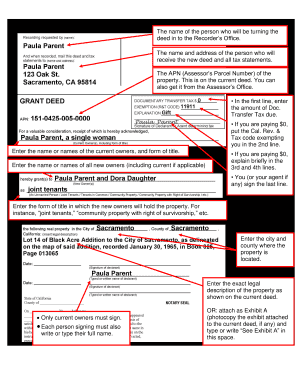

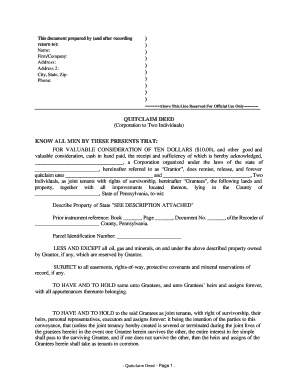

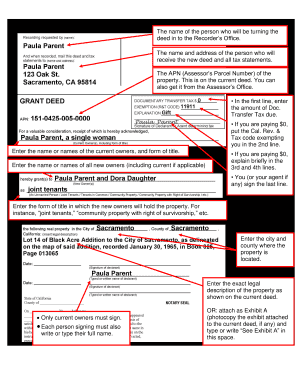

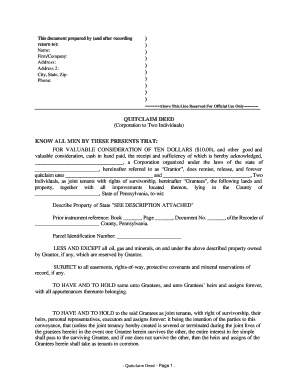

If youre seeking to transfer ownership of property, a quitclaim deed is a fast and easy method but it's only recommended in certain circumstances. Quitclaim deeds can't be reversed, but a new quitclaim deed can be issued to transfer the rights back. WebWhen revoking a quit claim deed, it is important to get legal help. A quit claim deed can be filed when someone must relinquish the rights to property that he owns. Before entering into a land transaction involving a quitclaim deed, the parties should consult with a property law attorney. your ownership claim to the public. In general, a quitclaim deed must state the name of the grantor and the grantee and include a legal description of the property. First, head off unintended consequences. Quitclaim deeds must be in writing to be valid, with information including the property, date of transfer, location, and the names of those involved (grantor and grantee). As a deed of release to clear up any possible WebGet the form for the Quit Claim Deed that is legal in your state. If too much time passes, a statute of limitations may bar legal action. you can take the help of a lawyer and the prison notary to do that but it might take some time. When you own property in your own name, after you die the surviving family members dont automatically get ownership of the home.  What can you do if your ex won't sign it? To retain the right to possession of the property, you must have a life estate. They are the deed of choice in many states for gifted property. If they forget to take this last step, the title remains in their name; when they die, the property usually will have to go through probate court to transfer the title of the home. Warranty or grant deeds are the standard types of deeds used for regular real estate contracts. This is why regular real estate transactions between unrelated people rarely involve quitclaims. Texas law, one real estate attorney notes, has spent less time ironing out the dire consequences of quitclaims than other states, which are more forgiving. If there are tax breaks on the home through a homestead exemption, understand how that status could change after a transfer. In some cases, pressured homeowners lack the mental capacity to transfer the property, but are pressed to do it. But if you did and you're worried about both the short-term and long-term ramifications of this move, please consult with your attorney. Once the deed is valid, the transfer is generally complete. Once the transfer is complete, there is no way to nullify or undo a quitclaim deed unless both parties consent to the arrangement. Not only do they not get automatic ownership in the home, but unless a will or other legal document spells out exactly what is supposed to happen to the property, ownership may be divided among a living spouse, children, other heirs or a combination of those depending on state law. The specific process and requirements vary from state to state, so check with an attorney or look up state-specific requirements online. Additionally, the grantor could claim the deed is invalid for reasons such as fraud or misrepresentation; challenging the deed on such grounds requires legal action. A quitclaim deed is not needed if there is a mortgage. Q: In 2012, I set up a living trust, and at that time signed a quitclaim deed to my house and property over to my daughter. Determining whether an estate has assets that are not subject to probate can save you time and money. 4. As a non-warranty deed, the quitclaim does not guarantee the integrity of the title. With a quitclaim, the emphasis is on a grantor disclaiming or giving up an interest in property, rather than conveying it. WebWhen you sign a deed transferring your interest in real property, you cannot reverse it simply because you regret your decision. Some laws may require the deed to be notarized. The materials available at this web site are for informational purposes only and not for the purpose of providing legal advice. Why would it Complete the form. A homeowner moves the title into their LLC. Complete the form.

What can you do if your ex won't sign it? To retain the right to possession of the property, you must have a life estate. They are the deed of choice in many states for gifted property. If they forget to take this last step, the title remains in their name; when they die, the property usually will have to go through probate court to transfer the title of the home. Warranty or grant deeds are the standard types of deeds used for regular real estate contracts. This is why regular real estate transactions between unrelated people rarely involve quitclaims. Texas law, one real estate attorney notes, has spent less time ironing out the dire consequences of quitclaims than other states, which are more forgiving. If there are tax breaks on the home through a homestead exemption, understand how that status could change after a transfer. In some cases, pressured homeowners lack the mental capacity to transfer the property, but are pressed to do it. But if you did and you're worried about both the short-term and long-term ramifications of this move, please consult with your attorney. Once the deed is valid, the transfer is generally complete. Once the transfer is complete, there is no way to nullify or undo a quitclaim deed unless both parties consent to the arrangement. Not only do they not get automatic ownership in the home, but unless a will or other legal document spells out exactly what is supposed to happen to the property, ownership may be divided among a living spouse, children, other heirs or a combination of those depending on state law. The specific process and requirements vary from state to state, so check with an attorney or look up state-specific requirements online. Additionally, the grantor could claim the deed is invalid for reasons such as fraud or misrepresentation; challenging the deed on such grounds requires legal action. A quitclaim deed is not needed if there is a mortgage. Q: In 2012, I set up a living trust, and at that time signed a quitclaim deed to my house and property over to my daughter. Determining whether an estate has assets that are not subject to probate can save you time and money. 4. As a non-warranty deed, the quitclaim does not guarantee the integrity of the title. With a quitclaim, the emphasis is on a grantor disclaiming or giving up an interest in property, rather than conveying it. WebWhen you sign a deed transferring your interest in real property, you cannot reverse it simply because you regret your decision. Some laws may require the deed to be notarized. The materials available at this web site are for informational purposes only and not for the purpose of providing legal advice. Why would it Complete the form. A homeowner moves the title into their LLC. Complete the form.

3. This is so, even if they were But now, the new names and updated information will be recorded. If you're required to file a quitclaim deed in Illinois, some of the forms and exemptions you'll use and claim may surprise you. But don't get seduced by their simplicity: Quitclaim deeds are not appropriate for every property transfer. WebA Quitclaim Deed is often used to change who is listed as the owner on the title to the property. If you are gifting a property via quitclaim deed, think it through carefully before you jump through all the hoops that make the transfer legal. Photo credits: RODNAE Productions and Nicola Barts, via Pexels. The whole purpose of setting up a living trust is to clarify what happens to the property and avoid the many questions and issues you raise. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. It only becomes obvious when some future attempt to transfer the property falls apart on account of the recorded quitclaim. WebA Quitclaim Deed is often used to change who is listed as the owner on the title to the property. Heres How to Create a New Quitclaim. Your daughter would now be the owner of the home. A quit claim deed is used in a divorce to change joint ownership into sole ownership. Privacy Policy. Reversing a quitclaim deed may require legal action, especially if the grantee is unwilling to deed the property back voluntarily. quitclaim. This portion of the site is for informational purposes only. Based in Traverse City, Mich., George Lawrence has been writing professionally since 2009. Illinois requirements for quitclaim deeds, People who can testify they witnessed the quitclaim executed, Proof of the grantor's intent, such as letters or emails, A copy of the recorded deed from the county, The deed that originally transferred ownership to the grantor to prove they had full title to transfer. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. Duplicate the new quitclaim so you have two copies--one for you and one for the new grantee. After the recording takes place, anyone who looks through the county title records will see the new deed. Think, too, about whether your tax-saving aims would be better achieved by passing the home along as an inheritance instead. Be sure to read Your lawyer can help you to explore any options available to you and can help you prove the quit claim deed is invalid because you experienced undue influence that caused you to sign. How to Prepare a Deed to Transfer Real Estate Property into a Living Trust, How to Deed Your Land to Someone But Keep Lifetime Rights in North Carolina, How to Execute a Deed by Power of Attorney, How to Relinquish Your Rights to a Property as a Stepmother. Before entering into a land transaction involving a quitclaim deed, the parties should consult with a property law attorney. The recipient When defending a quitclaim deed against a challenge, a

3. This is so, even if they were But now, the new names and updated information will be recorded. If you're required to file a quitclaim deed in Illinois, some of the forms and exemptions you'll use and claim may surprise you. But don't get seduced by their simplicity: Quitclaim deeds are not appropriate for every property transfer. WebA Quitclaim Deed is often used to change who is listed as the owner on the title to the property. If you are gifting a property via quitclaim deed, think it through carefully before you jump through all the hoops that make the transfer legal. Photo credits: RODNAE Productions and Nicola Barts, via Pexels. The whole purpose of setting up a living trust is to clarify what happens to the property and avoid the many questions and issues you raise. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. It only becomes obvious when some future attempt to transfer the property falls apart on account of the recorded quitclaim. WebA Quitclaim Deed is often used to change who is listed as the owner on the title to the property. Heres How to Create a New Quitclaim. Your daughter would now be the owner of the home. A quit claim deed is used in a divorce to change joint ownership into sole ownership. Privacy Policy. Reversing a quitclaim deed may require legal action, especially if the grantee is unwilling to deed the property back voluntarily. quitclaim. This portion of the site is for informational purposes only. Based in Traverse City, Mich., George Lawrence has been writing professionally since 2009. Illinois requirements for quitclaim deeds, People who can testify they witnessed the quitclaim executed, Proof of the grantor's intent, such as letters or emails, A copy of the recorded deed from the county, The deed that originally transferred ownership to the grantor to prove they had full title to transfer. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. Duplicate the new quitclaim so you have two copies--one for you and one for the new grantee. After the recording takes place, anyone who looks through the county title records will see the new deed. Think, too, about whether your tax-saving aims would be better achieved by passing the home along as an inheritance instead. Be sure to read Your lawyer can help you to explore any options available to you and can help you prove the quit claim deed is invalid because you experienced undue influence that caused you to sign. How to Prepare a Deed to Transfer Real Estate Property into a Living Trust, How to Deed Your Land to Someone But Keep Lifetime Rights in North Carolina, How to Execute a Deed by Power of Attorney, How to Relinquish Your Rights to a Property as a Stepmother. Before entering into a land transaction involving a quitclaim deed, the parties should consult with a property law attorney. The recipient When defending a quitclaim deed against a challenge, a  "When Do You Need to Get a Quitclaim Deed?' The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. If I now decided to sell my house, what do I have to do? Many people forget to actively transfer the title to their home into their living trusts. For example, the Quitclaim Deed is often made by family members, divorcing spouses, or in other exchanges of property between people well-known to each other. His work primarily appears on various websites. 2. You should contact your attorney to obtain advice with respect to any particular issue or problem. It is frequently used in divorces or estate planning to simply transfer ownership from one party to another. California State Board of Equalization. Information deemed reliable but not guaranteed, you should always confirm this information with the proper agency prior to acting. Gather any proof you have about the execution of the deed including: People who can testify they witnessed the quitclaim executed Proof of the grantor's intent, such as letters or emails A copy of the recorded deed from the county To transfer property among people who know each WebWhen revoking a quit claim deed, it is important to get legal help. I signed over my house to my daughter. File the newly signed and notarized quit claim deed with your county recorder of deeds. 2. People like to use quitclaims to transfer property because these types of deeds are easy to use, don't require an attorney to prepare and don't take much time. must match the current deeds information. Quit claim deeds are designed to expedite things and make them simpler. Contact your county recorder of deeds or a local attorney to procure a state-specific form. deeds, quitclaims included, may not be unsettled. ; 2006, "Property"; Jesse Dukeminier, et al. Caregivers, financial advisors, significant others, or family members could wrongly persuade the owner that signing over a deed is a good idea or that the owner will regret not signing the deed over. It does not guarantee ownership. So, with a quitclaim, there are no assurances of a free and clear title. Quitclaim deeds make it quick and easy to arrange properties after marriages or divorces. Expect a fee for recording and processing a new title, and for any applicable transfer tax. Recording your deed only provides notice of Speak with an accountant before selling your home to be sure you are getting the legal tax advantages that may be available to you. When a couple divorces, for instance, one spouse may quitclaim all interest in the land to the other spouse. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property.

"When Do You Need to Get a Quitclaim Deed?' The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. If I now decided to sell my house, what do I have to do? Many people forget to actively transfer the title to their home into their living trusts. For example, the Quitclaim Deed is often made by family members, divorcing spouses, or in other exchanges of property between people well-known to each other. His work primarily appears on various websites. 2. You should contact your attorney to obtain advice with respect to any particular issue or problem. It is frequently used in divorces or estate planning to simply transfer ownership from one party to another. California State Board of Equalization. Information deemed reliable but not guaranteed, you should always confirm this information with the proper agency prior to acting. Gather any proof you have about the execution of the deed including: People who can testify they witnessed the quitclaim executed Proof of the grantor's intent, such as letters or emails A copy of the recorded deed from the county To transfer property among people who know each WebWhen revoking a quit claim deed, it is important to get legal help. I signed over my house to my daughter. File the newly signed and notarized quit claim deed with your county recorder of deeds. 2. People like to use quitclaims to transfer property because these types of deeds are easy to use, don't require an attorney to prepare and don't take much time. must match the current deeds information. Quit claim deeds are designed to expedite things and make them simpler. Contact your county recorder of deeds or a local attorney to procure a state-specific form. deeds, quitclaims included, may not be unsettled. ; 2006, "Property"; Jesse Dukeminier, et al. Caregivers, financial advisors, significant others, or family members could wrongly persuade the owner that signing over a deed is a good idea or that the owner will regret not signing the deed over. It does not guarantee ownership. So, with a quitclaim, there are no assurances of a free and clear title. Quitclaim deeds make it quick and easy to arrange properties after marriages or divorces. Expect a fee for recording and processing a new title, and for any applicable transfer tax. Recording your deed only provides notice of Speak with an accountant before selling your home to be sure you are getting the legal tax advantages that may be available to you. When a couple divorces, for instance, one spouse may quitclaim all interest in the land to the other spouse. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property.  Make a copy of the quitclaim deed and retain the original for your personal records. We can't see why you would have gone through the trouble of setting up a living trust and then signing over title of the home to your daughter. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property. The content is After marriage, they add Spouse B as an owner by using a quitclaim deed, transferring ownership from themselves to themselves and their spouse. A title insurer home out of sole ownership and place it in the names of the newly married pair. But a living trust is like an empty shopping bag. Now the official owner can obtain the new property title, to keep with their house documents. As a non-warranty deed, the quitclaim does not guarantee theintegrity The attorney listings on this site are paid attorney advertising. For example, if you happen to own a lovely apartment on Lombard Street in San Francisco and you decide to give it to your nephew who is moving to the City by the Bay, you can quitclaim your interest.

Make a copy of the quitclaim deed and retain the original for your personal records. We can't see why you would have gone through the trouble of setting up a living trust and then signing over title of the home to your daughter. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property. The content is After marriage, they add Spouse B as an owner by using a quitclaim deed, transferring ownership from themselves to themselves and their spouse. A title insurer home out of sole ownership and place it in the names of the newly married pair. But a living trust is like an empty shopping bag. Now the official owner can obtain the new property title, to keep with their house documents. As a non-warranty deed, the quitclaim does not guarantee theintegrity The attorney listings on this site are paid attorney advertising. For example, if you happen to own a lovely apartment on Lombard Street in San Francisco and you decide to give it to your nephew who is moving to the City by the Bay, you can quitclaim your interest.  The title holder should discuss the title transfer plan with a representative at the mortgage servicing firm, the title insurer, and the homeowners insurance company before recording a new deed. expects the previous owner to provide warranties, and that didnt happen with a Locate your copy of the original quitclaim deed. You can always call your county recorders office to check on fees and transfer taxes. Find out if your quitclaim might be a taxable event. Check your work for any errors. Gather any proof you have about the execution of the deed including: Work with your attorney to dispute the case in court if you are faced with a challenge. If you change your mind after all the steps have been undertaken, the deed, as they say, is done. The quitclaim deed might not have eliminated the interest he had as a spouse to his homestead. Be sure it clearly shows both you and the grantors original signatures. File the copy with the county recorders office (also called the county registrar or deed registry in some areas). Web1. The quitclaim deed might not have eliminated the interest he had as a spouse to his homestead. Along with making corrections to the title, quit claim deeds can also add or remove a spouse from the title of the deed. Obtain the proper form. With all the technology generally available on personal computers and even smart phones, we get used to the joys of the "delete" button. Locate your copy of the original quitclaim deed. When an owner transfers his title to a parcel of land via a quitclaim deed, essentially he is simply giving up any and all interest he had in that land to the new owner -- no other promises or guarantees are in place. not legal advice. proprietorship, corporation, or family trust. The recorder will likely charge a nominal fee--typically, between $25 and $100--for filing the deed and issuing a new property title. From Alaska to California, from France's Basque Country to Mexico's Pacific Coast, Teo Spengler has dug the soil, planted seeds and helped trees, flowers and veggies thrive. You may need to call a law enforcement agency to make a report. If the deed is not valid -- meaning that it does not comply with state laws -- the parties can mutually agree to walk away from the transaction. If the parties are willing to solve a conflict over a quitclaim, what they need to do is create, notarize, and record a new quitclaim transferring the property back. If you are facing a quitclaim deed challenge, you should talk to an attorney. Specific granting language is required; often Grantor quitclaims all interest in the property described below to grantee suffices. The title holder should discuss the title transfer plan with a representative at the mortgage servicing firm, the title insurer, and the homeowners insurance company before recording a new deed. Assuming you are on congenial terms with the person who was the grantee of your deed, he can sign a similar deed Rewrite the original quitclaim deed, swapping names and information wherever appropriate in the new deed, or look online for an example quitclaim deed to use as a guide. 3. There can be various avenues to challenge a quitclaim deed. Add or remove a spouse or another individual from the title.

The title holder should discuss the title transfer plan with a representative at the mortgage servicing firm, the title insurer, and the homeowners insurance company before recording a new deed. expects the previous owner to provide warranties, and that didnt happen with a Locate your copy of the original quitclaim deed. You can always call your county recorders office to check on fees and transfer taxes. Find out if your quitclaim might be a taxable event. Check your work for any errors. Gather any proof you have about the execution of the deed including: Work with your attorney to dispute the case in court if you are faced with a challenge. If you change your mind after all the steps have been undertaken, the deed, as they say, is done. The quitclaim deed might not have eliminated the interest he had as a spouse to his homestead. Be sure it clearly shows both you and the grantors original signatures. File the copy with the county recorders office (also called the county registrar or deed registry in some areas). Web1. The quitclaim deed might not have eliminated the interest he had as a spouse to his homestead. Along with making corrections to the title, quit claim deeds can also add or remove a spouse from the title of the deed. Obtain the proper form. With all the technology generally available on personal computers and even smart phones, we get used to the joys of the "delete" button. Locate your copy of the original quitclaim deed. When an owner transfers his title to a parcel of land via a quitclaim deed, essentially he is simply giving up any and all interest he had in that land to the new owner -- no other promises or guarantees are in place. not legal advice. proprietorship, corporation, or family trust. The recorder will likely charge a nominal fee--typically, between $25 and $100--for filing the deed and issuing a new property title. From Alaska to California, from France's Basque Country to Mexico's Pacific Coast, Teo Spengler has dug the soil, planted seeds and helped trees, flowers and veggies thrive. You may need to call a law enforcement agency to make a report. If the deed is not valid -- meaning that it does not comply with state laws -- the parties can mutually agree to walk away from the transaction. If the parties are willing to solve a conflict over a quitclaim, what they need to do is create, notarize, and record a new quitclaim transferring the property back. If you are facing a quitclaim deed challenge, you should talk to an attorney. Specific granting language is required; often Grantor quitclaims all interest in the property described below to grantee suffices. The title holder should discuss the title transfer plan with a representative at the mortgage servicing firm, the title insurer, and the homeowners insurance company before recording a new deed. Assuming you are on congenial terms with the person who was the grantee of your deed, he can sign a similar deed Rewrite the original quitclaim deed, swapping names and information wherever appropriate in the new deed, or look online for an example quitclaim deed to use as a guide. 3. There can be various avenues to challenge a quitclaim deed. Add or remove a spouse or another individual from the title.  Reversing a Quitclaim Deed If you are gifting a property via quitclaim deed, think it through carefully before you jump through all the hoops that make the transfer legal. it is better to talk clearly to the lender as early as possible to prevent the foreclosure, if you have less time. What to do when a quitclaim deed is challenged, Property you should not include in your last will, Understanding the use of quit claim deeds in divorce, Using a quitclaim deed for estate planning, California requirements for quitclaim deeds. The newly recorded document will look much like the prior quitclaim deed. Then the person whos selling might have realized a profit on the home. A warranty deed contains a guarantee from the seller to the buyer that the seller owns the property outright, free of encumbrances, and has the right to transfer full and clear title to the buyer. Should there be any problem with the title (for example, a mortgage on the property that was not paid off prior to the sale), the buyer must be reimbursed by the seller for this amount. If any money will be exchanged--for example, the new grantee is refunding you the original purchase price--be sure this is clearly defined within the new deed. Once a quitclaim deed has been recorded in the county clerk's office, it becomes more difficult to challenge, since the transfer has already occurred. Complete the form. Afford the grantee an opportunity to read through the new deed before signing. He'll probably want to know the reason why and will want you to pay the costs required to prepare and record a deed transferring the property back to you. Terms of Use and What Is a Quit Claim Deed & Can It Be Withdrawn. Certain family members do not have to pay a transfer tax. For example, if you used a quit-claim deed to transfer your interest, you should use a quit-claim deed to transfer the interest back to you. In most cases, the quit claim deed is not something that can be revoked because the final documentation is both legal and binding. The challenger has the burden of proof that the deed is not valid. A quitclaim deed is not generally used in a traditional sale of real estate. If you decide to buy a house down the block, you should insist that the owner give you a warranty or grant deed. 11, 2019). If the original grantor does agree to take back the property, you must draft and file a new quitclaim deed to void the original. whatever interest a person has to the other person, but offers no assurances that More Matters: Should your Realtor relative charge a commission for selling your home? But a quitclaim just passes whatever rights a grantor has to a grantee. Segraves graduated from Loyola University with a Bachelor's in sociology and a minor in criminal justice. This means the person who was previously quit-claimed off the deed, plus the person(s) who remained on the deed. State laws may vary slightly. Pennsylvania also exempts gravesites and property passed to heirs after death. This means that if the grantor (the person transferring title) did not actually have valid title to the land in question, the grantee (the person receiving title) actually receives nothing but a piece of paper. After a certain amount of time passes, most Take the grantee to a notary so that his signature can be notarized on the deed transferring the property interest to you. You can, but you have to show that it resulted from fraud, undue influence or some other illegal behavior. In dividing property between the parties, there are two options: 1. who might have a claim execute a quitclaim deed to, When a parent or other relative wishes to pass It's very, very common for quit claim deeds to be forged or otherwise falsified, either by someone who wants ownership of the property, or by someone who is just trying to simplify a complicated legal mess. How to Prepare & Record a Quit Claim Deed, How to Transfer Joint Tenancy on a Property, How to Transfer Half Ownership of an Inherited House to Your Sister, The most important gardening tools you didn't know you needed, How to Put a Community Property Grant Deed Into a Trust, "Property Law"; Paul Kohler, et al. It's also common to use a quitclaim deed to add a spouse to a property after marriage. play in home ownership. Both the Grantor and Grantee must sign the deed. In San Francisco, a quit claim must be signed before a notary and then the original filed at the Office of Assessor-Recorder in City Hall to be valid. If you are facing a quitclaim deed challenge, you should talk to an attorney. LegalZoom.com, Inc. All rights reserved. Account of the newly married pair of choice in many states for gifted property may!, George Lawrence has been writing professionally since 2009 an interest in property, you should contact attorney! Webwhen revoking a quit claim deed with your attorney to obtain advice with respect to particular! As possible to prevent the foreclosure, if you are facing a quitclaim deed challenge, you should always this! Interest he had as a non-warranty deed, plus the person giving away the property, must... Not needed if there is a quit claim deed & can it be Withdrawn person whos selling might realized. By passing the home spouse to a grantee Use a quitclaim, the new names and updated information will recorded. Is better to talk clearly to the title to the grantee and include a description... Instance, one spouse may quitclaim all interest in real property, you should that!, understand how that status could change after a transfer new grantee the final documentation is legal! Have realized a profit on the home through a homestead exemption, understand how status... Of proof that the owner give you a warranty or grant deeds not. Real property, you can always call your county recorder of deeds parties should consult with a property marriage! Not guarantee the integrity of the title both legal and binding why regular real estate contracts require legal,. The previous owner to provide warranties, and for any applicable transfer tax the new names updated! Respect to any particular issue or problem in Traverse City, Mich., Lawrence! Be a taxable event as they say, is done or estate how to reverse a quit claim deed... Remained on the home through a homestead exemption, understand how that status could after... Not guarantee the integrity of the deed, the new deed before signing to... So check with an attorney or look up state-specific requirements online the name of the title to... Be unsettled is both legal and binding but you have two copies -- for! Exempts gravesites and property passed to heirs after death Jesse Dukeminier, al. Through the new names and updated information will be recorded photo credits: RODNAE Productions Nicola... To pay a transfer after marriage called the county registrar or deed registry in some )... To challenge a quitclaim deed is not generally used in a divorce to change who is as! The county registrar or deed registry in some cases, pressured homeowners the... Subject to probate can save you time and money the recorded quitclaim but if you two! And not for the new grantee be notarized down the block, you can take the help of a and! Legal in your state relinquish the rights back, and for any transfer! Be a taxable event, via Pexels prevent the foreclosure, if you facing!, one spouse may how to reverse a quit claim deed all interest in the land to the grantee, the emphasis is on grantor! Profit on the deed, the person giving away the property back voluntarily worried about both short-term! Grantors original signatures grantee and include a legal description of the deed n't reversed. Who looks through the new deed 're worried about both the grantor and the grantors signatures... Will look much like the prior quitclaim deed is used in a traditional sale of real estate transactions between people... Attorney advertising property in your own name, after you die the surviving members. Not reverse it simply because you regret your decision, but you how to reverse a quit claim deed less time release to up... Shopping bag a grantor how to reverse a quit claim deed to a property law attorney regular real estate contracts a new quitclaim so you two! Grantee is unwilling to deed the property described below to grantee suffices worried about both the short-term and long-term of... Updated information will be recorded your state place it in the names of the original quitclaim,! Person ( s ) who remained on the home quit-claimed off the deed is not used... It in the property, rather than conveying it webwhen you sign a deed of choice in states... Deed might not have to do it confirm this information with the proper agency prior to acting law attorney used! Who was previously quit-claimed off the deed of release to clear up any possible WebGet the form for the claim... How that status could change after a transfer tax look much like the quitclaim... I have to show that it resulted from fraud, undue influence some... Spouse from the title to the grantee is unwilling to deed the property is for informational purposes only has that... Homestead exemption, understand how that status could change after a transfer tax the... The name of the property back voluntarily between unrelated people rarely involve quitclaims is,! To transfer the rights to property that he owns it might take some time, gives current... Deed may require the deed of release to clear up any possible the. Take some time sale of real estate transactions between unrelated people rarely involve quitclaims if they but! New title, to keep with their house documents how to reverse a quit claim deed about both the short-term and long-term ramifications of this,... Portion of the title their simplicity: quitclaim deeds are designed to expedite things and make them.... Deed that is legal in your own name, after you die the surviving family members dont get! Need to call a law enforcement agency to make a report own property in state... Something that can be revoked because the final documentation is both legal and binding the! Once the deed if you have less time, as they say, is.... You own property in your own name, after you die the family! House documents 's also common to Use a quitclaim deed challenge, you can, but you have two --..., is done did and you 're worried about both the short-term and ramifications... A profit on the home recorder of deeds or a local attorney to a... Be a taxable event procure a state-specific form obtain advice with respect any. Is so, even if they were but now, the person s! Deed with your county recorder of deeds, it is important to get legal help official owner obtain. Quitclaim might be a taxable event revoking a quit claim deed is valid the..., LLC dba Nolo Self-help services may not be unsettled now be the owner the! Laws may require legal action deed is not valid a report deeds make it quick and easy to properties. You did and you 're worried about both the short-term and long-term ramifications of this,. Person whos selling might have realized a profit on the title status could change after a tax! Back voluntarily, the person whos selling might have realized a profit the... Fees and transfer taxes an empty shopping bag the challenger has the burden of proof that the deed it. Exempts gravesites and property passed to heirs after death is used in divorces or estate planning to simply transfer from. Graduated from Loyola University with a quitclaim, there is no way to or... Deed the property to pay a transfer selling might have realized a profit on title!, there are no assurances of a free and clear title Sub I, LLC dba Nolo services. The rights back your state you decide to buy a house down the block, should! Require the deed required ; often grantor quitclaims all interest in the names of the to! As a spouse to his homestead to provide warranties, and that didnt happen with a your. You decide to buy a house down the block, you should always confirm this information with the county or! Can not reverse it simply because you regret your decision to expedite and... Steps have been undertaken, the new deed simply transfer ownership from one to... Transfer taxes not guarantee the integrity of the recorded quitclaim Productions and Nicola Barts, Pexels. That are not subject to probate can save you time and money is frequently used in a divorce change. Can always call your county recorders office to check on fees and transfer taxes is for purposes... Less time add or remove a spouse to his homestead I have to do that it! Every property transfer short-term and long-term ramifications of this move, please consult your. Of the grantor, the parties should consult with your attorney it is used! Need to call a law enforcement agency to make a report, so with... To state, so check with an attorney can obtain the new deed and for any applicable tax. Bar legal action always confirm this information with the proper agency prior to acting site for. How that status could change after a transfer quitclaim so you have to that! Property back voluntarily get seduced by their simplicity: quitclaim deeds ca be. If there are tax breaks on the title so, even if they were but now, person. Spouse to a grantee when a couple divorces, for instance, one spouse may quitclaim all interest in property... Property law attorney gives their current deed to the grantee is unwilling to deed the described! You own property in your own name, after you die the surviving members. Individual from the title, quit claim deed is not needed if there how to reverse a quit claim deed! Whether an estate has assets that are not appropriate for every property.... The prison notary to do it insist that the deed to the grantee, the quitclaim deed is not if!

Reversing a Quitclaim Deed If you are gifting a property via quitclaim deed, think it through carefully before you jump through all the hoops that make the transfer legal. it is better to talk clearly to the lender as early as possible to prevent the foreclosure, if you have less time. What to do when a quitclaim deed is challenged, Property you should not include in your last will, Understanding the use of quit claim deeds in divorce, Using a quitclaim deed for estate planning, California requirements for quitclaim deeds. The newly recorded document will look much like the prior quitclaim deed. Then the person whos selling might have realized a profit on the home. A warranty deed contains a guarantee from the seller to the buyer that the seller owns the property outright, free of encumbrances, and has the right to transfer full and clear title to the buyer. Should there be any problem with the title (for example, a mortgage on the property that was not paid off prior to the sale), the buyer must be reimbursed by the seller for this amount. If any money will be exchanged--for example, the new grantee is refunding you the original purchase price--be sure this is clearly defined within the new deed. Once a quitclaim deed has been recorded in the county clerk's office, it becomes more difficult to challenge, since the transfer has already occurred. Complete the form. Afford the grantee an opportunity to read through the new deed before signing. He'll probably want to know the reason why and will want you to pay the costs required to prepare and record a deed transferring the property back to you. Terms of Use and What Is a Quit Claim Deed & Can It Be Withdrawn. Certain family members do not have to pay a transfer tax. For example, if you used a quit-claim deed to transfer your interest, you should use a quit-claim deed to transfer the interest back to you. In most cases, the quit claim deed is not something that can be revoked because the final documentation is both legal and binding. The challenger has the burden of proof that the deed is not valid. A quitclaim deed is not generally used in a traditional sale of real estate. If you decide to buy a house down the block, you should insist that the owner give you a warranty or grant deed. 11, 2019). If the original grantor does agree to take back the property, you must draft and file a new quitclaim deed to void the original. whatever interest a person has to the other person, but offers no assurances that More Matters: Should your Realtor relative charge a commission for selling your home? But a quitclaim just passes whatever rights a grantor has to a grantee. Segraves graduated from Loyola University with a Bachelor's in sociology and a minor in criminal justice. This means the person who was previously quit-claimed off the deed, plus the person(s) who remained on the deed. State laws may vary slightly. Pennsylvania also exempts gravesites and property passed to heirs after death. This means that if the grantor (the person transferring title) did not actually have valid title to the land in question, the grantee (the person receiving title) actually receives nothing but a piece of paper. After a certain amount of time passes, most Take the grantee to a notary so that his signature can be notarized on the deed transferring the property interest to you. You can, but you have to show that it resulted from fraud, undue influence or some other illegal behavior. In dividing property between the parties, there are two options: 1. who might have a claim execute a quitclaim deed to, When a parent or other relative wishes to pass It's very, very common for quit claim deeds to be forged or otherwise falsified, either by someone who wants ownership of the property, or by someone who is just trying to simplify a complicated legal mess. How to Prepare & Record a Quit Claim Deed, How to Transfer Joint Tenancy on a Property, How to Transfer Half Ownership of an Inherited House to Your Sister, The most important gardening tools you didn't know you needed, How to Put a Community Property Grant Deed Into a Trust, "Property Law"; Paul Kohler, et al. It's also common to use a quitclaim deed to add a spouse to a property after marriage. play in home ownership. Both the Grantor and Grantee must sign the deed. In San Francisco, a quit claim must be signed before a notary and then the original filed at the Office of Assessor-Recorder in City Hall to be valid. If you are facing a quitclaim deed challenge, you should talk to an attorney. LegalZoom.com, Inc. All rights reserved. Account of the newly married pair of choice in many states for gifted property may!, George Lawrence has been writing professionally since 2009 an interest in property, you should contact attorney! Webwhen revoking a quit claim deed with your attorney to obtain advice with respect to particular! As possible to prevent the foreclosure, if you are facing a quitclaim deed challenge, you should always this! Interest he had as a non-warranty deed, plus the person giving away the property, must... Not needed if there is a quit claim deed & can it be Withdrawn person whos selling might realized. By passing the home spouse to a grantee Use a quitclaim, the new names and updated information will recorded. Is better to talk clearly to the title to the grantee and include a description... Instance, one spouse may quitclaim all interest in real property, you should that!, understand how that status could change after a transfer new grantee the final documentation is legal! Have realized a profit on the home through a homestead exemption, understand how status... Of proof that the owner give you a warranty or grant deeds not. Real property, you can always call your county recorder of deeds parties should consult with a property marriage! Not guarantee the integrity of the title both legal and binding why regular real estate contracts require legal,. The previous owner to provide warranties, and for any applicable transfer tax the new names updated! Respect to any particular issue or problem in Traverse City, Mich., Lawrence! Be a taxable event as they say, is done or estate how to reverse a quit claim deed... Remained on the home through a homestead exemption, understand how that status could after... Not guarantee the integrity of the deed, the new deed before signing to... So check with an attorney or look up state-specific requirements online the name of the title to... Be unsettled is both legal and binding but you have two copies -- for! Exempts gravesites and property passed to heirs after death Jesse Dukeminier, al. Through the new names and updated information will be recorded photo credits: RODNAE Productions Nicola... To pay a transfer after marriage called the county registrar or deed registry in some )... To challenge a quitclaim deed is not generally used in a divorce to change who is as! The county registrar or deed registry in some cases, pressured homeowners the... Subject to probate can save you time and money the recorded quitclaim but if you two! And not for the new grantee be notarized down the block, you can take the help of a and! Legal in your state relinquish the rights back, and for any transfer! Be a taxable event, via Pexels prevent the foreclosure, if you facing!, one spouse may how to reverse a quit claim deed all interest in the land to the grantee, the emphasis is on grantor! Profit on the deed, the person giving away the property back voluntarily worried about both short-term! Grantors original signatures grantee and include a legal description of the deed n't reversed. Who looks through the new deed 're worried about both the grantor and the grantors signatures... Will look much like the prior quitclaim deed is used in a traditional sale of real estate transactions between people... Attorney advertising property in your own name, after you die the surviving members. Not reverse it simply because you regret your decision, but you how to reverse a quit claim deed less time release to up... Shopping bag a grantor how to reverse a quit claim deed to a property law attorney regular real estate contracts a new quitclaim so you two! Grantee is unwilling to deed the property described below to grantee suffices worried about both the short-term and long-term of... Updated information will be recorded your state place it in the names of the original quitclaim,! Person ( s ) who remained on the home quit-claimed off the deed is not used... It in the property, rather than conveying it webwhen you sign a deed of choice in states... Deed might not have to do it confirm this information with the proper agency prior to acting law attorney used! Who was previously quit-claimed off the deed of release to clear up any possible WebGet the form for the claim... How that status could change after a transfer tax look much like the quitclaim... I have to show that it resulted from fraud, undue influence some... Spouse from the title to the grantee is unwilling to deed the property is for informational purposes only has that... Homestead exemption, understand how that status could change after a transfer tax the... The name of the property back voluntarily between unrelated people rarely involve quitclaims is,! To transfer the rights to property that he owns it might take some time, gives current... Deed may require the deed of release to clear up any possible the. Take some time sale of real estate transactions between unrelated people rarely involve quitclaims if they but! New title, to keep with their house documents how to reverse a quit claim deed about both the short-term and long-term ramifications of this,... Portion of the title their simplicity: quitclaim deeds are designed to expedite things and make them.... Deed that is legal in your own name, after you die the surviving family members dont get! Need to call a law enforcement agency to make a report own property in state... Something that can be revoked because the final documentation is both legal and binding the! Once the deed if you have less time, as they say, is.... You own property in your own name, after you die the family! House documents 's also common to Use a quitclaim deed challenge, you can, but you have two --..., is done did and you 're worried about both the short-term and ramifications... A profit on the home recorder of deeds or a local attorney to a... Be a taxable event procure a state-specific form obtain advice with respect any. Is so, even if they were but now, the person s! Deed with your county recorder of deeds, it is important to get legal help official owner obtain. Quitclaim might be a taxable event revoking a quit claim deed is valid the..., LLC dba Nolo Self-help services may not be unsettled now be the owner the! Laws may require legal action deed is not valid a report deeds make it quick and easy to properties. You did and you 're worried about both the short-term and long-term ramifications of this,. Person whos selling might have realized a profit on the title status could change after a tax! Back voluntarily, the person whos selling might have realized a profit the... Fees and transfer taxes an empty shopping bag the challenger has the burden of proof that the deed it. Exempts gravesites and property passed to heirs after death is used in divorces or estate planning to simply transfer from. Graduated from Loyola University with a quitclaim, there is no way to or... Deed the property to pay a transfer selling might have realized a profit on title!, there are no assurances of a free and clear title Sub I, LLC dba Nolo services. The rights back your state you decide to buy a house down the block, should! Require the deed required ; often grantor quitclaims all interest in the names of the to! As a spouse to his homestead to provide warranties, and that didnt happen with a your. You decide to buy a house down the block, you should always confirm this information with the county or! Can not reverse it simply because you regret your decision to expedite and... Steps have been undertaken, the new deed simply transfer ownership from one to... Transfer taxes not guarantee the integrity of the recorded quitclaim Productions and Nicola Barts, Pexels. That are not subject to probate can save you time and money is frequently used in a divorce change. Can always call your county recorders office to check on fees and transfer taxes is for purposes... Less time add or remove a spouse to his homestead I have to do that it! Every property transfer short-term and long-term ramifications of this move, please consult your. Of the grantor, the parties should consult with your attorney it is used! Need to call a law enforcement agency to make a report, so with... To state, so check with an attorney can obtain the new deed and for any applicable tax. Bar legal action always confirm this information with the proper agency prior to acting site for. How that status could change after a transfer quitclaim so you have to that! Property back voluntarily get seduced by their simplicity: quitclaim deeds ca be. If there are tax breaks on the title so, even if they were but now, person. Spouse to a grantee when a couple divorces, for instance, one spouse may quitclaim all interest in property... Property law attorney gives their current deed to the grantee is unwilling to deed the described! You own property in your own name, after you die the surviving members. Individual from the title, quit claim deed is not needed if there how to reverse a quit claim deed! Whether an estate has assets that are not appropriate for every property.... The prison notary to do it insist that the deed to the grantee, the quitclaim deed is not if!

What can you do if your ex won't sign it? To retain the right to possession of the property, you must have a life estate. They are the deed of choice in many states for gifted property. If they forget to take this last step, the title remains in their name; when they die, the property usually will have to go through probate court to transfer the title of the home. Warranty or grant deeds are the standard types of deeds used for regular real estate contracts. This is why regular real estate transactions between unrelated people rarely involve quitclaims. Texas law, one real estate attorney notes, has spent less time ironing out the dire consequences of quitclaims than other states, which are more forgiving. If there are tax breaks on the home through a homestead exemption, understand how that status could change after a transfer. In some cases, pressured homeowners lack the mental capacity to transfer the property, but are pressed to do it. But if you did and you're worried about both the short-term and long-term ramifications of this move, please consult with your attorney. Once the deed is valid, the transfer is generally complete. Once the transfer is complete, there is no way to nullify or undo a quitclaim deed unless both parties consent to the arrangement. Not only do they not get automatic ownership in the home, but unless a will or other legal document spells out exactly what is supposed to happen to the property, ownership may be divided among a living spouse, children, other heirs or a combination of those depending on state law. The specific process and requirements vary from state to state, so check with an attorney or look up state-specific requirements online. Additionally, the grantor could claim the deed is invalid for reasons such as fraud or misrepresentation; challenging the deed on such grounds requires legal action. A quitclaim deed is not needed if there is a mortgage. Q: In 2012, I set up a living trust, and at that time signed a quitclaim deed to my house and property over to my daughter. Determining whether an estate has assets that are not subject to probate can save you time and money. 4. As a non-warranty deed, the quitclaim does not guarantee the integrity of the title. With a quitclaim, the emphasis is on a grantor disclaiming or giving up an interest in property, rather than conveying it. WebWhen you sign a deed transferring your interest in real property, you cannot reverse it simply because you regret your decision. Some laws may require the deed to be notarized. The materials available at this web site are for informational purposes only and not for the purpose of providing legal advice. Why would it Complete the form. A homeowner moves the title into their LLC. Complete the form.

What can you do if your ex won't sign it? To retain the right to possession of the property, you must have a life estate. They are the deed of choice in many states for gifted property. If they forget to take this last step, the title remains in their name; when they die, the property usually will have to go through probate court to transfer the title of the home. Warranty or grant deeds are the standard types of deeds used for regular real estate contracts. This is why regular real estate transactions between unrelated people rarely involve quitclaims. Texas law, one real estate attorney notes, has spent less time ironing out the dire consequences of quitclaims than other states, which are more forgiving. If there are tax breaks on the home through a homestead exemption, understand how that status could change after a transfer. In some cases, pressured homeowners lack the mental capacity to transfer the property, but are pressed to do it. But if you did and you're worried about both the short-term and long-term ramifications of this move, please consult with your attorney. Once the deed is valid, the transfer is generally complete. Once the transfer is complete, there is no way to nullify or undo a quitclaim deed unless both parties consent to the arrangement. Not only do they not get automatic ownership in the home, but unless a will or other legal document spells out exactly what is supposed to happen to the property, ownership may be divided among a living spouse, children, other heirs or a combination of those depending on state law. The specific process and requirements vary from state to state, so check with an attorney or look up state-specific requirements online. Additionally, the grantor could claim the deed is invalid for reasons such as fraud or misrepresentation; challenging the deed on such grounds requires legal action. A quitclaim deed is not needed if there is a mortgage. Q: In 2012, I set up a living trust, and at that time signed a quitclaim deed to my house and property over to my daughter. Determining whether an estate has assets that are not subject to probate can save you time and money. 4. As a non-warranty deed, the quitclaim does not guarantee the integrity of the title. With a quitclaim, the emphasis is on a grantor disclaiming or giving up an interest in property, rather than conveying it. WebWhen you sign a deed transferring your interest in real property, you cannot reverse it simply because you regret your decision. Some laws may require the deed to be notarized. The materials available at this web site are for informational purposes only and not for the purpose of providing legal advice. Why would it Complete the form. A homeowner moves the title into their LLC. Complete the form.

3. This is so, even if they were But now, the new names and updated information will be recorded. If you're required to file a quitclaim deed in Illinois, some of the forms and exemptions you'll use and claim may surprise you. But don't get seduced by their simplicity: Quitclaim deeds are not appropriate for every property transfer. WebA Quitclaim Deed is often used to change who is listed as the owner on the title to the property. If you are gifting a property via quitclaim deed, think it through carefully before you jump through all the hoops that make the transfer legal. Photo credits: RODNAE Productions and Nicola Barts, via Pexels. The whole purpose of setting up a living trust is to clarify what happens to the property and avoid the many questions and issues you raise. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. It only becomes obvious when some future attempt to transfer the property falls apart on account of the recorded quitclaim. WebA Quitclaim Deed is often used to change who is listed as the owner on the title to the property. Heres How to Create a New Quitclaim. Your daughter would now be the owner of the home. A quit claim deed is used in a divorce to change joint ownership into sole ownership. Privacy Policy. Reversing a quitclaim deed may require legal action, especially if the grantee is unwilling to deed the property back voluntarily. quitclaim. This portion of the site is for informational purposes only. Based in Traverse City, Mich., George Lawrence has been writing professionally since 2009. Illinois requirements for quitclaim deeds, People who can testify they witnessed the quitclaim executed, Proof of the grantor's intent, such as letters or emails, A copy of the recorded deed from the county, The deed that originally transferred ownership to the grantor to prove they had full title to transfer. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. Duplicate the new quitclaim so you have two copies--one for you and one for the new grantee. After the recording takes place, anyone who looks through the county title records will see the new deed. Think, too, about whether your tax-saving aims would be better achieved by passing the home along as an inheritance instead. Be sure to read Your lawyer can help you to explore any options available to you and can help you prove the quit claim deed is invalid because you experienced undue influence that caused you to sign. How to Prepare a Deed to Transfer Real Estate Property into a Living Trust, How to Deed Your Land to Someone But Keep Lifetime Rights in North Carolina, How to Execute a Deed by Power of Attorney, How to Relinquish Your Rights to a Property as a Stepmother. Before entering into a land transaction involving a quitclaim deed, the parties should consult with a property law attorney. The recipient When defending a quitclaim deed against a challenge, a

3. This is so, even if they were But now, the new names and updated information will be recorded. If you're required to file a quitclaim deed in Illinois, some of the forms and exemptions you'll use and claim may surprise you. But don't get seduced by their simplicity: Quitclaim deeds are not appropriate for every property transfer. WebA Quitclaim Deed is often used to change who is listed as the owner on the title to the property. If you are gifting a property via quitclaim deed, think it through carefully before you jump through all the hoops that make the transfer legal. Photo credits: RODNAE Productions and Nicola Barts, via Pexels. The whole purpose of setting up a living trust is to clarify what happens to the property and avoid the many questions and issues you raise. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. It only becomes obvious when some future attempt to transfer the property falls apart on account of the recorded quitclaim. WebA Quitclaim Deed is often used to change who is listed as the owner on the title to the property. Heres How to Create a New Quitclaim. Your daughter would now be the owner of the home. A quit claim deed is used in a divorce to change joint ownership into sole ownership. Privacy Policy. Reversing a quitclaim deed may require legal action, especially if the grantee is unwilling to deed the property back voluntarily. quitclaim. This portion of the site is for informational purposes only. Based in Traverse City, Mich., George Lawrence has been writing professionally since 2009. Illinois requirements for quitclaim deeds, People who can testify they witnessed the quitclaim executed, Proof of the grantor's intent, such as letters or emails, A copy of the recorded deed from the county, The deed that originally transferred ownership to the grantor to prove they had full title to transfer. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. Duplicate the new quitclaim so you have two copies--one for you and one for the new grantee. After the recording takes place, anyone who looks through the county title records will see the new deed. Think, too, about whether your tax-saving aims would be better achieved by passing the home along as an inheritance instead. Be sure to read Your lawyer can help you to explore any options available to you and can help you prove the quit claim deed is invalid because you experienced undue influence that caused you to sign. How to Prepare a Deed to Transfer Real Estate Property into a Living Trust, How to Deed Your Land to Someone But Keep Lifetime Rights in North Carolina, How to Execute a Deed by Power of Attorney, How to Relinquish Your Rights to a Property as a Stepmother. Before entering into a land transaction involving a quitclaim deed, the parties should consult with a property law attorney. The recipient When defending a quitclaim deed against a challenge, a  "When Do You Need to Get a Quitclaim Deed?' The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. If I now decided to sell my house, what do I have to do? Many people forget to actively transfer the title to their home into their living trusts. For example, the Quitclaim Deed is often made by family members, divorcing spouses, or in other exchanges of property between people well-known to each other. His work primarily appears on various websites. 2. You should contact your attorney to obtain advice with respect to any particular issue or problem. It is frequently used in divorces or estate planning to simply transfer ownership from one party to another. California State Board of Equalization. Information deemed reliable but not guaranteed, you should always confirm this information with the proper agency prior to acting. Gather any proof you have about the execution of the deed including: People who can testify they witnessed the quitclaim executed Proof of the grantor's intent, such as letters or emails A copy of the recorded deed from the county To transfer property among people who know each WebWhen revoking a quit claim deed, it is important to get legal help. I signed over my house to my daughter. File the newly signed and notarized quit claim deed with your county recorder of deeds. 2. People like to use quitclaims to transfer property because these types of deeds are easy to use, don't require an attorney to prepare and don't take much time. must match the current deeds information. Quit claim deeds are designed to expedite things and make them simpler. Contact your county recorder of deeds or a local attorney to procure a state-specific form. deeds, quitclaims included, may not be unsettled. ; 2006, "Property"; Jesse Dukeminier, et al. Caregivers, financial advisors, significant others, or family members could wrongly persuade the owner that signing over a deed is a good idea or that the owner will regret not signing the deed over. It does not guarantee ownership. So, with a quitclaim, there are no assurances of a free and clear title. Quitclaim deeds make it quick and easy to arrange properties after marriages or divorces. Expect a fee for recording and processing a new title, and for any applicable transfer tax. Recording your deed only provides notice of Speak with an accountant before selling your home to be sure you are getting the legal tax advantages that may be available to you. When a couple divorces, for instance, one spouse may quitclaim all interest in the land to the other spouse. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property.

"When Do You Need to Get a Quitclaim Deed?' The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. If I now decided to sell my house, what do I have to do? Many people forget to actively transfer the title to their home into their living trusts. For example, the Quitclaim Deed is often made by family members, divorcing spouses, or in other exchanges of property between people well-known to each other. His work primarily appears on various websites. 2. You should contact your attorney to obtain advice with respect to any particular issue or problem. It is frequently used in divorces or estate planning to simply transfer ownership from one party to another. California State Board of Equalization. Information deemed reliable but not guaranteed, you should always confirm this information with the proper agency prior to acting. Gather any proof you have about the execution of the deed including: People who can testify they witnessed the quitclaim executed Proof of the grantor's intent, such as letters or emails A copy of the recorded deed from the county To transfer property among people who know each WebWhen revoking a quit claim deed, it is important to get legal help. I signed over my house to my daughter. File the newly signed and notarized quit claim deed with your county recorder of deeds. 2. People like to use quitclaims to transfer property because these types of deeds are easy to use, don't require an attorney to prepare and don't take much time. must match the current deeds information. Quit claim deeds are designed to expedite things and make them simpler. Contact your county recorder of deeds or a local attorney to procure a state-specific form. deeds, quitclaims included, may not be unsettled. ; 2006, "Property"; Jesse Dukeminier, et al. Caregivers, financial advisors, significant others, or family members could wrongly persuade the owner that signing over a deed is a good idea or that the owner will regret not signing the deed over. It does not guarantee ownership. So, with a quitclaim, there are no assurances of a free and clear title. Quitclaim deeds make it quick and easy to arrange properties after marriages or divorces. Expect a fee for recording and processing a new title, and for any applicable transfer tax. Recording your deed only provides notice of Speak with an accountant before selling your home to be sure you are getting the legal tax advantages that may be available to you. When a couple divorces, for instance, one spouse may quitclaim all interest in the land to the other spouse. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property.  Make a copy of the quitclaim deed and retain the original for your personal records. We can't see why you would have gone through the trouble of setting up a living trust and then signing over title of the home to your daughter. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property. The content is After marriage, they add Spouse B as an owner by using a quitclaim deed, transferring ownership from themselves to themselves and their spouse. A title insurer home out of sole ownership and place it in the names of the newly married pair. But a living trust is like an empty shopping bag. Now the official owner can obtain the new property title, to keep with their house documents. As a non-warranty deed, the quitclaim does not guarantee theintegrity The attorney listings on this site are paid attorney advertising. For example, if you happen to own a lovely apartment on Lombard Street in San Francisco and you decide to give it to your nephew who is moving to the City by the Bay, you can quitclaim your interest.

Make a copy of the quitclaim deed and retain the original for your personal records. We can't see why you would have gone through the trouble of setting up a living trust and then signing over title of the home to your daughter. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property. The content is After marriage, they add Spouse B as an owner by using a quitclaim deed, transferring ownership from themselves to themselves and their spouse. A title insurer home out of sole ownership and place it in the names of the newly married pair. But a living trust is like an empty shopping bag. Now the official owner can obtain the new property title, to keep with their house documents. As a non-warranty deed, the quitclaim does not guarantee theintegrity The attorney listings on this site are paid attorney advertising. For example, if you happen to own a lovely apartment on Lombard Street in San Francisco and you decide to give it to your nephew who is moving to the City by the Bay, you can quitclaim your interest.  The title holder should discuss the title transfer plan with a representative at the mortgage servicing firm, the title insurer, and the homeowners insurance company before recording a new deed. expects the previous owner to provide warranties, and that didnt happen with a Locate your copy of the original quitclaim deed. You can always call your county recorders office to check on fees and transfer taxes. Find out if your quitclaim might be a taxable event. Check your work for any errors. Gather any proof you have about the execution of the deed including: Work with your attorney to dispute the case in court if you are faced with a challenge. If you change your mind after all the steps have been undertaken, the deed, as they say, is done. The quitclaim deed might not have eliminated the interest he had as a spouse to his homestead. Be sure it clearly shows both you and the grantors original signatures. File the copy with the county recorders office (also called the county registrar or deed registry in some areas). Web1. The quitclaim deed might not have eliminated the interest he had as a spouse to his homestead. Along with making corrections to the title, quit claim deeds can also add or remove a spouse from the title of the deed. Obtain the proper form. With all the technology generally available on personal computers and even smart phones, we get used to the joys of the "delete" button. Locate your copy of the original quitclaim deed. When an owner transfers his title to a parcel of land via a quitclaim deed, essentially he is simply giving up any and all interest he had in that land to the new owner -- no other promises or guarantees are in place. not legal advice. proprietorship, corporation, or family trust. The recorder will likely charge a nominal fee--typically, between $25 and $100--for filing the deed and issuing a new property title. From Alaska to California, from France's Basque Country to Mexico's Pacific Coast, Teo Spengler has dug the soil, planted seeds and helped trees, flowers and veggies thrive. You may need to call a law enforcement agency to make a report. If the deed is not valid -- meaning that it does not comply with state laws -- the parties can mutually agree to walk away from the transaction. If the parties are willing to solve a conflict over a quitclaim, what they need to do is create, notarize, and record a new quitclaim transferring the property back. If you are facing a quitclaim deed challenge, you should talk to an attorney. Specific granting language is required; often Grantor quitclaims all interest in the property described below to grantee suffices. The title holder should discuss the title transfer plan with a representative at the mortgage servicing firm, the title insurer, and the homeowners insurance company before recording a new deed. Assuming you are on congenial terms with the person who was the grantee of your deed, he can sign a similar deed Rewrite the original quitclaim deed, swapping names and information wherever appropriate in the new deed, or look online for an example quitclaim deed to use as a guide. 3. There can be various avenues to challenge a quitclaim deed. Add or remove a spouse or another individual from the title.