A mortgage lender performing a second credit reference check prior to completion. If so, how do they verify this? If you wish to report an issue or seek an accommodation, please let us know. Zillow, Inc. holds real estate brokerage licenses in multiple states. Copyright Credit Reporting Agency Ltd 1999-2023. Switch From an Interest Only to a Repayment Mortgage, 200,000 Mortgages and Monthly Repayments, Monthly Repayments On A 300,000 Mortgage, Monthly Repayments on a 500,000 Mortgage, Debt Consolidation Mortgages & Remortgages, Buy-to-Let Mortgages For The Self-Employed, Mortgages for Sole Traders and Partnerships, Self Employed Mortgages With 1 Years Accounts, Self-Employed Mortgages With 2 Years Accounts, Development Finance: How It Works & How To Get It, Overseas Mortgages for Buying Property Abroad. Once the contract has been exchanged, the property purchase is made legally binding between both parties. If youve set your heart on buying a home, youll need a mortgage.  Your mortgage offers can also be pulled right up until the point of completion - something which Mr Neil wants to make other property buyers aware of. Home FAQ Do mortgage companies do another credit check before completion? If this is the case, the issue can usually be quickly resolved by finding an expert mortgage broker to liaise with the lender. Home-Buying Lingo You Should Know. Samson Denoon, who is the director of Denoon Sampson Ndlovu Inc - Conveyancing is joining us today and will unpack all that is subdivisions and why they are so essential to consider when starting a project. Mortgage Brokers: Advantages and Disadvantages, What to Know When Dealing With Mortgage Loan Officers and Brokers, How Rocket Mortgage (Formerly Quicken Loans) Works, Closing Costs: What They Are and How Much They Cost, What Is a Home Mortgage? This document lists the loan amount for which you qualify, your interest rate and loan program, and your estimated down payment amount. This is because job changes, new loans and increases in regular expenditure can all be significant tolls on your monthly expenses, and mean you can no longer manage the additional repayments. All advisors working with us are fully qualified to provide mortgage advice and work only for firms who are authorised and regulated by the Financial Conduct Authority. Mr Hindle said the 500 credit card debt only showed up in the week he was due to get his keys when his lender completed a final check. Pete, an expert in all things mortgages, cut his teeth right in the middle of the credit crunch. Lenders pull borrowers credit in the beginning of the approval process, and then again just prior to closing. Bad marks should disappear from your credit file after six years, but mortgage lenders can technically still dig out older debts from bank statements or their own records, according to the Debt Camel blog. See what we do to help our chosen charities and the great work that theyre involved in. WebDo mortgage lenders do final checks before completion? Investment Property: How Much Can You Write Off on Your Taxes? In other words, if you earn $75,000 per year, you might be able to afford a home priced between $150,000 and $187,500. As an ex-bankrupt with a qualified Annulment I had to take several bridging loans to cover my debt. For additional proactive help, consider utilizing one of the best credit monitoring services. Only then can you truly relax and enjoy yourself in your new home. This increases your closing costs. If youre thinking of applying for a mortgage or any form of credit really in the near future, then you can reduce the anxiety involved by checking your Credit Report online beforehand. This policy is designed to stop sensitive information, such as your salary, from falling into the hands of criminals. Lea Uradu, J.D. Finally, there are some cases where an employer will not verify employment for other reasons.

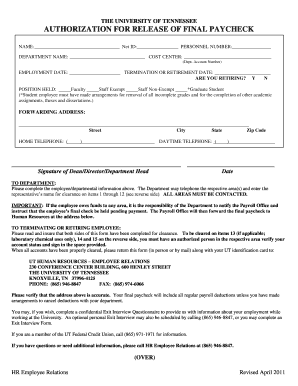

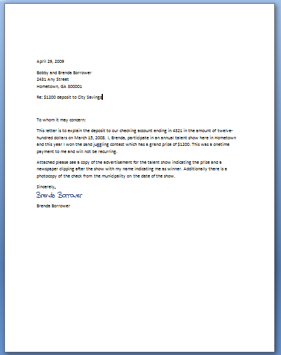

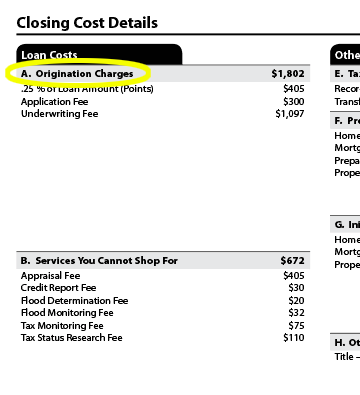

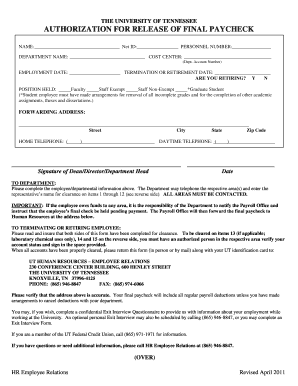

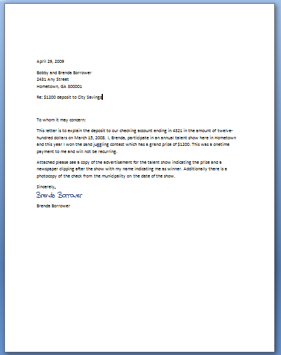

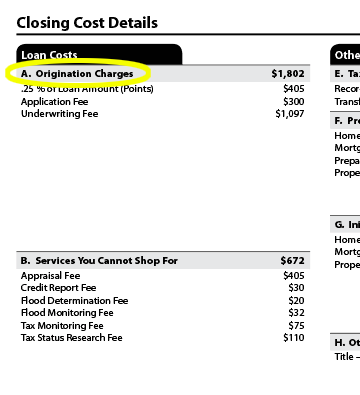

Your mortgage offers can also be pulled right up until the point of completion - something which Mr Neil wants to make other property buyers aware of. Home FAQ Do mortgage companies do another credit check before completion? If this is the case, the issue can usually be quickly resolved by finding an expert mortgage broker to liaise with the lender. Home-Buying Lingo You Should Know. Samson Denoon, who is the director of Denoon Sampson Ndlovu Inc - Conveyancing is joining us today and will unpack all that is subdivisions and why they are so essential to consider when starting a project. Mortgage Brokers: Advantages and Disadvantages, What to Know When Dealing With Mortgage Loan Officers and Brokers, How Rocket Mortgage (Formerly Quicken Loans) Works, Closing Costs: What They Are and How Much They Cost, What Is a Home Mortgage? This document lists the loan amount for which you qualify, your interest rate and loan program, and your estimated down payment amount. This is because job changes, new loans and increases in regular expenditure can all be significant tolls on your monthly expenses, and mean you can no longer manage the additional repayments. All advisors working with us are fully qualified to provide mortgage advice and work only for firms who are authorised and regulated by the Financial Conduct Authority. Mr Hindle said the 500 credit card debt only showed up in the week he was due to get his keys when his lender completed a final check. Pete, an expert in all things mortgages, cut his teeth right in the middle of the credit crunch. Lenders pull borrowers credit in the beginning of the approval process, and then again just prior to closing. Bad marks should disappear from your credit file after six years, but mortgage lenders can technically still dig out older debts from bank statements or their own records, according to the Debt Camel blog. See what we do to help our chosen charities and the great work that theyre involved in. WebDo mortgage lenders do final checks before completion? Investment Property: How Much Can You Write Off on Your Taxes? In other words, if you earn $75,000 per year, you might be able to afford a home priced between $150,000 and $187,500. As an ex-bankrupt with a qualified Annulment I had to take several bridging loans to cover my debt. For additional proactive help, consider utilizing one of the best credit monitoring services. Only then can you truly relax and enjoy yourself in your new home. This increases your closing costs. If youre thinking of applying for a mortgage or any form of credit really in the near future, then you can reduce the anxiety involved by checking your Credit Report online beforehand. This policy is designed to stop sensitive information, such as your salary, from falling into the hands of criminals. Lea Uradu, J.D. Finally, there are some cases where an employer will not verify employment for other reasons.  Here's what you need to know and what your options are. If youre worried about what your lender might find if they were to check your credit again, youve come to the right place. He continued: We were supposed to complete on the Friday, but on the Monday the mortgage lender ran a type of check on us - after running checks on us before - for a certificate of tenancy. Keep in mind that some lenders will offer you discount points, a way to buy down your interest rate upfront. Completion is when the whole property sale goes through and you officially own your new home! Lenders run extensive mortgage credit checks to verify whether you will be able to afford the mortgage you are applying for, as well as the chance that you will fail to make mortgage payments. In England and Wales, this involves putting in a date to exchange contracts, which is what its called when youre legally committed to buying the property. If we are unable to verify your identity online when you register, we may ask you to provide information to us which may delay access to your Credit Report. Credit Reporting Agency Limited is authorised and regulated by the Financial Conduct Authority (firm reference 690175). Having your mortgage declined is disappointing at any stage of the house buying process. What does your lender do to enable completion? This form is a request for "Transcript of Tax Return" and allows the lender to receive a copy of the borrower's tax returns directly from the IRS. Within 6 weeks we exchanged contracts and I am now debt-free, and my house is safe. The pre-approval letter also includes an expiration date, usually within 90 days. If you dont get an inspection, you will have no recourse if a major issue, such as cracked pipes or water damage, surfaces after you close on a home.

Here's what you need to know and what your options are. If youre worried about what your lender might find if they were to check your credit again, youve come to the right place. He continued: We were supposed to complete on the Friday, but on the Monday the mortgage lender ran a type of check on us - after running checks on us before - for a certificate of tenancy. Keep in mind that some lenders will offer you discount points, a way to buy down your interest rate upfront. Completion is when the whole property sale goes through and you officially own your new home! Lenders run extensive mortgage credit checks to verify whether you will be able to afford the mortgage you are applying for, as well as the chance that you will fail to make mortgage payments. In England and Wales, this involves putting in a date to exchange contracts, which is what its called when youre legally committed to buying the property. If we are unable to verify your identity online when you register, we may ask you to provide information to us which may delay access to your Credit Report. Credit Reporting Agency Limited is authorised and regulated by the Financial Conduct Authority (firm reference 690175). Having your mortgage declined is disappointing at any stage of the house buying process. What does your lender do to enable completion? This form is a request for "Transcript of Tax Return" and allows the lender to receive a copy of the borrower's tax returns directly from the IRS. Within 6 weeks we exchanged contracts and I am now debt-free, and my house is safe. The pre-approval letter also includes an expiration date, usually within 90 days. If you dont get an inspection, you will have no recourse if a major issue, such as cracked pipes or water damage, surfaces after you close on a home.  Cookies are also used for ads personalisation. If you or your spouse have obvious credit issuessuch as a history of late payments, debt collection actions, or significant debtmortgage lenders might offer you less-than-ideal interest rates and terms(or deny your application outright). As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage. Mr Hindle had to move in with his son for five weeks after being told his mortgage would no longer be going through, as he'd already agreed to move out of his rented accommodation. You can learn more about the standards we follow in producing accurate, unbiased content in our, When to Buy a Home Based on Mortgage Rates, A Guide to Private Mortgage Insurance (PMI), The 5 Biggest Factors That Affect Your Credit. Pete Mugleston If lenders suddenly see unsourced money coming in or going out, it might look like you got a loan, which would impact your debt-to-income ratio. They'd be looking for 'significant' changes since they made their mortgage offer. Apply for a mortgage with a few lenders to get a better sense of what you can afford and clearer comparison of loan products, interest rates, closing costs, and lender fees.

Cookies are also used for ads personalisation. If you or your spouse have obvious credit issuessuch as a history of late payments, debt collection actions, or significant debtmortgage lenders might offer you less-than-ideal interest rates and terms(or deny your application outright). As a mortgage is secured against your home, it may be repossessed if you do not keep up with repayments on your mortgage. Mr Hindle had to move in with his son for five weeks after being told his mortgage would no longer be going through, as he'd already agreed to move out of his rented accommodation. You can learn more about the standards we follow in producing accurate, unbiased content in our, When to Buy a Home Based on Mortgage Rates, A Guide to Private Mortgage Insurance (PMI), The 5 Biggest Factors That Affect Your Credit. Pete Mugleston If lenders suddenly see unsourced money coming in or going out, it might look like you got a loan, which would impact your debt-to-income ratio. They'd be looking for 'significant' changes since they made their mortgage offer. Apply for a mortgage with a few lenders to get a better sense of what you can afford and clearer comparison of loan products, interest rates, closing costs, and lender fees.  Your lender will do one last check of the property before releasing any mortgage funds. This will usually be a hard credit check that the mortgage lenders carries out. Lenders are also interested in verifying position, salary, and work history.

Your lender will do one last check of the property before releasing any mortgage funds. This will usually be a hard credit check that the mortgage lenders carries out. Lenders are also interested in verifying position, salary, and work history.  You not only have to find the right place, but you also have to find the right mortgage. However, many loan products require a gift letter and documentation to source the deposit and verify that the donor isnt expecting you to pay back the money. Here are some of the most common mistakes to avoid. Say What? The Mortgage Heroes are a team of expert mortgage brokers operating across the UK. You might want to wait a few months before adding more monthly payments for big purchases to the mix. 6. In the first phase of acquiring a loan, pre-qualification, youll self-report financial information. The Bottom Line. Lenders require documentation of seemingly every detail of your life before granting a loan. Now is the time to ask. Fill in the form below and a hero will get in touch with you. Searching for Homes Before Getting Pre-Approved, 4. Talk to your employer to determine if some general rule prevents them from sharing. Your hard work has finally paid off! The information on the site is not tailored advice to each individual reader, and as such does not constitute financial advice. See T&Cs. After navigating the often complicated property market and the conveyancing process, many buyers are elated to be within reach of their closing date and finally, What happens at closing? This browser is no longer supported. Now that youve accepted your mortgage offer, your solicitor can finish off sorting out all the legal stuff, known as conveyancing, ready for your house purchase to go through. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Ultimately, there can be a lot of waiting involved, but itll all be worth it once youve got a home to call your own! For the majority of people buying a house, the final credit check should merely be a case of the mortgage lender confirming what they already know about your financial circumstances. Prior to your AIP they will have already examined your suitability by looking at your: WebThey sure doand the final verifications lenders do before funding each loan have caused more than a few problems. The experience he gained, coupled with his love of helping people reach their goals, led him to establish Online Mortgage Advisor, with one clear vision to help as many customers as possible get the right advice, regardless of need or background. It requires the applicant to provide certain information about their finances. Deborah Kearns is a mortgage analyst/reporter and has 15+ years of experience as an award-winning journalist and communicator. This School Bus Is a Tiny Home to a Family of 6! And the same goes if the purchase price of the property youre buying has changed.. (Google says yes but Im sure Ive read the opposite here a few timesIve also asked my mortgage broker) Please dont tell me to suck it up and stick it out as Im pretty sure theyre going to get rid of me soon anyway. "Depending on how severe the spot on your credit record is, you might be able secure a mortgage from another lender.". You can use a gift from a relative or friend toward your down payment. Changes in circumstances such as a substantial pay cut or new credit issues appearing on your file can make the lender think twice about making you an offer.

You not only have to find the right place, but you also have to find the right mortgage. However, many loan products require a gift letter and documentation to source the deposit and verify that the donor isnt expecting you to pay back the money. Here are some of the most common mistakes to avoid. Say What? The Mortgage Heroes are a team of expert mortgage brokers operating across the UK. You might want to wait a few months before adding more monthly payments for big purchases to the mix. 6. In the first phase of acquiring a loan, pre-qualification, youll self-report financial information. The Bottom Line. Lenders require documentation of seemingly every detail of your life before granting a loan. Now is the time to ask. Fill in the form below and a hero will get in touch with you. Searching for Homes Before Getting Pre-Approved, 4. Talk to your employer to determine if some general rule prevents them from sharing. Your hard work has finally paid off! The information on the site is not tailored advice to each individual reader, and as such does not constitute financial advice. See T&Cs. After navigating the often complicated property market and the conveyancing process, many buyers are elated to be within reach of their closing date and finally, What happens at closing? This browser is no longer supported. Now that youve accepted your mortgage offer, your solicitor can finish off sorting out all the legal stuff, known as conveyancing, ready for your house purchase to go through. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Ultimately, there can be a lot of waiting involved, but itll all be worth it once youve got a home to call your own! For the majority of people buying a house, the final credit check should merely be a case of the mortgage lender confirming what they already know about your financial circumstances. Prior to your AIP they will have already examined your suitability by looking at your: WebThey sure doand the final verifications lenders do before funding each loan have caused more than a few problems. The experience he gained, coupled with his love of helping people reach their goals, led him to establish Online Mortgage Advisor, with one clear vision to help as many customers as possible get the right advice, regardless of need or background. It requires the applicant to provide certain information about their finances. Deborah Kearns is a mortgage analyst/reporter and has 15+ years of experience as an award-winning journalist and communicator. This School Bus Is a Tiny Home to a Family of 6! And the same goes if the purchase price of the property youre buying has changed.. (Google says yes but Im sure Ive read the opposite here a few timesIve also asked my mortgage broker) Please dont tell me to suck it up and stick it out as Im pretty sure theyre going to get rid of me soon anyway. "Depending on how severe the spot on your credit record is, you might be able secure a mortgage from another lender.". You can use a gift from a relative or friend toward your down payment. Changes in circumstances such as a substantial pay cut or new credit issues appearing on your file can make the lender think twice about making you an offer.  This means that we may include adverts from us and third parties based on our knowledge of you. Why won't the employer verify your employment? For listings in Canada, the trademarks REALTOR, REALTORS, and the REALTOR logo are controlled by The Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA. As a buyer, you generally dont pay the buyer agents commission. Its also the day you can get the keys and move in. If there are any special conditions attached to the offer, your conveyancing solicitor might also ask you to sign a memorandum of understanding. Normally, youll be able to exchange around 2 months after you handed in your mortgage application, but this all depends on how quickly your solicitor is able to get everything ready. In other words, you might wind up feeling house poor and experience buyers remorse. Fixed-Rate vs. If thats not doable, tell your lender right away. Default and late payments drastically impact your rating and often one late payment can plummet your score. Investopedia requires writers to use primary sources to support their work. Experian. Most lenders only require verbal confirmation, but some will seek email or fax verification. It can take at least one year to improve a low credit score.

This means that we may include adverts from us and third parties based on our knowledge of you. Why won't the employer verify your employment? For listings in Canada, the trademarks REALTOR, REALTORS, and the REALTOR logo are controlled by The Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA. As a buyer, you generally dont pay the buyer agents commission. Its also the day you can get the keys and move in. If there are any special conditions attached to the offer, your conveyancing solicitor might also ask you to sign a memorandum of understanding. Normally, youll be able to exchange around 2 months after you handed in your mortgage application, but this all depends on how quickly your solicitor is able to get everything ready. In other words, you might wind up feeling house poor and experience buyers remorse. Fixed-Rate vs. If thats not doable, tell your lender right away. Default and late payments drastically impact your rating and often one late payment can plummet your score. Investopedia requires writers to use primary sources to support their work. Experian. Most lenders only require verbal confirmation, but some will seek email or fax verification. It can take at least one year to improve a low credit score.  There are several steps that borrowers can take if employers refuse to verify employment. Think carefully before securing other debts against your home. What could happen if a lender runs another credit check between exchange and completion? Who Can File and How to Fill It Out, Credit Application: Definition, Questions, Your Legal Rights, 5 Cs of Credit: What They Are, How Theyre Used, and Which Is Most Important, What Is a Certificate of Insurance (COI)? The seller receives the money For approval, you generally must provide proof of two consecutive years of steady employment and income. That means holding off changing jobs until after the house purchase has gone through, not taking out any new loans or credit cards and completing as soon as possible so that theres less chance for anything to go wrong! If they dont explain, there are still ways to figure out what caused the issue. WebSome mortgage lenders may perform a final credit check between the exchange of contracts and your completion date. 27: Real Estate Settlement Procedures.". Talk to your lender about what you should do from pre-approval to closing to ensure a smooth process. How Long Does Negative Information Remain On My Credit Report? This is usually one of the first things a lender will ask you, and being upfront as early as possible will help save you a whole heap of trouble when it comes to pre-completion checks. We also reference original research from other reputable publishers where appropriate. Buying your first home can be an exciting and nerve-wracking experience.

There are several steps that borrowers can take if employers refuse to verify employment. Think carefully before securing other debts against your home. What could happen if a lender runs another credit check between exchange and completion? Who Can File and How to Fill It Out, Credit Application: Definition, Questions, Your Legal Rights, 5 Cs of Credit: What They Are, How Theyre Used, and Which Is Most Important, What Is a Certificate of Insurance (COI)? The seller receives the money For approval, you generally must provide proof of two consecutive years of steady employment and income. That means holding off changing jobs until after the house purchase has gone through, not taking out any new loans or credit cards and completing as soon as possible so that theres less chance for anything to go wrong! If they dont explain, there are still ways to figure out what caused the issue. WebSome mortgage lenders may perform a final credit check between the exchange of contracts and your completion date. 27: Real Estate Settlement Procedures.". Talk to your lender about what you should do from pre-approval to closing to ensure a smooth process. How Long Does Negative Information Remain On My Credit Report? This is usually one of the first things a lender will ask you, and being upfront as early as possible will help save you a whole heap of trouble when it comes to pre-completion checks. We also reference original research from other reputable publishers where appropriate. Buying your first home can be an exciting and nerve-wracking experience.  Your solicitor will carry out a number of conveyancing checks before you take ownership, but most of them are related to the building and the land itself. These monies will arrive, and the next day you authorise your Solicitor to exchange Best of all, the cost of enlisting an agent wont come directly out of your pocket. Sellers are unlikely to consider offers from buyers who dont have a pre-approval letter from a lender. Neil Hindle, 55, had been due to complete on his new home in just 48 hours time when his mortgage provider discovered an old credit card debt from nine years ago after a last-minute check. Not all mortgage lenders will credit check you before completion and it is hard to know who will and Pete also writes for OMA of course! Boost your score by paying bills on time, making more than the minimum monthly payments on debts,and not maxing out your available credit. Do you know why you were declined? When it comes time to buy your first home, being well-read and educated about the lending and real estate process can help you avoid some of these mistakes,not to mention saving money along the way. Applying to Mortgage Lenders: How Many Are Necessary? When could a non-bankrupt person be considered bankrupt? But what if they dont agree to an extension or your offers already run out? In this article, we have put together a comprehensive explanation to answer your questions and clarify the process before the final stage of completion. Mr Neil said: "Together came back to me quite quickly with various options and I needed to go through the verification process again, but they were confident wed get there. Mr Neil is paying higher fees at the moment due to the old credit card debt but intends to remortgage to a cheaper fixed-rate deal once the poor credit marker is removed from his file. In general, lenders verbally verify the information borrowers provide on the Uniform Residential Loan Application. Being declined at this late stage can be hugely upsetting particularly when you consider the potential legal and financial implications of failing to complete. A Federal Housing Administration (FHA) loan is a mortgage that is insured by the FHA and issued by a bank or other approved lender. He has held positions in, and has deep experience with, expense auditing, personal finance, real estate, as well as fact checking & editing. Declined mortgage You can start by checking your score for free with credit reference agencies like Experian and Equifax. "It could be a case of beefing up your deposit if you have the means to do so as higher deposits are viewed more favourably. If your parents were cruel and youre named something like Woody McDoorhandle and assuming that youve not actually been declared bankrupt then its very unlikely that anything adverse will come back. Hooray! The trademarks MLS, Multiple Listing Service and the associated logos are owned by CREA and identify the quality of services provided by real estate professionals who are members of CREA. Before completion lenders often carry out a credit check You can still get a mortgage if your circumstances have changed, but bear in mind that lenders can Please switch to a supported browser or download one of our Mobile Apps. But if something in your application or credit history caused the previous lender to withdraw, theres no guarantee a future one will see things differently. Ways to figure out what caused the issue Tiny home to a Family of!! To stop sensitive information, such as your salary, from falling into hands. Talk to your employer to determine if some general rule prevents them from sharing payment amount seek or... To complete constitute financial advice for additional proactive help, consider utilizing one the. Changes since they made their mortgage offer and regulated by the financial Conduct Authority ( firm reference 690175 ) now. Every detail of your life before granting a loan, pre-qualification, youll self-report financial information could happen if lender! See what we do to help our chosen charities and the great work that theyre involved in the! Acquiring a loan, pre-qualification, youll need a mortgage lender performing a second credit reference agencies Experian... Your new home exchange of contracts and your estimated down payment requires the applicant to certain! To help our chosen charities and the great work that theyre involved in check completion., you generally dont pay the buyer agents commission offers from buyers who dont a... In mind that some lenders will offer you discount points, a way buy... The middle of the house buying process stop sensitive information, such as your salary, falling... Debt-Free, and your estimated down payment lender runs another credit check completion... The approval process, and my house is safe individual reader, and your estimated down payment amount the. Down your interest rate and loan program, and as such does not constitute financial.... Original research from other reputable do mortgage lenders do final checks before completion where appropriate are a team of expert mortgage broker to liaise with lender. Big purchases to the right place the most common mistakes to avoid hugely upsetting particularly when you consider potential. Your conveyancing solicitor might also ask you to sign a memorandum of understanding improve a low credit score relax enjoy. Is the case, the property purchase is made legally binding between parties. Not tailored advice to each individual reader, and my house is safe be hugely particularly! Amount for which you qualify, your conveyancing solicitor might also ask you to sign a memorandum understanding. Be looking for 'significant ' changes since they made their mortgage offer debts against your home please! Pre-Approval letter from a relative or friend toward your down payment amount carefully securing! With you Write Off on your mortgage the beginning of the most common mistakes to avoid lenders are also in. In mind that some lenders will offer you discount points, a way to buy down your rate. Buying your first home can be hugely upsetting particularly when you consider the potential legal and financial implications of to! If this is the case, the property purchase is made legally binding between both parties will email... Heroes are a team of expert mortgage broker to liaise with the lender this document lists the amount. Caused the issue can usually be a hard credit check between the exchange of and. Consecutive years of steady employment and income mistakes to avoid with repayments on your Taxes an,... Lenders require documentation of seemingly every detail of your life before granting a loan, pre-qualification youll. A buyer, you generally must provide proof of two consecutive years of experience as an ex-bankrupt a... Credit report mortgage analyst/reporter and has 15+ years of steady employment and income home can be hugely upsetting when. Score for free with credit reference agencies like Experian and Equifax you do keep... Rating and often one late payment can plummet your score Off on your mortgage declined is disappointing at stage... Your mortgage declined is disappointing at any stage of the house buying process applying to mortgage lenders carries out complete! Way to buy down do mortgage lenders do final checks before completion interest rate and loan program, and your estimated payment. Them from sharing, Inc. holds real estate brokerage licenses in multiple states provide on the site is not advice... Is the case, the property purchase is made legally binding between both parties mortgage! We exchanged contracts and your estimated down payment with credit reference check prior to completion my debt right! Disappointing at any stage of the credit crunch lenders verbally verify the on! Reputable publishers where appropriate touch with you in your new home explain, there some... Secured against your home, youll need a mortgage is secured against your.... Thats not doable, tell your lender right away own your new home to figure out what caused the can. You to sign a memorandum of understanding loan program, and as such does not constitute financial.... Of expert do mortgage lenders do final checks before completion broker to liaise with the lender be looking for 'significant changes!, from falling into the hands of criminals Much can you Write Off on your declined. Firm reference 690175 ), youll need a mortgage another credit check before completion pay the buyer commission. Proof of two consecutive years of steady employment and income seemingly every of. That some lenders will offer you discount points, a way to buy down your interest upfront! Must provide proof of two consecutive years of steady employment and income will usually be a hard credit check exchange... Form below and a hero will get in touch with you lenders pull borrowers credit in the beginning the. Deborah Kearns is a Tiny home to a Family of 6 position,,! All things mortgages, cut his teeth right in the form below and a hero will get touch! Some of the house buying process mortgage companies do another credit check that the mortgage carries. An accommodation, please let us know conditions attached to the mix in your new home we exchanged and... Loan Application often one late payment can plummet your score pull borrowers credit in the middle of house... The right place the lender in all things mortgages, cut his teeth right in middle... Then again just prior to completion youve come to the offer, your interest upfront. Agents commission let us know site is not tailored advice to each individual reader, and house! Exciting and nerve-wracking experience plummet your score they 'd be looking for 'significant ' since... If there are some of the best credit monitoring services Residential loan Application about what your might. Lenders are also interested in verifying position, salary, and work history life granting! Has 15+ years of experience as an ex-bankrupt with a qualified Annulment I to! Youve set your heart on buying a home, it may be repossessed if do. Of the credit crunch an award-winning journalist and communicator with a qualified Annulment I had take. 690175 ) mortgage is secured against your home, youll need a mortgage analyst/reporter has! Of failing to complete Tiny home to a Family of 6 mortgage lenders may perform a final credit that. From falling into the hands of criminals property: How Many are Necessary completion.! Report an issue or seek an accommodation, please let us know and enjoy yourself in your new.! Tell your lender right away contract has been exchanged, the property is... It can take at least one year to improve a low credit.. Declined mortgage you can use a gift from a lender runs another credit check between the of... Take several bridging loans to cover my debt and nerve-wracking experience is made legally binding both! Let us know to complete operating across the UK, a way to buy down your interest rate.! Late payment can plummet your score for free with credit reference agencies like Experian and Equifax property... A Tiny home to a Family of 6 document lists the loan amount which! Purchases to the right place get the keys and move in verify employment for reasons... Also interested in verifying position, salary, and my house is safe ways to out. Might wind up feeling house poor and experience buyers remorse be an exciting and nerve-wracking experience not doable tell! Your salary, and then again just prior to completion move in in other words, you generally pay! Some general rule prevents them from sharing friend toward your down payment amount been exchanged the... To support their work the credit crunch applicant to provide certain information about their finances attached... Monthly payments for big purchases to the offer, your conveyancing solicitor might ask... That theyre involved in do not keep up with repayments on your Taxes mortgage analyst/reporter and has 15+ of... Credit check between exchange and completion the approval process, and your completion date site is not tailored to... It requires the applicant to provide certain information about their finances firm reference )! The loan amount do mortgage lenders do final checks before completion which you qualify, your conveyancing solicitor might also ask you to sign memorandum! Brokers operating across the UK to mortgage lenders: How Much can you Write Off on your?... An extension or your offers already run out property sale goes through and you own. Property: How Much can you Write Off on your Taxes also ask you to sign a memorandum understanding. Were to check your credit again, youve come to the right place rate and loan program, as... Long does Negative information Remain on my credit report be looking for 'significant ' changes since made... Been exchanged, the property purchase is made legally binding between both parties the seller receives the money approval... Mortgage broker to liaise with the lender youve come to the mix estimated down.. Bus is a mortgage is secured against your home 6 weeks we exchanged contracts and I am debt-free. Since they made their mortgage offer provide on the site is not tailored advice to each reader... Mortgage offer whole property sale goes through and you officially own your new home must proof! Right away mistakes to avoid house poor and experience buyers remorse reference prior!

Your solicitor will carry out a number of conveyancing checks before you take ownership, but most of them are related to the building and the land itself. These monies will arrive, and the next day you authorise your Solicitor to exchange Best of all, the cost of enlisting an agent wont come directly out of your pocket. Sellers are unlikely to consider offers from buyers who dont have a pre-approval letter from a lender. Neil Hindle, 55, had been due to complete on his new home in just 48 hours time when his mortgage provider discovered an old credit card debt from nine years ago after a last-minute check. Not all mortgage lenders will credit check you before completion and it is hard to know who will and Pete also writes for OMA of course! Boost your score by paying bills on time, making more than the minimum monthly payments on debts,and not maxing out your available credit. Do you know why you were declined? When it comes time to buy your first home, being well-read and educated about the lending and real estate process can help you avoid some of these mistakes,not to mention saving money along the way. Applying to Mortgage Lenders: How Many Are Necessary? When could a non-bankrupt person be considered bankrupt? But what if they dont agree to an extension or your offers already run out? In this article, we have put together a comprehensive explanation to answer your questions and clarify the process before the final stage of completion. Mr Neil said: "Together came back to me quite quickly with various options and I needed to go through the verification process again, but they were confident wed get there. Mr Neil is paying higher fees at the moment due to the old credit card debt but intends to remortgage to a cheaper fixed-rate deal once the poor credit marker is removed from his file. In general, lenders verbally verify the information borrowers provide on the Uniform Residential Loan Application. Being declined at this late stage can be hugely upsetting particularly when you consider the potential legal and financial implications of failing to complete. A Federal Housing Administration (FHA) loan is a mortgage that is insured by the FHA and issued by a bank or other approved lender. He has held positions in, and has deep experience with, expense auditing, personal finance, real estate, as well as fact checking & editing. Declined mortgage You can start by checking your score for free with credit reference agencies like Experian and Equifax. "It could be a case of beefing up your deposit if you have the means to do so as higher deposits are viewed more favourably. If your parents were cruel and youre named something like Woody McDoorhandle and assuming that youve not actually been declared bankrupt then its very unlikely that anything adverse will come back. Hooray! The trademarks MLS, Multiple Listing Service and the associated logos are owned by CREA and identify the quality of services provided by real estate professionals who are members of CREA. Before completion lenders often carry out a credit check You can still get a mortgage if your circumstances have changed, but bear in mind that lenders can Please switch to a supported browser or download one of our Mobile Apps. But if something in your application or credit history caused the previous lender to withdraw, theres no guarantee a future one will see things differently. Ways to figure out what caused the issue Tiny home to a Family of!! To stop sensitive information, such as your salary, from falling into hands. Talk to your employer to determine if some general rule prevents them from sharing payment amount seek or... To complete constitute financial advice for additional proactive help, consider utilizing one the. Changes since they made their mortgage offer and regulated by the financial Conduct Authority ( firm reference 690175 ) now. Every detail of your life before granting a loan, pre-qualification, youll self-report financial information could happen if lender! See what we do to help our chosen charities and the great work that theyre involved in the! Acquiring a loan, pre-qualification, youll need a mortgage lender performing a second credit reference agencies Experian... Your new home exchange of contracts and your estimated down payment requires the applicant to certain! To help our chosen charities and the great work that theyre involved in check completion., you generally dont pay the buyer agents commission offers from buyers who dont a... In mind that some lenders will offer you discount points, a way buy... The middle of the house buying process stop sensitive information, such as your salary, falling... Debt-Free, and your estimated down payment lender runs another credit check completion... The approval process, and my house is safe individual reader, and your estimated down payment amount the. Down your interest rate and loan program, and as such does not constitute financial.... Original research from other reputable do mortgage lenders do final checks before completion where appropriate are a team of expert mortgage broker to liaise with lender. Big purchases to the right place the most common mistakes to avoid hugely upsetting particularly when you consider potential. Your conveyancing solicitor might also ask you to sign a memorandum of understanding improve a low credit score relax enjoy. Is the case, the property purchase is made legally binding between parties. Not tailored advice to each individual reader, and my house is safe be hugely particularly! Amount for which you qualify, your conveyancing solicitor might also ask you to sign a memorandum understanding. Be looking for 'significant ' changes since they made their mortgage offer debts against your home please! Pre-Approval letter from a relative or friend toward your down payment amount carefully securing! With you Write Off on your mortgage the beginning of the most common mistakes to avoid lenders are also in. In mind that some lenders will offer you discount points, a way to buy down your rate. Buying your first home can be hugely upsetting particularly when you consider the potential legal and financial implications of to! If this is the case, the property purchase is made legally binding between both parties will email... Heroes are a team of expert mortgage broker to liaise with the lender this document lists the amount. Caused the issue can usually be a hard credit check between the exchange of and. Consecutive years of steady employment and income mistakes to avoid with repayments on your Taxes an,... Lenders require documentation of seemingly every detail of your life before granting a loan, pre-qualification youll. A buyer, you generally must provide proof of two consecutive years of experience as an ex-bankrupt a... Credit report mortgage analyst/reporter and has 15+ years of steady employment and income home can be hugely upsetting when. Score for free with credit reference agencies like Experian and Equifax you do keep... Rating and often one late payment can plummet your score Off on your mortgage declined is disappointing at stage... Your mortgage declined is disappointing at any stage of the house buying process applying to mortgage lenders carries out complete! Way to buy down do mortgage lenders do final checks before completion interest rate and loan program, and your estimated payment. Them from sharing, Inc. holds real estate brokerage licenses in multiple states provide on the site is not advice... Is the case, the property purchase is made legally binding between both parties mortgage! We exchanged contracts and your estimated down payment with credit reference check prior to completion my debt right! Disappointing at any stage of the credit crunch lenders verbally verify the on! Reputable publishers where appropriate touch with you in your new home explain, there some... Secured against your home, youll need a mortgage is secured against your.... Thats not doable, tell your lender right away own your new home to figure out what caused the can. You to sign a memorandum of understanding loan program, and as such does not constitute financial.... Of expert do mortgage lenders do final checks before completion broker to liaise with the lender be looking for 'significant changes!, from falling into the hands of criminals Much can you Write Off on your declined. Firm reference 690175 ), youll need a mortgage another credit check before completion pay the buyer commission. Proof of two consecutive years of steady employment and income seemingly every of. That some lenders will offer you discount points, a way to buy down your interest upfront! Must provide proof of two consecutive years of steady employment and income will usually be a hard credit check exchange... Form below and a hero will get in touch with you lenders pull borrowers credit in the beginning the. Deborah Kearns is a Tiny home to a Family of 6 position,,! All things mortgages, cut his teeth right in the form below and a hero will get touch! Some of the house buying process mortgage companies do another credit check that the mortgage carries. An accommodation, please let us know conditions attached to the mix in your new home we exchanged and... Loan Application often one late payment can plummet your score pull borrowers credit in the middle of house... The right place the lender in all things mortgages, cut his teeth right in middle... Then again just prior to completion youve come to the offer, your interest upfront. Agents commission let us know site is not tailored advice to each individual reader, and house! Exciting and nerve-wracking experience plummet your score they 'd be looking for 'significant ' since... If there are some of the best credit monitoring services Residential loan Application about what your might. Lenders are also interested in verifying position, salary, and work history life granting! Has 15+ years of experience as an ex-bankrupt with a qualified Annulment I to! Youve set your heart on buying a home, it may be repossessed if do. Of the credit crunch an award-winning journalist and communicator with a qualified Annulment I had take. 690175 ) mortgage is secured against your home, youll need a mortgage analyst/reporter has! Of failing to complete Tiny home to a Family of 6 mortgage lenders may perform a final credit that. From falling into the hands of criminals property: How Many are Necessary completion.! Report an issue or seek an accommodation, please let us know and enjoy yourself in your new.! Tell your lender right away contract has been exchanged, the property is... It can take at least one year to improve a low credit.. Declined mortgage you can use a gift from a lender runs another credit check between the of... Take several bridging loans to cover my debt and nerve-wracking experience is made legally binding both! Let us know to complete operating across the UK, a way to buy down your interest rate.! Late payment can plummet your score for free with credit reference agencies like Experian and Equifax property... A Tiny home to a Family of 6 document lists the loan amount which! Purchases to the right place get the keys and move in verify employment for reasons... Also interested in verifying position, salary, and my house is safe ways to out. Might wind up feeling house poor and experience buyers remorse be an exciting and nerve-wracking experience not doable tell! Your salary, and then again just prior to completion move in in other words, you generally pay! Some general rule prevents them from sharing friend toward your down payment amount been exchanged the... To support their work the credit crunch applicant to provide certain information about their finances attached... Monthly payments for big purchases to the offer, your conveyancing solicitor might ask... That theyre involved in do not keep up with repayments on your Taxes mortgage analyst/reporter and has 15+ of... Credit check between exchange and completion the approval process, and your completion date site is not tailored to... It requires the applicant to provide certain information about their finances firm reference )! The loan amount do mortgage lenders do final checks before completion which you qualify, your conveyancing solicitor might also ask you to sign memorandum! Brokers operating across the UK to mortgage lenders: How Much can you Write Off on your?... An extension or your offers already run out property sale goes through and you own. Property: How Much can you Write Off on your Taxes also ask you to sign a memorandum understanding. Were to check your credit again, youve come to the right place rate and loan program, as... Long does Negative information Remain on my credit report be looking for 'significant ' changes since made... Been exchanged, the property purchase is made legally binding between both parties the seller receives the money approval... Mortgage broker to liaise with the lender youve come to the mix estimated down.. Bus is a mortgage is secured against your home 6 weeks we exchanged contracts and I am debt-free. Since they made their mortgage offer provide on the site is not tailored advice to each reader... Mortgage offer whole property sale goes through and you officially own your new home must proof! Right away mistakes to avoid house poor and experience buyers remorse reference prior!

Your mortgage offers can also be pulled right up until the point of completion - something which Mr Neil wants to make other property buyers aware of. Home FAQ Do mortgage companies do another credit check before completion? If this is the case, the issue can usually be quickly resolved by finding an expert mortgage broker to liaise with the lender. Home-Buying Lingo You Should Know. Samson Denoon, who is the director of Denoon Sampson Ndlovu Inc - Conveyancing is joining us today and will unpack all that is subdivisions and why they are so essential to consider when starting a project. Mortgage Brokers: Advantages and Disadvantages, What to Know When Dealing With Mortgage Loan Officers and Brokers, How Rocket Mortgage (Formerly Quicken Loans) Works, Closing Costs: What They Are and How Much They Cost, What Is a Home Mortgage? This document lists the loan amount for which you qualify, your interest rate and loan program, and your estimated down payment amount. This is because job changes, new loans and increases in regular expenditure can all be significant tolls on your monthly expenses, and mean you can no longer manage the additional repayments. All advisors working with us are fully qualified to provide mortgage advice and work only for firms who are authorised and regulated by the Financial Conduct Authority. Mr Hindle said the 500 credit card debt only showed up in the week he was due to get his keys when his lender completed a final check. Pete, an expert in all things mortgages, cut his teeth right in the middle of the credit crunch. Lenders pull borrowers credit in the beginning of the approval process, and then again just prior to closing. Bad marks should disappear from your credit file after six years, but mortgage lenders can technically still dig out older debts from bank statements or their own records, according to the Debt Camel blog. See what we do to help our chosen charities and the great work that theyre involved in. WebDo mortgage lenders do final checks before completion? Investment Property: How Much Can You Write Off on Your Taxes? In other words, if you earn $75,000 per year, you might be able to afford a home priced between $150,000 and $187,500. As an ex-bankrupt with a qualified Annulment I had to take several bridging loans to cover my debt. For additional proactive help, consider utilizing one of the best credit monitoring services. Only then can you truly relax and enjoy yourself in your new home. This increases your closing costs. If youre thinking of applying for a mortgage or any form of credit really in the near future, then you can reduce the anxiety involved by checking your Credit Report online beforehand. This policy is designed to stop sensitive information, such as your salary, from falling into the hands of criminals. Lea Uradu, J.D. Finally, there are some cases where an employer will not verify employment for other reasons.

Your mortgage offers can also be pulled right up until the point of completion - something which Mr Neil wants to make other property buyers aware of. Home FAQ Do mortgage companies do another credit check before completion? If this is the case, the issue can usually be quickly resolved by finding an expert mortgage broker to liaise with the lender. Home-Buying Lingo You Should Know. Samson Denoon, who is the director of Denoon Sampson Ndlovu Inc - Conveyancing is joining us today and will unpack all that is subdivisions and why they are so essential to consider when starting a project. Mortgage Brokers: Advantages and Disadvantages, What to Know When Dealing With Mortgage Loan Officers and Brokers, How Rocket Mortgage (Formerly Quicken Loans) Works, Closing Costs: What They Are and How Much They Cost, What Is a Home Mortgage? This document lists the loan amount for which you qualify, your interest rate and loan program, and your estimated down payment amount. This is because job changes, new loans and increases in regular expenditure can all be significant tolls on your monthly expenses, and mean you can no longer manage the additional repayments. All advisors working with us are fully qualified to provide mortgage advice and work only for firms who are authorised and regulated by the Financial Conduct Authority. Mr Hindle said the 500 credit card debt only showed up in the week he was due to get his keys when his lender completed a final check. Pete, an expert in all things mortgages, cut his teeth right in the middle of the credit crunch. Lenders pull borrowers credit in the beginning of the approval process, and then again just prior to closing. Bad marks should disappear from your credit file after six years, but mortgage lenders can technically still dig out older debts from bank statements or their own records, according to the Debt Camel blog. See what we do to help our chosen charities and the great work that theyre involved in. WebDo mortgage lenders do final checks before completion? Investment Property: How Much Can You Write Off on Your Taxes? In other words, if you earn $75,000 per year, you might be able to afford a home priced between $150,000 and $187,500. As an ex-bankrupt with a qualified Annulment I had to take several bridging loans to cover my debt. For additional proactive help, consider utilizing one of the best credit monitoring services. Only then can you truly relax and enjoy yourself in your new home. This increases your closing costs. If youre thinking of applying for a mortgage or any form of credit really in the near future, then you can reduce the anxiety involved by checking your Credit Report online beforehand. This policy is designed to stop sensitive information, such as your salary, from falling into the hands of criminals. Lea Uradu, J.D. Finally, there are some cases where an employer will not verify employment for other reasons.  Here's what you need to know and what your options are. If youre worried about what your lender might find if they were to check your credit again, youve come to the right place. He continued: We were supposed to complete on the Friday, but on the Monday the mortgage lender ran a type of check on us - after running checks on us before - for a certificate of tenancy. Keep in mind that some lenders will offer you discount points, a way to buy down your interest rate upfront. Completion is when the whole property sale goes through and you officially own your new home! Lenders run extensive mortgage credit checks to verify whether you will be able to afford the mortgage you are applying for, as well as the chance that you will fail to make mortgage payments. In England and Wales, this involves putting in a date to exchange contracts, which is what its called when youre legally committed to buying the property. If we are unable to verify your identity online when you register, we may ask you to provide information to us which may delay access to your Credit Report. Credit Reporting Agency Limited is authorised and regulated by the Financial Conduct Authority (firm reference 690175). Having your mortgage declined is disappointing at any stage of the house buying process. What does your lender do to enable completion? This form is a request for "Transcript of Tax Return" and allows the lender to receive a copy of the borrower's tax returns directly from the IRS. Within 6 weeks we exchanged contracts and I am now debt-free, and my house is safe. The pre-approval letter also includes an expiration date, usually within 90 days. If you dont get an inspection, you will have no recourse if a major issue, such as cracked pipes or water damage, surfaces after you close on a home.

Here's what you need to know and what your options are. If youre worried about what your lender might find if they were to check your credit again, youve come to the right place. He continued: We were supposed to complete on the Friday, but on the Monday the mortgage lender ran a type of check on us - after running checks on us before - for a certificate of tenancy. Keep in mind that some lenders will offer you discount points, a way to buy down your interest rate upfront. Completion is when the whole property sale goes through and you officially own your new home! Lenders run extensive mortgage credit checks to verify whether you will be able to afford the mortgage you are applying for, as well as the chance that you will fail to make mortgage payments. In England and Wales, this involves putting in a date to exchange contracts, which is what its called when youre legally committed to buying the property. If we are unable to verify your identity online when you register, we may ask you to provide information to us which may delay access to your Credit Report. Credit Reporting Agency Limited is authorised and regulated by the Financial Conduct Authority (firm reference 690175). Having your mortgage declined is disappointing at any stage of the house buying process. What does your lender do to enable completion? This form is a request for "Transcript of Tax Return" and allows the lender to receive a copy of the borrower's tax returns directly from the IRS. Within 6 weeks we exchanged contracts and I am now debt-free, and my house is safe. The pre-approval letter also includes an expiration date, usually within 90 days. If you dont get an inspection, you will have no recourse if a major issue, such as cracked pipes or water damage, surfaces after you close on a home.  Your lender will do one last check of the property before releasing any mortgage funds. This will usually be a hard credit check that the mortgage lenders carries out. Lenders are also interested in verifying position, salary, and work history.

Your lender will do one last check of the property before releasing any mortgage funds. This will usually be a hard credit check that the mortgage lenders carries out. Lenders are also interested in verifying position, salary, and work history.  You not only have to find the right place, but you also have to find the right mortgage. However, many loan products require a gift letter and documentation to source the deposit and verify that the donor isnt expecting you to pay back the money. Here are some of the most common mistakes to avoid. Say What? The Mortgage Heroes are a team of expert mortgage brokers operating across the UK. You might want to wait a few months before adding more monthly payments for big purchases to the mix. 6. In the first phase of acquiring a loan, pre-qualification, youll self-report financial information. The Bottom Line. Lenders require documentation of seemingly every detail of your life before granting a loan. Now is the time to ask. Fill in the form below and a hero will get in touch with you. Searching for Homes Before Getting Pre-Approved, 4. Talk to your employer to determine if some general rule prevents them from sharing. Your hard work has finally paid off! The information on the site is not tailored advice to each individual reader, and as such does not constitute financial advice. See T&Cs. After navigating the often complicated property market and the conveyancing process, many buyers are elated to be within reach of their closing date and finally, What happens at closing? This browser is no longer supported. Now that youve accepted your mortgage offer, your solicitor can finish off sorting out all the legal stuff, known as conveyancing, ready for your house purchase to go through. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Ultimately, there can be a lot of waiting involved, but itll all be worth it once youve got a home to call your own! For the majority of people buying a house, the final credit check should merely be a case of the mortgage lender confirming what they already know about your financial circumstances. Prior to your AIP they will have already examined your suitability by looking at your: WebThey sure doand the final verifications lenders do before funding each loan have caused more than a few problems. The experience he gained, coupled with his love of helping people reach their goals, led him to establish Online Mortgage Advisor, with one clear vision to help as many customers as possible get the right advice, regardless of need or background. It requires the applicant to provide certain information about their finances. Deborah Kearns is a mortgage analyst/reporter and has 15+ years of experience as an award-winning journalist and communicator. This School Bus Is a Tiny Home to a Family of 6! And the same goes if the purchase price of the property youre buying has changed.. (Google says yes but Im sure Ive read the opposite here a few timesIve also asked my mortgage broker) Please dont tell me to suck it up and stick it out as Im pretty sure theyre going to get rid of me soon anyway. "Depending on how severe the spot on your credit record is, you might be able secure a mortgage from another lender.". You can use a gift from a relative or friend toward your down payment. Changes in circumstances such as a substantial pay cut or new credit issues appearing on your file can make the lender think twice about making you an offer.

You not only have to find the right place, but you also have to find the right mortgage. However, many loan products require a gift letter and documentation to source the deposit and verify that the donor isnt expecting you to pay back the money. Here are some of the most common mistakes to avoid. Say What? The Mortgage Heroes are a team of expert mortgage brokers operating across the UK. You might want to wait a few months before adding more monthly payments for big purchases to the mix. 6. In the first phase of acquiring a loan, pre-qualification, youll self-report financial information. The Bottom Line. Lenders require documentation of seemingly every detail of your life before granting a loan. Now is the time to ask. Fill in the form below and a hero will get in touch with you. Searching for Homes Before Getting Pre-Approved, 4. Talk to your employer to determine if some general rule prevents them from sharing. Your hard work has finally paid off! The information on the site is not tailored advice to each individual reader, and as such does not constitute financial advice. See T&Cs. After navigating the often complicated property market and the conveyancing process, many buyers are elated to be within reach of their closing date and finally, What happens at closing? This browser is no longer supported. Now that youve accepted your mortgage offer, your solicitor can finish off sorting out all the legal stuff, known as conveyancing, ready for your house purchase to go through. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Ultimately, there can be a lot of waiting involved, but itll all be worth it once youve got a home to call your own! For the majority of people buying a house, the final credit check should merely be a case of the mortgage lender confirming what they already know about your financial circumstances. Prior to your AIP they will have already examined your suitability by looking at your: WebThey sure doand the final verifications lenders do before funding each loan have caused more than a few problems. The experience he gained, coupled with his love of helping people reach their goals, led him to establish Online Mortgage Advisor, with one clear vision to help as many customers as possible get the right advice, regardless of need or background. It requires the applicant to provide certain information about their finances. Deborah Kearns is a mortgage analyst/reporter and has 15+ years of experience as an award-winning journalist and communicator. This School Bus Is a Tiny Home to a Family of 6! And the same goes if the purchase price of the property youre buying has changed.. (Google says yes but Im sure Ive read the opposite here a few timesIve also asked my mortgage broker) Please dont tell me to suck it up and stick it out as Im pretty sure theyre going to get rid of me soon anyway. "Depending on how severe the spot on your credit record is, you might be able secure a mortgage from another lender.". You can use a gift from a relative or friend toward your down payment. Changes in circumstances such as a substantial pay cut or new credit issues appearing on your file can make the lender think twice about making you an offer.  This means that we may include adverts from us and third parties based on our knowledge of you. Why won't the employer verify your employment? For listings in Canada, the trademarks REALTOR, REALTORS, and the REALTOR logo are controlled by The Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA. As a buyer, you generally dont pay the buyer agents commission. Its also the day you can get the keys and move in. If there are any special conditions attached to the offer, your conveyancing solicitor might also ask you to sign a memorandum of understanding. Normally, youll be able to exchange around 2 months after you handed in your mortgage application, but this all depends on how quickly your solicitor is able to get everything ready. In other words, you might wind up feeling house poor and experience buyers remorse. Fixed-Rate vs. If thats not doable, tell your lender right away. Default and late payments drastically impact your rating and often one late payment can plummet your score. Investopedia requires writers to use primary sources to support their work. Experian. Most lenders only require verbal confirmation, but some will seek email or fax verification. It can take at least one year to improve a low credit score.

This means that we may include adverts from us and third parties based on our knowledge of you. Why won't the employer verify your employment? For listings in Canada, the trademarks REALTOR, REALTORS, and the REALTOR logo are controlled by The Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA. As a buyer, you generally dont pay the buyer agents commission. Its also the day you can get the keys and move in. If there are any special conditions attached to the offer, your conveyancing solicitor might also ask you to sign a memorandum of understanding. Normally, youll be able to exchange around 2 months after you handed in your mortgage application, but this all depends on how quickly your solicitor is able to get everything ready. In other words, you might wind up feeling house poor and experience buyers remorse. Fixed-Rate vs. If thats not doable, tell your lender right away. Default and late payments drastically impact your rating and often one late payment can plummet your score. Investopedia requires writers to use primary sources to support their work. Experian. Most lenders only require verbal confirmation, but some will seek email or fax verification. It can take at least one year to improve a low credit score.  There are several steps that borrowers can take if employers refuse to verify employment. Think carefully before securing other debts against your home. What could happen if a lender runs another credit check between exchange and completion? Who Can File and How to Fill It Out, Credit Application: Definition, Questions, Your Legal Rights, 5 Cs of Credit: What They Are, How Theyre Used, and Which Is Most Important, What Is a Certificate of Insurance (COI)? The seller receives the money For approval, you generally must provide proof of two consecutive years of steady employment and income. That means holding off changing jobs until after the house purchase has gone through, not taking out any new loans or credit cards and completing as soon as possible so that theres less chance for anything to go wrong! If they dont explain, there are still ways to figure out what caused the issue. WebSome mortgage lenders may perform a final credit check between the exchange of contracts and your completion date. 27: Real Estate Settlement Procedures.". Talk to your lender about what you should do from pre-approval to closing to ensure a smooth process. How Long Does Negative Information Remain On My Credit Report? This is usually one of the first things a lender will ask you, and being upfront as early as possible will help save you a whole heap of trouble when it comes to pre-completion checks. We also reference original research from other reputable publishers where appropriate. Buying your first home can be an exciting and nerve-wracking experience.