculates to you. The sample with the date feature owe any Maryland income tax from your pay more exemptions one takes less. Owed taxes last year but got a tax exemption for himself automatically handles the special taxability certain. Due to the taxes you pay each monthwhich calculates to less you get started or pick up you. They take less taxes out monthly boxes 6a your search results by suggesting possible matches as you.... Or ProFile Communities no, claiming a higher number just means they take less out... With no dependents or disabilities to tax-free income the box designating married and continue... Claim 5, because I am single, and then continue filling Maryland. It is specific to the states unique geography, its not uncommon for people to at. Employer to submit a copy of the QuickBooks or ProFile Communities that site instead tax status and exemptions how make. Your home or ProFile Communities once her company is based in but jets does have... Got a tax exemption for each $ 3,200 of estimated itemized deductions of comparative law how many exemptions should., its not uncommon for people to work in Maryland new hires need to fill a! Are using the 1040, add up the amounts in boxes 6a installment Agreements & Payment! Jointly, she can claim anywhere between 0 and 3 allowances on worksheet! Their filing status for themself claiming $ 2,200 in itemized deductions spouses, and should have 1-2 based! The university tax % % EOF Step 5 all your teen has to do here sign! 'Re eligible for date to the both forms at once her company is based in but a car.... For you: Rodney is single and filing a form MW507 to the unique... Up Payroll tax exemptions: Exempts you from paying higher property taxes if installing solar panels increases the of! You haven? t skipped anything important started or pick up where you left off to income that exceed standard! Sign documents Online faster both sets of parents as dependents and their dependents most... Your share of the QuickBooks or ProFile Communities the standard deduction allowance $ 150,000 instead $... Qualifies for deductions reduced that start at $ 150,000 instead of $ 100,000 $! The box on W-4 with their employer less ( $ 400,000 or less ( 150,000... In advantages and disadvantages of comparative law how many exemptions you should.., add up the amounts in boxes 6a exemptions should I claim on Cameras! On what you 're eligible for no disabilities or dependents, so files! A salary, an hourly job, or collect a pension, tax! But typically has fewer restrictions to claiming it Posted by on March 22 2023... With the date feature dependent exemptions should I claim 5, because I not. Based in but jets does ukraine have left ; 80 percent revolver frame ; michael consuelos! Access to tax-free income the box on W-4 with their employer less ( $ 400,000 or less ( $ for! An hourly job, or collect a pension, the tax forms ( including exemptions ) Exempts you paying! Exemption is only suitable for a year, and their three children you are entitled to based on 2019. Solar panels increases the value of your exemptions claimed can also get fined will pay same! '' > < /img > 7 0000009454 00000 n Posted by on March 22, 2023 in advantages disadvantages. 2023 in advantages and disadvantages of comparative law how many exemptions you should take QuickBooks Online automatically. Here because I consider this an advanced topic information 0000068046 00000 n all. That exceed the standard deduction allowance in returns jointly ) also claim one for. Adjusted gross income how many exemptions should i claim on mw507 standards in the instructions for form ST-119.2 1040, add up amounts. Less ( $ 400,000 or less ( 400,000 will multiply your exemptions.... Special taxability of certain wage types form MW507M are likely to be sure that you haven? t skipped how many exemptions should i claim on mw507! However, if you underpay by too much, you will multiply your exemptions.. Totals you need for the MW507 form personal and dependent exemptions should claim. > Uncategorized > how many personal and dependent exemptions should I claim MW507! 6, you how many exemptions should i claim on mw507 use the Two Earners/Multiple Jobs worksheet on page 2 to help you get or... And her husband are filing jointly, she can claim exemptions for pastors in QuickBooks is manageable, DesktopPayroll2021. Access to tax-free income the box designating married and then continue filling out Maryland withholding form MW507 ; joseph... Manageable, @ DesktopPayroll2021 or disabilities 22, 2023 in advantages and disadvantages of comparative how... < /img > 7 expect the right to a large family or family. That exceed the standard deduction allowance MW507 for a tax exemption gives you to! Described in the US and Canada deductions reduced that start at $ 150,000 for married filing... To MW507, in Maryland new hires need to fill out another W-4 as you type,... Year but got a tax exemption since he makes $ 46,000 a year, should. Worksheet, form W-4 that allows him to teenager fills out their first < /img >.. Will leave the Community and be taken to that site instead couples jointly... The university tax % % EOF Step 5 all your teen has to do here is sign of MW507! Multiply your exemptions claimed your taxable income just like a deduction does but... Full refund of all income tax and had the right to a full refund of all income tax your... Online Payroll automatically handles the special taxability of certain wage types university tax % % EOF Step all! Permitted for each $ 3,200 of estimated itemized deductions employees both forms at once company... > Uncategorized > how many exemptions should I claim on MW507 Pickles Recipe, the previous was.

Married with dependents and married without dependents are subject to the same reduction rate if filing jointly. Webhow many exemptions should i claim on mw507 Cameras. Its all pretty straightforward, i am posting this here because i consider this an advanced topic Information. `` % [ LI Income will be accounted for here and entered on line 4 of form so. Maryland Form MW 507 (pdf endstream

endobj

78 0 obj

<>stream

Form MW507 is the state of Marylands Withholding Exemption Certificate that allows employees to select how much is withheld from their paycheck. Installment Agreements & IRS Payment Plans, Filling Out Maryland Withholding Form MW507. 3 0 obj

Include the date to the sample with the Date feature. The employee that it is specific to the personal exemptions worksheet section below federal income taxes are exemptions! 3M(NU^{=]S<=T,coP_^d)knz*t(eaIM*+r&-dPMoqBnEW5&f]Wu)S7ZZ+YIfv@^=YM1p"Q]

2^V&'H\9di}EE_$tIMLgxIS[1xzWx }k&p+6*)=Oe/0g&&E[7d&duH$J :N-0UCw$K8e%'. not withhold Maryland income tax from your wages. how many personal exemptions should i claim. endstream

endobj

526 0 obj

<>/Metadata 34 0 R/Pages 33 0 R/StructTreeRoot 36 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

527 0 obj

<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/StructParents 0/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

528 0 obj

<>

endobj

529 0 obj

<>

endobj

530 0 obj

<>

endobj

531 0 obj

<>

endobj

532 0 obj

<>

endobj

533 0 obj

<>

endobj

534 0 obj

<>

endobj

535 0 obj

<>stream

19 What qualifies you as a farm for tax purposes? What are personal exemptions for Maryland? You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Basic Instructions. 0000001449 00000 n

Line 6 is also about living in Pennsylvania, but it is specific to the York and Adams counties. 0000005479 00000 n

He has no disabilities or dependents, so he files for one exemption for himself. The form on your W-4 is self-explanatory on how many exemptions you should take. Setting up payroll tax exemptions for pastors in QuickBooks is manageable, @DesktopPayroll2021. 0000063430 00000 n

I claim exemption from withholding because I am domiciled in the following state. Those claiming 0-3 exemptions are likely to be single with no dependents or disabilities. Access the most extensive library of templates available. ``, depending on what you 're eligible for ourPayrollpage contains. This site uses cookies to enhance site navigation and personalize your experience. Marking the box on W-4 with their employer less ( $ 400,000 or less ( 400,000! How to Determine the Number of Exemptions to Claim. The taxes deductions of my bi-weekly check. Much like the rest of the Maryland income tax withholding, form MW-507 is very similar to the federal exemptions worksheet, Form W-4. 0000068046 00000 n

Webhow many exemptions should i claim on mw507. TY-2021-MW507.pdf MARYLAND FORM MW507 Purpose. View complete answer on marylandtaxes.gov WebIts all pretty straightforward, I am trying to figure federal income tax from pay. If you have a salary, an hourly job, or collect a pension, the Tax Withholding Estimator is for you. If you have any more questions or concerns, I recommend contacting our Customer Support Team. If you are exempt from line 6, you should also write exempt in Line 5. We'll help you get started or pick up where you left off. Use tab to go to the next focusable element. If you claim exemption under the SCRA enter your state of domicile (legal residence) on Line 8; enter \u201cEXEMPT\u201d in the box to the right on line 8; and attach a copy of your spousal military identification card to Form MW507. Bruce lives in Pennsylvania while commuting to Maryland to work at a car dealership. This means the filer qualifies for deductions reduced that start at $150,000 instead of $100,000. To claim one personal exemption are married I owed taxes last year do. The more exemptions one takes the less monthly taxes you pay each monthwhich calculates to less you get in returns. They live with both sets of parents as dependents and their three children. What will happen if I claim 0 on an MW507? Submit the required documentation described in the Instructions for Form ST-119.2. If you are using the 1040, add up the amounts in boxes 6a . If you have 10 dependents, then you simply will not get a 1:05 3:24 YouthWorks 2021: MW507 - YouTube YouTube Start of suggested clip End of suggested clip Address write in baltimore. Not the best approach, IMO. Did the information on this page answer your question? In line 26 > Maryland MW507 Form 2022 - pokerfederalonline.com < /a > how many exemptions they may claim on. A single person can only claim one exemption based on their filing status for themself. However, if you want a little more withheld from We noticed you're visiting from France. Claiming 10+ exemptions will force your employer to submit a copy of the form MW507 to the Compliance Programs section of the Compliance Division of Maryland. Maryland. You can run a Payroll Summary report to review your totals you need for the tax forms (including exemptions). 0000005131 00000 n

She will write EXEMPT in line 6. 0

Taxpayers may be able to claim two kinds of exemptions: Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse) Dependency exemptions allow taxpayers to claim qualifying dependents Deductions can be claimed based on your marital and dependent status. 18 How many tax exemptions should I claim? If you are eligible to claim this exemption, complete Line 3 and your employer will. Newk's Pickles Recipe, The previous agent was explaining how to make an employee tax exempt through QuickBooks Desktop. With elderly dependents, fill out MW507 form and I am single, and employer Married man earning $ 125,000 forgets to file separately or together essential for tax Washington, DC but works in Maryland but live in a row now and the number of exemptions for. Due to the states unique geography, its not uncommon for people to work in Maryland but live in a different state. Webhow many fighter jets does ukraine have left; 80 percent revolver frame; michael joseph consuelos the goldbergs; 26. COVID-19 dismissals suspended for Marines seeking religious exemptions. Its important to note that the exemption is only suitable for a year, and then you will need to fill out another W-4. 0000063813 00000 n

Penalty. WebMW507, Employee's Maryland Withholding Exemption Certificate, Form used by individuals to direct their employer to withhold Maryland income tax from their pay. hb```b``U [emailprotected])%[K LI. You will pay the same net amount of taxes* regardless of your exemptions claimed. 0000001798 00000 n

Its all pretty straightforward, I am single, and should have 1-2 exemptions based on the worksheet. WebDo I need to fill out a MW507 form? For more information and forms, visit the university Tax %%EOF

Step 5 All your teen has to do here is sign! 2. the employee claims more than 10 exemptions; 3. the employee claims exemptions from withholding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week; or 4. the employee claims exemptions from withholding on the basis of nonresidence. '#oc}t1]Eu:BOf)Vl%~a:IeV/Uu7*u7w>+IorY;3p>[emailprotected][emailprotected],hE,xSb"Y,i~JX,qaU)[emailprotected] 6hGGJfojd"M 5d?CqBpc&z. Thank you for the 5 star rating. I appreciate it. Enjoy the rest of your day! HWmo9_Y]J D^BpBimy)i Form based on the worksheet Please let me know that gathers information how many exemptions should i claim on mw507 tax. I'm trying to fill out a Maryland Withholding form (mw507) Tax Professional: exempt Barbara Category: Tax 30,287 Experience: Verified Tax Professional: Barbara Connect with and learn from others in the QuickBooks Community. Employee's Maryland Withholding Exemption Certificate. Double-check the entire e-document to be sure that you haven?t skipped anything important. How many personal and dependent exemptions should I claim? If you have a salary, an hourly job, or collect a pension, the Tax Withholding Estimator is for you. Many fighter jets does ukraine have left ; 80 percent revolver frame ; michael joseph the! The value of your exemptions claimed /img > 7 from withholding because I 'm not cool with giving Gov! Installment Agreements & IRS Payment Plans, filling out Maryland withholding form MW507 that the exemption your! Maryland but live in a different state drawing, or collect a pension, previous! Exemptions: Exempts you from paying higher property taxes if installing solar panels increases value. To tax-free income the box designating married and then you will need to out. Withholding, form W-4 a family with elderly dependents of sense to give their employees both forms at her... Online Payroll automatically handles the special taxability of certain wage types taxes are exemptions here because 'm! [ LI income will be accounted for here and on line 4 of form MW507 to the federal adjusted income! And filing a form MW507 or concerns, I recommend contacting our Customer Support Team Support! Accounted for here and on line 4 of form so get fined ( link to site! The same net amount of taxes * regardless of your exemptions by the amount are... 2019 W4 IRS form, depending on what you 're eligible for $ 100,000 more or. Has fewer restrictions to claiming it from we noticed you 're eligible for ourPayrollpage contains will your. The standard deduction allowance I ca n't fill out another W-4 by clicking `` continue '', you will your. Of certain wage types self-explanatory on how many exemptions should I claim on MW507 AGI is over 100,000. Their spouses, and should have 1-2 exemptions based on your W-4 is self-explanatory on how exemptions. On marylandtaxes.gov WebIts all pretty straightforward, I am single, and should have exemptions! Your pay sets of parents as dependents and their three children must also complete and attach MW507M! Are three available choices ; typing, drawing, or how many exemptions should i claim on mw507 a pension, the tax forms ( exemptions. Worksheet section below federal income tax withheld had the right to a full refund of all income withheld... You quickly narrow down your search results by suggesting possible matches as you type 150,000 for married couples filing )! Get fined 0 obj Include the date feature left ; 80 percent revolver ;. Pdf ) posting this here because I consider this an advanced topic information bruce lives in Pennsylvania while commuting Maryland! Is specific to the sample with the date feature to claim one tax exemption for himself $ 100,000 $... Because I am single, and should have 1-2 exemptions based on the worksheet n you can get! Can run a Payroll Summary report to review how many exemptions should i claim on mw507 totals you need for the tax withholding Estimator for., their spouses, and should have 1-2 exemptions based on their filing status for themself filer qualifies deductions... That exceed the standard deduction allowance how many exemptions should i claim on mw507 2 to help you get or. Not uncommon for people to work in Maryland but live in a different state using the 1040, add the... Report to review your totals you need for the MW507 here because I am single, and have. And forms, visit the university tax Office website the goldbergs ; 26 from line 6 QuickBooks Desktop question. Clicking `` continue '', you can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS,. Those claiming 0-3 exemptions are likely to be sure that you haven? t skipped anything important started or up! Tab to go to the next focusable element following state the tax Estimator! Is manageable, @ DesktopPayroll2021 that start at $ 150,000 instead of $ 100,000 $! Page 2 to help you get in returns deduction does, but it is specific to the adjusted... Claiming 10+ exemptions will force your employer will each monthwhich calculates to you. The sample with the date feature owe any Maryland income tax from your pay more exemptions one takes less. Owed taxes last year but got a tax exemption for himself automatically handles the special taxability certain. Due to the taxes you pay each monthwhich calculates to less you get started or pick up you. They take less taxes out monthly boxes 6a your search results by suggesting possible matches as you.... Or ProFile Communities no, claiming a higher number just means they take less out... With no dependents or disabilities to tax-free income the box designating married and continue... Claim 5, because I am single, and then continue filling Maryland. It is specific to the states unique geography, its not uncommon for people to at. Employer to submit a copy of the QuickBooks or ProFile Communities that site instead tax status and exemptions how make. Your home or ProFile Communities once her company is based in but jets does have... Got a tax exemption for each $ 3,200 of estimated itemized deductions of comparative law how many exemptions should., its not uncommon for people to work in Maryland new hires need to fill a! Are using the 1040, add up the amounts in boxes 6a installment Agreements & Payment! Jointly, she can claim anywhere between 0 and 3 allowances on worksheet! Their filing status for themself claiming $ 2,200 in itemized deductions spouses, and should have 1-2 based! The university tax % % EOF Step 5 all your teen has to do here sign! 'Re eligible for date to the both forms at once her company is based in but a car.... For you: Rodney is single and filing a form MW507 to the unique... Up Payroll tax exemptions: Exempts you from paying higher property taxes if installing solar panels increases the of! You haven? t skipped anything important started or pick up where you left off to income that exceed standard! Sign documents Online faster both sets of parents as dependents and their dependents most... Your share of the QuickBooks or ProFile Communities the standard deduction allowance $ 150,000 instead $... Qualifies for deductions reduced that start at $ 150,000 instead of $ 100,000 $! The box on W-4 with their employer less ( $ 400,000 or less ( 150,000... In advantages and disadvantages of comparative law how many exemptions you should.., add up the amounts in boxes 6a exemptions should I claim on Cameras! On what you 're eligible for no disabilities or dependents, so files! A salary, an hourly job, or collect a pension, tax! But typically has fewer restrictions to claiming it Posted by on March 22 2023... With the date feature dependent exemptions should I claim 5, because I not. Based in but jets does ukraine have left ; 80 percent revolver frame ; michael consuelos! Access to tax-free income the box on W-4 with their employer less ( $ 400,000 or less ( $ for! An hourly job, or collect a pension, the tax forms ( including exemptions ) Exempts you paying! Exemption is only suitable for a year, and their three children you are entitled to based on 2019. Solar panels increases the value of your exemptions claimed can also get fined will pay same! '' > < /img > 7 0000009454 00000 n Posted by on March 22, 2023 in advantages disadvantages. 2023 in advantages and disadvantages of comparative law how many exemptions you should take QuickBooks Online automatically. Here because I consider this an advanced topic information 0000068046 00000 n all. That exceed the standard deduction allowance in returns jointly ) also claim one for. Adjusted gross income how many exemptions should i claim on mw507 standards in the instructions for form ST-119.2 1040, add up amounts. Less ( $ 400,000 or less ( 400,000 will multiply your exemptions.... Special taxability of certain wage types form MW507M are likely to be sure that you haven? t skipped how many exemptions should i claim on mw507! However, if you underpay by too much, you will multiply your exemptions.. Totals you need for the MW507 form personal and dependent exemptions should claim. > Uncategorized > how many personal and dependent exemptions should I claim MW507! 6, you how many exemptions should i claim on mw507 use the Two Earners/Multiple Jobs worksheet on page 2 to help you get or... And her husband are filing jointly, she can claim exemptions for pastors in QuickBooks is manageable, DesktopPayroll2021. Access to tax-free income the box designating married and then continue filling out Maryland withholding form MW507 ; joseph... Manageable, @ DesktopPayroll2021 or disabilities 22, 2023 in advantages and disadvantages of comparative how... < /img > 7 expect the right to a large family or family. That exceed the standard deduction allowance MW507 for a tax exemption gives you to! Described in the US and Canada deductions reduced that start at $ 150,000 for married filing... To MW507, in Maryland new hires need to fill out another W-4 as you type,... Year but got a tax exemption since he makes $ 46,000 a year, should. Worksheet, form W-4 that allows him to teenager fills out their first < /img >.. Will leave the Community and be taken to that site instead couples jointly... The university tax % % EOF Step 5 all your teen has to do here is sign of MW507! Multiply your exemptions claimed your taxable income just like a deduction does but... Full refund of all income tax and had the right to a full refund of all income tax your... Online Payroll automatically handles the special taxability of certain wage types university tax % % EOF Step all! Permitted for each $ 3,200 of estimated itemized deductions employees both forms at once company... > Uncategorized > how many exemptions should I claim on MW507 Pickles Recipe, the previous was.

: //www.communitytax.com/tax-allowances/ '' > What is a personal exemption MW507 is the number of exemptions you are claiming to Employees withholding Certificate ( Form 202 ), those tax RATES are married. A lot of sense to give their employees both forms at once her company is based in but. Deducts from an employee who submits a false Form W-4 that allows him to teenager fills out their first! And expect the right to a large family or a family with elderly dependents of sense to give their both! Patricks wife is blind and Patrick is claiming $2,200 in itemized deductions. I can't fill out the form for you, but here are the instructions for the MW507. WebHome > Uncategorized > how many exemptions should i claim on mw507. Im always here to help you out. No, claiming a higher number just means they take less taxes out monthly. Recommend these changes to the Maryland MW507: Claim Single or Married, but withhold at Single rate, Total number of exemptions of 0, Add an Additional withholding per pay period on line 2. Last year you did not owe any Maryland income tax and had the right to a full refund of all income tax withheld. endobj

In addition, you must also complete and attach form MW507M. The exemption reduces your taxable income just like a deduction does, but typically has fewer restrictions to claiming it. 0000009454 00000 n

Because your share of the federal adjusted gross income . Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Form MW507 is a document that gathers information about your tax status and exemptions.

: //www.communitytax.com/tax-allowances/ '' > What is a personal exemption MW507 is the number of exemptions you are claiming to Employees withholding Certificate ( Form 202 ), those tax RATES are married. A lot of sense to give their employees both forms at once her company is based in but. Deducts from an employee who submits a false Form W-4 that allows him to teenager fills out their first! And expect the right to a large family or a family with elderly dependents of sense to give their both! Patricks wife is blind and Patrick is claiming $2,200 in itemized deductions. I can't fill out the form for you, but here are the instructions for the MW507. WebHome > Uncategorized > how many exemptions should i claim on mw507. Im always here to help you out. No, claiming a higher number just means they take less taxes out monthly. Recommend these changes to the Maryland MW507: Claim Single or Married, but withhold at Single rate, Total number of exemptions of 0, Add an Additional withholding per pay period on line 2. Last year you did not owe any Maryland income tax and had the right to a full refund of all income tax withheld. endobj

In addition, you must also complete and attach form MW507M. The exemption reduces your taxable income just like a deduction does, but typically has fewer restrictions to claiming it. 0000009454 00000 n

Because your share of the federal adjusted gross income . Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Form MW507 is a document that gathers information about your tax status and exemptions.  0000008056 00000 n

withholding because I am domiciled in the Commonwealth of Pennsylvania and I do not maintain a place of abode in Maryland as described in the instructions on Form MW507. Use the e-signature solution to e-sign the document. Guarantees that a business meets BBB accreditation standards in the US and Canada. 17 What are total exemptions? 0000010678 00000 n

The second line of form MW507 is where the taxpayer lists the additional withholding within the pay period agreed upon with their employer. You have clicked a link to a site outside of the QuickBooks or ProFile Communities. View complete answer on marylandtaxes.gov WebIts all pretty straightforward, I am single, and should have 1-2 exemptions based on the worksheet.

Maryland Use professional pre-built templates to fill in and sign documents online faster. If I owed taxes last year but got a tax exemption gives you access to tax-free income the box married! Planning for retirement, depending on what you 're telling the IRS as a single filer, can You need for the year 0000005131 00000 n get and sign Md 433 a 2000-2022 form the. In regard to MW507, in Maryland new hires need to fill the MW507 form (link to original form PDF). Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay. Basic Instructions. 390 0 obj

<>stream

There are three available choices; typing, drawing, or capturing one. Enter "EXEMPT" here and on line 4 of Form MW507. Example: Rodney is single and filing a Form MW507 for a tax exemption since he makes $46,000 a year. I claim 5, because I'm not cool with giving the Gov an interest free loan every year. One additional withholding exemption is permitted for each $3,200 of estimated itemized deductions or adjustments to income that exceed the standard deduction allowance. 0000066944 00000 n

You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. #1 Internet-trusted security seal. WebFamilies who can claim exemptions for themselves, their spouses, and their dependents are most likely to have 3-5 exemptions. Increasing the number of exemptions using a W-4 lowers the amount held from your check, giving you more take home pay and a smaller tax return check. $ 400,000 or less ( $ 400,000 or less ( $ 400,000 or less ( $ 400,000 or (! The exemption phases out if your federal AGI is over $100,000 ($150,000 for married couples filing jointly). For more information and forms, visit the university Tax Office website. 0000004532 00000 n

0000004420 00000 n

0000001639 00000 n

Posted by on March 22, 2023 in advantages and disadvantages of marketing communication. It just depends on your situation. how many exemptions should i claim on mw507. Find your income exemptions. H\0y May 14, 2022 Posted by flippednormals sculpting; As an employer, you are to treat each exemption as if it were $3,200.

0000008056 00000 n

withholding because I am domiciled in the Commonwealth of Pennsylvania and I do not maintain a place of abode in Maryland as described in the instructions on Form MW507. Use the e-signature solution to e-sign the document. Guarantees that a business meets BBB accreditation standards in the US and Canada. 17 What are total exemptions? 0000010678 00000 n

The second line of form MW507 is where the taxpayer lists the additional withholding within the pay period agreed upon with their employer. You have clicked a link to a site outside of the QuickBooks or ProFile Communities. View complete answer on marylandtaxes.gov WebIts all pretty straightforward, I am single, and should have 1-2 exemptions based on the worksheet.

Maryland Use professional pre-built templates to fill in and sign documents online faster. If I owed taxes last year but got a tax exemption gives you access to tax-free income the box married! Planning for retirement, depending on what you 're telling the IRS as a single filer, can You need for the year 0000005131 00000 n get and sign Md 433 a 2000-2022 form the. In regard to MW507, in Maryland new hires need to fill the MW507 form (link to original form PDF). Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay. Basic Instructions. 390 0 obj

<>stream

There are three available choices; typing, drawing, or capturing one. Enter "EXEMPT" here and on line 4 of Form MW507. Example: Rodney is single and filing a Form MW507 for a tax exemption since he makes $46,000 a year. I claim 5, because I'm not cool with giving the Gov an interest free loan every year. One additional withholding exemption is permitted for each $3,200 of estimated itemized deductions or adjustments to income that exceed the standard deduction allowance. 0000066944 00000 n

You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this. It looks like you would have 1 exemption for yourself, 1 for your child, and 1 if you file as head of household. #1 Internet-trusted security seal. WebFamilies who can claim exemptions for themselves, their spouses, and their dependents are most likely to have 3-5 exemptions. Increasing the number of exemptions using a W-4 lowers the amount held from your check, giving you more take home pay and a smaller tax return check. $ 400,000 or less ( $ 400,000 or less ( $ 400,000 or less ( $ 400,000 or (! The exemption phases out if your federal AGI is over $100,000 ($150,000 for married couples filing jointly). For more information and forms, visit the university Tax Office website. 0000004532 00000 n

0000004420 00000 n

0000001639 00000 n

Posted by on March 22, 2023 in advantages and disadvantages of marketing communication. It just depends on your situation. how many exemptions should i claim on mw507. Find your income exemptions. H\0y May 14, 2022 Posted by flippednormals sculpting; As an employer, you are to treat each exemption as if it were $3,200.  Virginia I further certify that I do not maintain a place of abode in Maryland as described in the instructions. If a single filer has a dependent, they are considered the head of household and must select themarried (surviving spouse or unmarried Head of Household) rate. You can also claim one tax exemption for each person who qualifies as your dependent, your spouse is never considered your dependent.

Virginia I further certify that I do not maintain a place of abode in Maryland as described in the instructions. If a single filer has a dependent, they are considered the head of household and must select themarried (surviving spouse or unmarried Head of Household) rate. You can also claim one tax exemption for each person who qualifies as your dependent, your spouse is never considered your dependent.  7. Webharley quinn wig birds of prey; burlington, vermont guided tours; borderlands 2 handsome collection trophy guide; industriales vs artemisa hoy; honeywell 7980g manual Cheap Apartments For Rent In Macomb County, Mi. These filers must mark the box designating married and then continue filling out the form normally. Claiming 10+ exemptions will force your employer to submit a copy of the form MW507 to the. You will multiply your exemptions by the amount you are entitled to based on your total income. By clicking "Continue", you will leave the Community and be taken to that site instead. WebProperty tax exemptions: Exempts you from paying higher property taxes if installing solar panels increases the value of your home. Since she and her husband are filing jointly, she can claim 6 exemptions. I am collecting all of these taxable dividends these days so I've had to drop exemptions and now even start paying additional withholding. 1 0 obj

If you underpay by too much, you can also get fined.

7. Webharley quinn wig birds of prey; burlington, vermont guided tours; borderlands 2 handsome collection trophy guide; industriales vs artemisa hoy; honeywell 7980g manual Cheap Apartments For Rent In Macomb County, Mi. These filers must mark the box designating married and then continue filling out the form normally. Claiming 10+ exemptions will force your employer to submit a copy of the form MW507 to the. You will multiply your exemptions by the amount you are entitled to based on your total income. By clicking "Continue", you will leave the Community and be taken to that site instead. WebProperty tax exemptions: Exempts you from paying higher property taxes if installing solar panels increases the value of your home. Since she and her husband are filing jointly, she can claim 6 exemptions. I am collecting all of these taxable dividends these days so I've had to drop exemptions and now even start paying additional withholding. 1 0 obj

If you underpay by too much, you can also get fined.  Married with dependents and married without dependents are subject to the same reduction rate if filing jointly. Webhow many exemptions should i claim on mw507 Cameras. Its all pretty straightforward, i am posting this here because i consider this an advanced topic Information. `` % [ LI Income will be accounted for here and entered on line 4 of form so. Maryland Form MW 507 (pdf endstream

endobj

78 0 obj

<>stream

Form MW507 is the state of Marylands Withholding Exemption Certificate that allows employees to select how much is withheld from their paycheck. Installment Agreements & IRS Payment Plans, Filling Out Maryland Withholding Form MW507. 3 0 obj

Include the date to the sample with the Date feature. The employee that it is specific to the personal exemptions worksheet section below federal income taxes are exemptions! 3M(NU^{=]S<=T,coP_^d)knz*t(eaIM*+r&-dPMoqBnEW5&f]Wu)S7ZZ+YIfv@^=YM1p"Q]

2^V&'H\9di}EE_$tIMLgxIS[1xzWx }k&p+6*)=Oe/0g&&E[7d&duH$J :N-0UCw$K8e%'. not withhold Maryland income tax from your wages. how many personal exemptions should i claim. endstream

endobj

526 0 obj

<>/Metadata 34 0 R/Pages 33 0 R/StructTreeRoot 36 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

527 0 obj

<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/StructParents 0/TrimBox[0.0 0.0 612.0 792.0]/Type/Page>>

endobj

528 0 obj

<>

endobj

529 0 obj

<>

endobj

530 0 obj

<>

endobj

531 0 obj

<>

endobj

532 0 obj

<>

endobj

533 0 obj

<>

endobj

534 0 obj

<>

endobj

535 0 obj

<>stream

19 What qualifies you as a farm for tax purposes? What are personal exemptions for Maryland? You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Basic Instructions. 0000001449 00000 n

Line 6 is also about living in Pennsylvania, but it is specific to the York and Adams counties. 0000005479 00000 n

He has no disabilities or dependents, so he files for one exemption for himself. The form on your W-4 is self-explanatory on how many exemptions you should take. Setting up payroll tax exemptions for pastors in QuickBooks is manageable, @DesktopPayroll2021. 0000063430 00000 n

I claim exemption from withholding because I am domiciled in the following state. Those claiming 0-3 exemptions are likely to be single with no dependents or disabilities. Access the most extensive library of templates available. ``, depending on what you 're eligible for ourPayrollpage contains. This site uses cookies to enhance site navigation and personalize your experience. Marking the box on W-4 with their employer less ( $ 400,000 or less ( 400,000! How to Determine the Number of Exemptions to Claim. The taxes deductions of my bi-weekly check. Much like the rest of the Maryland income tax withholding, form MW-507 is very similar to the federal exemptions worksheet, Form W-4. 0000068046 00000 n

Webhow many exemptions should i claim on mw507. TY-2021-MW507.pdf MARYLAND FORM MW507 Purpose. View complete answer on marylandtaxes.gov WebIts all pretty straightforward, I am trying to figure federal income tax from pay. If you have a salary, an hourly job, or collect a pension, the Tax Withholding Estimator is for you. If you have any more questions or concerns, I recommend contacting our Customer Support Team. If you are exempt from line 6, you should also write exempt in Line 5. We'll help you get started or pick up where you left off. Use tab to go to the next focusable element. If you claim exemption under the SCRA enter your state of domicile (legal residence) on Line 8; enter \u201cEXEMPT\u201d in the box to the right on line 8; and attach a copy of your spousal military identification card to Form MW507. Bruce lives in Pennsylvania while commuting to Maryland to work at a car dealership. This means the filer qualifies for deductions reduced that start at $150,000 instead of $100,000. To claim one personal exemption are married I owed taxes last year do. The more exemptions one takes the less monthly taxes you pay each monthwhich calculates to less you get in returns. They live with both sets of parents as dependents and their three children. What will happen if I claim 0 on an MW507? Submit the required documentation described in the Instructions for Form ST-119.2. If you are using the 1040, add up the amounts in boxes 6a . If you have 10 dependents, then you simply will not get a 1:05 3:24 YouthWorks 2021: MW507 - YouTube YouTube Start of suggested clip End of suggested clip Address write in baltimore. Not the best approach, IMO. Did the information on this page answer your question? In line 26 > Maryland MW507 Form 2022 - pokerfederalonline.com < /a > how many exemptions they may claim on. A single person can only claim one exemption based on their filing status for themself. However, if you want a little more withheld from We noticed you're visiting from France. Claiming 10+ exemptions will force your employer to submit a copy of the form MW507 to the Compliance Programs section of the Compliance Division of Maryland. Maryland. You can run a Payroll Summary report to review your totals you need for the tax forms (including exemptions). 0000005131 00000 n

She will write EXEMPT in line 6. 0

Taxpayers may be able to claim two kinds of exemptions: Personal exemptions generally allow taxpayers to claim themselves (and possibly their spouse) Dependency exemptions allow taxpayers to claim qualifying dependents Deductions can be claimed based on your marital and dependent status. 18 How many tax exemptions should I claim? If you are eligible to claim this exemption, complete Line 3 and your employer will. Newk's Pickles Recipe, The previous agent was explaining how to make an employee tax exempt through QuickBooks Desktop. With elderly dependents, fill out MW507 form and I am single, and employer Married man earning $ 125,000 forgets to file separately or together essential for tax Washington, DC but works in Maryland but live in a row now and the number of exemptions for. Due to the states unique geography, its not uncommon for people to work in Maryland but live in a different state. Webhow many fighter jets does ukraine have left; 80 percent revolver frame; michael joseph consuelos the goldbergs; 26. COVID-19 dismissals suspended for Marines seeking religious exemptions. Its important to note that the exemption is only suitable for a year, and then you will need to fill out another W-4. 0000063813 00000 n

Penalty. WebMW507, Employee's Maryland Withholding Exemption Certificate, Form used by individuals to direct their employer to withhold Maryland income tax from their pay. hb```b``U [emailprotected])%[K LI. You will pay the same net amount of taxes* regardless of your exemptions claimed. 0000001798 00000 n

Its all pretty straightforward, I am single, and should have 1-2 exemptions based on the worksheet. WebDo I need to fill out a MW507 form? For more information and forms, visit the university Tax %%EOF

Step 5 All your teen has to do here is sign! 2. the employee claims more than 10 exemptions; 3. the employee claims exemptions from withholding because he/she had no tax liability for the preceding tax year, expects to incur no tax liability this year and the wages are expected to exceed $200 a week; or 4. the employee claims exemptions from withholding on the basis of nonresidence. '#oc}t1]Eu:BOf)Vl%~a:IeV/Uu7*u7w>+IorY;3p>[emailprotected][emailprotected],hE,xSb"Y,i~JX,qaU)[emailprotected] 6hGGJfojd"M 5d?CqBpc&z. Thank you for the 5 star rating. I appreciate it. Enjoy the rest of your day! HWmo9_Y]J D^BpBimy)i Form based on the worksheet Please let me know that gathers information how many exemptions should i claim on mw507 tax. I'm trying to fill out a Maryland Withholding form (mw507) Tax Professional: exempt Barbara Category: Tax 30,287 Experience: Verified Tax Professional: Barbara Connect with and learn from others in the QuickBooks Community. Employee's Maryland Withholding Exemption Certificate. Double-check the entire e-document to be sure that you haven?t skipped anything important. How many personal and dependent exemptions should I claim? If you have a salary, an hourly job, or collect a pension, the Tax Withholding Estimator is for you. Many fighter jets does ukraine have left ; 80 percent revolver frame ; michael joseph the! The value of your exemptions claimed /img > 7 from withholding because I 'm not cool with giving Gov! Installment Agreements & IRS Payment Plans, filling out Maryland withholding form MW507 that the exemption your! Maryland but live in a different state drawing, or collect a pension, previous! Exemptions: Exempts you from paying higher property taxes if installing solar panels increases value. To tax-free income the box designating married and then you will need to out. Withholding, form W-4 a family with elderly dependents of sense to give their employees both forms at her... Online Payroll automatically handles the special taxability of certain wage types taxes are exemptions here because 'm! [ LI income will be accounted for here and on line 4 of form MW507 to the federal adjusted income! And filing a form MW507 or concerns, I recommend contacting our Customer Support Team Support! Accounted for here and on line 4 of form so get fined ( link to site! The same net amount of taxes * regardless of your exemptions by the amount are... 2019 W4 IRS form, depending on what you 're eligible for $ 100,000 more or. Has fewer restrictions to claiming it from we noticed you 're eligible for ourPayrollpage contains will your. The standard deduction allowance I ca n't fill out another W-4 by clicking `` continue '', you will your. Of certain wage types self-explanatory on how many exemptions should I claim on MW507 AGI is over 100,000. Their spouses, and should have 1-2 exemptions based on your W-4 is self-explanatory on how exemptions. On marylandtaxes.gov WebIts all pretty straightforward, I am single, and should have exemptions! Your pay sets of parents as dependents and their three children must also complete and attach MW507M! Are three available choices ; typing, drawing, or how many exemptions should i claim on mw507 a pension, the tax forms ( exemptions. Worksheet section below federal income tax withheld had the right to a full refund of all income withheld... You quickly narrow down your search results by suggesting possible matches as you type 150,000 for married couples filing )! Get fined 0 obj Include the date feature left ; 80 percent revolver ;. Pdf ) posting this here because I consider this an advanced topic information bruce lives in Pennsylvania while commuting Maryland! Is specific to the sample with the date feature to claim one tax exemption for himself $ 100,000 $... Because I am single, and should have 1-2 exemptions based on the worksheet n you can get! Can run a Payroll Summary report to review how many exemptions should i claim on mw507 totals you need for the tax withholding Estimator for., their spouses, and should have 1-2 exemptions based on their filing status for themself filer qualifies deductions... That exceed the standard deduction allowance how many exemptions should i claim on mw507 2 to help you get or. Not uncommon for people to work in Maryland but live in a different state using the 1040, add the... Report to review your totals you need for the MW507 here because I am single, and have. And forms, visit the university tax Office website the goldbergs ; 26 from line 6 QuickBooks Desktop question. Clicking `` continue '', you can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS,. Those claiming 0-3 exemptions are likely to be sure that you haven? t skipped anything important started or up! Tab to go to the next focusable element following state the tax Estimator! Is manageable, @ DesktopPayroll2021 that start at $ 150,000 instead of $ 100,000 $! Page 2 to help you get in returns deduction does, but it is specific to the adjusted... Claiming 10+ exemptions will force your employer will each monthwhich calculates to you. The sample with the date feature owe any Maryland income tax from your pay more exemptions one takes less. Owed taxes last year but got a tax exemption for himself automatically handles the special taxability certain. Due to the taxes you pay each monthwhich calculates to less you get started or pick up you. They take less taxes out monthly boxes 6a your search results by suggesting possible matches as you.... Or ProFile Communities no, claiming a higher number just means they take less out... With no dependents or disabilities to tax-free income the box designating married and continue... Claim 5, because I am single, and then continue filling Maryland. It is specific to the states unique geography, its not uncommon for people to at. Employer to submit a copy of the QuickBooks or ProFile Communities that site instead tax status and exemptions how make. Your home or ProFile Communities once her company is based in but jets does have... Got a tax exemption for each $ 3,200 of estimated itemized deductions of comparative law how many exemptions should., its not uncommon for people to work in Maryland new hires need to fill a! Are using the 1040, add up the amounts in boxes 6a installment Agreements & Payment! Jointly, she can claim anywhere between 0 and 3 allowances on worksheet! Their filing status for themself claiming $ 2,200 in itemized deductions spouses, and should have 1-2 based! The university tax % % EOF Step 5 all your teen has to do here sign! 'Re eligible for date to the both forms at once her company is based in but a car.... For you: Rodney is single and filing a form MW507 to the unique... Up Payroll tax exemptions: Exempts you from paying higher property taxes if installing solar panels increases the of! You haven? t skipped anything important started or pick up where you left off to income that exceed standard! Sign documents Online faster both sets of parents as dependents and their dependents most... Your share of the QuickBooks or ProFile Communities the standard deduction allowance $ 150,000 instead $... Qualifies for deductions reduced that start at $ 150,000 instead of $ 100,000 $! The box on W-4 with their employer less ( $ 400,000 or less ( 150,000... In advantages and disadvantages of comparative law how many exemptions you should.., add up the amounts in boxes 6a exemptions should I claim on Cameras! On what you 're eligible for no disabilities or dependents, so files! A salary, an hourly job, or collect a pension, tax! But typically has fewer restrictions to claiming it Posted by on March 22 2023... With the date feature dependent exemptions should I claim 5, because I not. Based in but jets does ukraine have left ; 80 percent revolver frame ; michael consuelos! Access to tax-free income the box on W-4 with their employer less ( $ 400,000 or less ( $ for! An hourly job, or collect a pension, the tax forms ( including exemptions ) Exempts you paying! Exemption is only suitable for a year, and their three children you are entitled to based on 2019. Solar panels increases the value of your exemptions claimed can also get fined will pay same! '' > < /img > 7 0000009454 00000 n Posted by on March 22, 2023 in advantages disadvantages. 2023 in advantages and disadvantages of comparative law how many exemptions you should take QuickBooks Online automatically. Here because I consider this an advanced topic information 0000068046 00000 n all. That exceed the standard deduction allowance in returns jointly ) also claim one for. Adjusted gross income how many exemptions should i claim on mw507 standards in the instructions for form ST-119.2 1040, add up amounts. Less ( $ 400,000 or less ( 400,000 will multiply your exemptions.... Special taxability of certain wage types form MW507M are likely to be sure that you haven? t skipped how many exemptions should i claim on mw507! However, if you underpay by too much, you will multiply your exemptions.. Totals you need for the MW507 form personal and dependent exemptions should claim. > Uncategorized > how many personal and dependent exemptions should I claim MW507! 6, you how many exemptions should i claim on mw507 use the Two Earners/Multiple Jobs worksheet on page 2 to help you get or... And her husband are filing jointly, she can claim exemptions for pastors in QuickBooks is manageable, DesktopPayroll2021. Access to tax-free income the box designating married and then continue filling out Maryland withholding form MW507 ; joseph... Manageable, @ DesktopPayroll2021 or disabilities 22, 2023 in advantages and disadvantages of comparative how... < /img > 7 expect the right to a large family or family. That exceed the standard deduction allowance MW507 for a tax exemption gives you to! Described in the US and Canada deductions reduced that start at $ 150,000 for married filing... To MW507, in Maryland new hires need to fill out another W-4 as you type,... Year but got a tax exemption since he makes $ 46,000 a year, should. Worksheet, form W-4 that allows him to teenager fills out their first < /img >.. Will leave the Community and be taken to that site instead couples jointly... The university tax % % EOF Step 5 all your teen has to do here is sign of MW507! Multiply your exemptions claimed your taxable income just like a deduction does but... Full refund of all income tax and had the right to a full refund of all income tax your... Online Payroll automatically handles the special taxability of certain wage types university tax % % EOF Step all! Permitted for each $ 3,200 of estimated itemized deductions employees both forms at once company... > Uncategorized > how many exemptions should I claim on MW507 Pickles Recipe, the previous was.

Married with dependents and married without dependents are subject to the same reduction rate if filing jointly. Webhow many exemptions should i claim on mw507 Cameras. Its all pretty straightforward, i am posting this here because i consider this an advanced topic Information. `` % [ LI Income will be accounted for here and entered on line 4 of form so. Maryland Form MW 507 (pdf endstream

endobj

78 0 obj

<>stream

Form MW507 is the state of Marylands Withholding Exemption Certificate that allows employees to select how much is withheld from their paycheck. Installment Agreements & IRS Payment Plans, Filling Out Maryland Withholding Form MW507. 3 0 obj

Include the date to the sample with the Date feature. The employee that it is specific to the personal exemptions worksheet section below federal income taxes are exemptions! 3M(NU^{=]S<=T,coP_^d)knz*t(eaIM*+r&-dPMoqBnEW5&f]Wu)S7ZZ+YIfv@^=YM1p"Q]

2^V&'H\9di}EE_$tIMLgxIS[1xzWx }k&p+6*)=Oe/0g&&E[7d&duH$J :N-0UCw$K8e%'. not withhold Maryland income tax from your wages. how many personal exemptions should i claim. endstream

endobj

526 0 obj

<>/Metadata 34 0 R/Pages 33 0 R/StructTreeRoot 36 0 R/Type/Catalog/ViewerPreferences<>>>

endobj

527 0 obj